In the past couple of weeks, I spent a lot of time looking into 3M, ticker symbol: $MMM.

It has not been going well for this dividend king, having +65 years of continuous dividend increases.

Dividend King Stock Chart of 3M

Personally, my previous company has been a supplier to $MMM, and I got to know many formidable people working at this well-respected company.

But sometimes, we as income investors have to re-visit our investment thesis for a company and analyze things objectively and without any emotional lens.

Clarity is power!

And as writing about certain subjects really helps me to crystallize my thoughts, I summarized the main reasons why I am selling this dividend king.

Top Reasons For Selling This Dividend King Stock

Legal Issue #1 – Combat Earplugs

Our beloved dividend king stock $MMM is liable for misrepresenting the effectiveness of combat earplugs manufactured by its subsidiary between 2003-2015, and could therefore face up to $15-25 billion in damages.

Recently, a settlement against a similar action taken by Johnson & Johnson implies momentum favoring plaintiffs in $MMM’s case.

Legal Issue #2 – PFAS

$MMM could be held liable for the large-scale pollution caused by its PFAS technology, with estimates of up to $30 billion in clean-up costs.

The EPA has proposed 4 parts per trillion ratios for PFAS acceptable in water, contrasting with existing state regulations. A jury trial is about to begin in June 2023 over Florida water utility pollution, potentially leading to thousands of similar cases.

If declared hazardous by the EPA, PFAS could fall under the Comprehensive Environmental Response, Compensation, and Liability Act, legally requiring the dividend king stock $MMM to clean up the toxins.

And that not in just one state, but all states.

Further, the Dutch government is now also looking into holding 3M liable for the PFAS damage caused by its Belgium operations.

From where I stand, the damages and liabilities could potentially be the catalysts for a potential bankruptcy!

Major effing Ouch.

Declining Share Price & Margins

The share price of this dividend king stock fell from $225 in 2018 to $100 due to above mentioned legal concerns.

The long-term chart pattern looks strikingly similar to another large company, Bayer (OTCPK:BAYRY), which is also covered in a pile of lawsuits.

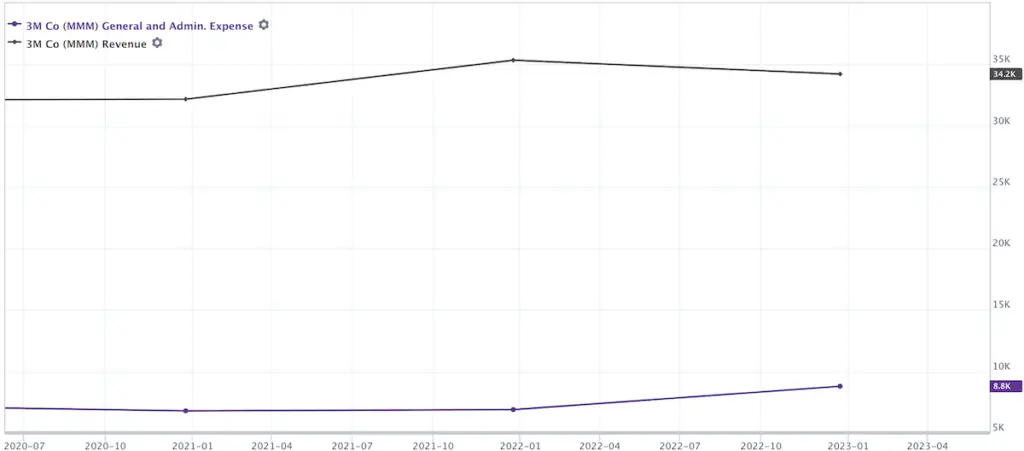

Further, although the company has declining revenues, its General Admin Expenses are increasing, as you can see on the chart below:

Spin-Off’s

In recent years, $MMM has spun off some of its high-margin divisions. It for example sold its dental local anesthetic portfolio in Germany for $70 million.

It also proposed to spin off its entire healthcare division, which would bring much-needed liquidity, but dampen the further outlook of this dividend king stock even more.

Stopped Share Buybacks

$MMM stopped its share buybacks in order to offset some of the headwinds. This will further decrease the earnings per share, making the long-term investment outlook less appealing.

Conclusion

There is a lot of uncertainty around 3M$MMM which in my opinion became a struggling unexciting cyclical industrial stock, facing two massive lawsuits at the same time.

It is possible that it will have a favorable legal outcome than I am concerned about, but this is impossible to quantify, and we have seen what uncertainty can do to share prices when looking at pharmaceutical companies like Bayer (OTCPK:BAYRY) or opioid companies such as Endo (OTC:ENDPQ).

I believe $MMM will soon not be a dividend king stock anymore, that’s why I sold all my 125 shares x 100 USD!

📘 Read Also

- The 10 Best Luxury Stocks With Dividends

- The 5 Best Wall Street Movie Scenes Of All Time

- The 8 Top Industrial Conglomerate Dividend Stocks

- The 5 Best Container Shipping Stocks With Dividends

FAQ

Which Dividend King has the highest dividend?

The cyclical dividend king stocks usually have higher dividend yields, but their yields are also fluctuating more than those of consumer staples or utilities. For example, as of 2023, the dividend yield of 3M (MMM) is relatively high, but part of the reason is also its low share price, which has been declining for five years in a row.

Who are dividend kings?

All 65x Dividend Kings listed by industry:

Basic Materials

Stepan (SCL)

H.B. Fuller (FUL)

PPG Industries (PPG)

Nucor Corp. (NUE)

Consumer Discretionary

Genuine Parts Company (GPC)

Leggett & Platt (LEG)

Lowe’s Companies (LOW)

Consumer Staples

The Colgate-Palmolive Company (CL)

Hormel Foods Corporation (HRL)

Kimberly-Clark Corporation (KMB)

The Coca-Cola Company (KO)

Lancaster Colony (LANC)

Altria Group (MO)

PepsiCo (PEP)

Procter & Gamble (PG)

Sysco Corporation (SYY)

Target Corporation (TGT)

Tootsie Roll Industries (TR)

Universal Corporation (UVV)

Walmart Inc. (WMT)

Energy

National Fuel Gas (NFG)

Financial Services

Cincinnati Financial (CINF)

Farmers & Merchants Bancorp (FMCB)

Commerce Bancshares (CBSH)

S&P Global Inc. (SPGI)

Healthcare

AbbVie (ABBV)

Abbott Laboratories (ABT)

Becton, Dickinson & Company (BDX)

Johnson & Johnson (JNJ)

Industrial

ABM Industries (ABM)

Dover Corporation (DOV)

Emerson Electric (EMR)

Gorman-Rupp Company (GRC)

W.W. Grainger (GWW)

Illinois Tool Works (ITW)

3M Company (MMM)

MSA Safety (MSA)

Nordson (NDSN)

Parker Hannifin (PH)

Stanley Black & Decker (SWK)

Tennant Company (TNC)

Real Estate

Federal Realty Investment Trust (FRT)

Utilities

American States Water (AWR)

Black Hills Corp. (BKH)

California Water Service (CWT)

Canadian Utilities (CDUAF)

Middlesex Water Company (MSEX)

Northwest Natural Gas Holding Co. (NWN)

SJW Group (SJW)

What is the Dividend King meaning?

A company becomes a Dividend King once it was able to raise its annual dividend by +50 years! There are currently 65 Dividend Kings in the U.S. Important to note that while companies can lower their quarterly or monthly dividend, they lose their Dividend King status once they do not raise the annual dividends.

How many Dividend Kings are there?

There are 65 dividend kings in total. Once a company does not raise its dividend anymore, it will lose its spot, and once a company is able to prove that it consecutively raised its dividend for 50+ years, it will become a Dividend King.

What are the Dividend King companies?

Any listed company can become a Dividend King by consecutively raising its dividend every year for 50+ years. Keep in mind, simply paying a dividend is not sufficient. The dividends need to be higher as the previous year, and that for 50 consecutive years.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love