I was active in March and sold a total of $30,000 crypto and re-balanced the proceeds into dividend stocks.

Passive Income Numbers For March

An okay month dividend-wise.

| Shares | Amount | |

| CapitaLand India | 25,500 | $578 |

| BHP | 250 | $356 |

| Dexus | 2,900 | $338 |

| Enbridge | 510 | $292 |

| Brookfield | 730 | $259 |

| Shell | 350 | $241 |

| Pfizer | 600 | $176 |

| Unilever | 400 | $138 |

| Public Storage | 45 | $115 |

| Realty | 445 | $97 |

| BlackRock | 25 | $96 |

| Welltower | 200 | $85 |

| J&J | 80 | $85 |

| Franco Nevada | 123 | $38 |

| Total | $2,894 |

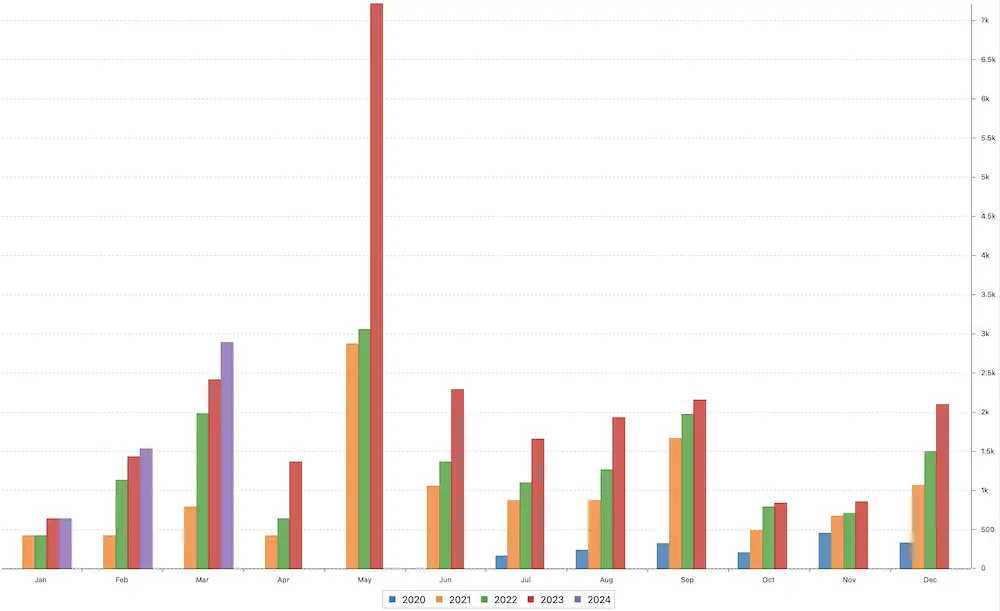

If I compare my income numbers with those of last year, it looks like this:

Income Report – Month by Month

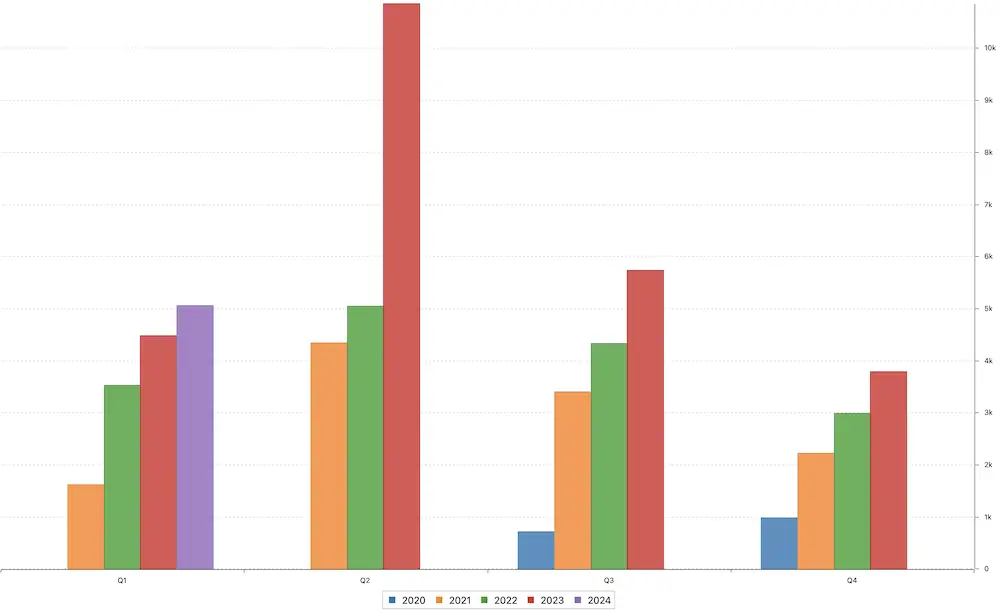

Quarterly Income Report – Since 2020

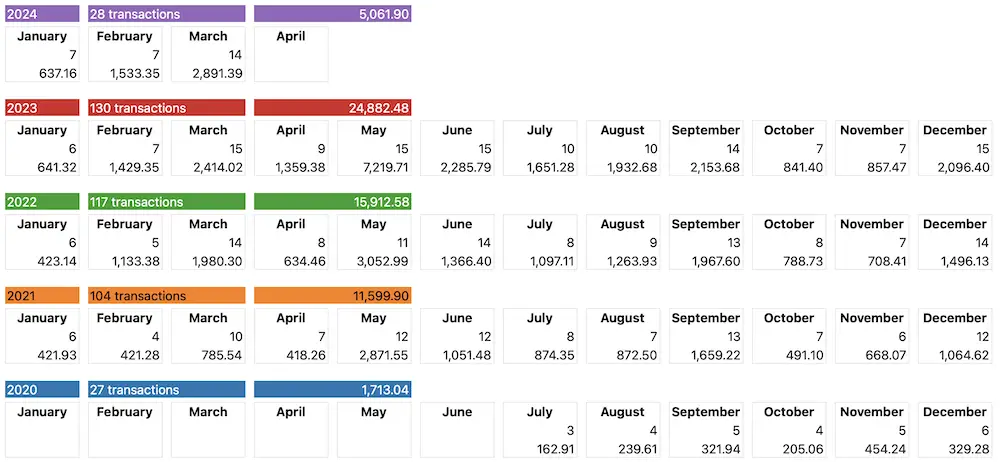

Income Report – Details

Profit Taking From Crypto Gains

I started to take some first profits from my Solana position. It shot from $10 up to $200 US within a year. My average purchase price is $23.

I sold a total of 110 SOL at an average sales price of $180.

I also sold 1,000 RUNE at $11, the native coin of Thorchain. In total, I took $30,000 off the table, and re-balanced into my All-Weather Portfolio, with solid, long-term dividend stocks.

Stock Purchases

After Unilever $UL announced that it would divest/spin off its ice creme business, historically the business line with the lowest margin, and focus instead of its 30 core brands, I decided to buy 250 additional $UL.

After Reckitt Benckiser was beaten badly, I bought another 100 of $RBGLY.

| Purchases |

Shares |

Amount |

| Unilever |

250 |

$12,759 |

| Reckitt |

100 |

$6,531 |

| Avalon Bay |

27 |

$4,859 |

| Deere |

11 |

$4,394 |

| ProSiebenSat1 |

425 |

$2,957 |

| Link REIT |

500 |

$2,238 |

| AbbVie |

5 |

$895 |

| Total |

$34,632 |

To increase my income in the months with the least dividend income, October and November, I added to my Avalon Bay $AVB and John Deere $DE positions.

In my opinion, Link REIT (official website, ticker in the U.S. $LKREF and in Europe $STU:L5R) is the best REIT in Asia and also offers good entry opportunities.

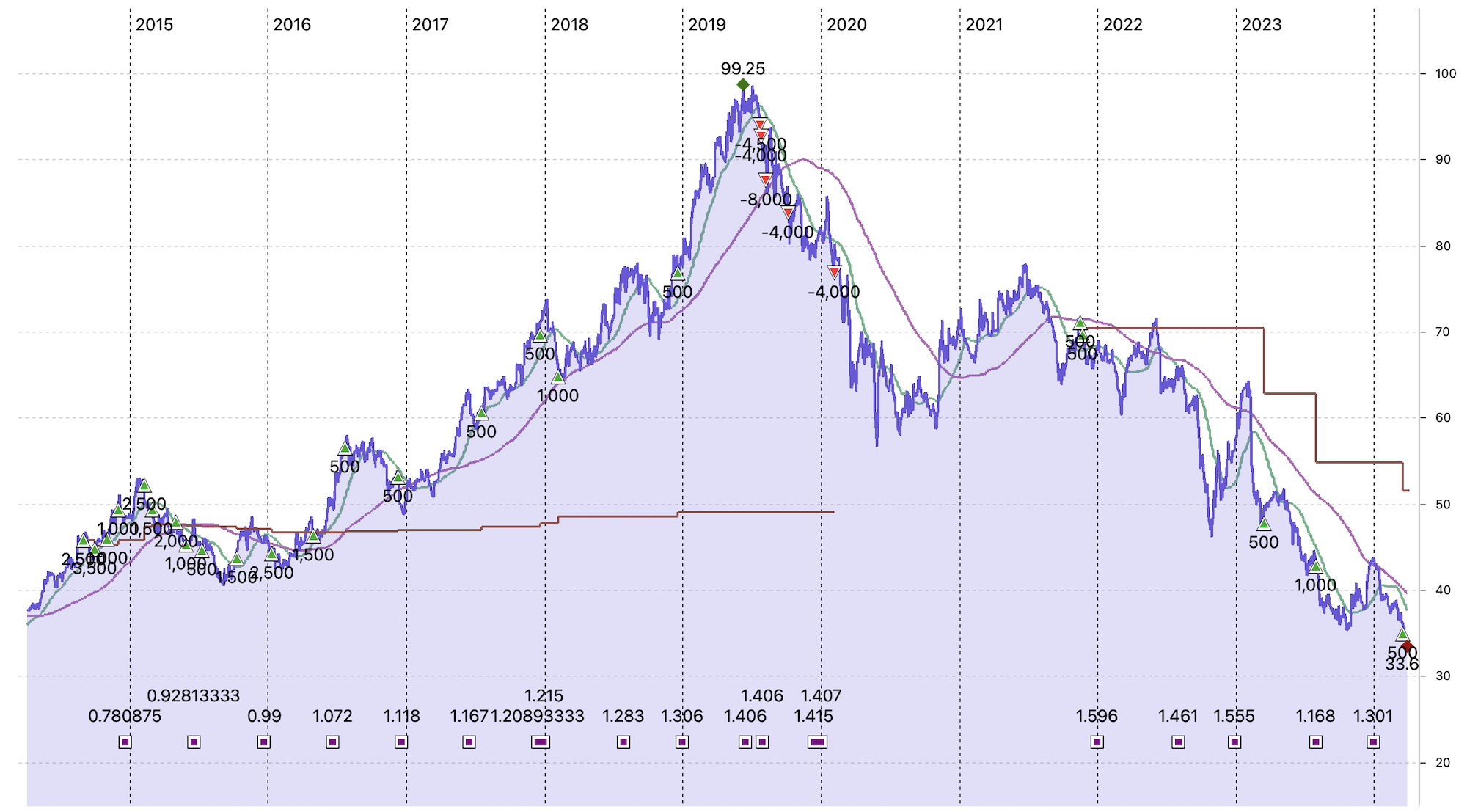

The little green triangles represent buys, and the red one sells. In 2014 I bought LINK up and sold when Hong Kong started to see issues.

In hindsight, I started buying back in too early.

I bought the first 500x at 70 HKD, but given that I had sold 24,500 about two years before, it shows that I just started building a first position.

At current levels, I am happy to add to my position, but this one will take patience! In the meantime, LINK will surely boost my income numbers.

Income From Airdrops

Airdrop season is in full swing. In the past three months, here’s what I got.

| Coin | Chain | Qty | 🪂 Price | 🪂 Value |

| EtherFi | Ethereum | 1,042 | $3.78 | $3,939 |

| Dymension | Cosmos | 389 | $5.05 | $1,966 |

| Ethena | Ethereum | 1,821 | $0.55 | $1,002 |

| Jupiter | Solana | 400 | $0.63 | $250 |

| Altlayer | Ethereum | 241 | $0.35 | $84 |

| Earthlings Steam | Hedera | 11,654 | $0.005 | $58 |

| Pacmoon | Blast | 3,000 | $0.014 | $42 |

| Grelf | Hedera | 32 | $0.68 | $21 |

| Total | $7,362 |

What’s crazy is that I received Dymension only because I staked Celestia, which I received from staking ATOM.

Looks like the airdrop snowball keeps growing – and the next three months will be massive in terms of airdrops, which have boosted my income numbers a lot in 2024.

Here’s my recent Simple Airdrop Guide post explaining what I did (some of these projects already completed their airdrops).

Upcoming Airdrop

If you like to farm an interesting upcoming airdrop, check out GetGrass.

I’ll write a blog post about it next week because I think it’s a groundbreaking project.

At this stage, you don’t need any crypto wallet or knowledge – for now, it’s all about collecting points grass!

Simply put, GetGrass powers AI models through an innovative infrastructure. By simply installing the Grass web extension, you can transform idle internet bandwidth completely anonymously into a valuable asset, sold to reputable AI enterprises.

Conclusion

My plan for the coming months is to keep re-balancing crypto gains from my digital asset portfolio into my dividend portfolio.

Although I believe the crypto bull market still has a lot of room to grow, I am currently having $2 Mio US in pure crypto.

That’s about 30% of my total net worth.

📘 Read Also

- How To Structure An Investment Portfolio – 8 Strong Pillars

- Sitting on $1.5M Crypto Gains – Still Frugal Lifestyle Or fatFIRE?

- The 6 Best Dividend-Paying Fertilizer Stocks

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love