Stock Dividend Summary

I just wrapped up the month of June, and with it, the first-half of the year.

In terms of stock dividends, the following months are usually my best three:

- 🥇 May

- 🥈 March

- 🥉 June

June typically is my 3rd best month, so let’s check out the stock dividend summary:

| Shares |

Received |

||

|

2023-06-16 |

🇩🇪 Vonovia | 550 | $512 |

|

2023-06-01 |

🇨🇦 Enbridge | 470 | $263 |

|

2023-06-16 |

🇺🇸 Anheuser | 275 | $211 |

|

2023-06-08 |

🇬🇧 Ecora Resources | 7,500 | $196 |

|

2023-06-12 |

🇺🇸 3M (sold!) | 125 | $159 |

|

2023-06-27 |

🇬🇧 Shell | 250 | $144 |

|

2023-06-12 |

🇺🇸 Pfizer | 350 | $100 |

|

2023-06-15 |

🇺🇸 Realty | 429 | $93 |

|

2023-06-24 |

🇺🇸 BlackRock | 25 | $92 |

|

2023-06-08 |

🇺🇸 J&J | 80 | $86 |

|

2023-06-30 |

🇺🇸 Kraft-Heinz | 300 | $84 |

|

2023-06-30 |

🇺🇸 Union Pacific | 75 | $83 |

|

2023-06-06 |

🇨🇳 Tencent | 250 | $77 |

|

2023-06-29 |

🇨🇦 Franco Nevada | 123 | $36 |

| Total | $2,135 |

I received dividends from 14 different dividend stocks, for a total of $2,135 US.

Last year in the same month I got $1,232, which you can check out here dividend income in June 2022, an increase of 73%.

But this has little to do with how much these companies raised their dividends, and much more to do with the additional money I invested since then.

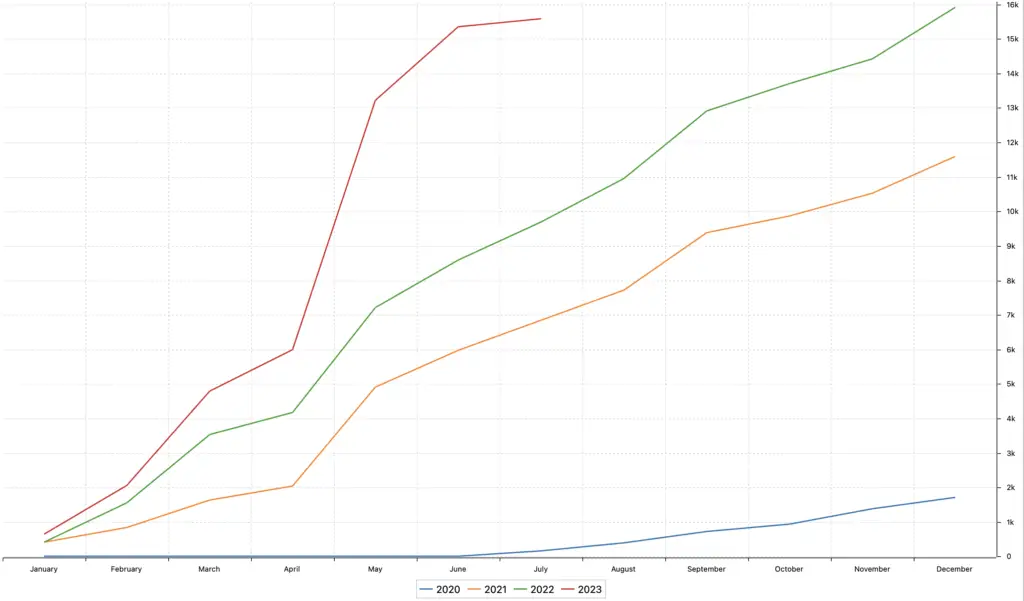

Stock Dividend Summary Comparison – By Month

May 2023 was a lot more than last year because I bought many more shares in certain German companies that pay only annual dividends in May (check out the entire dividend income report).

Charts like that (created via the 100% free Portfolio Performance) makes it easy to spot my 3-4 slowest months:

- January

- April

- October

- November

I will try and improve my dividend income by buying more shares of the companies paying dividends in those months, and considering buying new positions.

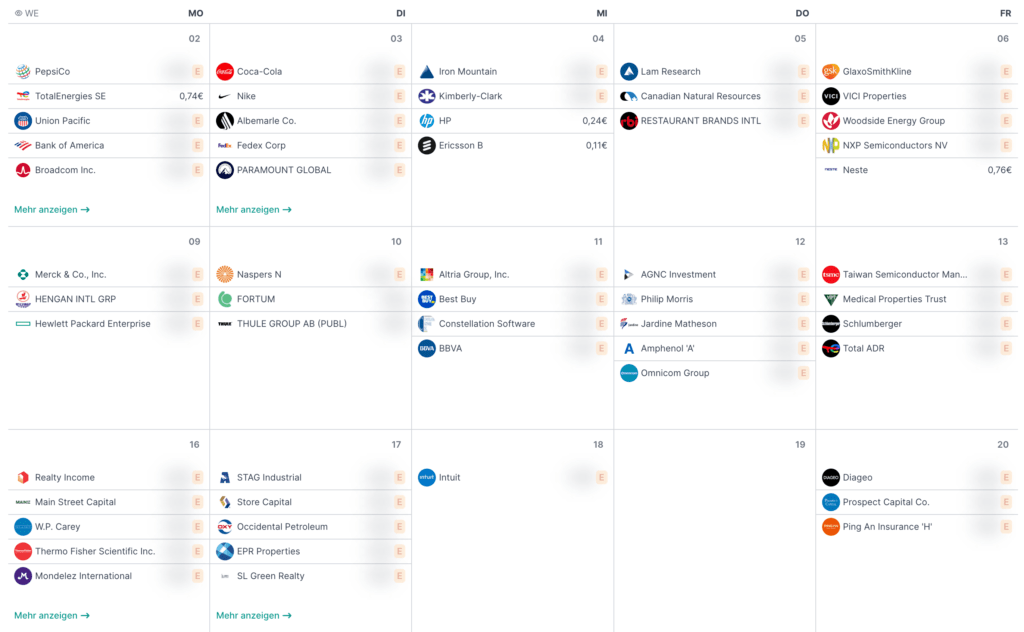

The dividend calendar over on Parqet (in German only) comes in really handy!

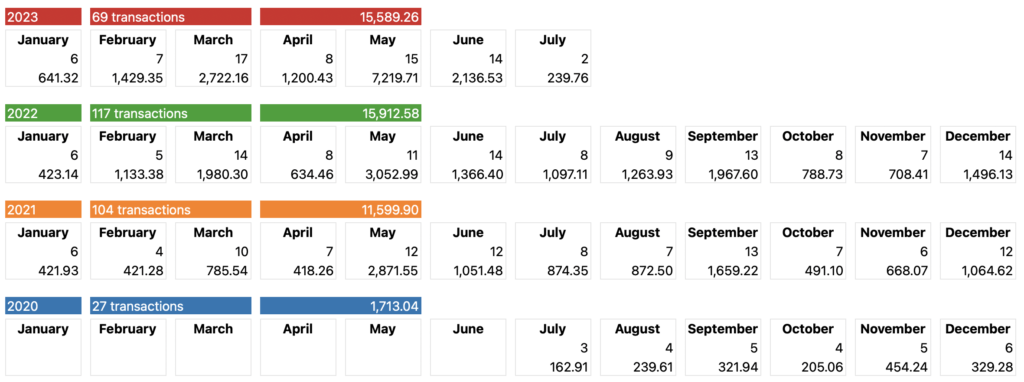

Stock Dividends Summary – Monthly Head-To-Head

The following chart shows the accumulated stock dividends received in each month.

Compounding Effect of Stock Dividends

When reinvesting dividends, over time, wealth will start to exponentially increase. Not as fast as a rabbit on steroids, it takes time. But if you don’t just take the dividends and splurge, but re-invest them, you soon will reap the rewards.

The essence of dividend investing and the key for us long-term income investors is to hold onto positions for YEARS and allow dividend growth and reinvestment to do its magic for that sweet financial freedom we are aiming to reach.

The passive income stream that comes along with it increases rapidly – these are the rewards that come with patience.

The chart above proves that this really works. I only started investing in dividend stocks back in mid-2020, and the progress is encouraging.

I 🩵 dividend investing.

Purchases Of The Month

In June, I was again quite active and made seven purchases:

| Buys in June | Shares |

Spent |

|

|

2023-06-06 |

🇬🇧 Ecora Resources | 3,780 | $5,424 |

|

2023-06-30 |

🏴 Scottish Mortgage Trust | 500 | $4,240 |

|

2023-06-27 |

🇩🇪 Sixt | 50 | $3,832 |

|

2023-06-26 |

🇺🇸 Mondelez | 50 | $3,643 |

|

2023-06-21 |

🇩🇪 Vonovia | 150 | $2,925 |

|

2023-06-15 |

🇺🇸 Pfizer | 50 | $2,018 |

|

2023-06-22 |

🇬🇧 Unilever | 35 | $1,785 |

| Total | $23,868 |

I re-invested into six dividend stocks and also bought one new position: Sixt, ticker symbol: SIX3.

Based in 🇩🇪 Munich, Sixt is a global car rental company operating all over the EU and the U.S., offering car rental solutions for both individuals and businesses.

I analyzed the world’s best car rental stocks, and am convinced we have a clear winner.

Half-Year Comparison

Half-Year 2022 vs 2023 – Stock Dividend Summary

When adding up all dividends of the first half year and comparing it with last year, we see the following:

| First half-year 2022 | First half-year 2023 |

| $8,588 (44 dividends) | $15,437 (53 dividends) |

| increase of 79,7% |

Multi-Year Stock Dividend Summary

The overview below shows all payments I ever received – per month:

The value of my All-Weather Dividend Portfolio is currently $800,000 US. With $16,000 received in 2022, that equals a yield of 2%. Not really great.

However, for the entire 2023, I should be getting roughly $24,000, representing a dividend yield of 3%.

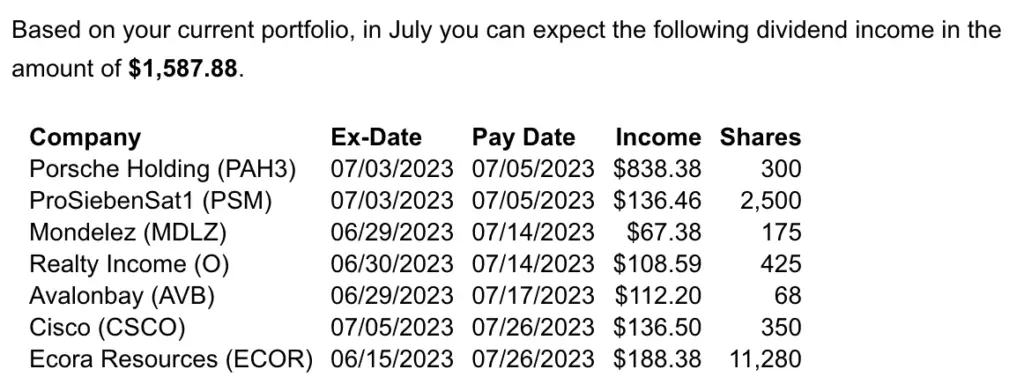

Dividend Forecast

For the remainder of July I am expecting the following dividends:

If you also like to get an overview on the 1st of each month, check out the free DivvyDiary.com.

Conclusion

A good/okay month without any bad surprises. I feel good about the steady progress.

Each month’s income is higher compared to the same month of the previous year.

Besides my above-mentioned dividend income, I made a further $10,409 US in other passive income (click here if you like to see a full breakdown).

FAQ

How to get a good stock dividend summary?

There are several (free) tools you can use to keep track and get a good stock dividend summary:

– Parqet.com

– DivvyDiary.com

– SeekingAlpha.com

What is stock dividend yield?

The ‘stock dividend yield’ is a measure that shows how much money you can expect to earn from owning a stock. It is easy to calculate: Simply divide the annual dividend payment by your stock’s current price.

Put simply, it tells you how much cash flow you can earn as a % of the stock’s current value, ie. if your stock yields 3%, it means that for every $100 invested in the stock, you can expect to earn $3 per year in dividends. If the share price jumps one day to $200, your dividend might still be $3, but your dividend yield goes down to 2% (3/200=2%).

Do dividends-in-kind, or stock dividends, affect share price?

When a company pays out a dividend-in-kind, also called a stock dividend, it means that instead of paying out cash to shareholders, it distributes additional shares of the company’s stock. This essentially means that existing shareholders will receive more shares without having to buy them. The immediate impact of a stock dividend on share price is usually negligible.

Although the total number of shares increases, the value of each individual share decreases proportionally. So, while shareholders may have more shares, the overall value of their investment remains the same. In the long term, stock dividends can potentially have an effect on share price, by increasing the number of shares outstanding, it may signal to the market that the company has confidence in its future performance and is willing to share its profits with shareholders.

Which dividend stock to buy now?

There are thousands of great dividend stocks in the world, and which dividend stock to buy always depends on every investor’s unique situation. There are certain dividend stocks you can buy and hold forever, such as $PEP, $JNJ, or stocks paying monthly dividends such as Realty Incom (ticker symbol: $O), but no size fits all.

When stock dividends are paid?

It depends on every specific company and its dividend policy. Most companies pay dividends on a regular basis, in the U.S. typically quarterly, in Europe and Asia usually semi-annually, or annually. Others may pay them irregularly or not at all. The timing of dividend payments is usually determined by factors such as the company’s financial performance, cash flow, and management decisions. It’s important to regularly check the dividend payment schedule on the company’s investor relations page or websites such as SeekingAlpha.com or SimplyWall.st.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love