Dividend Income 2022/06

The dividend income I received in the month of June 2022 was okay and as expected.

I received 1,800 USD pre-tax dividend income, post-tax dividend income was 1,232 USD (see table below).

| Security | June 22 |

| Enbridge | $249 |

| Fresenius | $203 |

| Shell | $118 |

| 3M | $95 |

| Unilever | $93 |

| Realty Income | $85 |

| Kraft-Heinz | $80 |

| J&J | $76 |

| Pfizer | $58 |

| Union Pacific | $53 |

| Tencent | $48 |

| Welltower | $48 |

| Franco Nevada | $27 |

| Total | $1,232 |

The above listed dividends are those I received in my All-Weather Portfolio in June.

Recent Buys.

With the dividends I received, plus additional/new money, I made the following dividend stock purchases:

- bot 16x Vonovia at 35 EUR

- bot 10x DHL at 37 EUR

- bot 10x Deere at 355 USD and 3x at 322 USD

- Bot 560x Aroundtown at 3.57 EUR

Total capital deployed 7,400 USD

Why do I buy these stocks?

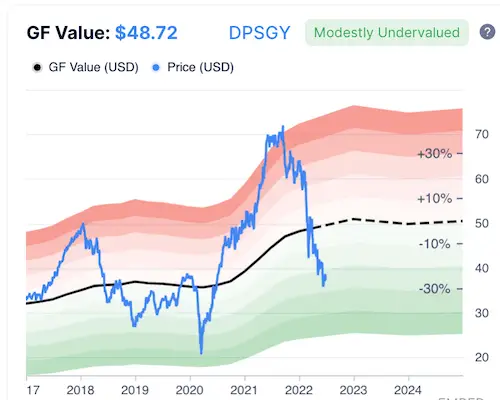

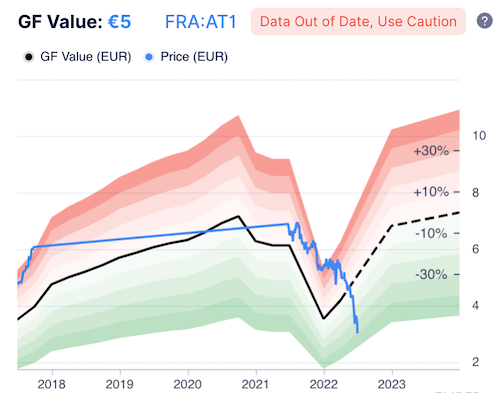

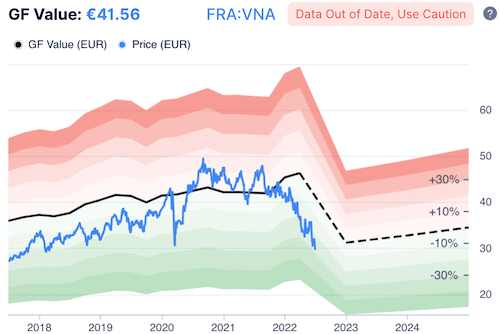

I see they currently provide good value. One ratio I like and use is Gurufocus’ in-house GF Value. See some examples below.

It says the ‘GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

- Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

- GuruFocus adjustment factor, based on the company’s past returns and growth.

- Future estimates of the business performance.

According to this value ratio, the price of my All-Weather Stocks Deutsche Post (DHL), Aroundtown, and Vonovia, currently provide a good risk/reward ratio:

Deutsche Post (DHL)

Aroundtown

Vonovia

Dividend income compared to last year

Last year, in June 2021, I received 1,090 USD in pre-tax dividend income. The increase of 900 USD is mainly due to the additional share purchases I made in the past 12 months.

In addition to the 1,232 USD, I made approx. 8,800 USD via my other passive income streams (see the full breakdown on my Dividend Calendar).

My annual dividend report chart

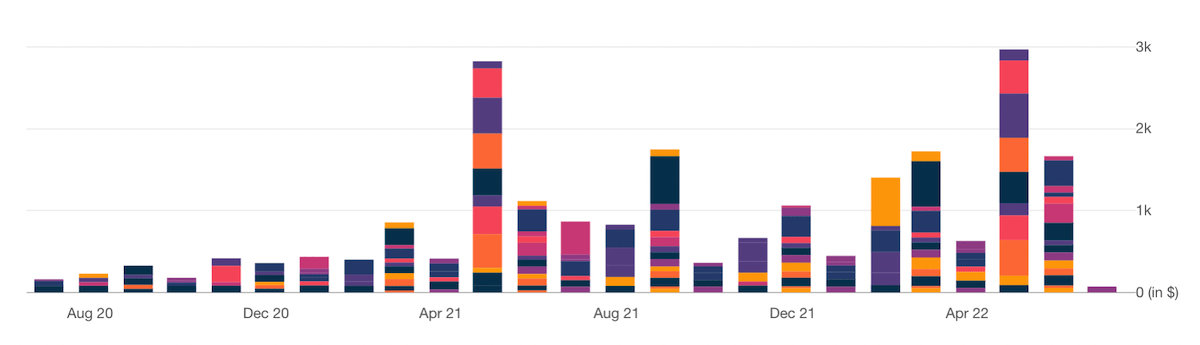

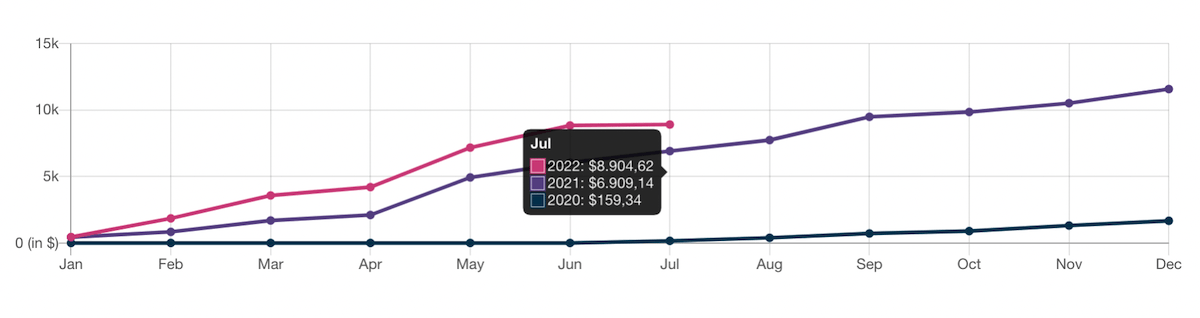

Below are some charts from Parquet.com (one of the essential tools I like and use). I keep track of all the dividend income I receive, giving me a quick visual overview like the two charts below:

The above chart shows the amounts of dividend income received per month. May and June are typically very good months for my dividend portfolio. The below chart shows the accumulated income compared year by year. I started my dividend portfolio in May 2020, hence there is no income prior to that.

Check out my full passive income on my here.

Related Posts

- Check out my total net worth

- Read the dividend report 2022/05

- Why I believe this is a dream REIT stock

- Why I think this chemical company is a buy-and-hold forever stock

- Read about the best gold stock in the world

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love