Monthly Financial Report (2023/02)

The month of February was a regular month for me.

I received 158 USD in the form of my first dividend from Ecora Resources, a UK-based, non-precious metals-focused royalty company. Ecora specializes in helping operators mine commodities, supporting a sustainable future. I am super bullish on this company and am happy to receive a first dividend.

Here are all the dividends I received this month:

|

Date |

Dividends |

Shares |

Received |

|

2023-02-14 |

🇩🇪 Siemens* |

165 |

$745 |

|

2023-02-15 |

🇺🇸 AbbVie |

130 |

$164 |

|

2023-02-16 |

🇬🇧 Ecora Resources |

7,500 |

$158 |

|

2023-02-01 |

🇺🇸 AT&T |

600 |

$142 |

|

2023-02-16 |

🇺🇸 PG |

125 |

$103 |

|

2023-02-15 |

🇺🇸 Realty |

429 |

$91 |

|

2023-02-08 |

🇺🇸 Deere |

18 |

$18 |

|

$1,420 |

The amounts are ‘after-tax’ (withholding tax has been deducted)

The 745 USD Siemens dividend is my largest ever payout. Previously the highest dividend was BHP, paid in Sep 2022, you can check out my monthly stock dividends report from back then.

Last year’s monthly financial report, of Feb 2022, saw total dividends received of 1,338 USD. So this year is 82 USD higher.

Last year Warner Bros was still part of AT&T, therefore, the dividend back then was about twice as large as it is now.

February Monthly Financial Report Chart

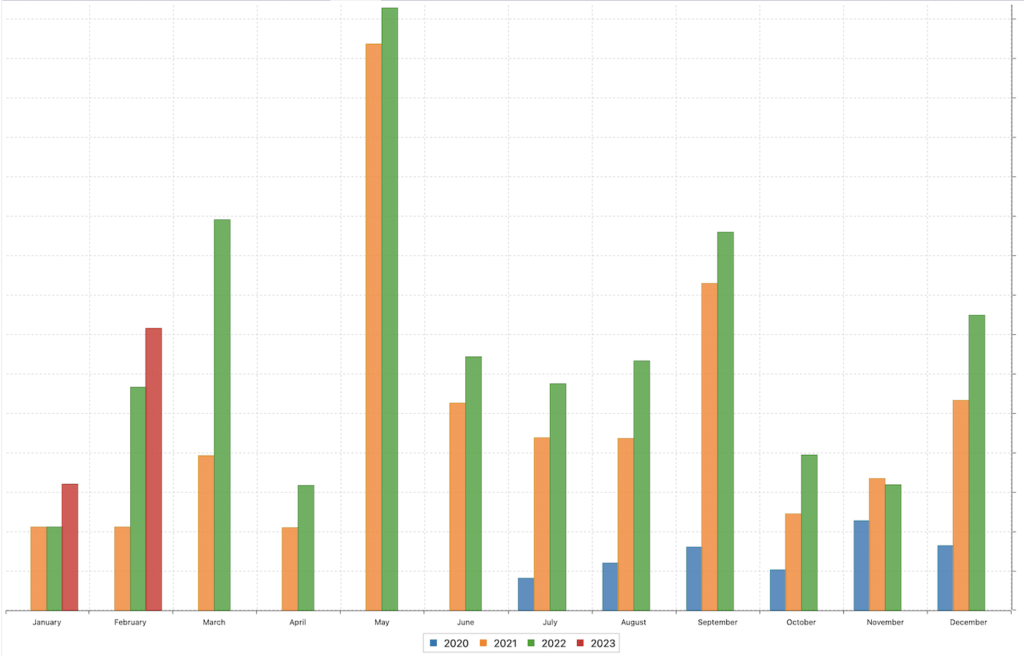

I started dividend stock investing in May 2020. This year will be my first year in which I can compare three full years.

March, May, September, and December are the months in which I receive the highest dividend payments. This graph is taken from Portfolio-Performance.info, a free/open-source app I use to track all my transactions.

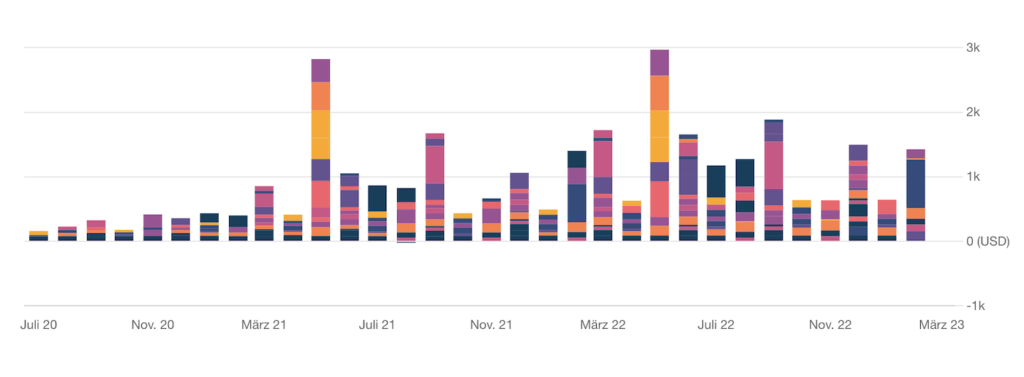

Below shows the same but taken from another Parqet.com, which I like and use (in German). I use the free version for about 2.5 years now.

Dividend Stock Purchases

In terms of purchases this month: I invested a total of 19,000 USD into five dividend stocks:

|

Date |

Purchases |

Shares |

Amount |

|

2023-02-13 |

🇬🇧 Reckitt |

50 |

$3,488 |

|

2023-02-24 |

🇺🇸 3M |

25 |

$2,676 |

|

2023-02-22 |

🇺🇸 Fresenius |

150 |

$4,409 |

|

2023-02-21 |

🇺🇸 Union Pacific |

25 |

$4,986 |

|

2023-02-17 |

🇺🇸 BlackRock |

5 |

$3,550 |

|

$19,109 |

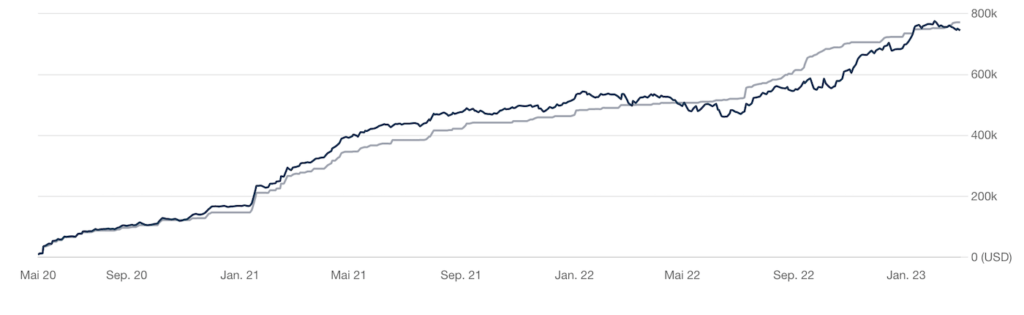

All are existing holdings and long-term holds of mine. My All-Weather Portfolio currently sits at a total value of 750,000 USD.

The below chart shows the invested capital (blue) compared to the current value (gray).

For the last nine months or so, the actual value was lower than the invested capital. Just at the beginning of this year, I was back in the green, and now it again dipped below.

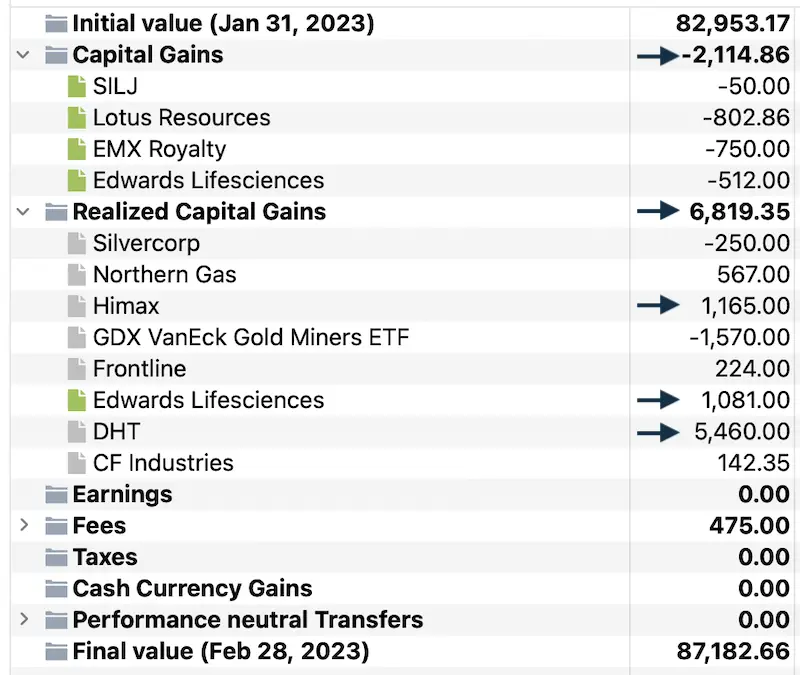

Short-Term Trading Account Income

In February I did relatively well with short-term stock trading, here are my trades:

I realized gains of 6,810 USD, less 475 in trading fees, that’s a profit of 6,344 USD. With my trading account, I try to generate extra cash flow via the short-term buying and selling of stocks.

Other Passive Income

My total income for the month is 18,553 USD, divided up into

- Dividends from Companies

- Stock Dividends from All-Weather Portfolio

- Income via HSBC Cash Deposits

- Trading Gains

- Income Rental Property (GER)

- Staking Rewards & DeFi

- Income from solar panels

If you like to see the full breakdown, please click here.

📘 Read Also

- Warren Buffett Loves Railway Stocks – The 8x Best Ones Reviewed!

- Monthly Stock Dividends Report – February 2023

- The 3 Best Self-Storage Stocks To Buy

- Why Hedera Is The Best Crypto To Invest In & Why I Bought 1 Mio HBAR

Community FAQs

What tools to use to create monthly financial reports?

I keep it very simple. I use the free/open-source Portfolio-Performance.info app to track all my transactions. It calculates everything, from the dividend yield to my IRR, ROI, and so on. I use Gurufocus.com and SeekingAlpha.com to analyze the stocks I like to buy. And I use Parqet.com and DivvyDiary.com to keep track of my dividends.

What is the biggest dividend payment you received?

My biggest one so far was this month from Siemens, 745 USD. Prior to that, it was BHP’s 742 USD dividend in September 2022.

What are your favorite dividend stocks?

I get this asked a lot, that’s why I created a post called “10 Dividend Stocks You Can Buy & Hold Forever”, check it out here.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love