The 3 Best Australian REITs To Buy

Some readers asked me what I believe are the best Australian REITs that are listed in both the U.S. and Europe, hence I got to work.

| Company | Dexus | Charter Hall | Goodman Group |

| Ticker | $DEXSF | $CTOUF | $GMGSF |

| Category | Best Office REIT | Best Diversified REIT | Best Industrial REIT |

| Headquartered | Australia (Sydney) | Australia (Sydney) | Australia (Sydney) |

| Revenues, in US$ | $0.3 Bio | $1.4 Bio | $0.5 Bio |

| Market Cap | $5.2 Bio | $4.7 Bio | $44 Bio |

| Enterprise Value | $8.3 Bio | $4.7 Bio | $46.4 Bio |

| Dividend Yield | 6.5% | 3.0% | 0.90% |

| FCF Margin | 91.6% | 73.1% | 64.7% |

| Gross Margin | 79% | negative | 57% |

Why Australia?

I believe Australia presents an attractive risk-reward ratio, making it a compelling option for international investors for the following four reasons:

1/ An Alternative Far from Geopolitical Hotspots: Australia’s geographical isolation, located far from major conflict zones and geopolitical tensions such as wars in Europe or the Middle East, offers international investors a peaceful and stable alternative for real estate investments.

2/ Stable and Growing Economy: Australia has a robust, stable economy with low unemployment and consistent GDP growth, making it a safe haven for real estate investments, especially during global economic uncertainty.

3/ High Demand for Diverse Property Types: Strong population growth, urbanization, and e-commerce expansion drive demand for industrial, office, and diversified properties, benefiting REITs like Dexus (office REIT), Goodman (logistic REIT) and Charter Hall (diversified REIT).

4/ Attractive Yields and Currency Stability: Australian REITs offer competitive dividend yields (e.g., 2.5–4.0% as shown in your table), and the Australian dollar is relatively stable, providing a reliable income stream and currency hedge for international investors.

Quick Profiles

Best Diversified REIT In Australia – Charter Hall

Charter Hall (CTOUF), operates as a diversified REIT, with investments across industrial, logistics, office, retail, and social infrastructure. This diversification reduces risk but dilutes focus. is a good REIT for international dividend investors:

-

Competitive Dividends: Offers a 3.0% yield, providing a steady income for investors.

-

Diverse Properties: Invests in industrial, office, and retail, reducing risk and boosting growth.

-

Stable Leases: Long-term leases (e.g., 12.2 years) ensure reliable rental income.

-

Strong Australian Presence: Benefits from Australia’s stable economy and growing demand.

-

Easy Access: Listed on the ASX for liquidity and transparency for global investors.

Best Australian Office REIT – Dexus

Dexus (DEXSF), specializes in office properties, with significant holdings in major Australian cities like Sydney and Melbourne. This focus caters to corporate tenants and reflects a concentration on premium commercial real estate, which can be sensitive to economic cycles but stable with long-term leases.

-

Solid Dividend Yield: Offers a 6.5% yield, delivering reliable income for investors seeking steady returns.

-

Office Property Focus: Specializes in premium office assets, benefiting from strong demand in major cities.

-

Long-Term Lease Stability: Features long leases with high-quality tenants, reducing risk.

-

Stable Australian Economy: Provides a safe haven for international investors amid global uncertainties.

-

Liquidity on ASX: Listed on the ASX, offering daily liquidity and transparency for global portfolios

Best Industrial REIT in Australia

Goodman Group (GMGSF), concentrates on industrial and logistics properties, such as warehouses and business parks. Its focus on e-commerce-driven logistics (e.g., Amazon partnerships) positions it differently, targeting growth sectors like online retail and supply chain infrastructure.

- Competitive Growth Focus: Offers a 0.9% yield but prioritizes growth, appealing to investors seeking long-term capital gains.

- Industrial Property Leader: Specializes in logistics and industrial assets, benefiting from e-commerce and supply chain demand globally.

- Stable Long-Term Leases: Features long leases with major tenants, ensuring steady income and low risk for investors.

- Massive Scale: With a $70.0 billion market cap, Goodman is a global leader, offering stability and liquidity for international portfolios.

- Robust Australian Base: Leverages Australia’s stable economy, plus international expansion, as a safe haven for investors.

The Best Australian REIT – Dexus

My favorite REIT in Australia is Dexus. Let me explain why.

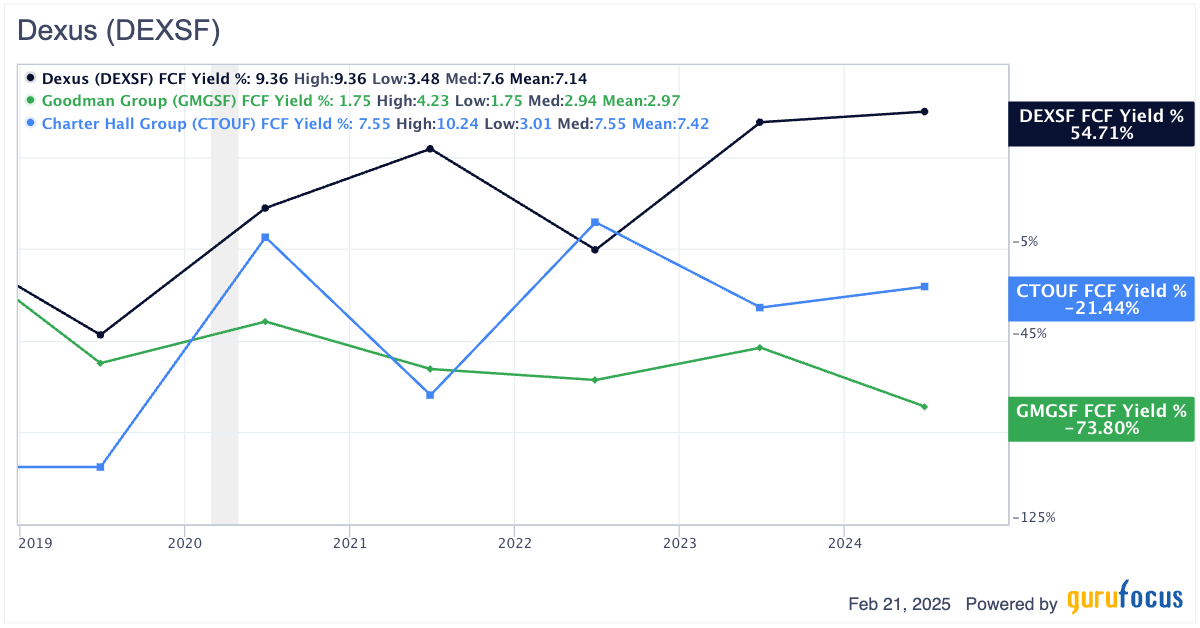

Highest Free Cash Flow Margin

Dexus’s FCF margin (explained here) is notably strong compared to its peers, indicating that Dexus generates significant cash flow relative to its revenues, reflecting efficient operations and strong financial health. For dividend investors, this is critical as it suggests Dexus has ample cash to sustain and potentially grow its dividends!

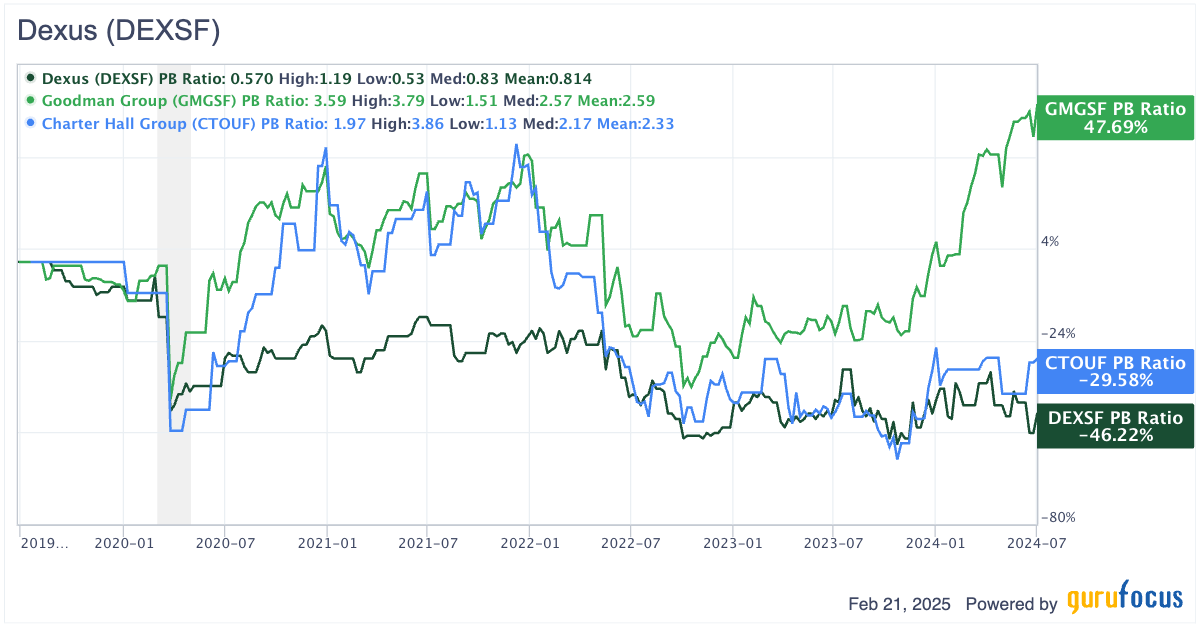

Lowest PB Ratio

Dexus’s price-to-book (PB ratio) is the lowest, reflecting its undervalued status relative to its book value, driven by its strong office portfolio and stable cash flows in Australia’s resilient market. As long-term investors, we look for opportunities and hence are trying to find undervalued companies with low PB ratios.

Good Dividend Yield

Dexus offers a high dividend yield, which is competitive and significantly higher than Goodman’s or Charter Hall’s.

This yield is particularly compelling for international dividend investors seeking steady income, especially given Australia’s stable economy and Dexus’s focus on office properties with long-term leases to high-quality tenants.

European VS Australian REITs

My most-read article is about The Best European REITs, which portrays Aroundtown, Vonovia and Segro (I hold the first two in my All-Weather Portfolio).

Let’s take a quick look at how the European REITS do compared to the best Australian REITs.

| Company | M Cap | Sales | Yield % | Free Cash Flow % | PB Ratio |

| Goodman | $41,525 | 1,382 | 0.9% | 2.05% | 3.64 |

| Vonovia SE | $24,457 | 5,462 | 3.31% | 10.1% | 0.95 |

| Segro PLC | $12,007 | 931 | 3.96% | 3.74% | 0.8 |

| Dexus | $5,096 | 547 | 6.52% | 9.42% | 0.82 |

| Charter Hall | $4,706 | 303 | 3.03% | 5.66% | 2.67 |

| Aroundtown | $2,882 | 1,487 | 0% | 27.76% | 0.25 |

Goodman is surprisingly the largest company by market cap. Vonovia is the largest by sales.

The best dividend payer is Dexus. Aroundtown has the lowest PB ratio!

Conclusion

Overall, I am happy with the stocks I own: Aroundtown, Vonovia, and Dexus.

All of them have not been performing well in the past few years, but with the changing interest rate environment, I believe they all will do well in the many years to come.

I will hold on to them and add to the positions in further weakness.

📘 Read Also

- The 2 Best Latin American Energy Stocks

- The 5 Best Asian REITs To Buy

- Selling A Dividend Stock After An Awful Experience

- Crypto Gains of $2 Mio US – What To Do? Feeling Like A Genius

FAQ

What makes Australian REITs attractive?

Australian REITs offer a strong risk-reward ratio with a stable economy, high demand for diverse properties like offices and logistics, attractive dividend yields (up to 7.0%), and an ‘uneventful’ location far from geopolitical hotspots, making them a safe haven for international investors.

Dividends of best Australian REITs?

REITs in Australia provide competitive dividend yields, such as up to 4.0%, which often outperform many European markets (e.g., 2.8–3.7%) and match or exceed U.S. averages, offering reliable income in a stable currency environment.

What are the risks of investing in Australian REITs?

Key risks include rising interest rates affecting property valuations, economic downturns impacting tenant demand, and currency fluctuations for international investors, but these can be mitigated by focusing on high-quality, long-lease portfolios like those in premium office REITs.

Do REITs in Australia have growth potential?

Australian REITs vary by property type: office REITs benefit from strong urban demand and long leases, industrial REITs thrive on e-commerce growth, and diversified REITs spread risk across sectors, with office-focused REITs offering stable growth in major cities like Sydney.

How are Australian REITs taxed?

International investors face a 30% withholding tax on dividends from Australian REITs, but this can be reduced to 15% under tax treaties. Consulting a tax advisor and using platforms like the ASX ensures compliance and optimizes returns.

How to start investing in Australian REITs?

International investors can open a brokerage account with global platforms like Interactive Brokers or local ASX brokers, research top REITs via their websites or financial reports, and buy shares listed on the Australian Stock Exchange for daily liquidity and transparency.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love