Why I Add The BlackRock Stock To My Portfolio

Key Takeaways

☑️ BlackRock is the world’s largest asset manager, by AUM

☑️ It is a highly innovative company that keeps on re-inventing itself

☑️ When it comes to asset management fees, size does matter

☑️ It pays a good dividend and has a good stock performance

About BlackRock

BlackRock is the world’s largest asset manager, proving customers all around the world with investment, asset allocation, and risk management solutions. It defines its purpose as “helping people achieve financial well-being by building savings that last a lifetime”.

The company was founded in 1988 and currently, as of 2023, has $10 trillion in assets under management. It operates globally with 70 offices in 30 countries. Besides Vanguard and State Street, BlackRock is considered one of the three dominant ETF and index fund managers in the world.

The BlackRock Stock – Compared!

Let’s start by getting a feeling for how the BlackRock stock is doing compared to its biggest competitors.

The Largest Asset Managers In The World

| Company | M. Cap in Bio $ | Sales in Bio $ | PE | Yield |

| 🇺🇸 BlackRock (BLK) | $107 | $18 | 21 | 2.8% |

| 🇺🇸 Blackstone (BX) | $70 | $7 | 40 | 4.6% |

| 🇺🇸 T. Rowe Price (TROW) | $27 | $6 | 18 | 4.0% |

| 🇬🇧 3i Group (IGQ5) | $20 | $5 | 5 | 1.4% |

| 🇺🇸 Franklin Resources (BEN) | $16 | $8 | 16 | 3.8% |

| 🇺🇸 Corebridge (formerly AIG) | $14 | $30 | 1 | 2.3% |

| 🇫🇷 Amundi (AMDUF) | $14 | $7 | 11 | 7.8% |

| 🇬🇧 Schroders (PYXB) | $10 | $4 | 15 | 4.4% |

| 🇺🇸 Invesco (IVZ) | $8 | $6 | 12 | 4.0% |

| 🇩🇪 DWS (DWS) | $7 | $5 | 8 | 6.4% |

Interesting to note here is that $BLK is obviously the largest asset manager by market cap, but when we look at the revenues, it is Corebridge (CRBG), formerly known as AIG, that is almost twice as big as $BLK.

Also interesting is that most of the stocks of the asset managers have PE ratios of below 20, only (BX) is an outlier with 40. Some are even in the low single digits!

Of the 10 largest asset managers, 6 are from the U.S., two are from the UK, one is from FRA, and one is from GER.

Not Easy To Compare Apples With Apples

What makes it challenging to compare asset management companies with each other is the fact that often the asset management side of things is just one part of a large company.

Many insurance firms, like for example Allianz (which I own in my All-Weather Portfolio), have huge asset management divisions, yet can not really be compared with pure asset managers like BlackRock.

Therefore, the companies listed above are not meant to be a full and comprehensive list, but those that I believe are pure asset management companies.

The Best Asset Management Stocks

Below are those five asset management stocks I believe are worthy to be looked at in more detail, ranked by Return-on-Assets, in %. As you can see, the BlackRock stock fares well but is not the top dog.

| Company | ROE % | ROA % | ROIC % |

| 🇺🇸 T. Rowe Price (TROW) | 17 | 13 | 19 |

| 🇩🇪 DWS (DWS) | 10 | 6 | 14 |

| 🇫🇷 Amundi (AMDUF) | 11 | 4 | 4 |

| 🇺🇸 BlackRock (BLK) | 14 | 4 | 4 |

| 🇬🇧 Schroders (PYXB) | 14 | 2 | 3 |

For an asset manager, the most important metric to look at is how well the team deploys and allocates the assets under management, in short, the AUM.

Based on this, $TROW is the undisputed leader. Basically across all three ROI metrics, be it the return-on-equity, return-on-assets, or return-on-invested capital.

Top Asset Management Firms, by AUM

T. Rowe Price is a good asset allocator, however, they work off a much smaller base. BlackRock has essentially invented the ETF category, labeled under their iShares brand, and can therefore more effectively generate fees without the need for a lot of expensive money managers.

| Asset Manager | Assets Under Management |

| -1- 🇺🇸 BlackRock (BLK) | 9.57 Trillion |

| -2- 🇺🇸 Vanguard (private) | 8.10 Trillion |

| -3- 🇺🇸 Fidelity (private) | 4.28 Trillion |

| -4- 🇨🇭 UBS (UBS) | 4.24 Trillion |

| -5- 🇺🇸 State Street Global Advisors (STT) | 4.02 Trillion |

| -13- 🇫🇷 Amundi (AMDUF) | 2.25 Trillion |

| -20- 🇺🇸 Invesco (IVZ) | 1.50 Trillion |

| -36- 🇬🇧 Schroders (PYXB) | 0.98 Trillion |

| -54- 🇩🇪DWS (DWS) | 0.98 Trillion |

Source: advratings.com/top-asset-management-firms

Why I Add The BlackRock Stock To My Portfolio

After I digested the above and read two of its investor presentations, I finally settled and chose to add the BlackRock stock to my dividend portfolio. Find the top 5 reasons below.

Market Power & Highest AUM Base

$BLK has the highest AUM of all asset managers – globally. It has a dominant market power, attracting, and retaining, the brightest minds in the biz.

Just its three largest ETFs have massive AUMs, see below:

| Symbol | Name | AUM |

|---|---|---|

| IJH | iShares Core S&P Mid-Cap ETF | 70,3 Bio |

| IWF | iShares Russell 1000 Growth ETF | 62,0Bio |

| IWM | iShares Russell 2000 ETF | 56,3Bio |

Just these three ETFs alone represent +185 Bio USD of AUM. BlackRock’s fees to manage those are minimal, about 0.10-0.20% on average. That three ETFs alone bring in approx.

75 Million USD in management fees. Keep in mind, these are just passively managed funds, not requiring the brightest fund allocators, but just a back office replicating the respective indexes.

Full Investment Spectrum

BlackRock covers the whole gamut of investment options, from managed mutual funds to ETFs to closed-end funds, including any sort of asset class you can imagine. One new asset class that will be added soon is digital asset funds like cryptocurrencies, etc.

| FUND TYPE | ASSET CLASS |

| Mutual funds | Cash funds |

| iShares ETFs | Commodity funds |

| Closed-end funds | Stock funds |

| Bond funds | |

| Multi-asset funds | |

| Real estate funds |

Regardless if investors want an active or passive investment approach, $BLK will have something to offer!

Innovation Powerhouse

What I like most about BlackRock is its ability to innovate and be a front-runner. Although State Street Global Advisors invented the category of exchange-traded funds (ETFs), it was BlackRock that perfected it. With its iShares brand, it created an iconic brand, trusted by millions of investors from around the world.

BlackRock’s cutting-edge Aladin investment platform, recently integrated with Coinbase Prime allows millions of BlackRock’s institutional-grade investors and wealth managers to access crypto trading and custody directly via Aladin!

BlackRock Dividend & Stock Performance

The BlackRock dividend currently sits at 2.81%, which is not bad but also not great. However, as the stock performed well in the past 5 years, the Yield on Cost sits at 4.98%. Simply put, if you would have invested 10,000 USD 5 years ago, without having added any more capital, you’d now get 498 USD every single year.

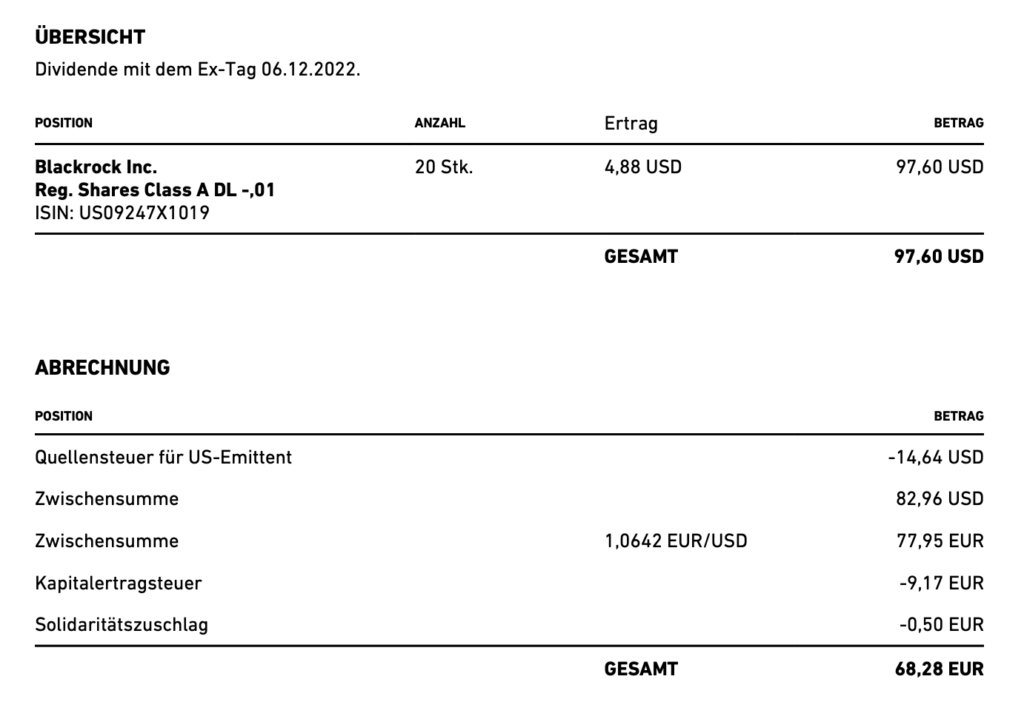

As for myself, I just started dollar-cost-averaging into the BlackRock stock in late 2022, and I received the first BlackRock dividend on my Trade Republic account in Dec 2022, see below. I received 4.88 USD for each of the 20 shares 👉97.60 USD in total, minus withholding tax, 82.96 USD.

This all makes BlackRock an attractive option for income-oriented long-term investors like myself, looking for stable long-term returns.

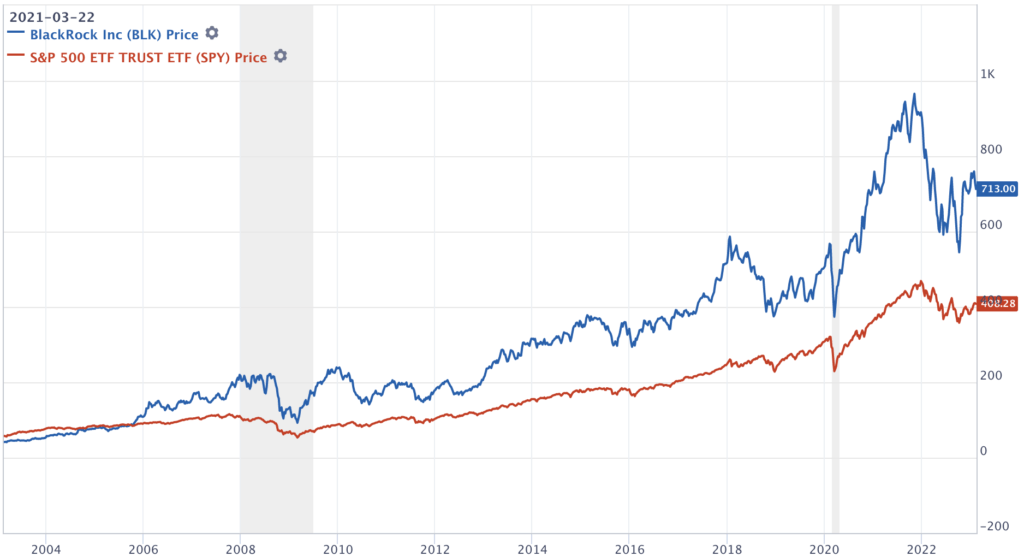

Compared with the S&P 500, the BlackRock stock did well! If the assets manager I recommend would not be even able to beat the market index, I am not sure why to buy its shares!

See the following chart:

click the image to get directly to the chart on Gurufocus

Low Debt

BlackRock has a low capital adequacy ratio of 0.13, well below the industry average of 0.24. It has about 6.5 Bio in debt.

What this means is basically less leverage and less risk. Most governments have mountains of debt, and no one knows how this will all play out.

I believe it is key that especially asset managers like BlackRock have managabel debt loads.

Conclusion

I believe the BlackRock stock can become a foundational element of my long-term dividend portfolio. Its scale, its market dominance, its reach, its innovation power, its openness to disrupt itself, its attractive dividend, etc., all of those are the reasons why I like this stock.

I am not going all-in at this price level, but once we are back to 600-625 USD, I would like to add more!

The recent bear market in 2022, and the record Fed rate hike have basically tested BlackRock’s business model, and we think the management team around CEO Larry Fink has done a good job!

📘 Read Also

- The 3 Best Banks in Asia

- Why I just Bought 1 Mio Hedera HBAR

- The 3 Best Self-Storage Stocks To Buy

FAQ

What are the best asset management stocks?

BlackRock (BLK), with a market cap of $107B, and a yield of 2.8%

Blackstone (BX), with a market cap of $70B, and a yield of 4.6%

T. Rowe Price (TROW), with a market cap of $27B, and a yield of 4.0%

3i Group (IGQ5), with a market cap of $20B, and a yield of 1.4%

Franklin Resources (BEN), with a market cap of $16B, and a yield of 3.8%

What is the BlackRock stock dividend?

As of 2023/Q1, the BlackRock stock dividend sits at 2.8%.

How about the BlackRock stock dividend history?

BlackRock’s historical trailing annual dividend yield has been ranging between 2-3.5% in the last 15 years. When you can buy $BLK at a higher yield relative to its historical value, it often means it is more profitable at the moment.

How does BlackRock make money?

BlackRock is an asset manager that makes money by taking a management fee for the mutual funds, ETFs, or portfolios it manages. Fees for ETFs can be as low as 0,05% (on average 0,15-0,20%). For some mutual funds, BlackRock charges close to a 2% management fee per year.

BlackRock Stock Review

There are many asset management stocks in Europe, Asia and U.S.? I review the largest one by region, and explain why BlackRock is my top pick.

PROS

- Market Power & Highest AUM Base

- Full Investment Spectrum

- Innovation Powerhouse

- Solid Dividend

- Low Debt

CONS

- Impact From Higher Interest Rates

- Valuation Okay But Not Cheap

- Under Threat From AI Robo Advisors

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love