My Exit Plan – When Is The Best Time To Sell?

Recently, several friends and readers have asked me, “When should I sell?“

I believe it’s crucial to have a long-term exit plan. “Plan the trade, and trade the plan” was one of the first lessons I learned from my trading mentor.

Without an exit plan, we’re like a tiny, aimless raft on the wide ocean, getting tossed around by unpredictable winds and high waves.

Whether it’s a transaction in my trading account or crypto portfolio, I always set price targets before I enter a trade.

Example – My Crypto Portfolio

As of today, which in cryptolalaland changes quickly, I’m sitting on total paper gains of $1.38 Mio US.

No one, including me, knows when is the best time to sell, hence I try to do it differently.

My Simple Exit Plan – When I Will Sell Crypto

Here is my simple written long-term exit plan for my principal crypto holdings, following the financial adage “Don’t chase the trade, let the price come to you!“:

- Keep 10x BTC till 2030, sell the rest when price hits 150k/200k/250k/300k/350k/400k/450k

- Keep 250x SOL till 2030, sell the rest when the price hits

150/200/250/500/600/750/1,000 - Keep 500,000x HBAR till 2030, sell the rest when price hits 0.75/1.00/1.25/1.50/1.75/2.00/2.50

- Keep 10x ETH till 2030, sell the rest when the price hits 4,500/5,000/6,000/7,500/9,000/10,000

- Move all realized gains into stablecoins and deposit on Ethena to earn approx. 15% on USDe

Earn Passive Income While Waiting!

While I wait for the tokens to meet my price targets, I earn solid passive income via staking. Here is what I use:

- I earn passive income on 5x BTC on Nexo and currently earn 5.5%

- I liquid stake 750,000 HBAR with Stader Labs, earning 5%

- I stake 10x ETH each on Blast (Juice Finance), on Arbitrum (Kelp and Renzo)

- I stake 900x SOL on Sanctum and currently earn 9% p.a. (!) (buy INF with your SOL)

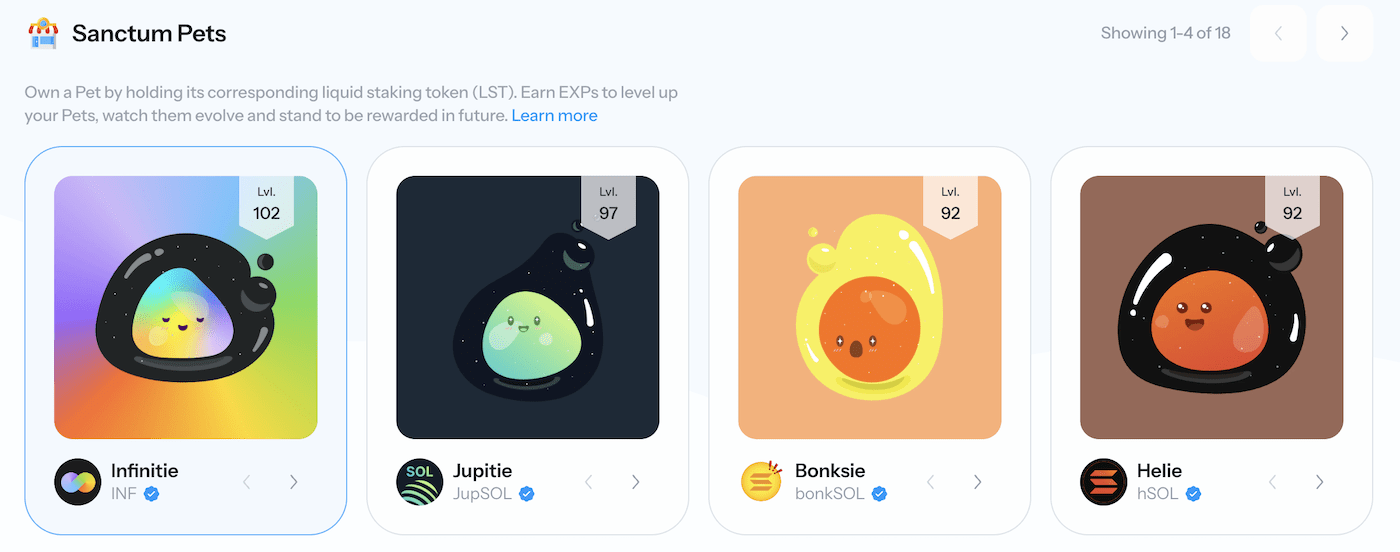

Check out the fantastic job the Sanctum team did! They gamified the pretty boring process of staking.

Now, by locking up your Solana into a staking contract, you get a “pet” which will evolve the more SOL you stake and the longer you stake it.

I love my 4x pets – check them out below:

To get one of these pets as well:

- Have a Solana wallet e.g. Phantom.app, and transfer some SOL to your wallet,

- Visit Sanctum’s Wonderland page here,

- Click on Infinity on the left, and deposit SOL to get INF in return.

That’s it!

Selling Requires Practice

Buying an asset on the cheap is usually the easy part. The real challenge is knowing when to sell and pulling the trigger.

Selling is like a muscle; it gets stronger the more you use it. The more you practice and flex it, the better you’ll become.

Someone who never sells will rarely catch the market at its peak. Your chances of success are much higher when you start selling smaller positions here and there.

Solana Example

Take my recent two sales of Solana as an example.

I sold 65x at $150, and 50x at $200.

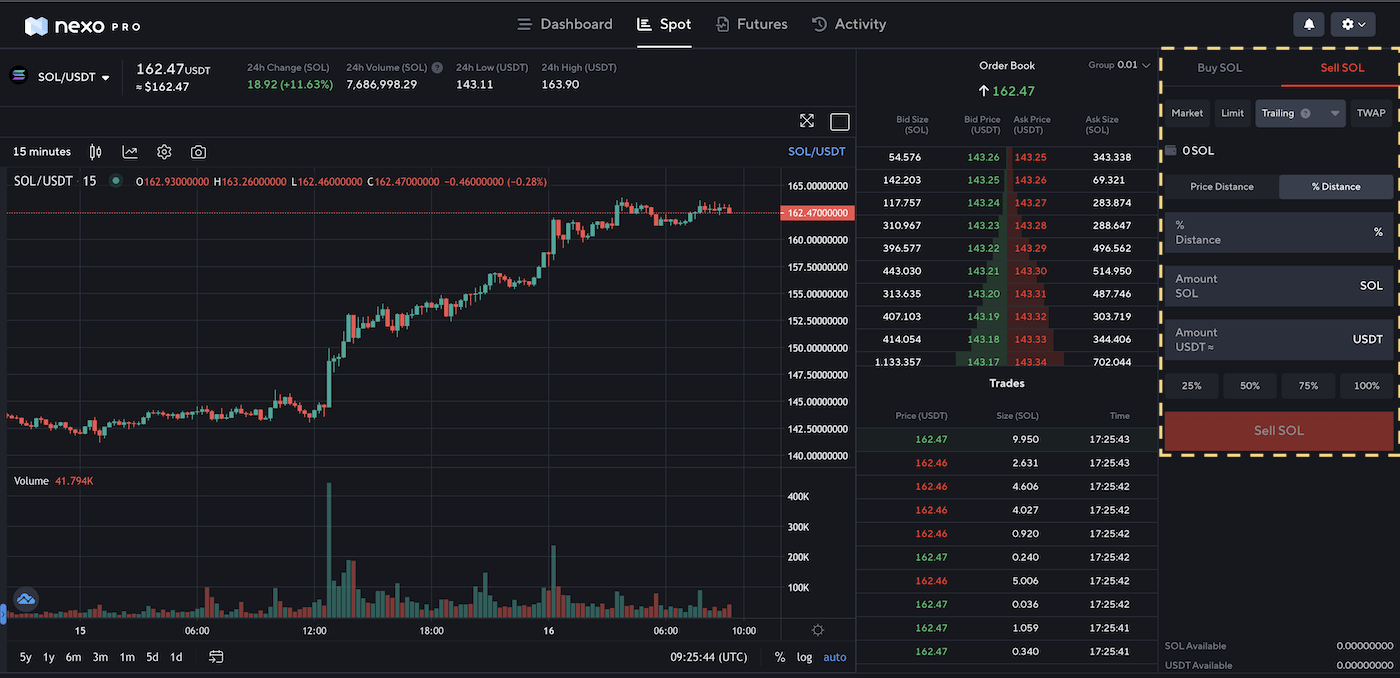

I don’t set limit orders before my target is met. Instead, I use trailing stop limit orders (you can find more info on Investopedia) after they hit my target.

This way, I “lock in” my original price target as the “worst-case scenario” and let it keep running.

Ideally, the price will continue to rise, and the order will automatically “trail” and lock in an even higher price.

I do most of my trading on Nexo Pro, here is what the trading interface looks like:

For the % distance, I typically set it at 2.5%. This means that once the price drops by 2.5%, the order is triggered, and the asset is sold. If the price keeps going up, so does my stop loss.

A trailing stop-loss order is especially helpful when dealing with volatile cryptocurrency prices!

Conclusion

Plan the trade & trade the plan. Have a trade journal and use simple written plans to hold yourself accountable.

If you get FOMO and don’t want to sell, remind yourself that there are always good trade to be found, and the next good one is right around the corner.

📘 Read Also

- The Via Negativa Concept – 5 Tips on How to Win by Not Losing

- How To Spot A Financial Scam – 4 Important Tips

- My Story Of How I Reached Financial Independence With $5M In Net Worth

FAQ

What is an exit plan in business?

An exit plan in business is a strategy for how an owner will try to sell or transfer ownership of his/her company. It typically outlines steps for maximizing value and ensuring a smooth transition, whether selling to another company, going public, or passing it on to a family member.

What is an exit plan in investing?

An exit plan in investing is a strategy for when and how to sell your investments to achieve your financial goals. It involves setting target prices, using tools like stop-loss or trailing stop orders, and planning for different market conditions.

How to set an exit plan?

To set an exit plan for your investments, first define your financial goals and target prices for your investments. Decide on the tools you’ll use, such as stop-loss or trailing stop orders. Regularly review and adjust your plan based on market conditions and your changing financial situation.

What should an exit plan contain?

An exit plan should contain:

– Clear Goals: Define your financial or business objectives for the exit.

– Target Prices: Set specific price points for selling investments or business assets.

– Timeline: Outline when you plan to exit.

– Strategies: Detail the methods you’ll use, such as selling, mergers, or passing on ownership.

– Contingency Plans: Have backup plans for different market conditions or unexpected changes.

– Tax Considerations: Plan for any tax implications of the sale.

– Legal & Financial Advice: Include consultations with professionals to ensure all aspects are covered.

Try to always keep your plan simple and easy to execute.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love