Top 10 Trading Psychology Tips

In my investor journey, I realized pretty early that I suck at day trading. I am not a momentum trader. I am a good long-term investor.

Nevertheless, I keep a small separate trading account focused on generating additional cash flow. I put in $70k, currently worth $100k, representing less than 3% of my liquid net worth (and 1.8% of my total net worth).

In my 30 years of trading, I’ve learned invaluable lessons in trading psychology, which I like to share with you today.

1/ Know Yourself

To begin, identify your trading style:

- Scalper: Executes rapid buy and sell transactions within minutes

- Day Trader: Engages in short-term trading, closing positions intra-day

- Swing Trader: Holds trades for short to medium terms, spanning days/weeks

- Position Trader: Takes a long-term approach, holds assets for months/years

Personally, I identify strongly as a long-term investor, with little resonance even with the term Position Trader.

2/ Temperament Over Intellect

Your temperament is crucial to your success as a trader.

Discipline, patience, and emotional control often yield greater rewards than sheer intellectual prowess.

While it can be tempting to try and pick the exact bottom of a declining stock for the thrill of it, such attempts often end in frustration.

Instead, focus on capturing the profitable middle of a bull run, steering clear of the risks associated with being either too hasty or too tardy in your decisions.

3/ Understand The Difference Between Intuition & Impulse

Intuition gives you a slow, calm relaxed feeling of wisely knowing. It’s your subconscious mind helping you to calmly recognize patterns.

Impulses make you want to act ‘right now, or otherwise..‘. In particular, learn to recognize and tame emotions like FOMO, and differentiate them from true intuition.

One of my favorite stoic philosophers, Epictetus, already knew that more than 2,100 years ago: “Before you proceed, step back and look at the big picture, lest you act rashly on raw impulse.”

4/ Emotions & Position Sizes

Avoid overly large positions that cause excitement (or boredom), as these can lead to irrational decisions.

Opt for position sizes that keep you focused and disciplined.

Put simply, if you are getting a buzz from your position, and check its price multiple times a day, it’s a sign it’s too big.

5/ Patience & Market Understanding

Understand that markets move in cycles and trends. Patience is key to waiting for the right opportunities and not reacting impulsively to short-term fluctuations.

Warren Buffett once said, “We make the biggest gains by doing nothing and simply sitting tight (but please don’t tell our clients that).”

6/ Plan The Trade + Trade The Plan

Develop and stick to a simple trading plan - a well-defined trading plan that includes entry and exit strategies.

Consistently following your plan helps avoid emotional trading and improves decision-making.

Know that once you exit a trade, the next trade is right around the corner.

7/ Maintain A Trading Journal

Maintain and keep a simple trading journal, logging each trade you make.

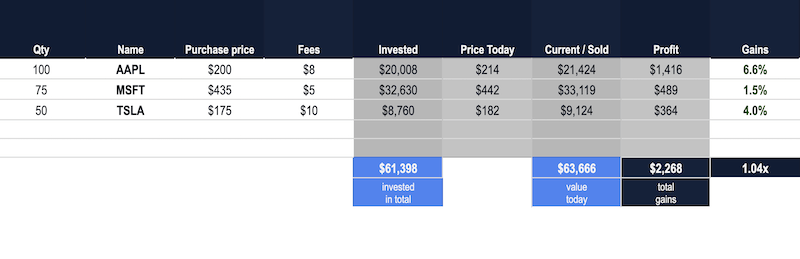

You can do so in a notebook, Excel, or Google Sheets (use this one if you like, or use the awesome & free Portfolio Performance):

The key is to log your buys and sales and track your performance. Please keep it simple, but log everything you do.

8/ Log Your Emotions Too

Keep a journal to record your trading emotions and experiences as well.

This practice helps identify patterns, improve self-awareness, and enhance decision-making based on intuition.

I learned a lot about “emotions in trading” from Denise Shull, check out this video for example.

9/ Focus On The Cut

It does not matter what you think before or after the trade. All that matters is “the cut”, meaning when you bought and when you sold.

Be an ice-cold, rational Trading Samurai , intensely focused only on execution.

Understand that trading is purely about numbers. You’re on the right track if you win 60 out of 100 times. But this also means shrugging off 40 losing trades along the way.

Simply by thinking about a suitable trading psychology, you will already have an edge over people who blindly start trading without a plan.

10/ Maintain Focus & Discipline

To maintain clarity and prevent overextension, restrict the number of assets in your portfolio.

Establish precise thresholds and uphold them by promptly executing stop-loss orders when triggered.

Define target prices, called TPs, and execute sales upon their attainment. Approach trading with a dedicated and professional mindset, treating it as a rigorous profession.

Such steadfast commitment is essential for achieving success as a trader.

Conclusion

In the unpredictable world of trading, having a good understanding of your trading psychology can make and break your trading success.

Remember, it’s not just about being right—it’s about staying disciplined, patient, and focused on your goals. Not just for a couple of days, but for many many months and years.

So, whether you’re aiming for the bull’s eye or navigating the twists of a bear market, let these tips guide you toward smarter, more confident trading.

Happy trading, and may the odds ever be in your favor!

📘 Read Also

- The 5 Best Hard Assets – A Quick Investment Guide

- The AI Investment Pyramid – Building A Balanced Portfolio

- Sitting on $1.5M Crypto Gains – Still Frugal Lifestyle Or fatFIRE?

FAQ

What is trading psychology?

Trading psychology refers to the mental and emotional factors that influence a trader’s decisions in the financial markets. It involves understanding and managing emotions such as fear, greed, and confidence to improve trading outcomes.

How does trading psychology work?

Trading psychology works by helping traders recognize and control their emotions during trading. By maintaining discipline, managing risk, and staying focused on long-term goals, traders can make more rational and informed decisions.

How to master trading psychology?

To master trading psychology, traders should practice self-awareness, maintain a trading plan, and learn techniques to manage emotions effectively. Consistent learning, staying disciplined, and seeking mentorship or coaching can also help improve psychological resilience.

Why is trading psychology important?

Trading psychology is crucial because it influences how traders react to market volatility and make decisions. By understanding their psychological tendencies, traders can avoid common pitfalls like emotional trading and maintain a consistent approach to trading.

Who are good trading psychology coaches?

Good trading psychology coaches include Denise Shull, Peter Brandt, and Dave Floyd from Aspen Trading. They offer insights into managing emotions and improving decision-making skills in trading. You can find many good interviews on YouTube.

Good trading psychology books?

Some recommended trading psychology books include “Trading in the Zone” by Mark Douglas, “The Psychology of Trading” by Brett N. Steenbarger, and “Market Wizards” series by Jack D. Schwager.

Trading psychology for dummies?

The book “Trading Psychology for Dummies” by Barry Burns provides practical advice and strategies for understanding and improving trading psychology in a straightforward and accessible manner.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love