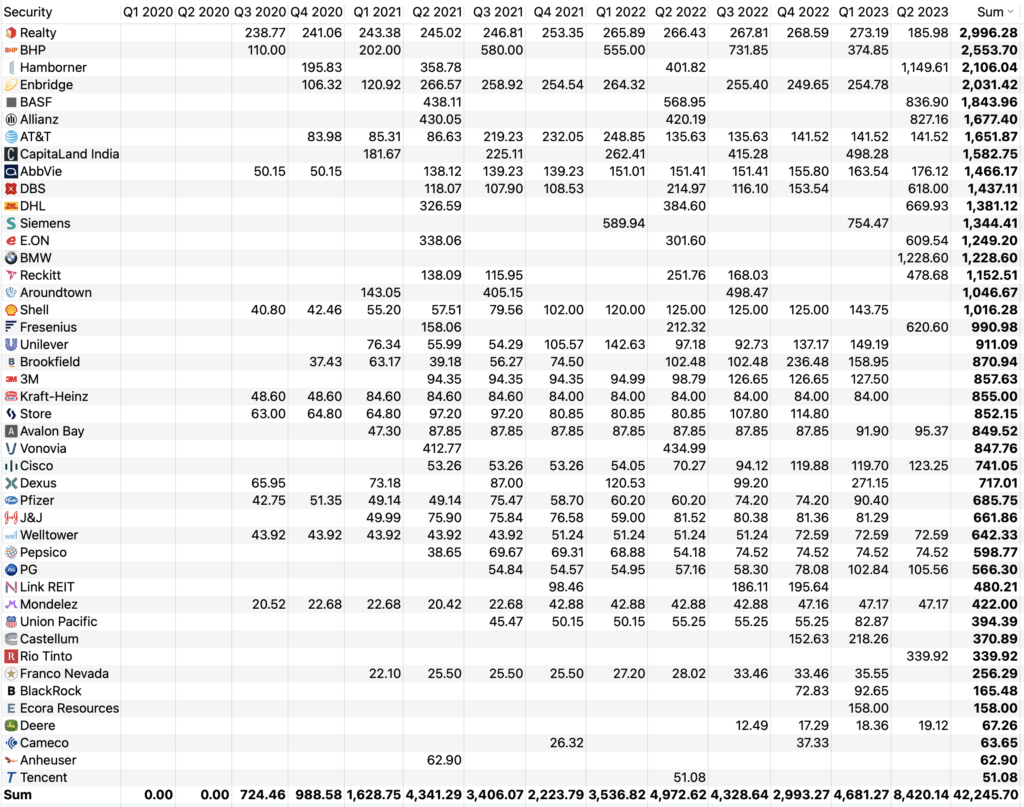

My monthly dividend income report for the month of May is my best one ever so far!

I received $7,762 US from 15 different stocks.

The largest three dividend payers were

- BMW with $1,326 US

- BASF with $1,241 US

- Hamborner REIT with $1,150

These dividends are net tax, meaning I already deducted the withholding tax (26.25% for German dividends and typically 25% for dividends from companies in the U.S.).

Several companies increased their dividends, some kept it as is, and others completely stopped paying dividends.

I am particularly happy about the German companies.

2021 and 2022 were tough years for many of them, and throughout all the uncertainty and challenges, companies like BMW, Fresenius, E.ON, Allianz and BASF were able to pay record dividends!

Compared to last year’s monthly passive income report, my dividend income increased from $3,053 to $7,762, an increase of 2.3x.

Most of the increase can be attributed to the additional money I’ve invested in the past 12 months.

Back in May 2022, the total amount I had invested into my All-Weather Portfolio was $515,000 US, now at the end of May 2023, it’s $824,000 US, an increase of 1,6x. You can find the monthly dividend income report for May 2021 here.

| Shares | Dividends | ||

| 2023-05-01 | AT&T | 600 | $142 |

| 2023-05-04 | Hamborner | 3,000 | $1,150 |

| 2023-05-04 | BASF | 285 | $1,241 |

| 2023-05-08 | Deere | 18 | $19 |

| 2023-05-10 | Allianz | 90 | $827 |

| 2023-05-11 | DHL | 450 | $662 |

| 2023-05-15 | AbbVie | 140 | $176 |

| 2023-05-15 | Realty | 429 | $93 |

| 2023-05-16 | BMW | 180 | $1,326 |

| 2023-05-16 | PG | 125 | $106 |

| 2023-05-16 | Welltower | 170 | $73 |

| 2023-05-22 | E.ON | 1,500 | $658 |

| 2023-05-23 | Fresenius | 850 | $621 |

| 2023-05-23 | DBS | 600 | $191 |

| 2023-05-24 | Reckitt | 350 | $479 |

| Total | $7,762 |

Almost all of my REITs have taken a monster haymaker to the chin.

Some, like in the example of Aroundtown, are down +70%. This is mainly due to the fastest interest rate hike in financial history (!).

No one knows, but I believe at these levels, most of the negative news has been priced in.

That’s why I added to my real estate investment trust positions, such as the mentioned Aroundtown, but also Hamborner REIT, Castellum (largest Scandinavian REIT), Dexus (in Australia), and Avalon Bay (U.S.-based REIT).

Look how much Aroundtown fell in the past 12 months. Crazy!

Overview Of Purchases

I received a +65,000 USD dividend payment from one of the private companies I own shares in, and as I still sit on a lot of cash, I thought it was time to add to my dividend stock positions.

Therefore, I was quite active in May and invested a total of $43,000 US.

I am still sitting on quite a lot of cash, and when REITs are down +70%, it is time to buy.

I did not buy new positions but added to my existing positions:

| Buys | Shares | Buys | |

| 2023-05-04 | AT&T | 25 | $426 |

| 2023-05-08 | Hamborner | 500 | $4,191 |

| 2023-05-10 | AbbVie | 5 | $731 |

| 2023-05-12 | Castellum | 500 | $5,312 |

| 2023-05-17 | Avalon Bay | 2 | $351 |

| 2023-05-25 | Enbridge | 10 | $361 |

| 2023-05-26 | ProSiebenSat1 | 500 | $4,111 |

| 2023-05-26 | Aroundtown | 2,500 | $2,686 |

| 2023-05-26 | BASF | 55 | $2,585 |

| 2023-05-31 | Dexus | 400 | $2,149 |

| 2023-05-31 | Scottish Mortgage | 500 | $3,997 |

| 2023-05-31 | Castellum | 1,000 | $5,320 |

| 2023-05-31 | Capitaland India | 2,500 | $1,925 |

| 2023-05-31 | Porsche Holding | 100 | $5,640 |

| 2023-05-31 | Gold (physical/2xKrugerrand) | 2 | $3,991 |

| Total | $43,350 |

*Major buys in bold

I again DCAed into the Scottish Mortgage Trust, in my opinion, one of the best global tech fund.

I am prepared to sit through this weakness, as I believe all the companies I own will make it through and these prices represent good long-term buying opportunities.

Monthly Dividend Income Report Comparison

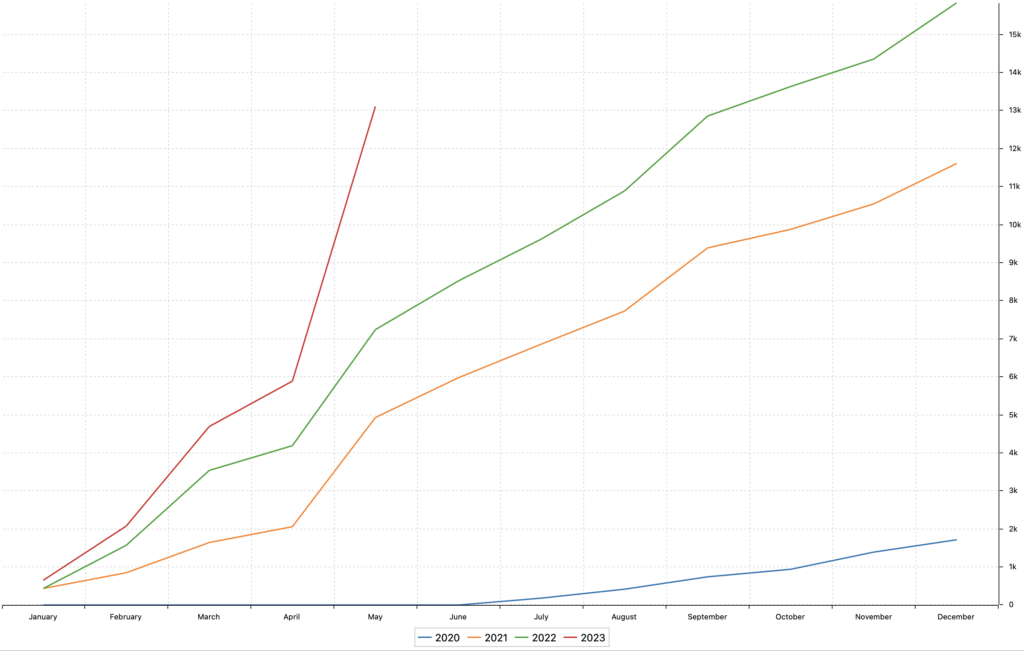

I started building my dividend portfolio in May 2020, and since then have seen a constant increase in my monthly dividend income.

The first dividend I ever received was from Mondelez in July 2020. Since then, out of 36 months in total, there was only one month in which the dividend amount was smaller than the previous year (because AT&T spun off Warner Bros).

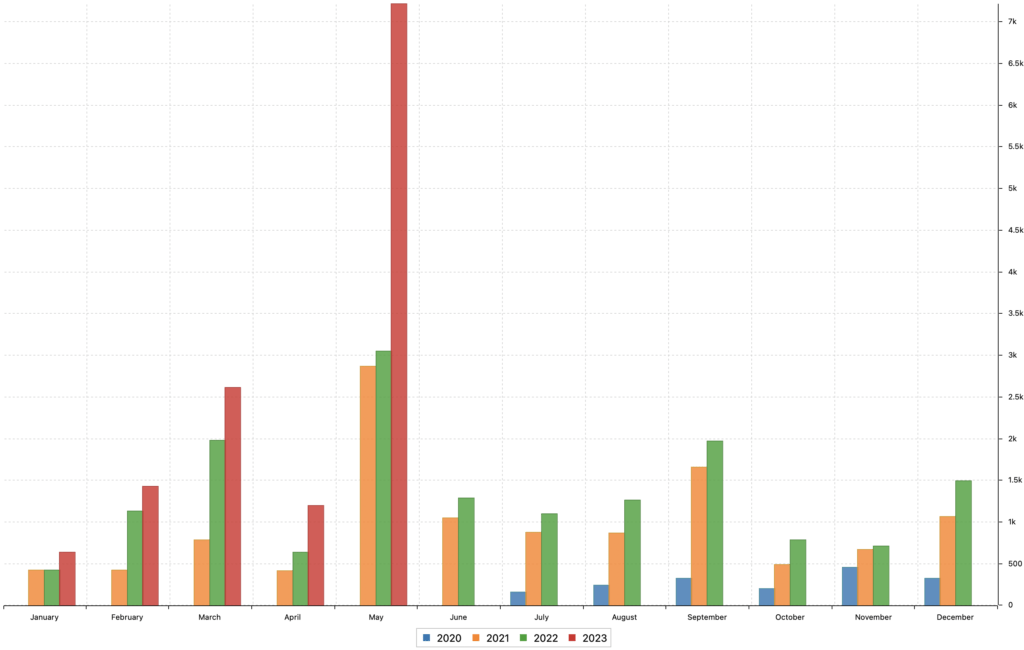

The above chart shows the monthly dividend income report compared by year, and the chart below shows the month-by-month comparison.

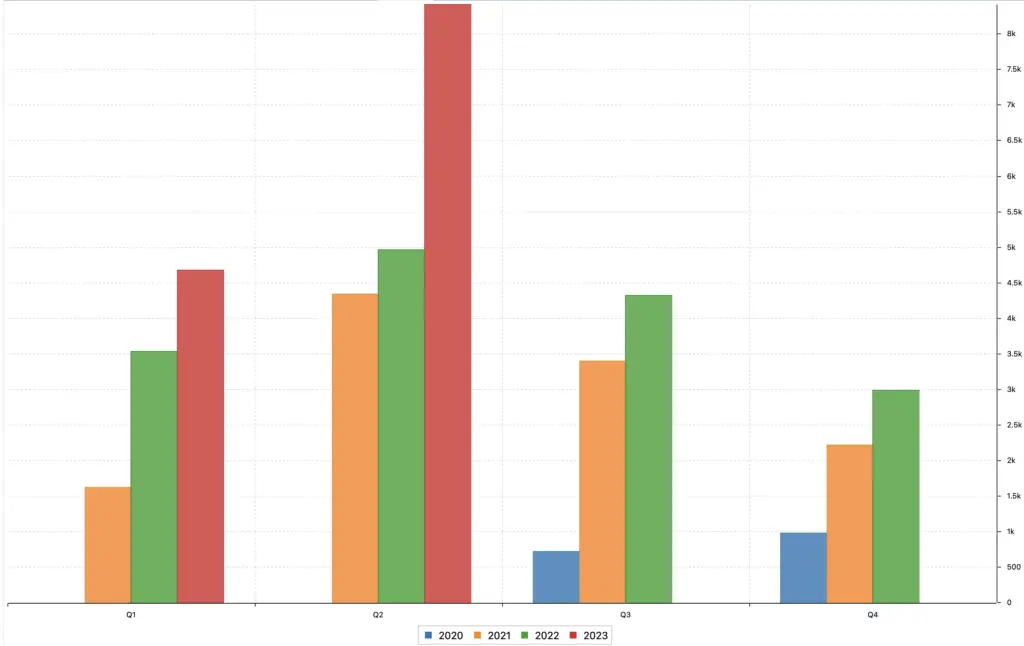

Quarterly Dividend Income Comparison

The chart below shows my entire dividend come, by quarter.

This typical step-wise increase in dividend income is noticeable by many income investors.

Exciting and gratifying to see!

The chart below shows my entire monthly dividend income reports for the past three years (starting in May 2020).

The total monthly expense for my family is roughly $10,000, and my dividend income, little by little, is slowly getting there.

The income my All-Weather Portfolio generates is at the moment not my largest income stream.

Signup for my 100% free newsletter to check out and instantly unlock my entire passive income.

📘 Read Also

- The 8 Top Industrial Conglomerate Dividend Stocks

- The 5 Best Wall Street Movie Scenes Of All Times

- The 10 Best Luxury Stocks With Dividends

- How To Invest $50000 Right Now

FAQ

Which stocks generate good monthly dividend income?

Most stocks in the U.S. pay quarterly dividends. In Europe and Asia, most stocks pay annual or bi-annual dividends. With just 3-4 stocks you can already build a small portfolio that generates a passive income every single month. There are also stocks that pay monthly dividends, such as Realty Income (O), one of the largest commercial real estate investment trusts in the world.

How to get monthly dividend income reports?

You get monthly dividend income by buying stocks of companies that pay out part of their profits as dividends to shareholders. If a company for example has a profit of 100 and decides to pay out 30 to its shareholders, it would have a payout ratio of 30%. If the share price is at for example 100, and the annual dividend is at 5, the company would have a dividend yield of 5%.

Where should monthly dividend income be recorded?

It is best to use dividend tracking tools such as Parqet.com or Divvydairy.com. Most users however prefer to build a simple dividend tracker in Google Sheets or Excel.

What is a monthly dividend yield?

A monthly dividend is a dividend paid by a company on a monthly basis. There are companies that do so, such as Realty Income, ticker symbol $O, that have been reliably paying a regular dividend for decades, every single month.

Are monthly dividend stocks worth it?

Whether a company pays a monthly, quarterly, bi-annually, or annual dividend, or even no dividend at all, should not impact your assessment of a company. What investors should pay attention to is the valuation, the growth, the debt, and multiple other financial ratios that are more important than how much of the company’s profit is distributed.

Can you live off monthly dividends?

Yes, if you receive an amount in monthly dividends that is higher than your total monthly cost of living, including but not limited to rent, food, insurance, utilities, travel, car, communication, etc. Instead of looking at single months, it is recommended to look at your total yearly cost and your total yearly dividend income. If the later exceeds the earlier, and you have really considered all costs, you should be able to live off your dividends.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love