Is Kohl’s The Next Big Short Squeeze Opportunity?

The mass retail sector is facing what many consider a terminal decline.

Disrupted by the rise of e-commerce and the ongoing “retail apocalypse”, traditional brick-and-mortar retailers like Kohl’s have struggled to compete.

Baby boomers, once a key consumer group, are aging and shopping less, while younger generations—Millennials and Gen Z—are more inclined to favor the convenience of online shopping over in-store experiences.

Often Kohl is named “your mother’s favorite retailer”, not the greatest label in the fast-changing times we live in!

The Kohl’s Stock

Despite these headwinds, Kohl’s stock price has fallen to what I believe is an irrational level.

Let’s take a look at the chart, which saw a height of $82 in 2018:

Down by 77%!

A New Short Squeeze Opportunity In The Making?

More than a third of its float (!!) is currently sold short, as you can see on the excellent dashboard on Finviz (see blue arrow).

Simply put, short sellers are betting that the stock price will drop further. To do this, they borrow shares, paying significant interest to maintain the short position as they wait for the price to decline.

Whoever is interested in short squeezes should watch the excellent movie ‘Dumb Money‘ by Craig Gillespie.

What might happen here is a classical short squeeze. This happens when coordinated buying (e.g. by Reddit-led retail investors) drives up the stock price to a certain level, forcing short sellers to cover their positions (aka buying the stock on the open market), thereby amplifying the rally further.

Kohl’s Hidden Assets

The company’s true value might be overlooked, especially when factoring in its owned property portfolio.

The real estate alone is worth at least twice Kohl’s entire enterprise value (including its financial debt). In relation to its market capitalization, the value approaches nearly 4x, based on conservative, depreciated property valuations.

This suggests that the market may be significantly underestimating Kohl’s long-term potential, positioning it as a compelling candidate for a Reddit-fueled short squeeze, similar to what we saw with retail peer GameStop (GME) or cinema chain AMC (AMC).

Both of these stocks saw massive gains, with AMC, for example, surging from $15 to $350 in just a few months, an increase of 20-25x!

Given that Kohl’s is also part of the traditional, old-school retail sector, it aligns well with the type of targets that often attract the Reddit army’s hunger for the next big short-squeeze opportunity.

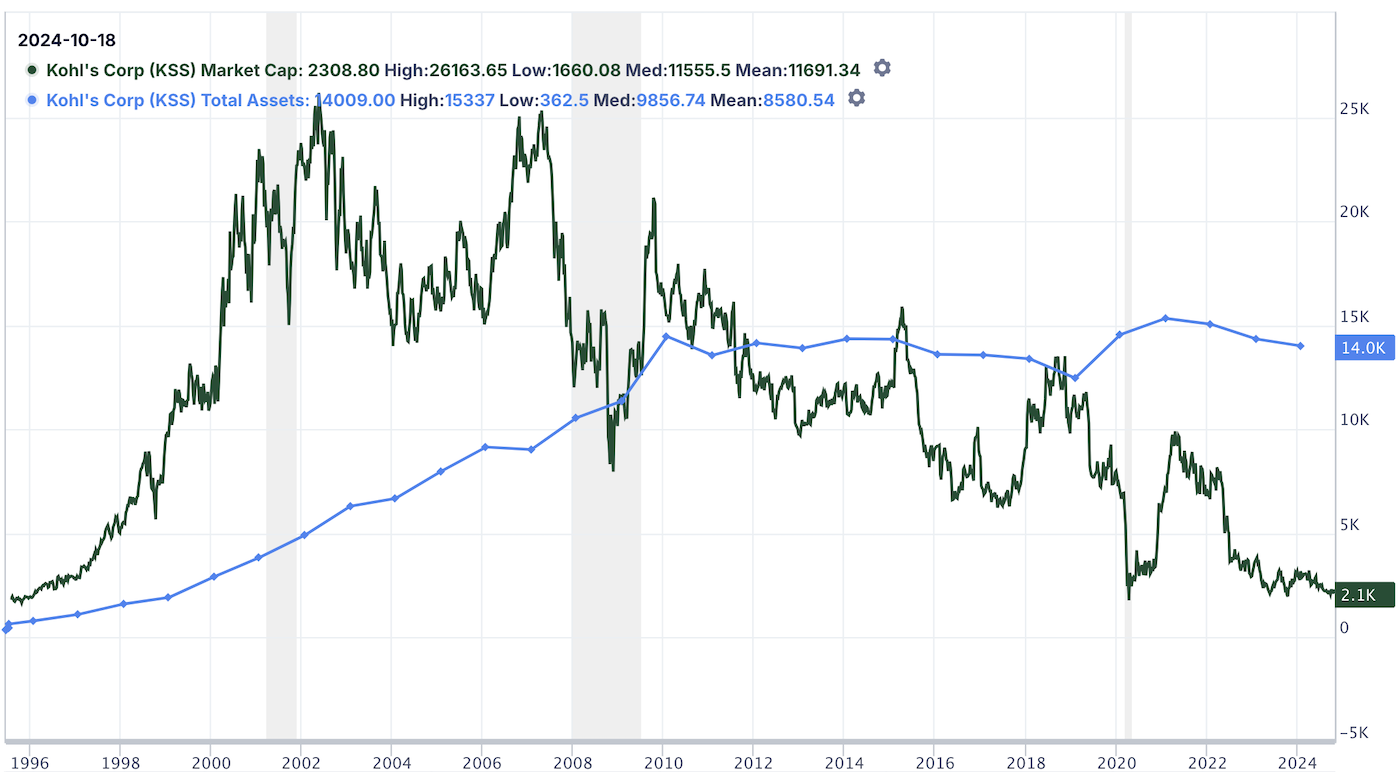

Compare Kohl’s current market cap with its total assets – we can note an almost 7x difference.

We get a similar image when looking at Kohl’s price-to-book and price-to-sales ratios.

Both are at a historical low. Never in history could you get the Kohl stock at a PB ratio of 0.55 or a PS ratio of 0.12.

Kohl’s Revenues & Net Income

Kohl’s revenues are basically flat and not growing anymore.

However, it keeps on gaining in property value (see black line)!

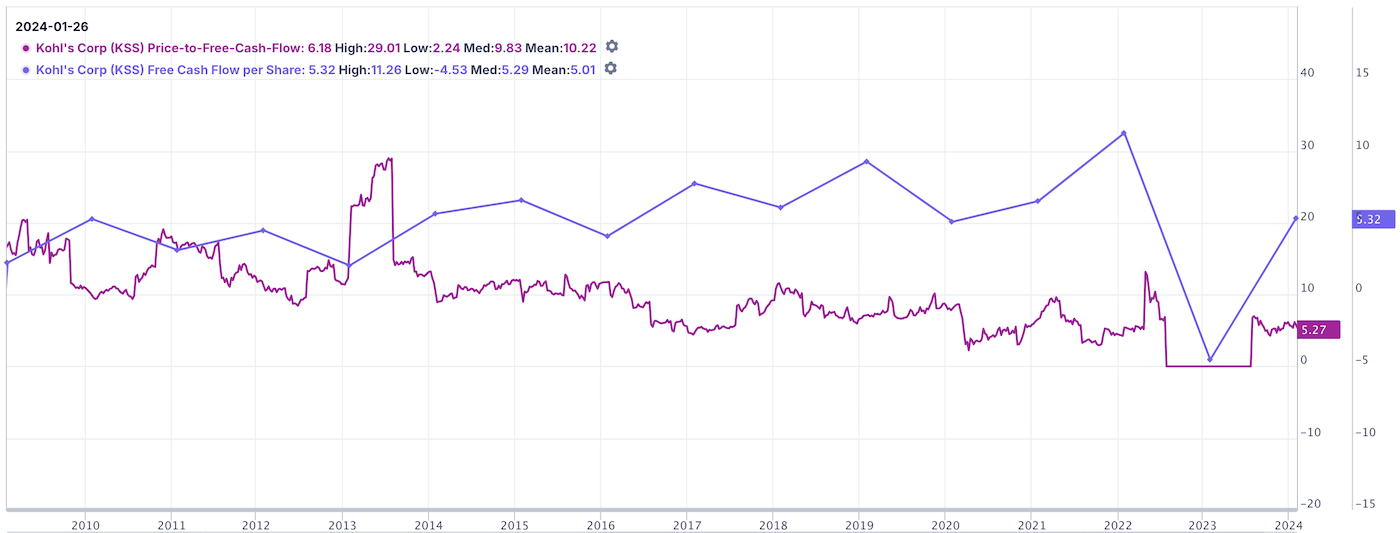

Although declining revenues, it basically achieved positive free cash flows and net margins throughout the years.

Recommended Action

I don’t know if this irrational valuation will be corrected soon, but I surely believe at these levels, Kohl’s represents an interesting short-term buy.

There is strong support between $18-19, see below’s chart. I believe buying in this range can offer an attractive risk/reward ratio, with asymmetric upside.

Once in, you can put a tight stop-loss at $17.50 (the low in 2023 was at $17.68).

Conclusion

I currently have all funds of my Trading Portfolio fully invested, but am eyeing selling my $DHT position and getting exposed to $KSS!

Besides, my 2nd order of Celsius Holdings (CEL) just triggered (which I call the best Gen Z stock), so I have a full position in this one as well.

If my $DHT sale order gets triggered, I will set a first buy order for $KSS at $18.50, with a target price of $38.

📘 Read Also

- My Next Big Crypto Bet: Jupiter Exchange

- The 5 Best Hard Assets – A Quick Investment Guide

- The 3 Best CRISPR Stocks for a Multi-Decade Investment

FAQ

What is a short squeeze, and how does it impact stock prices?

Short squeezes happen when a stock’s price rises sharply, forcing short sellers (those who bet the price will drop) to buy shares to cover their positions. This in return creates increased demand, pushing the price even higher. As more short sellers scramble to buy, the stock’s price can skyrocket in a short period, making the squeeze profitable for some investors and risky for others.

How can investors spot a potential short-squeeze opportunity?

Investors can look for stocks with high short interest—meaning a large portion of shares are sold short—usually over 20%. A sudden rise in trading volume and upward price movement can also indicate a possible short squeeze. Other signals include news or social media attention that could drive more buyers into the market.

What are famous examples of short squeezes?

Notable examples include GameStop $GME and cinema-chain AMC Entertainment $AMC in early 2021. These short squeezes were driven by high short interest combined with coordinated buying efforts by retail investors, especially those on social media platforms like Reddit. This led to explosive price increases, as many short sellers were forced to buy back shares at higher prices, further fueling the rally. Watch the excellent movie ‘Dumb Money’ here, directed by Craig Gillespie.

Can a short squeeze happen again?

Yes, short squeezes can occur again when market conditions align, such as high short interest and strong buying momentum. Historical examples, like $GameStop and $AMC, show that these situations can arise unexpectedly, especially with the influence of retail investors. In late 2024, some people believe $KSS, the stock of retail giant Kohl’s, might become the next short squeeze target.

What does short squeeze mean?

A short squeeze happens when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy shares to cover their positions. This demand can drive the price even higher, creating a feedback loop.

Why does a short squeeze happen?

Short squeezes occur when positive catalysts—like strong earnings or good news—cause a stock’s price to rise, leading short sellers to buy shares to limit losses. This action can further elevate the stock price and create volatility.

How to find short-squeeze stocks?

To find potential short-squeeze stocks, look for high short-interest ratios (over 20%), unusual trading volumes, and growing social media interest. Financial platforms can help track these metrics.

How to open a short squeeze in Hamster Kombat?

In Hamster Kombat, start a short squeeze by identifying undervalued “hamsters” and creating demand through strategic play. Engaging actively in the game’s economy can enhance your chances of success .

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love