Key Takeaways

✅ 10+ companies are strong contenders to be the best pharma stock

✅ Seven out of the ten best pharma stocks are from the U.S.

✅ Most pharmaceutical companies are good dividend payers

✅ I believe $ABBV is the best pharma stock to buy and hold for the longterm

The Best Pharma Stocks – Compared

Healthcare and the aging population are global megatrends. The wealthy and massive baby boomer generation is retiring, resulting in a lot of demand for good meds, and pharmaceutical products.

When looking at the 10 largest pharmaceutical companies in the world, we can see that they are based out of only three countries: U.S., France, and Switzerland:

| Symbol | Company Name | Market Cap in Bio $ | Dividend Yield % | PE Ratio |

| $JNJ | 🇺🇸 Johnson & Johnson | $460 | 2.53 | 25 |

| $LLY | 🇺🇸 Eli Lilly | $346 | 1.08 | 55 |

| $ABBV | 🇺🇸 AbbVie | $280 | 3.57 | 21 |

| $PFE | 🇺🇸 Pfizer | $278 | 3.23 | 10 |

| $MRK | 🇺🇸 Merck | $276 | 2.54 | 18 |

| $XSWX:ROG | 🇨🇭Roche | $268 | 3.01 | 18 |

| $XSWX:NOVN | 🇨🇭Novartis | $189 | 3.72 | 9 |

| $BMY | 🇺🇸 Bristol-Myers Squibb | $168 | 2.73 | 26 |

| $AMGN | 🇺🇸 Amgen | $150 | 2.75 | 23 |

| $XPAR:SAN | 🇫🇷 Sanofi | $116 | 3.78 | 17 |

We can note that, out of the 10 largest pharma companies by market cap, only three are non-U.S. companies: Roche (XSWX:ROG) and Novartis (XSWX:NOVN) from Switzerland, and Sanofi (XPAR:SAN) from France.

As a German DIY Investor, I was actually expecting BAYER (XTER:BAYN), the producer of Aspirin, but it only is at spot #12 of the largest and best pharma stocks.

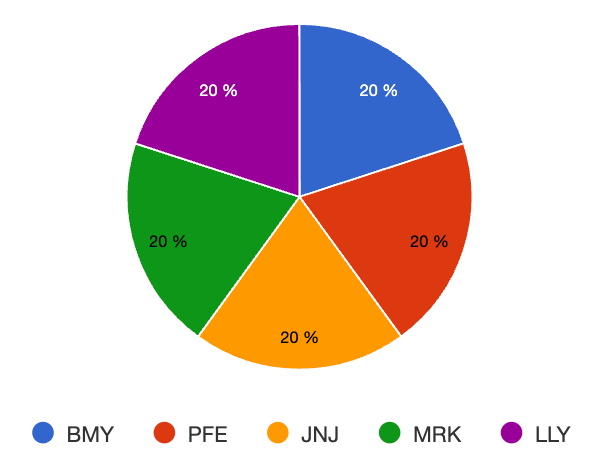

Model Portfolio Of Best Pharma Stocks

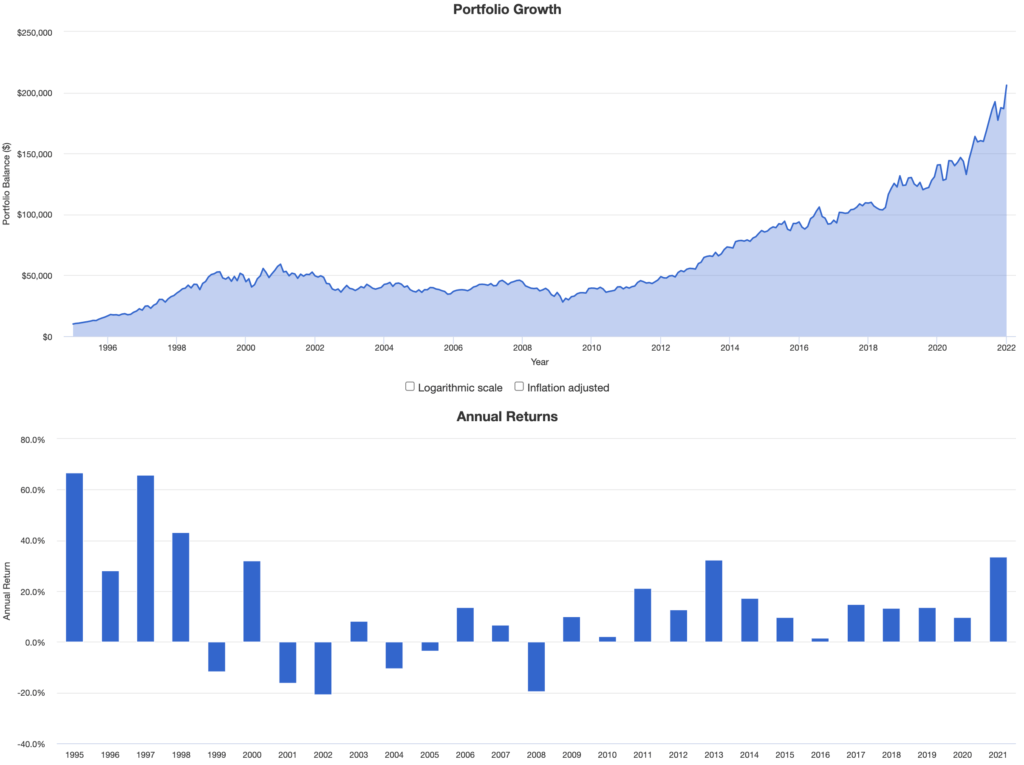

$10,000 invested in Jan 1995 – Dec 2021 into 5x leading pharma stocks, with an equal allocation of each 20%:

| Ticker | Name | Allocation |  |

|---|---|---|---|

| $BMY | Bristol-Myers Squibb | 20.00% | |

| $PFE | Pfizer, Inc. | 20.00% | |

| $JNJ | Johnson & Johnson | 20.00% | |

| $MRK | Merck & Company, Inc. | 20.00% | |

| $LLY | Eli Lilly and Company | 20.00% |

If we invested an imaginary initial amount of $10,000 US in January 1995, the final balance would come down to $206,000 USD at the end of 2021:

| Initial Balance | Final Balance | CAGR | Best Year | Worst Year |

| $10,000 | $206,084 | 11.86% | 66.61% | -20.68% |

A CAGR of 11.86% means you compounded your money by approx. 12% every year.

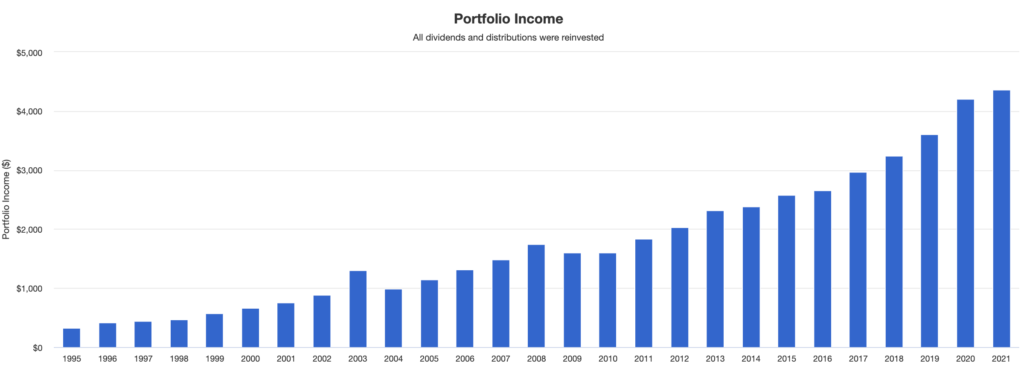

To 20X your money in those 26 years is nothing to sneeze at, but what’s really interesting is the fact that every single year going forward, this portfolio generates you passive income in form of dividends of $4,300 US, every single year (representing a yield on cost of 43%!).

So every second year you essentially would get back 100% of what you invested. The power of compounding at work.

The below chart now shows the yearly dividends you would have received on your initial $10,000 US.

Revenues of The Best Pharma Stocks

When looking at the revenues/sales of the largest pharma stocks, we get the following:

| Symbol | Company Name | Revenue in $ Mio | ROIC % |

| PFE | Pfizer Inc | $99,879 | 19.5% |

| JNJ | Johnson & Johnson | $96,041 | 16.6% |

| XSWX:ROG | Roche Holding AG | $68,668 | 21.2% |

| MRK | Merck & Co Inc | $58,974 | 22.6% |

| ABBV | AbbVie Inc | $57,819 | 13.2% |

| XSWX:NOVN | Novartis AG | $52,856 | 8.4% |

| BMY | Bristol-Myers Squibb Co | $46,738 | 8.3% |

| XPAR:SAN | Sanofi SA | $44,239 | 8.0% |

| LLY | Eli Lilly and Co | $29,240 | 22.3% |

| AMGN | Amgen Inc | $26,330 | 20.1% |

Warren Buffett is known for paying close attention to the ROIC% (return in invested capital)), showing thatul but four have ROICs of above 15% (10% is usually considered to be good, with the minimum to be above real yield).

The Best Pharma Stock – AbbVie

My current largest holding, and in my opinion the best pharma stock I hold in my All-Weather Portfolio, is AbbVie (ABBV).

This globally-diversified biopharmaceutical company has with multiple businesses. It has several sources of growth and excellent long-term prospects.

$ABBV’s approx. 50,000 employees and scientists discover, develop, and commercialize advanced therapeutics with the aim of positively impacting people’s lives.

I currently own 130 shares of $ABBV, valued at approx. $20,000 US.

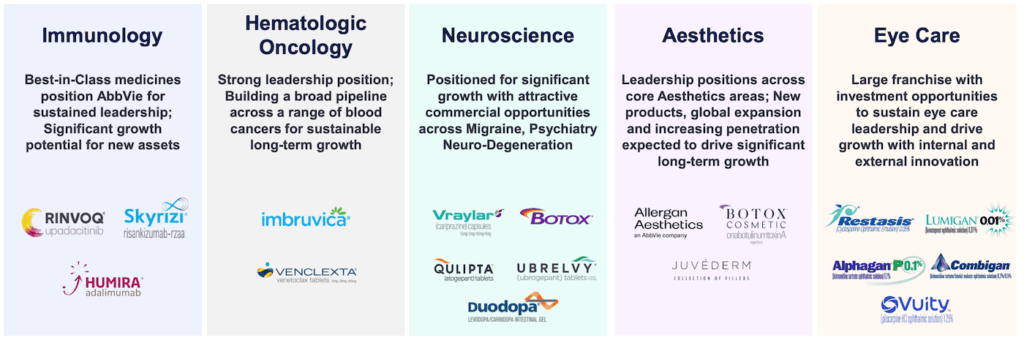

Multiple Sources of Growth

Source: J.P. Morgan Healthcare Conference / Rob Michael / CFO / January 11, 2022

- Immunology (Humira)

- Immunology (Rheumatology, Dermatology and Gastroenterology)

- Neuroscience (Migraine Treatment, Parkinson’s and Alzheimer’s Diseases)

- Oncology (cancer treatment)

- Eye Care

- Aesthetics

Each one of those by itself is a multi-billion dollar strong division, with massive potential.

Diverse Product Portfolio

$ABBV has a fantastic and diverse portfolio of products, with the largest revenue drivers being

- Humira

- AndroGel

- CREON

- Depakote

- Botox

- plus all Allergan products besides Botox (acquired 2019)

Humira used to be 60% of $ABBV‘s sales, now it ‘only’ represents 40%, a more healthy ratio.

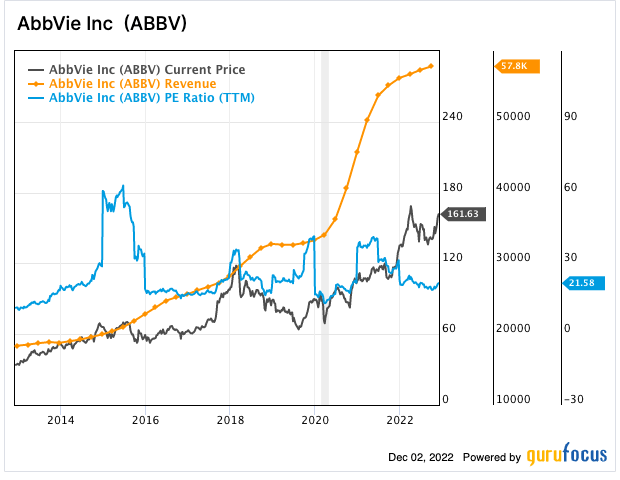

Reasonable Valuation

$ABBV grows quickly (see orange series, the big jump in 2020 is from the Allergan acquisition).

Historically, $ABBV’s PE is in the high 20s, often above 30, but currently (Dec 2022), it sits at 21 (see blue series on the below’s chart), which is not cheap, but also not expensive.

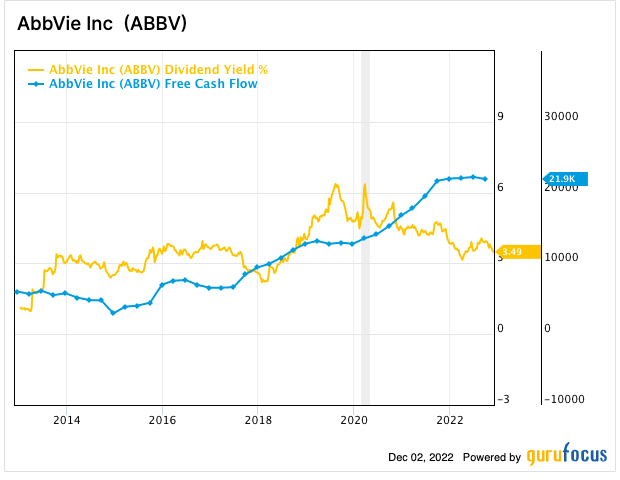

Strong Cashflows

$ABBV is throwing off cash left and right. It did not have one year in the past 10 years without strong free cashflows (blue line on the below chart).

Its dividend yield, yellow line, since 2012, ranges between 2.25% – 6.25%. It currently sits at 3.49%.

Conclusion

In my opinion, $ABBV is the best pharma stock because it has it all! It’s growing quickly, has an extensive portfolio, covers multiple sectors, and still has massive portfolio. In my opinion, $ABBV is one of those stocks I will buy and hold forever.

Another drug stock I like is Pfizer (PFE), which I also hold in my All-Weather Portfolio.

📘 Read Also

FAQ

What pharmaceutical stock should I buy?

What is the best pharmaceutical stock to invest in?

What pharma stock comparison is good?

AbbVie - The Best Pharma Stock

PROS

- Multiple Sources of Growth

- Diverse Product Portfolio

- Reasonable Valuation

- Strong Cashflows

CONS

- Dependence on Humira & Botox

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love