The Best Emerging Market Stocks To Buy

Key Takeaways

✅ Emerging markets should be part of every investor’s portfolio

✅ We can find diverse opportunities across the emerging market landscape

✅ We look at the fastest-growing emerging economies

✅ I share my 10 favorite emerging market stocks, some of which I own

👇

Wisestacker, 2024

If global economic growth were ‘a gigantic ass’, emerging market stocks would sit right next to the ‘a**hole’. This is where the action happens!

Introduction to Emerging Economies

Emerging economies are countries experiencing rapid development and industrialization, offering us investors good opportunities for growth.

These economies often boast expanding middle classes, vibrant cultures, and thriving industries. Join me in uncovering the potential and promise of investing in emerging economies, and discover how they’re reshaping the global economic landscape.

Fastest Growing Emerging Markets

Before we jump into the details, here are the fastest-growing emerging markets:

| Country | GDP Growth |

| India | 8.50% |

| Vietnam | 6.50% |

| China | 5.10% |

| Indonesia | 4.90% |

| Turkey | 4.20% |

| Russia | 3.60% |

| South Korea | 3.00% |

| Mexico | 3.10% |

Favorite Emerging Economies Among Investors

Based on my entirely subjective point of view and my reading of the current market sentiment, I find the following emerging economies as the favorite ones among investors:

India: Investors are bullish on India due to its strong economic growth, demographic dividend (demography is destiny!), and structural reforms. I have personally been to India, and all I can say is that it’s a black box. It’s indeed “incredible”.

China: Market sentiment in China is so incredibly bad at the moment, that many investors take the opposite side of the trade. Despite regulatory challenges, I believe it will soon become a favorite once more, due to its size, market potential, and innovation capabilities. I hold two Chinese stocks at the moment: Alibaba, and Tencent.

Vietnam: Vietnam is gaining traction among investors due to its favorable business environment, many multinational’s “China +1” move, young workforce, and strategic location. I am heavily invested in Vietnam via my commercial real estate company.

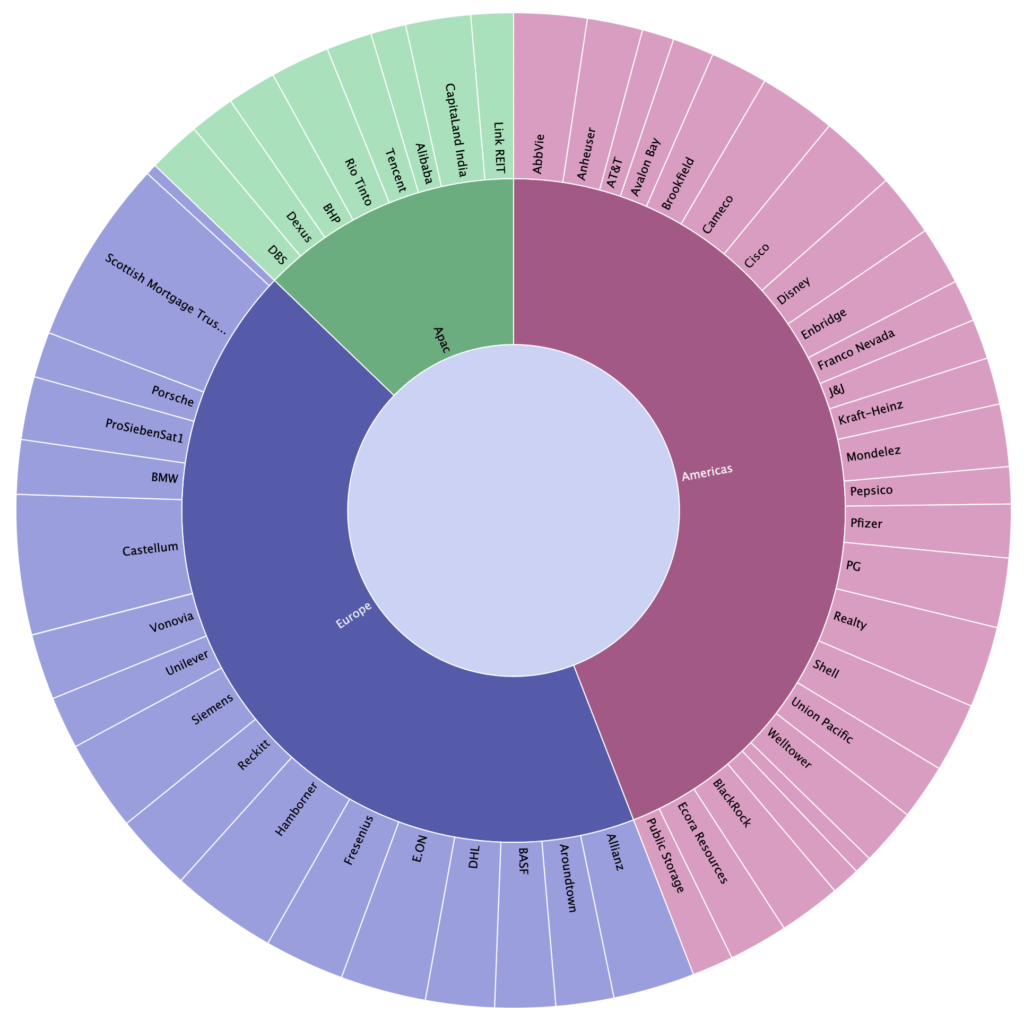

My Allocation To Emerging Market Stocks

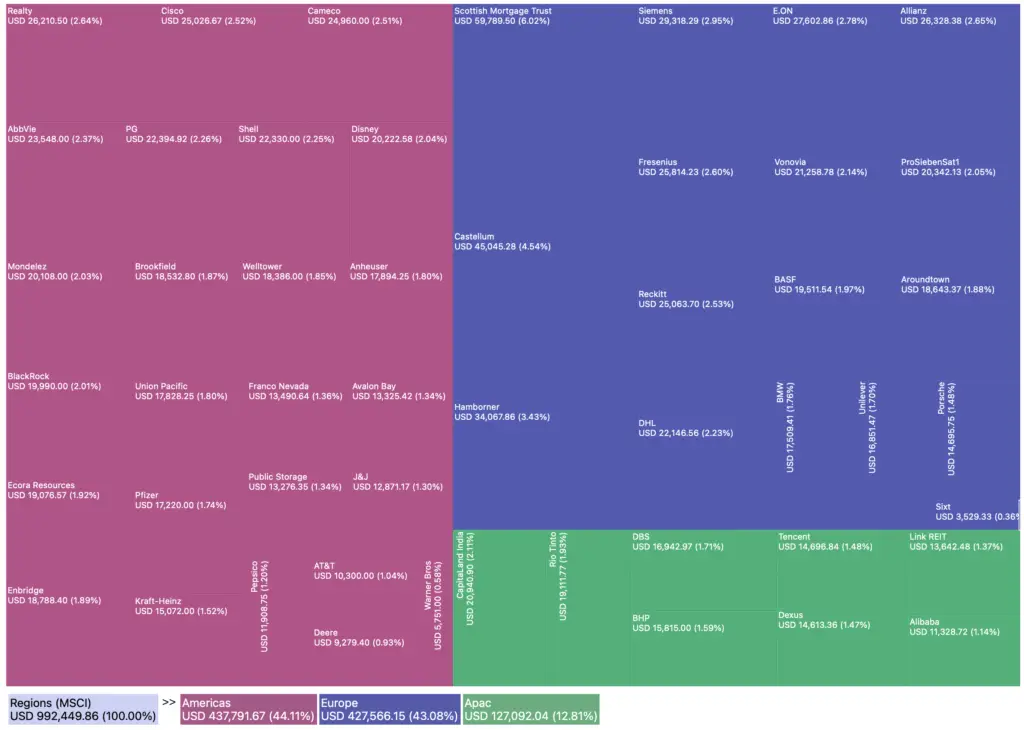

In my dividend portfolio, emerging market stocks currently make up 13% of the total. Here are two charts, showing all positions.

Below is another view of the same portfolio. My emerging market stocks are in green.

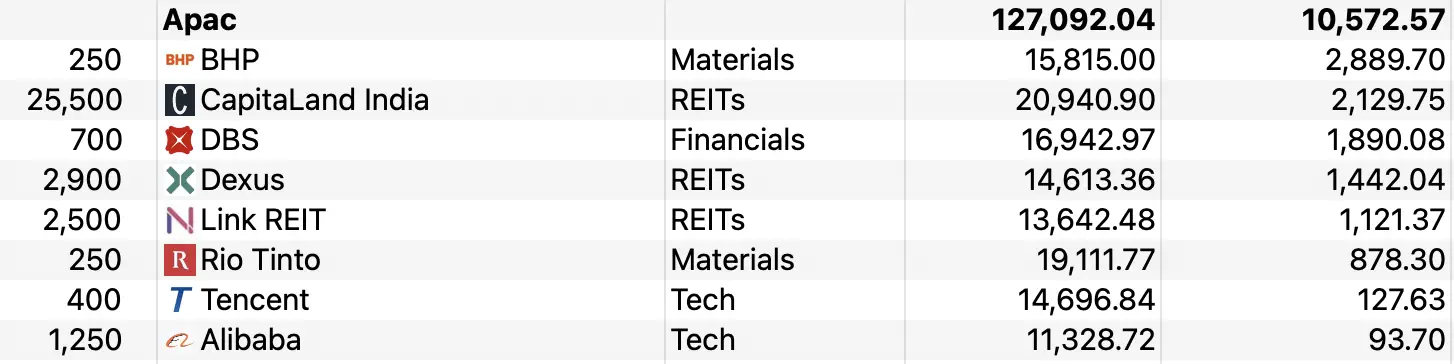

And here’s a detailed view of the emerging market stocks and their position size.

The column on the right shows the dividends received since 2022/05 when I started building my portfolio.

4 Great Emerging Market ETFs & Mutual Funds

Stocks marked with an * are in my All-Weather Portfolio.

When we look at the top holdings of those ETFs and mutual funds, we can see that

- TSMC, Samsung, Tencent, and Alibaba are the most-held emerging market stocks

- TSMC is the top holding of each of the funds

- Asia dominates, LatinAm and Africa are hardly present

- China, Korea, and India are the dominant countries

The 10 Best Emerging Market Stocks

I live in Singapore, the heart of Southeast Asia, and see everyday first-hand how quickly this region is growing. There is a certain buzz that I simply miss in Europe or the US. But now, without further ado, here are my 10 favorite emerging market stocks:

1️⃣ Samsung Electronics, South Korea

Leading global electronics manufacturer.

Revenue: $90 billion USD

Why I like it: Innovative leader in consumer electronics!

2️⃣ Taiwan Semiconductor Manufacturing Company (TSM), Taiwan

Semiconductor manufacturing giant.

Revenue: $65 billion USD

Why I like it: The world’s pioneer in semiconductor manufacturing!

3️⃣ Alibaba, China

E-commerce and technology conglomerate.

Revenue: $72 billion USD

Why I like it: Revolutionizing e-commerce and technology!

In my portfolio 💼

4️⃣ Tencent, China

Internet and technology company.

Revenue: $65 billion USD

Why I like it: Driving innovation in internet services!

In my portfolio 💼

5️⃣DBS, Singapore (DBSDF)

Multinational banking and financial services corporation.

Revenue: $14.6 billion USD

Why I like it: Trusted leader in banking and financial services!

In my portfolio 💼

6️⃣ BYD, China (BYDDY)

Electric vehicle and battery manufacturer.

Revenue: $81 billion USD

Why I like it: Shaping the future of EVs, batteries, and energy infrastructure!

7️⃣ Link REIT, Hong Kong (LKREF)

Asia’s largest real estate investment trust.

Revenue: $1.6 billion USD

Why I like it: Asia’s largest real estate investment trust – and Asians like it BIG!

In my portfolio 💼

8️⃣ CapitaLand India REIT, India (ACNDF)

Real estate investment trust focused on India.

Revenue: $161 million USD

Why I like it: Capturing growth opportunities in Indian real estate!

In my portfolio 💼

9️⃣ Reliance Industries, India (RLNIY)

Conglomerate with interests in petrochemicals, refining, and telecommunications.

Revenue: $106 billion USD

Why I like it: Diversified Indian powerhouse in energy and telecommunications!

🔟 Petrobras, Brazil (PBR)

Leading Brazilian petroleum company.

Revenue: $105 billion USD

Why I like it: Dominant player in Brazil’s oil and gas sector!

Risks When Investing In Emerging Market Stocks

Here are the four key risks I see when investing in emerging markets:

Market Volatility

Emerging markets are often subject to higher levels of volatility compared to developed markets. Political instability, regulatory changes, and economic uncertainties can lead to significant fluctuations in asset prices.

Currency Risk

Investments in emerging market stocks may be exposed to currency risk. Fluctuations in exchange rates can impact the value of investments denominated in foreign currencies, potentially leading to losses when converting returns back into the investor’s home currency.

Liquidity Risk

Emerging markets may have less developed financial markets and lower trading volumes compared to developed markets. This can result in challenges in buying or selling assets at desired prices, leading to liquidity risk for us investors.

Geopolitical and Regulatory Risks

Emerging markets may face geopolitical tensions, government instability, and regulatory changes that can affect investment outcomes. Investors need to stay informed about political developments and regulatory environments in the countries where they invest.

For example, it took my Uranium mining stock, Global Atomic (GLATF), five entire months to recover from a government coup in Niger/July 2023.

What Would I Buy Now?

If I did not have any exposure to emerging markets yet, I would start by buying $PBR Petro Bras (currently with a PE of 4 and a yield of 19%!), $DBSDY DBS (PE of 8 and a yield of 5.6%) and $TSM Taiwan Semiconductor Manufacturing (Buffett-owned, with a PE of 22 and a yield of 1.55%).

Conclusion

In conclusion, the 10 presented emerging market stocks exemplify the vast potential and diverse opportunities present in growing economies worldwide.

By carefully considering the strengths and growth trajectories of each company, you can position yourself to capitalize on the dynamic landscape of emerging markets.

With diligent research and strategic investment decisions, the journey toward financial success in these vibrant markets awaits.

📘 Read Also

- The 3 Best French Dividend Stocks To Buy in 2024

- Financial Astrology – Investment Guide For the Age of Air

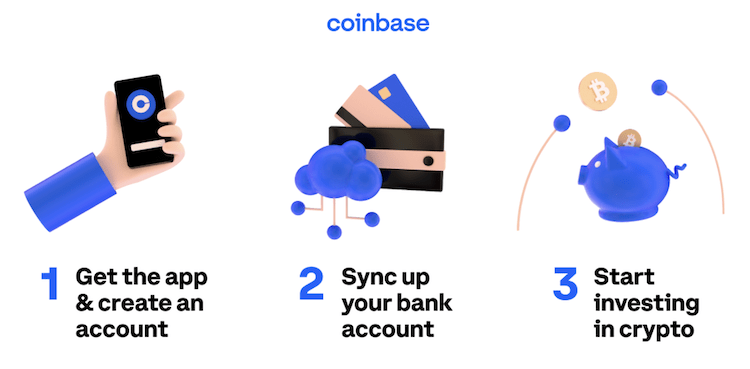

- How To Build A Simple Crypto Portfolio – A Step By Step Guide

FAQ About Emerging Market Stocks

What’s an emerging market?

Emerging markets are countries that are in the process of rapid industrialization and experiencing significant economic growth. Examples include countries like Vietnam, and Indonesia, but major economies like China and India still count as emerging markets as well!

They typically have lower per capita income levels, less developed infrastructure, and higher risk compared to developed markets.

Which emerging market ETF is best?

The best-emerging market ETF depends on your investment goals, risk tolerance, and specific market conditions. Some popular options include iShares MSCI Emerging Markets ETF (EEM) and Vanguard FTSE Emerging Markets ETF (VWO).

What’s the best emerging market fund?

If you prefer an actively managed emerging market mutual fund, there are two options I like:

1/ Templeton Emerging Markets Fund (EMF)

2/ Schroder Emerging Markets Small Cap Fund | SMLNX (SCGMOAA:LX)

Will emerging market equities play catch-up?

Emerging market equities have the potential to outperform over the long term, but it’s important to consider the inherent risks and volatility associated with investing in these markets. A smaller allocation of between 10-20% of your total portfolio is recommended.

How is China an emerging market?

China is still considered an emerging economy due to its rapid economic growth, ongoing industrialization, and transition toward a market-oriented economy. Despite its size and influence, China still faces challenges common to emerging economies. Cities like Shanghai or Beijing are considered to be expensive and first-world cities, but the vast majority of China’s 1.4 billion people still live in relatively poor conditions.

Why emerging markets?

Emerging markets offer investors opportunities for growth and diversification beyond developed markets. They represent dynamic economies with expanding middle classes, rising consumer spending, and untapped potential for investment returns.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love