Key Takeaways

✅ We learn how a millionaire invests $20 Mio

✅ His plan is surprisingly simple to follow

✅ I also share how another millionaire invests $2,5 Mio

What To Do With $20 Mio US?

A good friend of mine owns and manages a PE fund in Shanghai, China. In 2005, he bought two neighbouring villas in Pudong for $2.5 Mio US each.

Earlier this year, he sold one of the villas for $20 million US.

That’s an 8x or 700% return in 18 years.

He owns multiple other properties in Shanghai, but also in Singapore and Hong Kong, as well as his own PE firm, and several stakes in some well-known firms. In other words, he is set for life.

I thought it would be interesting to share what he plans to do with this large pile of cash. Before I share his plan, let’s take a quick look at which countries currently has most of most millionaires these days:

Millionaires By Country

| Country | Number of Millionaires | Share |

|---|---|---|

| USA | 25,580,000 | 39% |

| China | 6,190,000 | 9% |

| Japan | 3,366,000 | 7% |

| UK | 2,849,000 | 5% |

Source: Wikipedia.org

Billionaires By Country

And here’s just for comparison’s sake where most Billionaires live:

| Country | Number of Billionaires | Share |

|---|---|---|

| USA | 735 | 39% |

| China | 495 | 9% |

| India | 129 | 7% |

| Germany | 126 | 5% |

Source: Wikipedia.org

$20 Mio Compared To Top Properties

Now, the sale of a property for $20 Mio US certainly sounds impressive, but other villas were sold for a multiple of this. Check out this little video called “Inside The 5 Most Expensive Mansions in China”. The top one costs a whopping $154 Mio US.

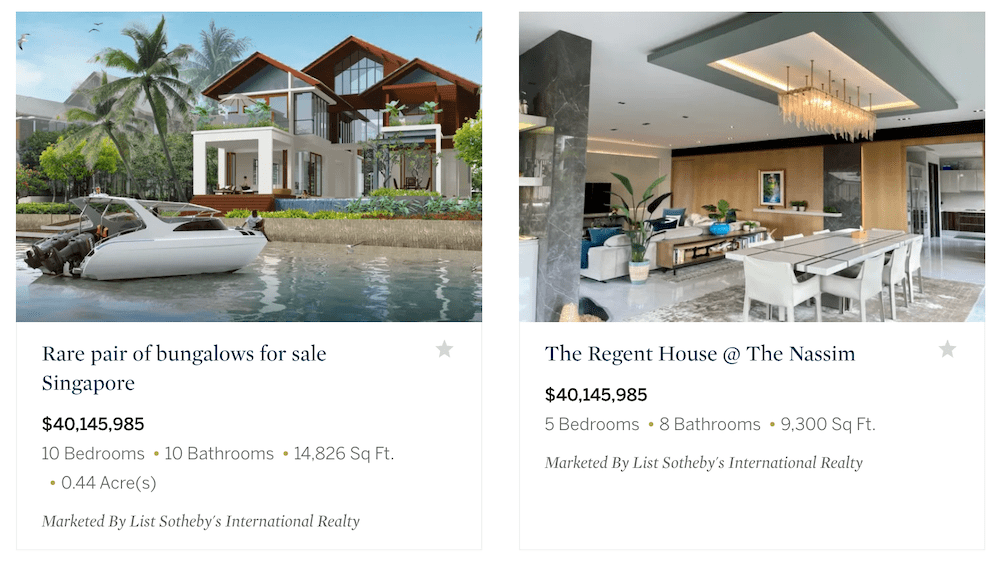

Or check out some of the listed villas for sale in Singapore on this website. $20 Mio is surely a lot, but compared to others, it’s not actually such big of a deal.

Surprisingly Simple Millionaire Investment Plan

I asked what he plans to do with the $20 Mio, and he smiled and said “As always, I like to keep things simple“.

This is how he will put these $20 Mio to work.

50% In U.S. Treasuries

He said he put $10 Mio right away into U.S. treasuries. He explained that he won’t need any of the money for quite a while, he said he got a little bit more than 5% through his private banker (not sure who he’s using). He’ll roughly generate $42,000 US per month in pure passive income. Not too bad.

40% In Single Stocks

Then he will put 40% in his long-term stock portfolio. I don’t know his exact allocation, but he said it’s a conservatively managed portfolio with large, blue-chip stocks. He does not follow a pure dividend strategy like I do with my All-Weather Portfolio, but invests across all sectors, regions, and industries.

From previous chats, I know he owns a lot of Disney, Mondelez, PepsiCo, and Walmart, as these are companies he knows well.

10% In Fine Art

What surprised me was what he said about the last 10%. He said he’ll invest in art!

He has a trusted Fine Art Advisor, who helps him to invest in the right artists and pieces. He mainly buys oil paintings which he then hangs in his offices and private homes. He said these are not only great to look at, but also provide good returns!

In fact, returns in contemporary art have beaten the S&P in the past 25 years.

I am currently looking into this topic, and believe I found a good way to invest in it via a platform offering art investment products to the retail investing public. It’s the only platform I know that allows you to invest in and own fragments of multi-million dollar works of art by leading artists.

How Another Millionaire Invests $2,5 Mio

Another friend of mine who lives in Hong Kong and co-owns and runs a pharmaceutical company, just shared with me that he just got a dividend of $2,5 Mio US.

He explained that this is in fact the first time that his company was able to pay a meaningful dividend, and he will simply put $2 Mio US in dividend-paying ETFs.

The aim is to never touch these $2 Mio again, covering not all but a lot of his monthly living expenses with the roughly $5,000 US per month.

Also not bad.

Conclusion

There you have it folks. Each millionaire invests in a different way, but one common feature is to keep things simple.

They usually know how much they want to or should have in each asset class, then use simple vehicles for each.

Some prefer single stocks, others ETFs, but they usually always own real estate and shares in companies they co-own, and often manage.

📘 Read Also

- My 7-Figure Portfolio Allocation – Back Above $5 Mio!

- How To Start With Investing

- How To Invest $50,000 Right Now

- Passive Income Tracker – My Dividend Income in 2023/08

FAQ

How do Millionaires invest their money?

Millionaires typically diversify their investments across various asset classes such as stocks, real estate, private equity (aka owning shares in private companies), bonds, VC+PE funds, and businesses, usually seeking long-term growth and wealth preservation.

What Should You As A Millionaire Invest In?

As a Millionaire you should consider a balanced portfolio allocation. One that aligns with your risk tolerance and long-term financial goals. This may and typically should include stocks, real estate, mutual funds, bonds, alternative investments, or business ventures. Check out my current allocation here.

Do Millionaires Invest In Index Funds?

Many millionaires do indeed invest in index funds due to their low-cost structure and ability to provide broad market exposure. However, investment strategies vary, and individual preferences may lead to different investment choices.

What Actually Do Millionaires Invest in?

In most cases, Millionaires invest in a wide range of assets, including stocks, real estate, startups, mutual funds, hedge funds, VC funds, PE funds, commodities, bonds, and private equity directly. Their investment choices depend on their risk appetite, knowledge, investment goals, and time horizon. They usually have constant passive income, allowing them to make long-term investments.

What are the best millionaire investments?

The best investments for Millionaires depend on their financial goals, risk tolerance, and investment expertise. Common choices include diversified stock portfolios using ETFs and mutual funds, dividend stocks, income-producing real estate, private equity opportunities, investments in art, and tax-efficient vehicles like retirement accounts.

Best millionaire investments?

Millionaires invest in a wide range of asset classes, hence there is no such thing as a “best investment”. If I’d need to pick one then I’d go with investing in the property sector. I hardly ever met a Millionaire who doesn’t at least own one or two residential or commercial properties. Followed closely by private equity. Most Millionaires I know make money via owning or selling a business, hence owning shares in one or several companies is seen as a typical millionaire investment.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love