Monthly Dividend Recap | Mar 2025

March was a strong month: I received $3,216 from 15 different companies – with most paying more than they did last year.

As always, the slow but steady increase keeps me motivated—that’s the essence of dividend investing. I launched my All-Weather Portfolio in May 2020 and collected my first dividend that July.

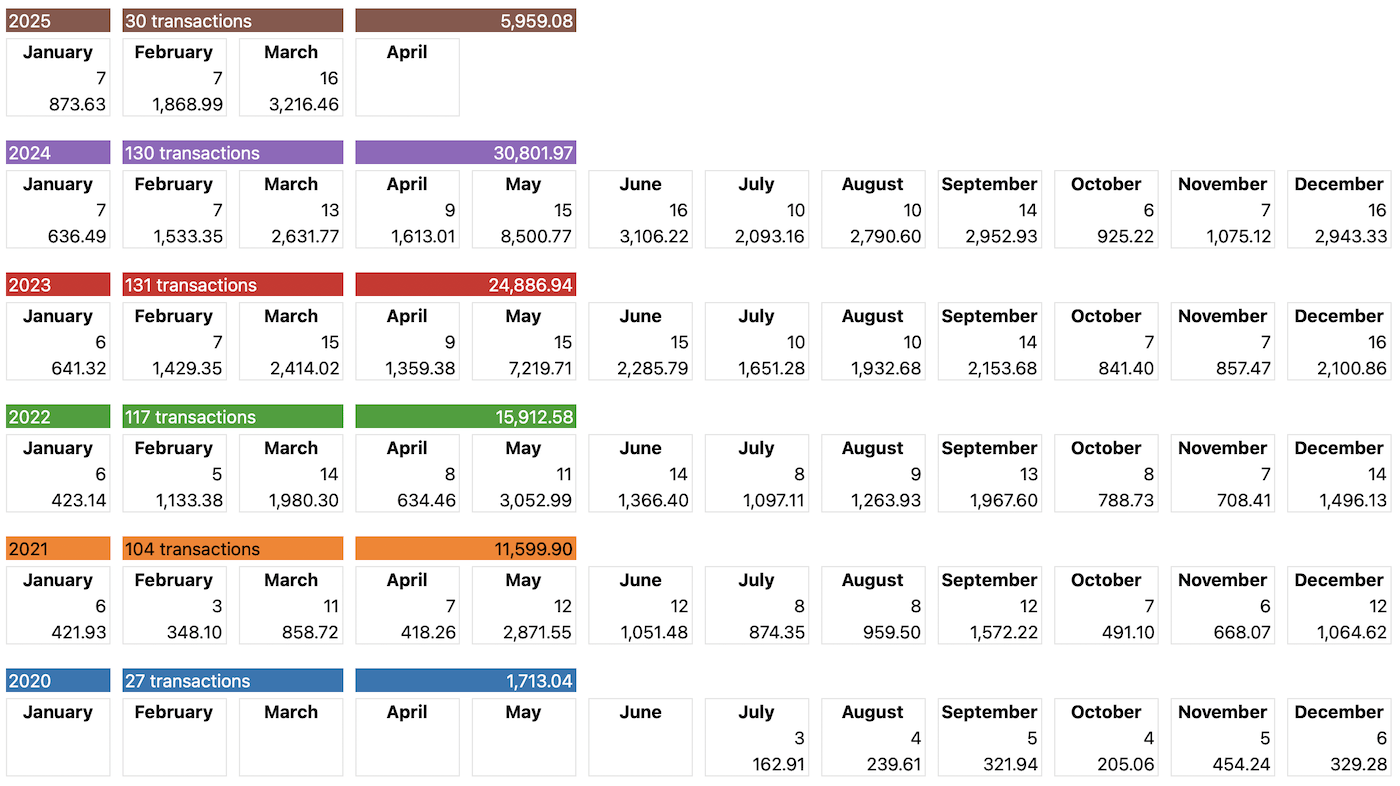

See below for a detailed month-by-month dividend recap comparison, also showing the total amount and amount of transactions for each respective year:

I’m a big fan of Portfolio Performance, a 100% free tool I use to track my dividends. It keeps rolling out handy new reports like the one above.

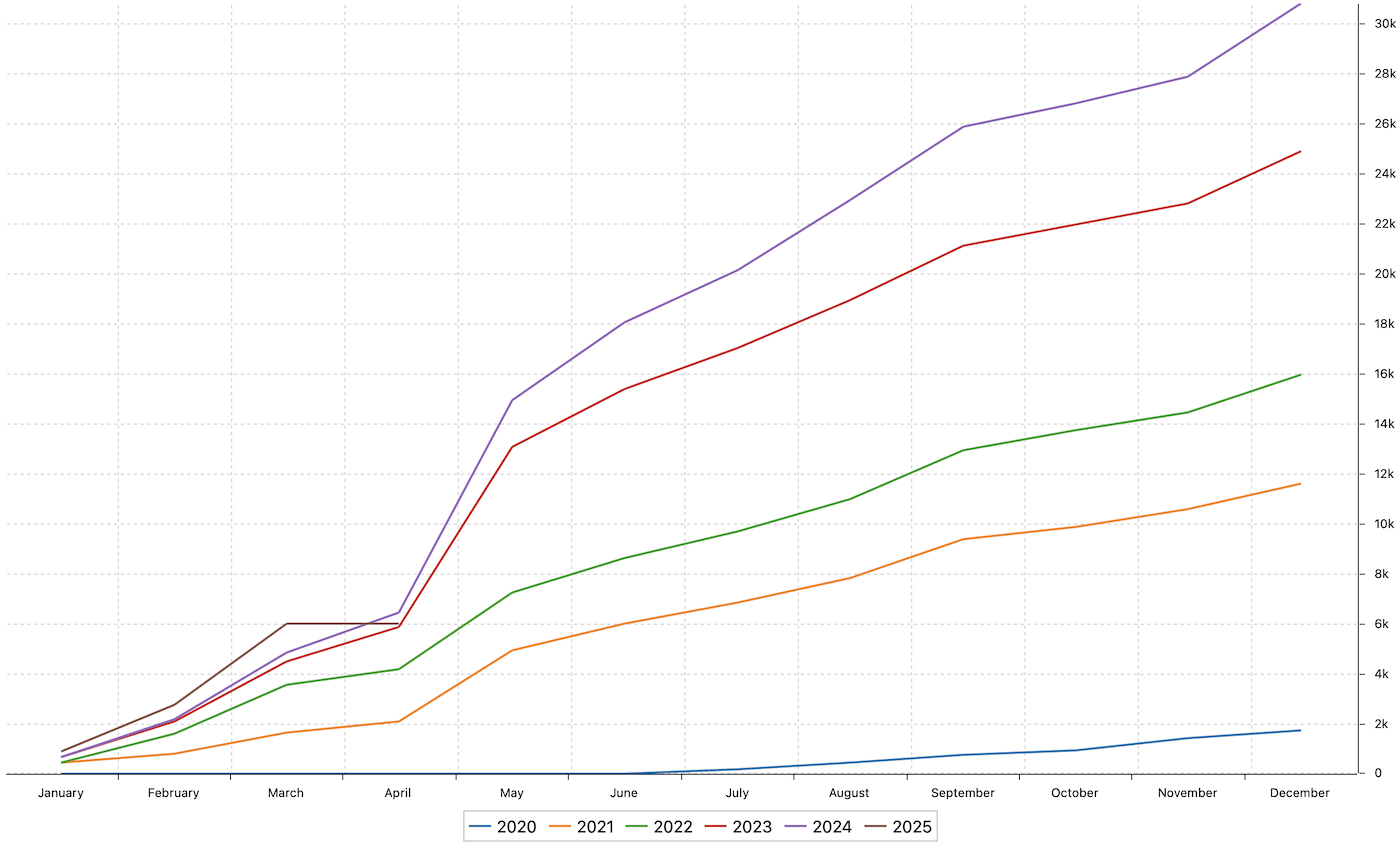

The chart below pits each year against the others in a head-to-head race:

According to Parqet, another tool I enjoy, I’m currently averaging $2,580 per month in passive dividend income.

From the start, my long-term goal has been to generate $50,000 annually from the best dividend stocks I could find—like my 10 favorite dividend stocks you can buy and hold forever.

Stock Purchase Recap

Throughout the month, I deployed a total of $17,590 to make the following purchases:

| Company | Qty | Amount Invested |

| EcoPetrol | 700 | $7,021 |

| L’Oreal | 18 | $6,956 |

| CapitaLand India | 5,000 | $3,613 |

| Total | $17,590 |

EcoPetrol is my favorite energy stock in Latin America (expecting my first dividend of +$1,000 in April).

L’Oreal is one of my favorite luxury stocks.

CapitaLand India is one of my favorite REITs in Asia.

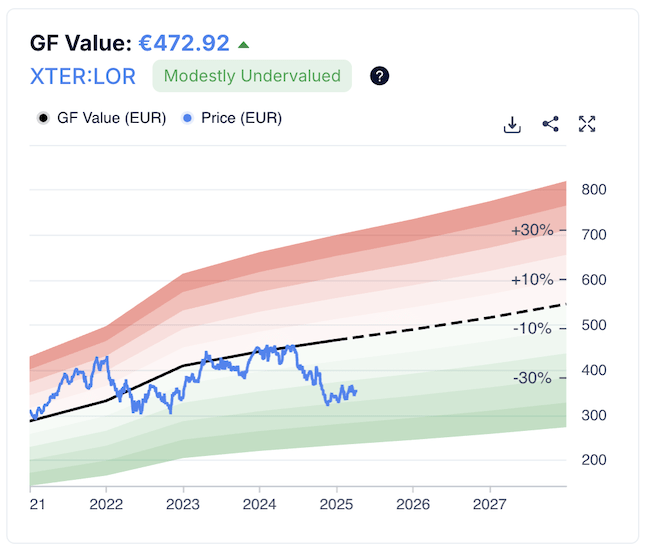

To figure out which dividend stock to buy, I primarily use one tool called Gurufocus.

Check out their in-house valuation chart, which gives you an instant hint whether a stock is over or under-valued.

On Gurufocus, I also have my entire portfolio, and with the click of one button their in-house valuation profiler shows me which of the stocks currently offers the best risk/reward ratio. Love it!

Impact of Trump’s Tariffs

Markets went wild thanks to Trump’s tariffs. Amid the chaos, it was reassuring to see some of my dividend stocks hold up well (check the arrows on the FinViz chart below):

Summary Of This Month’s Dividend Recap

Overall, it was a solid month. My dividend portfolio feels like it’s on the right track!

Whatever the current administration throws at us, I’m confident the companies I’ve chosen have a strong chance of not just surviving but thriving in the long run.

📘Read Also

- The 3Fs You Need, The 3Fs You Want

- The 3 Best Australian REITs To Buy

- The 2 Best Latin American Energy Stocks To Buy

FAQ

Why do a monthly dividend recap?

Investors should log and file the income they generate from their dividends in a monthly dividend recap report. To do so, simply log the name of the company and the amount received. Keep it simple. Put everything in an Excel file or Google Sheet. By this you can see how your income develops over time.

Why does a dividend recap increase irr?

A dividend recap—short for recapitalization—can boost IRR (Internal Rate of Return) because it lets investors pull money out of a company earlier while still keeping ownership. Here’s how it works: in a dividend recap, the company takes on new debt to pay a big dividend to its investors. This means you, as an investor, get a chunk of cash now instead of waiting years for the company to grow and be sold. Since IRR measures how fast your investment grows over time, getting money back sooner increases the “rate” of your return—it’s like getting a head start in a race. Plus, you still own the company, so you can benefit from future growth or a sale later.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love