Does Gold Outperform The Stock Market?

I was recently asked: “Does gold outperform the stock market in the long term?“. This an interesting question, so I took a look.

John Maynard Keynes, one of the world’s most renowned economists, called gold a ‘barbarous relic’. It is supposed to be antiquated and useless. Fast forward to today, and gold still plays a critical role in the global financial system.

In this article, I like to answer the following question: Does gold outperform the stock market?

When looking at the last 20 years, the short answer is, yes.

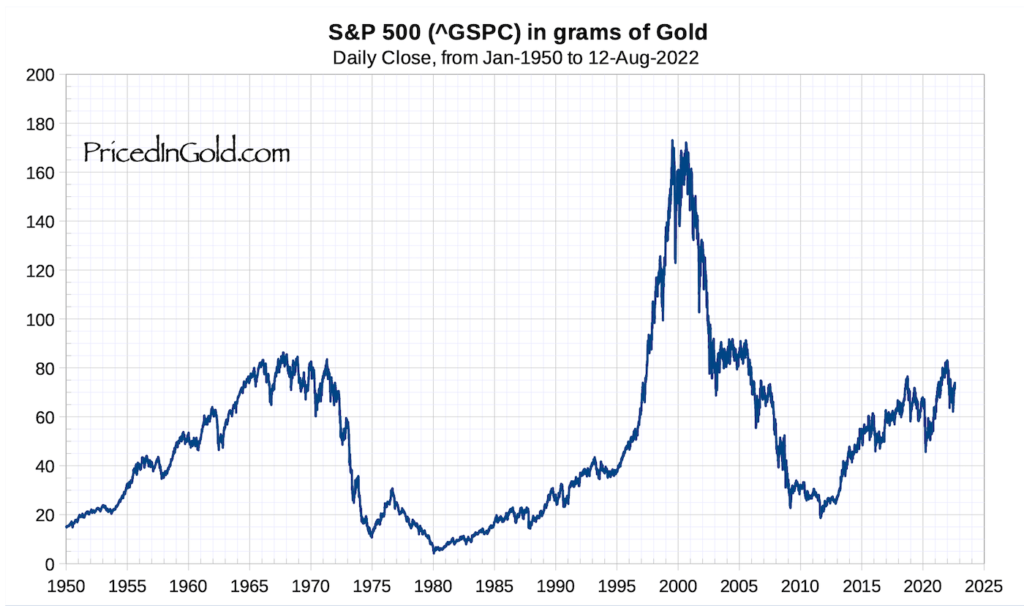

Let’s first take a look at one of the best performing stock market indices in the past 20 years, the Standard & Poor’s S&P500 ($SPY), consisting of the best companies not only in the U.S. but arguably in the world, such as Apple, Amazon, Google, Meta, Microsoft, etc.

S&P 500 in grams of Gold

What is striking is the fact that the S&P500, measured in grams of gold, was not even able to recoup its 2000 high!

In other words, it’d have been better to simply buy and own physical gold in all those 22 years.

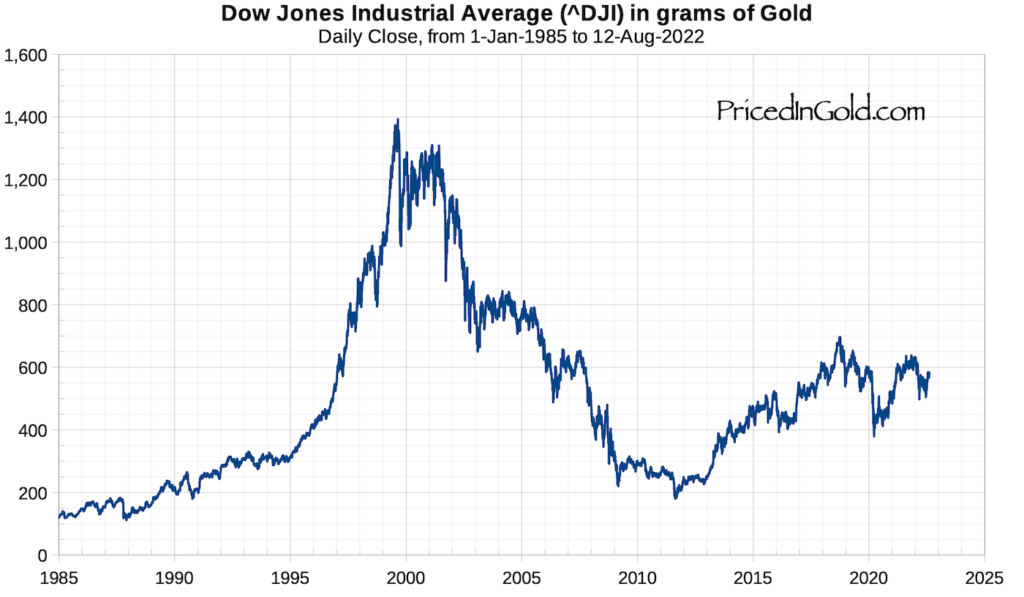

Dow Jones Industrial Avg in grams of Gold

When looking at the Dow Jones, basically the same picture.

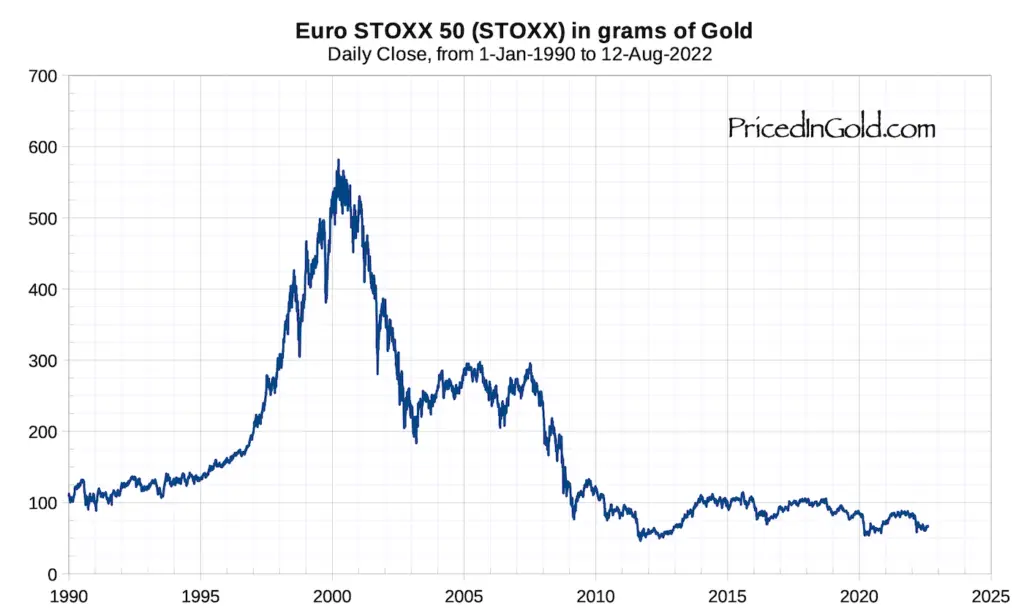

And as the Euro Stoxx 50 performed significantly worse than the SPY or Dow Jones, gold also has a field day with the large blue-chip European stocks.

Euro STOXX 50 in grams of Gold

The Euro STOXX 50 chart, measured in grams of gold, is quite depressing to look at. Investors who believed in Europe, and invested in the best European stocks, would be approx. 5,5 times worse off as someone who just purchased gold bars or gold coins with it!

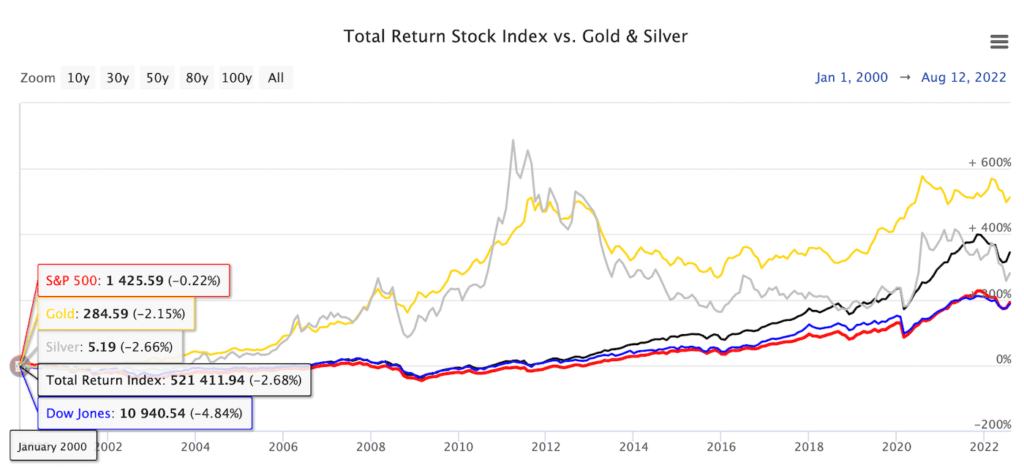

20 Year Performance Comparison

Let’s take a look at the facts: On 1. January 2000, the gold price was 285 USD per Oz. As of today, 16 August 2022, it’s at 1,780.

| Price Jan 1, 2020 | Price Aug 17, 2022 | Performance | |

| Gold 🏆 | 285 USD | 1.780 USD | +512% |

| S&P500 | 1.425 USD | 4.160 USD | +191% |

| Dow Jones | 10.940 USD | 32.955 USD | +186% |

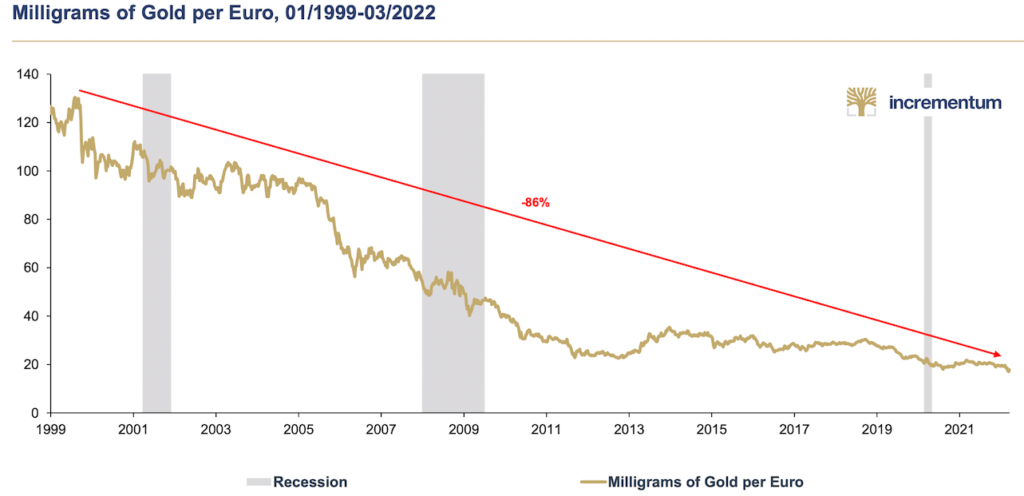

| Mg of Gold in € | 123 mg per € | 20 mg per € | -86% |

Does Gold Outperform Currencies?

When looking at how gold performs in major currencies, it’s an even better performance. Let’s first look at how gold does compare to Euro. In 1999, you could buy approx. 120 milligram of gold with 1 Euro. In 2022, you can only buy 20 mg per Euro, a massive decrease of -83%.

Gold Performance Since 2000 In Various Currencies

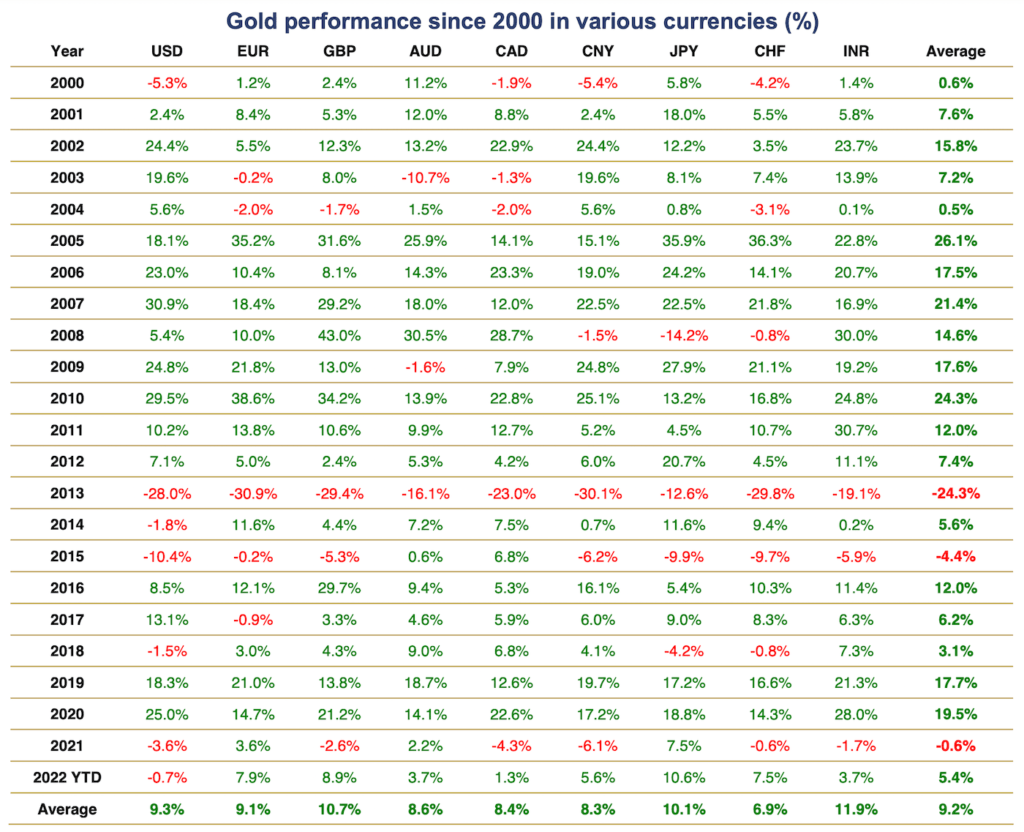

Incrementum released its annual InGoldWeTrust.report, a release I look forward to every year. My favorite table is the following, showing how gold has performed in various currencies:

Conclusion

Numbers and charts don’t lie. When zooming out, not even the best stock markets indices were able to beat the ‘barbarous relic’. Many people are in disbelief when hearing that since 2000, Gold is up more than the S&P500! Although it doesn’t generate free cash flow or dividends, it still outperforms almost all asset classes.

The relentless money printing will continue, and the debt-train wreck will speed up. In the coming decade, we will thus see an even faster debasement of fiat currencies. And this will result in the price of gold increasing a lot.

📘 Read Also

- The Top 10 Reasons To Invest In Gold

- How To Invest In Commodities – 15 Great Commodity Stock Ideas

- How To Build A Portfolio Of Gold Mining Companies

- How To Store Precious Metals At Home – 5 Important Tips!

FAQ

Is it better to buy gold coins or gold bars?

Typically you get more gold for your fiat when buying gold bars. Personally, I keep things simple and buy 1 oz Krugerrands at Goldbroker.com.

Does gold outperform the stock market?

Yes, when looking at for example 2000-2022, gold increased 512% in value, whereas the $SPY only increased 191%. In other words, it would have been a much better investment simply to buy gold in January 2000.

How do I invest in gold?

There are multiple ways. The easiest is to buy physical gold at a local trusted gold dealer. I simply buy gold online at Goldbroker.com. Another way is to buy a gold ETF just like the $IAU or the one I’d choose, $PHYS from Sprott.

How to store precious metals?

Basically, you have two options, either you store your gold in a vault like the one I like and use, Goldbroker.com, or you store precious metals at home. I have written a detailed post about this as well.

Will gold go up in the coming years?

No one knows, but if history is any guide, the chance for the trend to continue ‘up’, is undoubtedly higher than for it to revert.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love