How To Find High Dividend Stocks

For serious DIY investors, I recommend using the All-in-One-Screener from Gurufocus.com. This is the most detailed stock screener out there.

For the more casual investor, the stock screener from Finviz.com is a good alternative. Its free version has all the essential filters, but you can not go as deep as with the screener of Gurufocus.

Looking for high dividend stocks can be a fun and easy task, once you have the right tools, and know what you are looking for.

The best stock screener from Gurufocus.com is great, but not cheap. A Gurufocus plan ranges between 499-1,299 USD p.a. for full access, depending on the plan you get. I use the Premium Account with USA, Europe, and Asia since 2015, and use it every single day for my stock research.

Below I explain the simple steps ‘How to find high dividend stocks”.

If you don't find a way to make money while you sleep, you will work until you die. Warren Buffett

How To Find High Dividend Stocks In 10 Steps

There are many approaches you can take. One way that works well for me is to use a good stock screener, and use the following set of search criteria with the aim of finding high dividend stocks.

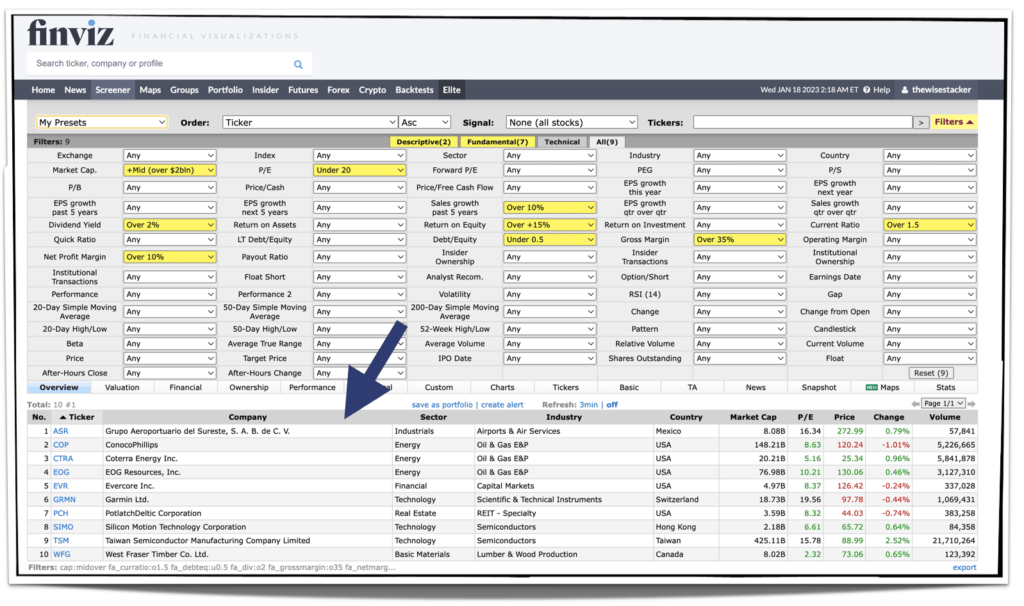

For the below example, let’s use the stock screener from Finviz.com, and look for stocks that match the following search criteria:

- Market Cap To ‘Over $2 Bio’

- Dividend Yield To ‘Over 2%’

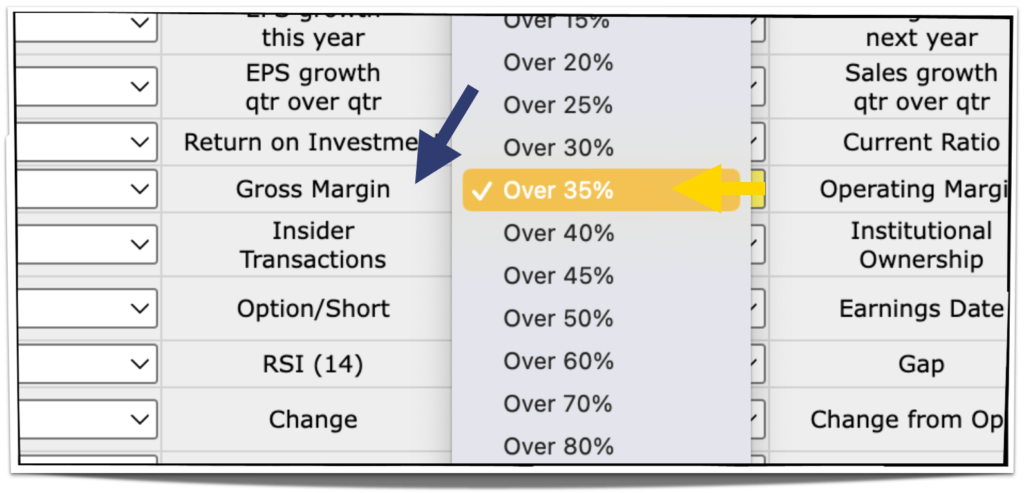

- Gross Margin To ‘Over 35%’

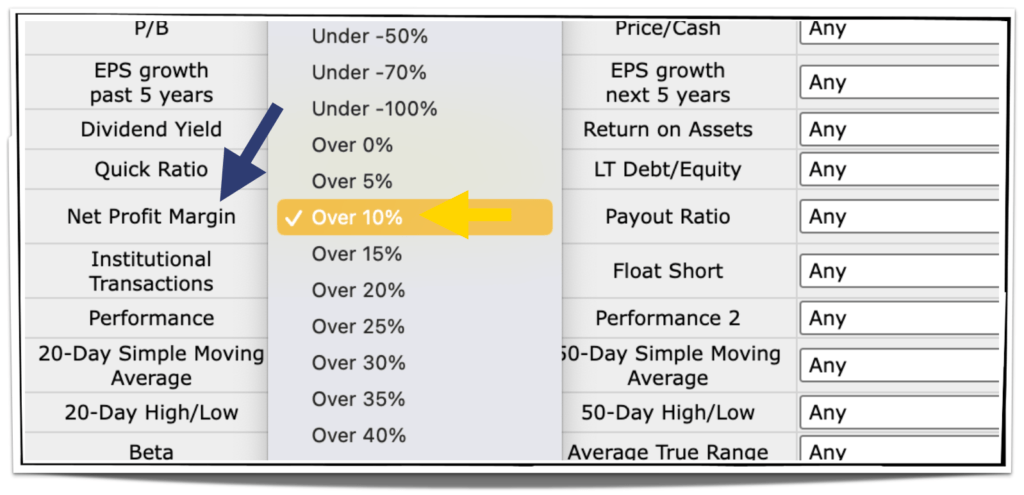

- Net Profit Margin To ‘Over 10%’

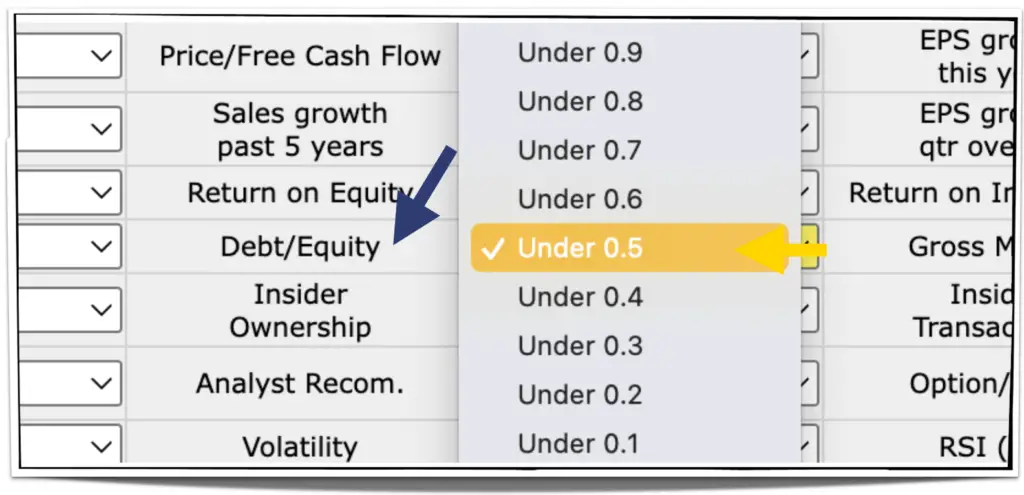

- Debt/Equity To ‘Under 0.5’

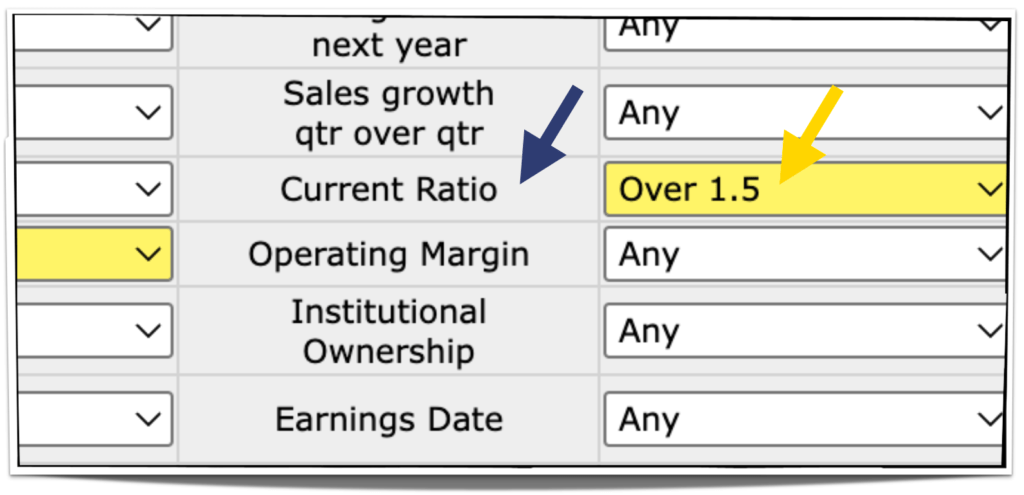

- Current Ratio To ‘Over 1.5’

- Return On Equity To ‘Over +15%’

- ‘Sales Growth’ To ‘Over 10%’

How To Find Good Dividend Stocks

takes approx. 15 minutes

-

Step 1: Head Over To Finviz.com

Finviz.com offers excellent charting and stock research tools. In particular, I like their (free) stock screener. It has all the essential search criteria required to produce a list of 5-10 good dividend stocks.

-

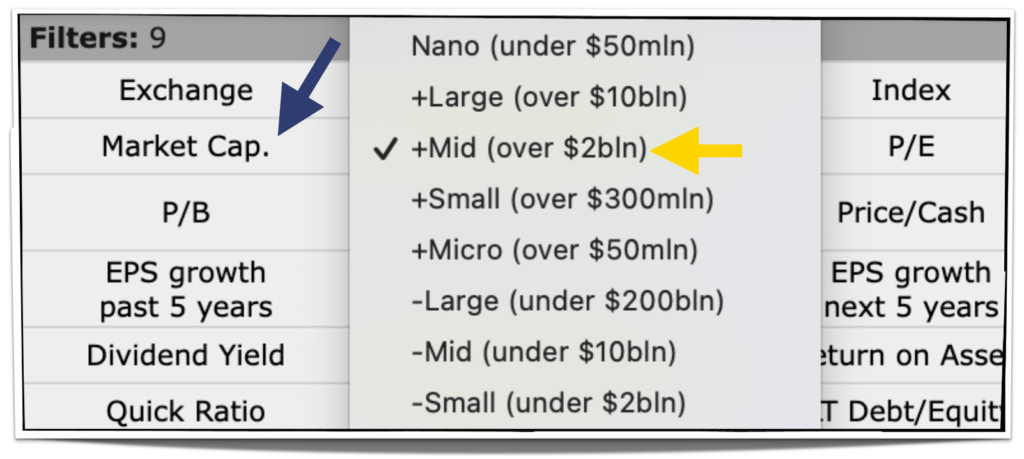

Step 2: Set Market Cap To ‘+Mid’

Let’s search for companies with a minimum market cap of $2 Bio USD (you can set whatever you like).

-

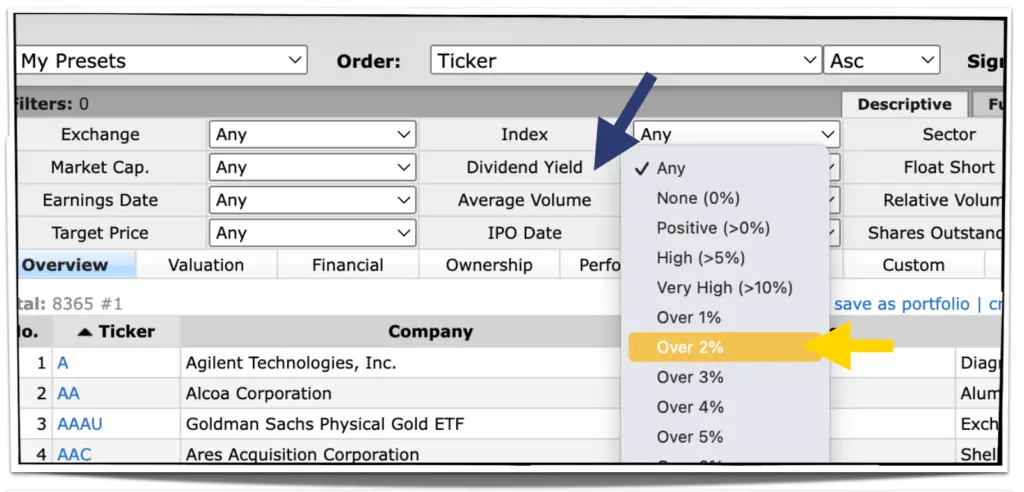

Step 3: Set Dividend Yield To ‘Over 2%’

Choose the ‘Dividend Yield’ and select ‘over 2%’. This filters out all companies that pay either no dividends, or less than 2%.

-

Step 4: Set Gross Margin To ‘Over 35%’

Choose ‘Gross Margin’ and select gross margins of ‘over 35%’.

-

Step 5: Set Net Profit Margin To ‘Over 10%’

Let’s now filter out all those companies with ‘net profits’ of below 10% by clicking on ‘net profit margin’ and selecting ‘over 10%’.

-

Step 6: Set Debt/Equity To ‘Under 0.5’

Good dividend stocks should not only pay high dividends but also should not have in-debted by too much. Therefore, let’s ask the screener to filter out companies with too much debt. In order to do so, click on ‘Debt/Equity’ and set it to ‘under 0.5’. The debt/equity ratio indicates the relative proportion of equity and debt used to fund a company’s assets.

-

Step 7: Set Current Ratio To ‘Over 1.5’

A ‘Current Ratio’ of 1 or higher is usually good. The way to calculate is Total Current Assets divided by Total Current Liabilities. Acceptable current ratios vary from industry to industry. Good current ratios are between 1 and 3. The higher the more able a company to pay its obligations. Ratios below 1 suggest the company might not able to pay off its obligations if they came due at that point.

-

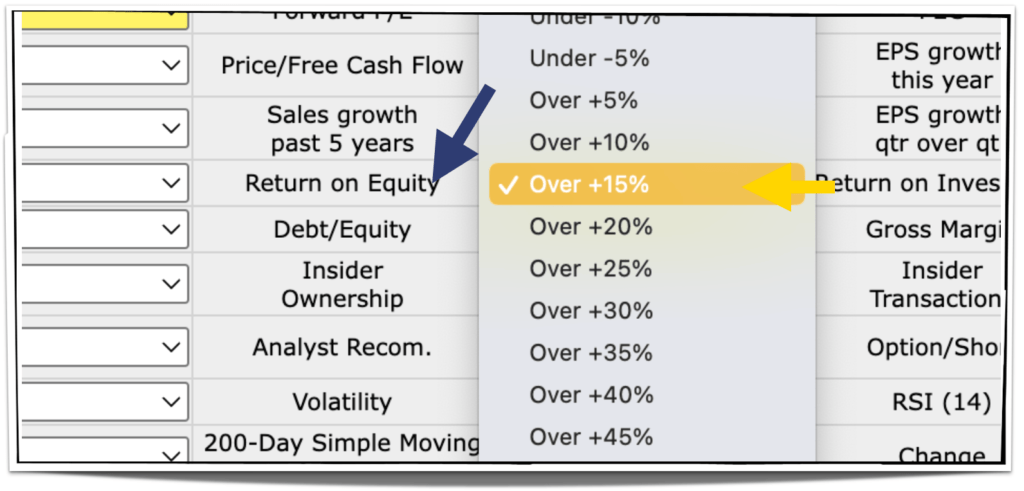

Step 8: Set Return On Equity To ‘Over +15%’

Choose the ‘Return-on-Equity’ search criteria, and choose ‘over +15%’. What this does is filter out all companies having ROE’s of less than 15%. Simply put, it is how much net income a company generates with the capital of the shareholders (excluding all loans, external financing, etc.). To increase your ROE, either the net income goes UP, or shareholder equity comes DOWN.

-

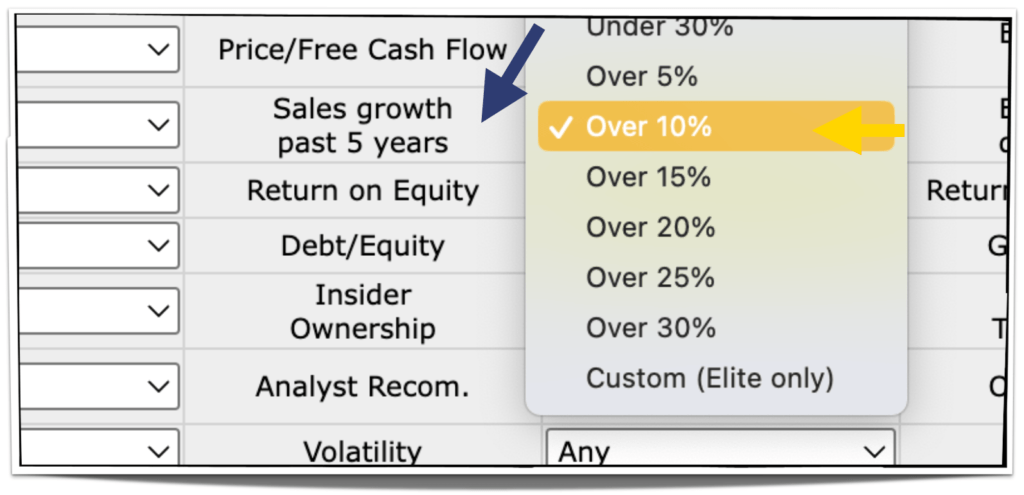

Step 9: Set ‘Sales Growth’ To ‘Over 10%’

The last step is to look for companies that grow by an average of ‘over 10%’ per year. To do so, click on ‘sales growth past 5 years’ and set it to ‘over 10%’. This filters out all companies that grow by less than 10% per year (on average!).

-

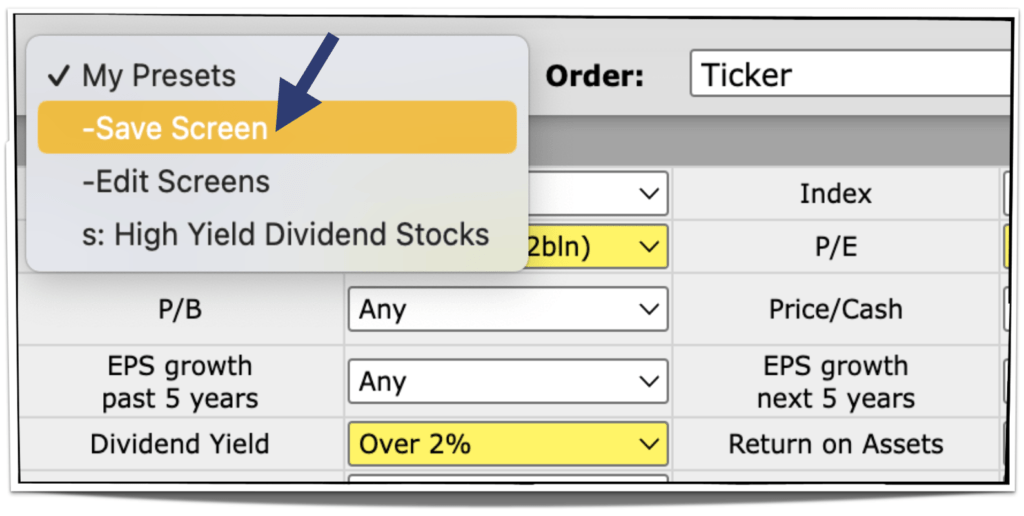

Step 10: Save Your Screener

The final step is to save the screener we just created. To do so, simply click on the top left ‘My Presets’, then click ‘save screen’. Now you can screen for good dividend stocks any time you like.

BONUS TIP: You can now easily check region by region, e.g. U.S., Europe, or Asia, or even by country. To do so, click on ‘Country’ in the top right corner of the screener.

Supply:

- What you need:

- – internet connection

- – a desktop computer or tablet

Tools:

- Tools we will be using:

- – free Finviz stock screener

- – 8x simple search criteria

Materials: – the 8x search filters/criteria as explained

High Dividend Stock Search Results

When we apply the above-mentioned search criteria, the Finviz Screener gives us

| Symbol | Name | Industry | M. Cap | PE | Yield |

| $ASR | 🇲🇽 Grupo Aeroportuario | Industrials | 8.12B | 16 | 7.6% |

| $COP | 🇺🇸 ConocoPhillips | Energy | 146.13B | 9 | 5.2% |

| $EOG | 🇺🇸 EOG Resources | Energy | 76.23B | 10 | 3.3% |

| $GRMN | Garmin Ltd. | Technology | 18.51B | 19 | 2.9% |

| $EVR | 🇺🇸 Evercore | Financial | 4.86B | 8 | 2.9% |

| $CTRA | 🇺🇸 Coterra Energy | Energy | 19.68B | 5 | 2.5% |

| $TSM | 🇨🇳 Taiwan Semiconductor | Technology | 427.40B | 16 | 2.3% |

| $SIMO | 🇭🇰 Silicon Motion Tech | Technology | 2.16B | 7 | 2.0% |

| $PCH | 🇺🇸 PotlatchDeltic | Real Estate | 3.62B | 8 | 1.8% |

| $WFG | 🇨🇦 West Fraser Timber | Basic Materials | 8.00B | 2 | 1.6% |

Two High Dividend Stocks Buffett Owns or Owned

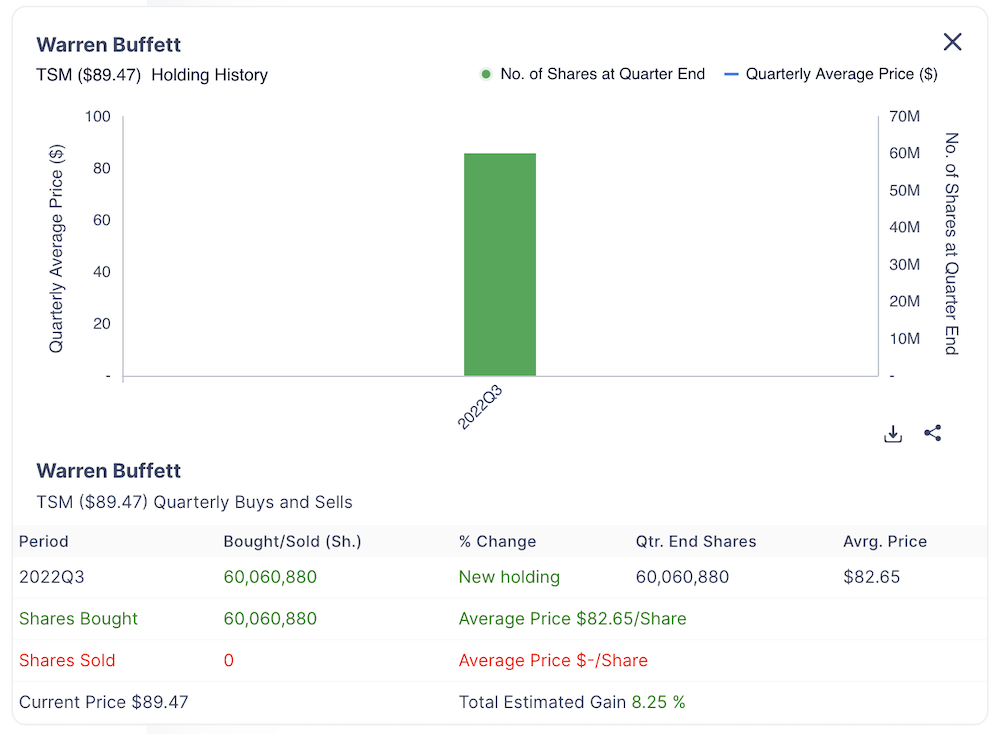

Interesting that our search found two high dividend stocks that Warren Buffett owns, or owned:

- Taiwan Semiconductor (TSM), which he just purchased recently)

- ConocoPhillips (COP), of which Berkshire Hathaway sold its position in 2015.

One Gurufocus feature I love is how each transaction of the various investment gurus is presented. At one glance, it’s easy to get an overview, see the following example of Berkshire Hathaway’s (see all its holdings) position in $TSM:

What About High Dividend Gowth Stock?

Should you care about the companies you invested in being able to grow their dividends? The answer is a resounding yes. Especially if you are at the beginning of your investor journey, the speed with which a company can grow its dividend is almost of higher importance than the current yield.

Recommendation – only invest in companies that can raise their dividends in a stable and predictable way (see dividend aristocrats, dividing kings, etc.).

Search Result Disclaimer

Important – I do not recommend you buy those 10 above-listed high dividend stocks. Far from it. It’s just an initial list of high dividend stocks for you to start your research with.

One-Click To My High Dividend Stock Screener Preset!

You reached the end of the article, which needs to be rewarded!

Click on the button below and all of the above search criteria are already pre-set in the Finviz stock screener!

📘 Read Also

- Check out my 10 Favorite Dividend Stocks You Can Buy And Hold Forever

- Why Realty Income is the perfect buy-and-hold forever stock

- The Best Dividend-Paying Entertainment Stocks

- The 3 Best Self-Storage Stocks

FAQ

How do dividends work?

When companies are profitable, their board may decide to use some of its after-tax profit to pay it in forms of a dividend to its shareholders. If you for example own some Microsoft stocks, and Microsoft pays out $0.5 US in dividends per share, you’d receive this amount for every Microsoft share you hold in your brokerage account.

How to find high dividend stocks?

There are many (free) stock screeners that allow you to search for high dividend stocks. One good one is the Finviz.com screener, and below are some recommended search criteria:

– Market Cap To ‘Over $2 Bio’

– Dividend Yield To ‘Over 2%’

– Gross Margin To ‘Over 35%’

– Net Profit Margin To ‘Over 10%’

– Debt/Equity To ‘Under 0.5’

– Current Ratio To ‘Over 1.5’

– Return On Equity To ‘Over +15%’

– Sales Growth’ To ‘Over 10%’

What companies have paid dividends the longest?

The companies that have paid dividends the longest are called Dividend Kings. As of 2023, below are the Top 10 Dividend Kings paying high dividends the longest:

American States Water Co. 66 years

Dover Corp. 66 years

Genuine Parts Co. 65 years

Northwest Natural Holding Co. 65 years

Procter & Gamble Co. 65 years

Parker-Hannifin Corp. 65 years

Emerson Electric Co. 64 years

3M Co. 63 years

Cincinnati Financial Corp. 61 years

Coca-Cola Co 59 years

Full list: https://time.com/nextadvisor/investing/dividend-kings/

What is the dividend yield?

The dividend yield of a company puts the paid-out dividend in relation to the current share price. Let’s say a stock’s share price is currently sitting at 100, and it pays out 5 in dividends, the dividend yield would be 5%. Now, should the share price double to 200, and the dividend goes to 10, then the yield is still 5%. However, if you bought the stock at 100, and now it pays a dividend of 10, then your dividend yield on cost is 10%.

What is the best high dividend ETF?

The five best, or better, most popular high dividend ETFs:

– Vanguard High Dividend Yield ETF (VYM)

– Schwab U.S. Dividend Equity ETF (SCHD)

– WisdomTree Emerging Markets Small Cap Dividend Fund (DGS)

– iShares International Select Dividend ETF (IDV)

– SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

What are the top 25 dividend stocks?

Every investor has different criteria to choose his/her top 25 dividend stocks. A good place to start is the list of dividend aristocrats. The companies on this list managed to raise their dividends for 25 consecutive years. Often the dividend aristocrats are labeled as the top 25 dividend stocks, listed below:

Top Dividend Aristocrats, ranked by the number of years

1 – Dover Corp. (DOV) Industrials – with 66 years

2 – Genuine Parts Co. (GPC) Consumer discretionary – with 66 years

3 – Procter & Gamble Co. (PG) Consumer staples – with 66 years

4 – 3M Co. (MMM) Industrials – with 64 years

5 – Cincinnati Financial Corp. (CINF) Financials – with 62 years

6 – The Coca-Cola Co. (KO) Consumer staples – with 60 years

7 – Colgate-Palmolive Co. (CL) Consumer staples – with 60 years

8 – Emerson Electric Co. (EMR) Industrials – with 60 years

9 – Johnson & Johnson (JNJ) Health care – with 60 years

10 – Hormel Foods Corp. (HRL) Consumer staples – with 56 years

11 – Stanley Black & Decker Inc. (SWK) Industrials – with 54 years

12 – Illinois Tool Works Inc. (ITW) Industrials – with 51 years

13 – W.W. Grainger Inc. (GWW) Industrials – with 51 years

14 – Abbott Laboratories (ABT) Health care – with 50 years

15 – AbbVie Inc. (ABBV) Health care – with 50 years

16 – Becton, Dickinson & Co. (BDX) Health care – with 50 years

17 – Federal Realty Investment Trust (FRT) Real estate – with 50 years

18 – PPG Industries Inc. (PPG) Materials – with 50 years

19 – Target Corp. (TGT) Consumer discretionary – with 50 years

20 – VF Corp. (VFC) Consumer discretionary – with 50 years

– – – ALL ABOVE ARE ALSO REFERRED TO AS DIVIDEND KINGS – – –

21 – Kimberly-Clark Corp. (KMB) Consumer staples – with 49 years

22 – Nucor Corp. (NUE) Materials – with 49 years

23 – PepsiCo Inc. (PEP) Consumer staples – with 49 years

24 – S&P Global Inc. (SPGI) Financials – with 49 years

25 – Walmart Inc. (WMT) Consumer staples – with 49 years

What are the highest dividend stocks in the world?

The highest dividend stocks are typically from cyclical companies that do well in good/boom times, but not well during bad times such as in a recession. For example, during the pandemic, some cargo and container companies paid out dividends as high as 20-30%, but often these are one-off events.

One rule of thumb is: Whenever you see a dividend yield of 10%, or more, you need to be careful if it is not a “value trap” (meaning the dividend percentage only appears high because the share price decreased by e.g. 80%, etc.).

What are the best dividend stocks in 2023?

To each investor, this depends on many different factors, such as risk tolerance, investment time horizon, asset allocation, etc. For 2023, the best dividend stocks are typical of those companies with solid financials. Some investors think the following five are some of the best dividend stocks in 2023:

– Johnson & Johnson (JNJ)

– Procter & Gamble (PG)

– Walmart (WMT)

– Honeywell (HON)

– PepsiCo (PEP)

What are the best high dividend stocks quarterly?

What are the highest dividend stocks on Robinhood?

Robinhood lists over 5,000 stocks from most major exchanges such as the NYSE, NASDAQ, AMEX, but also many international exchanges plus most ADRs. Therefore, you can find many of the highest dividend stocks on Robinhood, such as the following:

– BHP (BHP), with a yield of 9.8%

– Rio Tinto (RIO), with a yield of 9.3%

– Western Union (WU), with a yield of 6.6%

– Coterra Energy (CTRA), with a yield of 6.5%

– Auburn National Bank (AUBN), with a yield of 5.15%

What is a stock with good dividend yield?

Stocks with a good dividend yield are those that distribute a relatively large part of their net profits in form of monthly, quarterly, bi-annually and annual dividends. If a company for example pays an annual dividend of 4 and has a share price of 100, then it would have a good dividend yield of 4%. Typically all dividends above 3% can be considered to be ‘good dividend yields’.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love