Introduction

In my +30 years as an investor in stocks, startups, and people, I’ve learned that some of the best investment decisions come not just from logic or hard data but from something less tangible—intuition.

Time and again, I’ve found that the most successful outcomes emerged when objective logic was aligned with an inner sense of “knowing” that can’t always be fully explained.

This gut feeling, which I believe can be nurtured and can grow sharper with experience, often signals truths that numbers alone can’t reveal.

Learning to trust my intuition has become one of the most valuable skills in my investing toolkit, and with this article, I like to share my 5 best tips on how you can use and foster it too.

Important Difference Between Impulse and Intuition

As I wrote in Top 10 Trading Psychology Tips, I believe intellect, psychology, temperament, and intuition, all play a vital role when it comes to your investing success.

That’s why, let’s drill down on intuition, and how I believe you can use it to improve your investing.

5 Best Tips On How to Use Intuition in Investing

Investors need to take in and synthesize an abundant and overwhelming amount of information.

Crazy fact: According to author John Lloyd, a single New York Times edition contains more information than what an average person in 17th-century England would have come across in their lifetime.

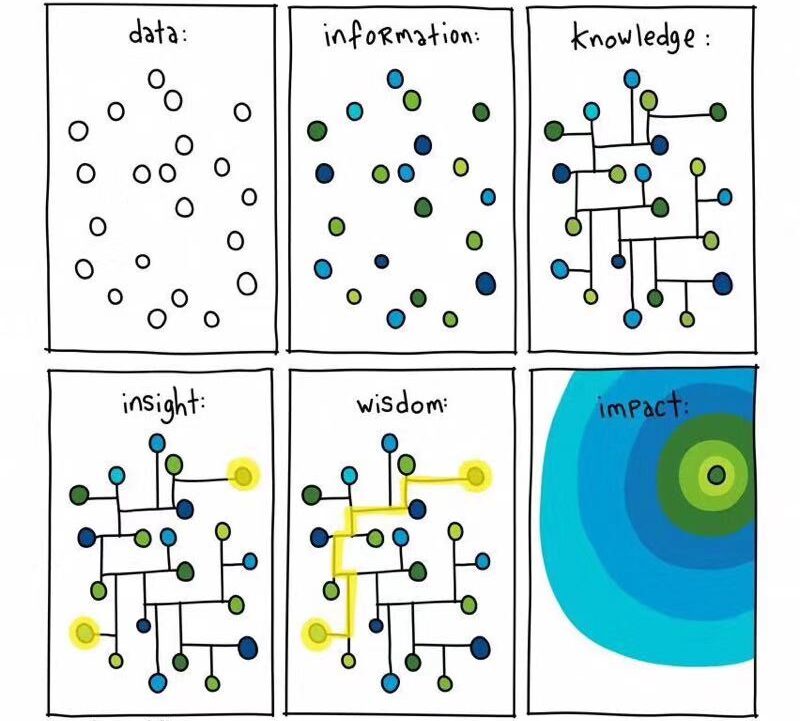

So there is no lack of information, the question is what to extract from it, and what is relevant. This chart helps to visualize how basic data becomes increasingly connected and contextualized, ultimately leading to actionable wisdom that drives meaningful change.

The key takeaway here is that true impact is achieved not merely by collecting data but by understanding and applying it in a way that leads to informed, real-world results.

Put simply:

- Data: Raw, unconnected points with no structure.

- Information: Organized data with some context.

- Knowledge: A network of connected information starts to form.

- Insight: Recognized patterns within knowledge.

- Wisdom: Strategic pathways based on insight (how to get from here to there).

- Impact: A ripple effect created by applying wisdom (knowing what makes a difference?).

In a world overflowing with information, making wise judgments relies more than ever on the ability to trust and refine your intuition.

For someone with street-smarts, intuition is often grounded in quick, instinctive judgments based on past experiences in unpredictable environments. They might use intuition to sense danger, spot opportunities, or detect people’s intentions rapidly.

In contrast, wise persons use intuition more reflectively, combining it with learned insights and broader life experiences. Their intuition is likely more tempered by patience and ethical considerations, helping them see beyond immediate circumstances to make decisions that align with long-term values and impacts.

Smart Joe knows how to get out of a tricky situation, Wise Joe does not even get himself into situations that put him in danger.

So, what are some practical ways to sharpen your gut instincts?

Tip 1 – Trust Your Instinct, Temper Your Impulse

Begin by honoring that first gut instinct, but pause before acting. True intuition comes from a sense of calm confidence, not urgency.

In particular, as soon as you sense any FOMO, take a step back—try a calming walk or some deep breathing—to reconnect with your inner voice.

Avoid acting impulsively, as intuitive decisions feel right without demanding immediate action.

My grandmother used to say, ‘Noah, you’ll be successful no matter what. There’s no need to finish everything today!‘

To this day, I often remember her words, which remind me not to feel bad about leaving some tasks undone.

Sleeping on an important decision often helps me approach it with a clearer mind the next day.

Tip 2 – Create Inner Calm to Strengthen Your Gut Feel

A quiet mind is essential for accessing genuine gut feeling.

Epictetus said, “Before you proceed, step back and look at the big picture, lest you act rashly on raw impulse.”

My best investment decisions happened when I felt a deep calm yet non-emotional conviction.

Tip 3 – Prioritize Physical Well-Being

A strong mind requires a healthy body. Make exercise (and sleep!) non-negotiable to keep your psychological well-being in top shape, strengthening your ability to make intuitive decisions.

Your body is your most valuable asset, and it’s your responsibility to take excellent care of it.

Clear thinking flows from a calm, rested body and mind.

Tip 4 – Write Down Your Emotions to Sharpen Intuition

Keeping a journal of all your buys & sells, as well as your emotional states can reveal patterns that strengthen your self-awareness over time.

Log your emotions before and after trades, and you might gain clarity on how intuition manifests for you, making it easier to trust your gut in the future.

Tip 5 – Focus on What You Can Control

Drawing inspiration from Stoic philosophy, I try to focus only on what I can control and let go of the rest. All I can do is control my actions.

That’s why I have a consistent daily routine, helping me to stay calm and balanced throughout the day.

For example, on a normal weekday, before checking any emails, news, or the stock market, my routine looks like this:

- Make and eat breakfast with my kids

- Shower and get dressed

- Meditate (even if it’s just for 5 minutes)

- Set my goals for the day (ask yourself: What do I need to accomplish today so that at the end of the day I’d think it was a good day?)

- Complete or at least commence with the key task of the day

This routine allows me to start the day with a sense of calm and readiness.

Temperament, combined with intellect, is often the key to successful investing.

This balanced approach encourages patience, allowing my intuition to guide my decisions rather than reacting to external noise.

Conclusion

Intuition plays a vital role when it comes to investing. It can and needs to be fostered & nurtured.

When you put in some work, it will surely improve your decision-making and ultimately your investment success.

📘 Read Also

- Top 10 Trading Psychology Tips for Your Investing Success

- Financial Astrology – Investment Guide For the Age of Air

- Buying The Best GenZ Stock | Trade Alert

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love