Realty Income Is My ‘Steady Eddy’.

In late 2019 I made the decision to sell all my MSCI World ETF, and build up an All-Weather Portfolio, with only those stocks I felt great about. I didn’t like my MSCI World ETF anymore, because it contained a lot of sectors and industries I was not bullish on anymore. Mainly sin stocks, defense, and tobacco companies.

I was lucky when the market tanked due to Covid back in March of 2020. I was close before pulling the trigger when most of the stocks I shortlisted as candidates for my forever portfolio suddenly plunged in value. Then, Realty Income ($O), was the first stock I bought.

I strongly believe Realty Income is a forever stock. That’s why it was not only my first purchase, but I also made it my largest holding. I believe the “The Monthly Dividend Stock” is a must-own stock for every income investor.

About Realty Income

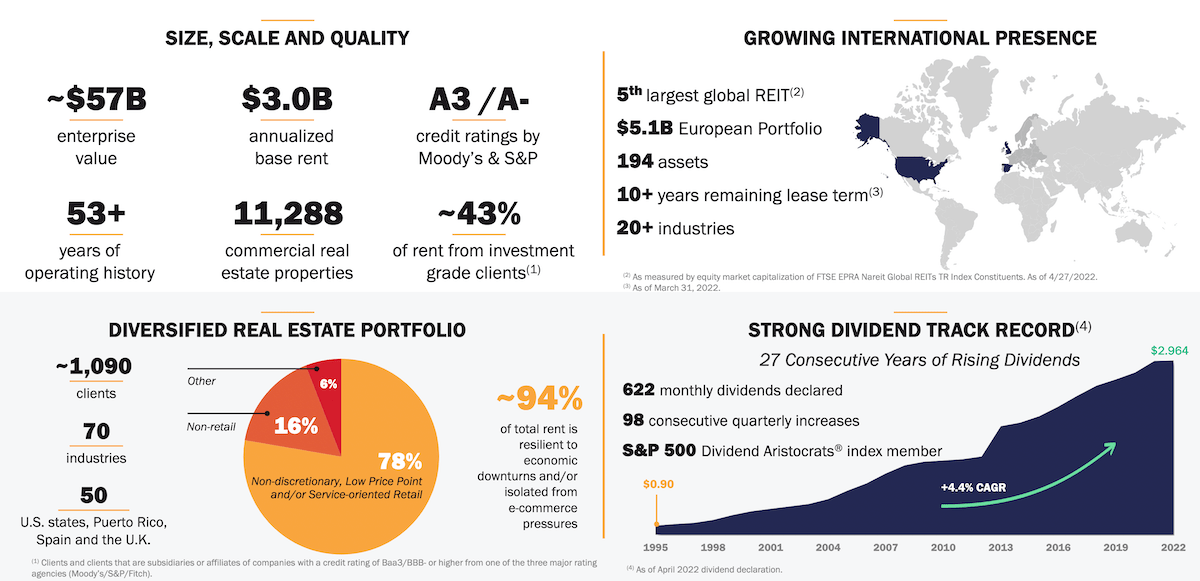

Realty Income is one of the world’s largest, diversified real estate companies. It owns over 11,000 commercial properties in the U.S., the United Kingdom, and Spain. Its +1,000 long-term customers are coming from 70+ industries. Its European portfolio has a NAV of +5 Bio USD.

Most of Realty Income’s leases are structured as triple-net leases (also called triple NNN). This means that besides paying rent every month, the client is responsible for the entire management of the property, including all its operating expenses, taxes, maintenance, and insurance.

This simplifies things greatly for Realty Income, and, makes it possible to have highly predictable cash flow. And this is, in my point of view, not only the basis for the monthly dividend but also the reason why Realty Income is a forever stock.

In the past 27 years, Realty Income has paid a rising dividend in each of the 27 consecutive years!. This makes part of the Dividend Aristocrats. Also, with a dividend CAGR of 4,4%. appealing to dividend growth investors. Another proof Realty Income is a forever stock.

My First Realty Income Purchase

See below for a 10-year (weekly) stock chart showing both the GFC, Global Financial Crisis, and the Covid crash.

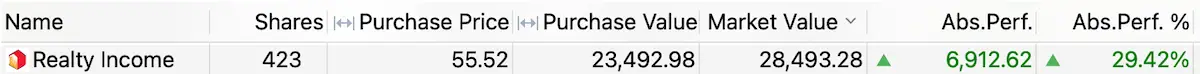

My first purchase, on June 2, 2020, was 400x Realty Income x 57 USD. Since then I re-invested the dividends and now own 423 shares, paying out 88 USD every single month (withholding tax already deduced). In total, I have received 1,900 USD in dividends, lowering my average purchase price to 55 USD (see below).

Unfortunately, I didn’t catch the bottom at 40 USD, but as Confucius said ‘he who picks bottoms gets stinky fingers’. I am still happy with my average buying price of 57 USD, because just a few weeks earlier, I would have paid +80 USD for one Realty Income share. My 57 USD buying price is therefore roughly 30% off the all-time-high. Since then, $O has been trading in the standard range.

What Is A Good Price To Buy Realty Income At?

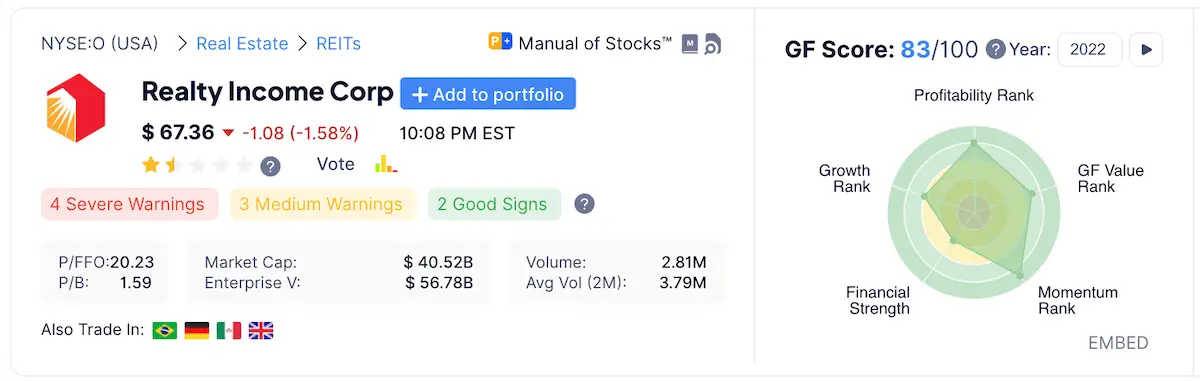

I believe at the moment (early June 2022), when Realty Income is below 70 USD, it represents an ‘okay range’ to buy. Not ideal, but ok. To me, Realty Income is best bought in moments of market panic. The company has a fortress-like balance sheet and has a widely diversified customer base (+70 industries!). This makes Realty Income very resilient, and able to survive even the longest of bear markets.

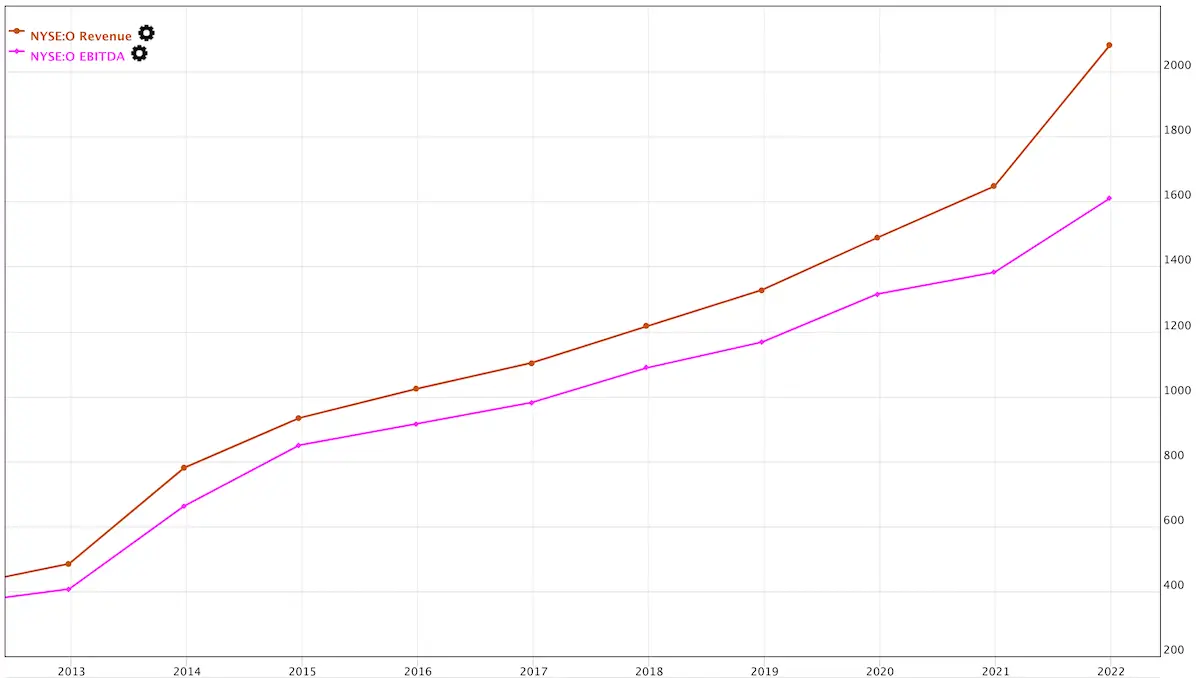

Does Realty Income Have Predictable Financials?

Let’s take a quick look at the revenues and EBIDTA over the years. I usually do this before looking at the stock price or market cap. Revenues are growing steadily, and so does the EBITDA. Nice.

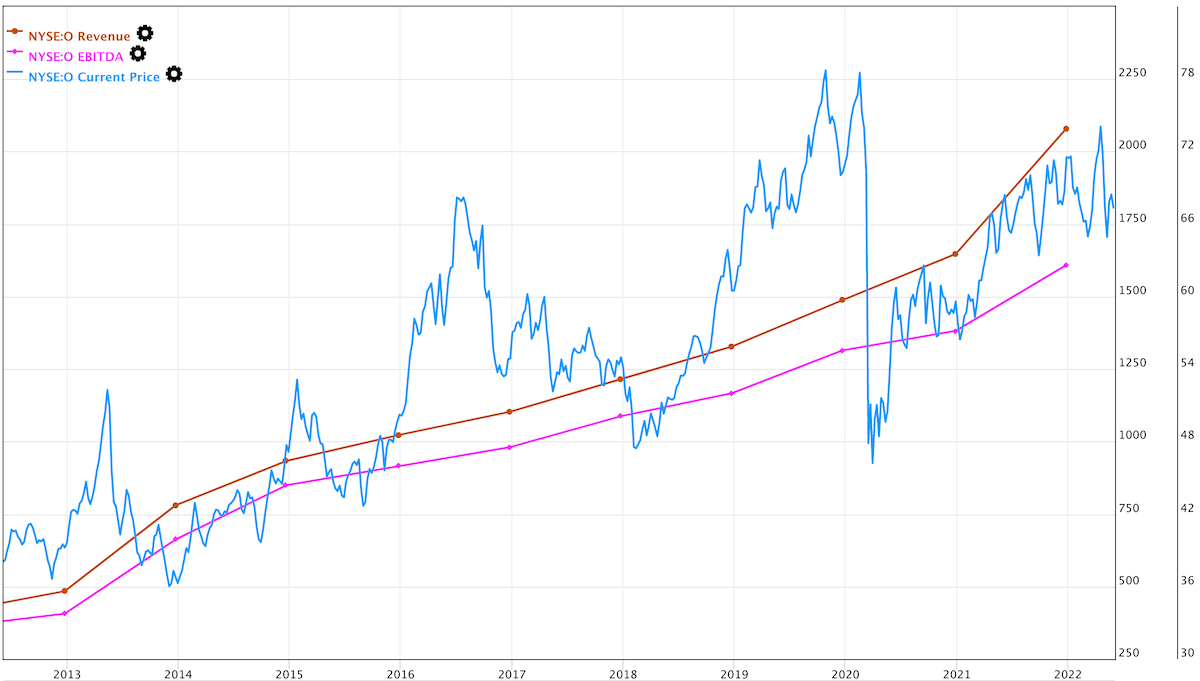

Now when we add the stock price to the same chart, we get the following:

What Does Realty Income’s Long-Term Chart Look Like?

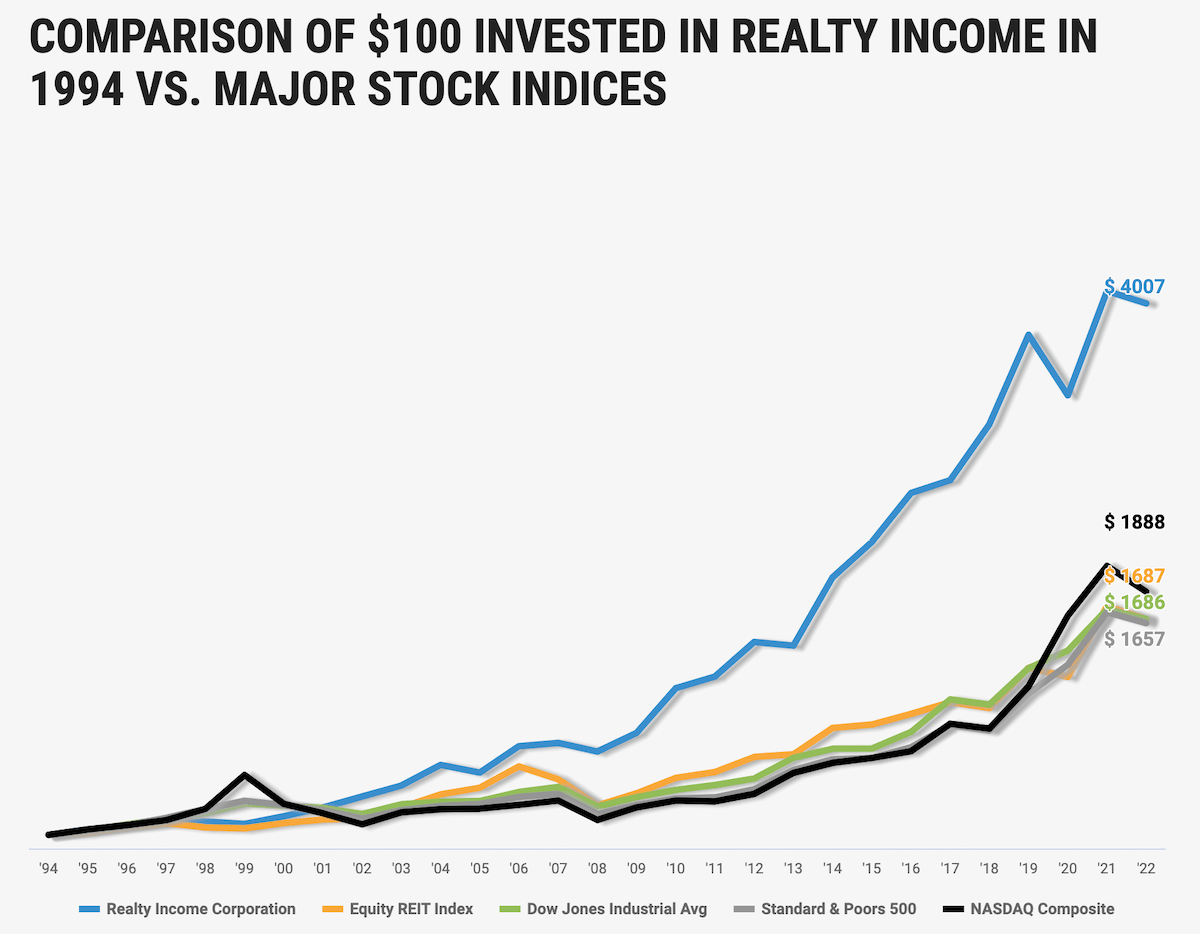

I believe the following chart speaks for itself and is proof that Realty Income is a forever stock – nothing more to add!

Why Is Reason Realty Income A Forever Stock?

In one word, predictability. Anyone looking at the above chart can tell you that this is most likely a steady, stable, and highly predictable business.

Having managed my own traditional service firm in Singapore before selling it, I can tell you that my financials did not look like this! It’s a real thing of beauty.

With +11,000 owned properties, a fortress-like balance sheet, a vast client base, a unique financing competence, and unparallel access to property deals, it’s clear as day that Realty Income is a forever stock, and deserves a place in your long-term dividend portfolio.

📘 Read Also

- How To Invest $50,000 Right Now

- See which European REITs I think are good buys

- Check out my dream REIT stock in the U.S.

- Like to see my total monthly income 👉 Dividend Calendar

- The only 5 European stocks with 20+ years of consecutive dividend increases

FAQ

What is the Pfizer stock symbol?

What is the Pfizer stock price today?

To check Pfizer’s stock price, head over to Google Finance. To analyze $PFE on a stock analysis platform like Gurufocus.com, click here.

Where to check Pfizer stock dividends?

Head over to Pfizer’s dividend page on Gurufocus.com to see the past, current and future dividends for $PFE.

Is Pfizer a good stock to buy and hold?

Yes, Pfizer has shown it is innovative enough with the required staying power and resilience to make it a good buy and hold stock. It has been a stable dividend payer for decades, and its medicine has helped billions of people all over the world.

Conclusion & WiseStacker's Take

As the 5th largest REIT in the world, Realty Income is a forever stock due to its massive economies of scale, extensive diversification across 70 industries, and its highly cash-generative business model.

PROS

- massive economies of scale

- highly predictable cash generation

- limited risk due to the Triple-Net Leases

- endless global growth opportunities

- excellent capital allocators

CONS

- relatively high dependency on retail

- cluster risk on the United States

- not present in Asia yet

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love