Key Takeaways

☑️ Asia is the epicenter of growth with excellent demographics

☑️ Three Asian bank stocks offer compelling risk/reward ratios

☑️ The largest banks in Asia in each country are presented

☑️ Investors need to be patient

The Leading Asian Bank Stocks

The above table shows the largest Asian bank stocks in each country, measured by their respective market cap. We can quickly see that the Chinese banks dominate in terms of size, but when we dig a little deeper, we can find some interesting undervalued banking stocks.

Are Chinese Bank Stocks Investible?

In general, as an international investor, you can certainly buy Chinese bank stocks through your brokerage account.

However, as a European living in Asia for 20+ years, I have grown a healthy skepticism when it comes to Chinese stocks. Especially when it comes to Chinese financial institutions in general and Asian bank stocks in particular.

I personally burned my fingers with several Chinese publicly-listed companies, that were pure frauds, and forged their books. That’s why, at least in my opinion, I see Chinese bank stocks as ‘uninvestable’ at this stage, and will not consider them going forward for the remainder of this post.

Largest Banks In Each Asian Country

The largest Asian bank stocks in each country in Asia are as follows (in no particular order):

- 🇯🇵 Japan – Mitsubishi UFJ

- 🇰🇷 Korea – Shinhan

- 🇸🇬 Singapore – DBS

- 🇮🇳 India – HDFC

- 🇲🇾 Malaysia – Malayan Banking MYS

- 🇹🇭 Thailand – Kasikornbank

- 🇻🇳 Vietnam – VCB

- 🇵🇭 Philippines – BDO Unibank

- 🇭🇰 Hong Kong – HSBC

🇨🇳 China – ICBC– see above – not recommended🇨🇳China – Construction Bank

After removing the two Chinese banks (which I believe are un-investable at the time being, see further above), the table of the largest Asian bank stocks looks like this:

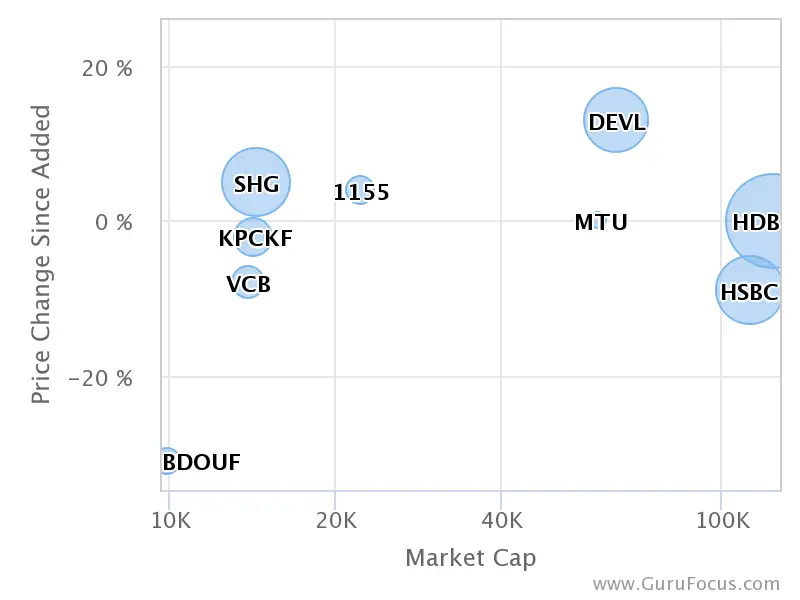

Market Cap Of Asian Bank Stocks

The following chart shows the significant differences in market cap, and their respective year-to-date performance (as of Nov 11):

Two massive Asian bank stocks stand out:

- HDFC (FRA:HDFA) in India, and,

- HSBC (FRA:HBC1) in Hong Kong.

HSBC is technically a UK company, having its HQ in London, but most people consider it a Hong Kong bank, as it even has “Hong Kong Shanghai Banking Cooperation” in its name).

These two Asian bank stocks each have market caps north of $110 Bio USD.

Then, in third place, are DBS, Singapore’s largest bank, and Mitsubishi UFJ, Japan’s largest bank.

Thereafter, with quite some distance, are the stocks of relatively smaller banks. Keep in mind I only looked at the largest Asian bank stock in each country!

Let’s now look at those three Asian bank stocks I like the most:

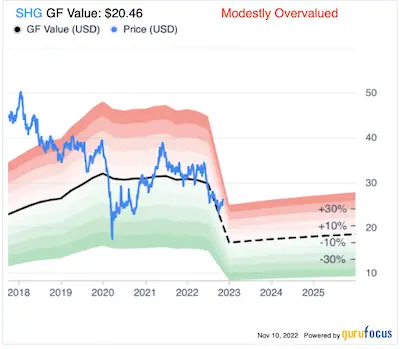

3rd Best Asian Bank Stock – Shinhan Bank 🇰🇷

| Market Cap $ M | 13,684 |

| Enterprise Value $ M | 82,034 |

| P/E | 4 |

Shinhan Financial (SHG), headquartered in Seoul, is Korea’s largest banking group. It has more than $1 trillion in assets and more than 18 Mio customers. It has the most branches, high customer satisfaction, and a strong capital position, cementing it as the top Asian bank stock in South Korea.

What I like about Shinhan Bank in particular is the fact that it is very open to and experimenting with digital assets and cryptocurrencies. For example, it is the first Korean bank to become a global council member of Hedera, an organization that will help govern the Hedera platform.

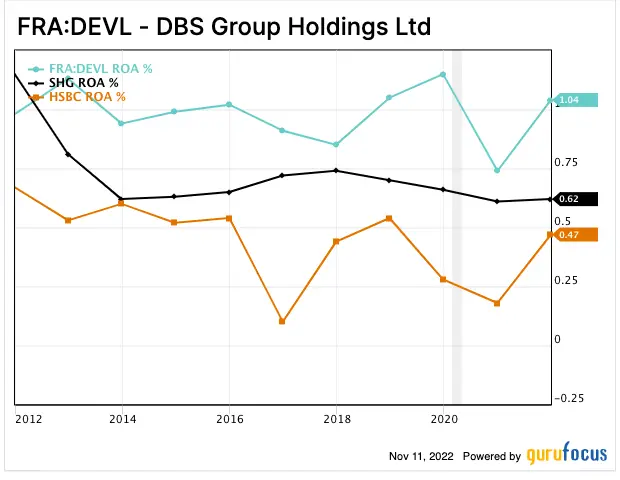

Shinhan currently has a very low PE of 4, while its dividend yield is at 3%. It has a free-cash-flow yield of 38%, meaning it generates ample cash to give back to its shareholders. Its relatively low Return on Assets of just 0,66 should be watched carefully as its Asian banking peers do much better.

My Take on Shinhan Bank: A solid and modern Asian bank stock, suitable for long-term-oriented dividend investors.

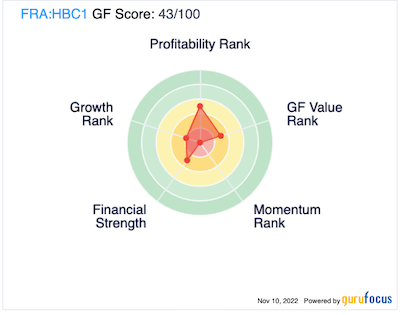

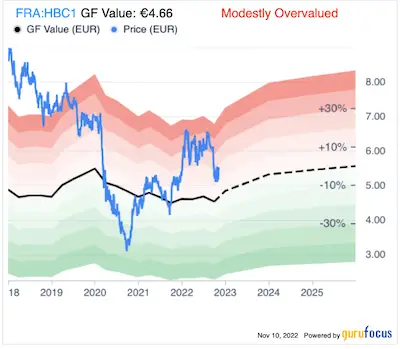

2nd Best Asian Bank Stock – HSBC 🇭🇰

| Market Cap € M | 109,876 |

| Enterprise Value € M | -106,380 |

| P/E | 10 |

HSBC is one of the largest banks in the world with assets of USD 3 trillion and operations in over 70 countries and territories.

HSBC was established in 1865 in Hong Kong but has a sort of complicated dual-listing in the UK as well. It has operations and +6,500 offices worldwide, in over 70 countries.

HSBC I have been a long-time customer of HSBC for over 20 years, and know the bank and how it operates. Surely, not everything is rosy, but overall I could always rely on HSBC’s service. There are many horror stories, but from my personal experience, it’s a solid bank, offering a very wide range of services.

It is one of the most established Asian banks you can find.

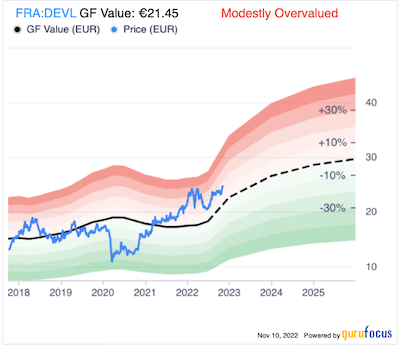

My Take on HSBC: A super large Asian bank with the biggest presence of all. Important is to get it below $25 USD (for U.S.-listed shares (NYSE:HSBC).

The Best Asian Bank Stock – DBS 🇸🇬

| Market Cap € M | 63,405 |

| Enterprise Value € M | 22,407 |

| P/E | 13 |

DBS (FRA:DEVL) / (DBSDF), is a Singapore-based banking group providing a full range of consumer, small to midsize enterprise, and corporate and investment banking products. It has a strong presence in APAC, with over 16 Mio customers.

Besides HSBC, I am a long-time DBS customer as well. I like their corporate online banking suite (more modern than HSBC’s).

DBS is my favorite Asian bank stock. Disclosure: I hold and own DBS shares in my All-Weather Portfolio.

Why DBS Is The Best Asian Bank Stock

There are several reasons why I believe DBS is the best Asian bank stock, let’s dive in.

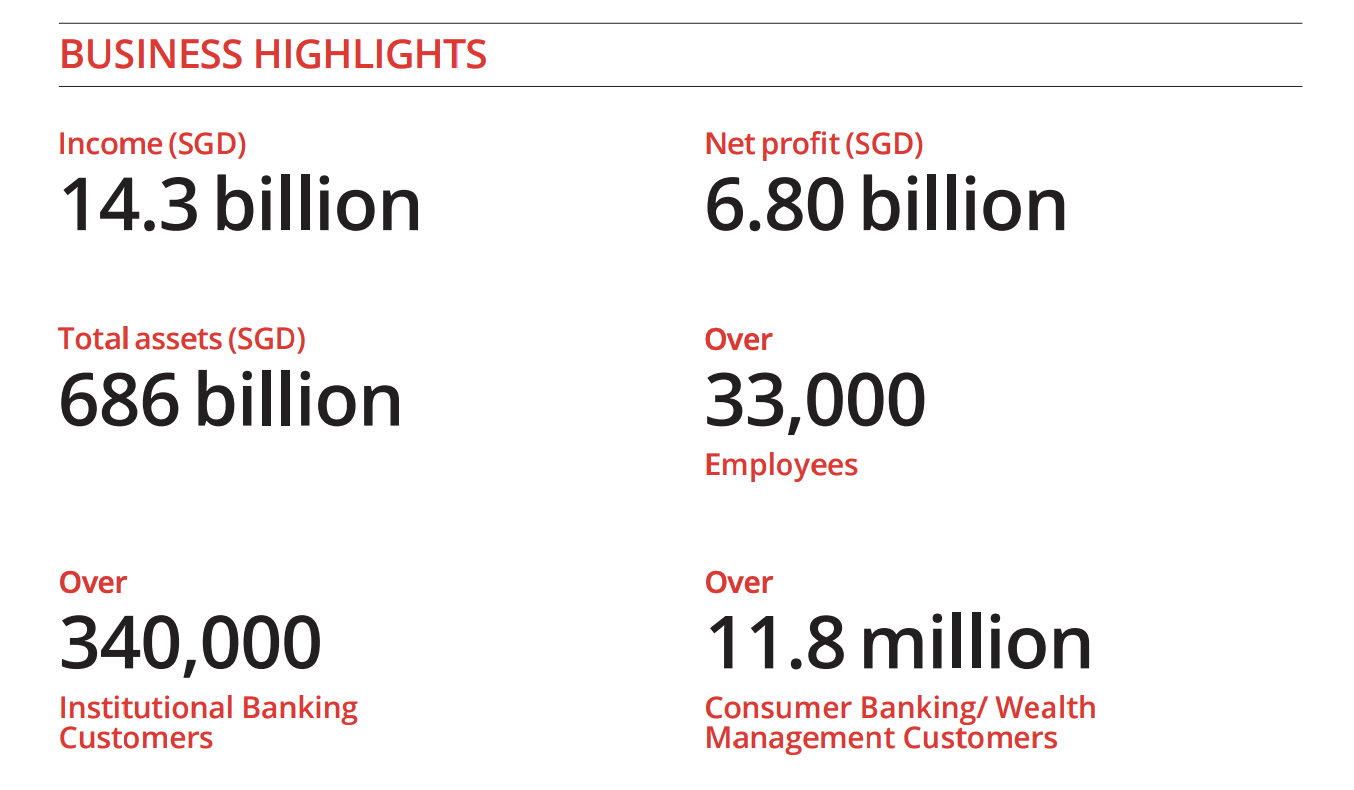

First off, it is very profitable with 6,8 Bio SGD in net profit, with a total income of 14,3 Bio SGD.

High Return on Asset Ratio

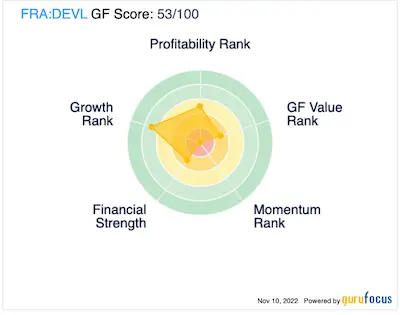

One of the most important financial ratios to look at when analyzing bank stocks is the ROA%, the Return on Asset ratio. Put simply, how much % does the bank generate with the assets on hand? This is where DBS does very well, see the chart below (DBS is the greenish line).

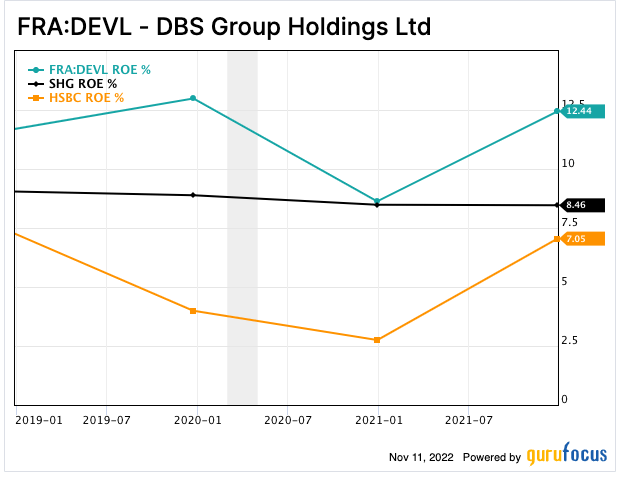

High Return On Equity

As a long-term shareholder, or “equity holder”, we are interested in how the company does in terms of ROE%, the Return on Equity. This is a key metric when analyzing how well management teams generate value for their shareholders. Here as well, DBS fares well.

ROE is one of the key ratios Warren Buffett considers when analyzing stocks. Watch this short video in which he explains why:

Rapid Digital Transformation

Another reason why I believe DBS is the best Asian bank stock to buy is its rapid digital transformation and general embracement of new technologies. It was one of the first major banks to announce it would build out a digital exchange, offering crypto trading, bond digitalization, etc.

Similar to Shinhan Bank (in my opinion the 3rd best Asian bank stock, see above), DBS also became a global council member of Hedera, one of the most used, sustainable, enterprise-grade public networks. running a node, insuring that the network is fair, fast, well-governed, and secure. It also works closely with JPMorgan, the Monetary Authority of Singapore (MAS) on finding ways how to let banks use DeFi.

Blockchain and distributed ledger tech like Hedera will be similarly disruptive to the banking sector as the internet is to the retail sector. Hence I could only imagine investing in a bank stock that has a clear strategy in this regard. And DBS has and does many things in that domain!

DBS also continuously wins important awards. For example, it was just honored as the Global Winner for most ‘Innovative in Digital Banking’ by Financial Times publication The Banker, in its 2021 Innovation.

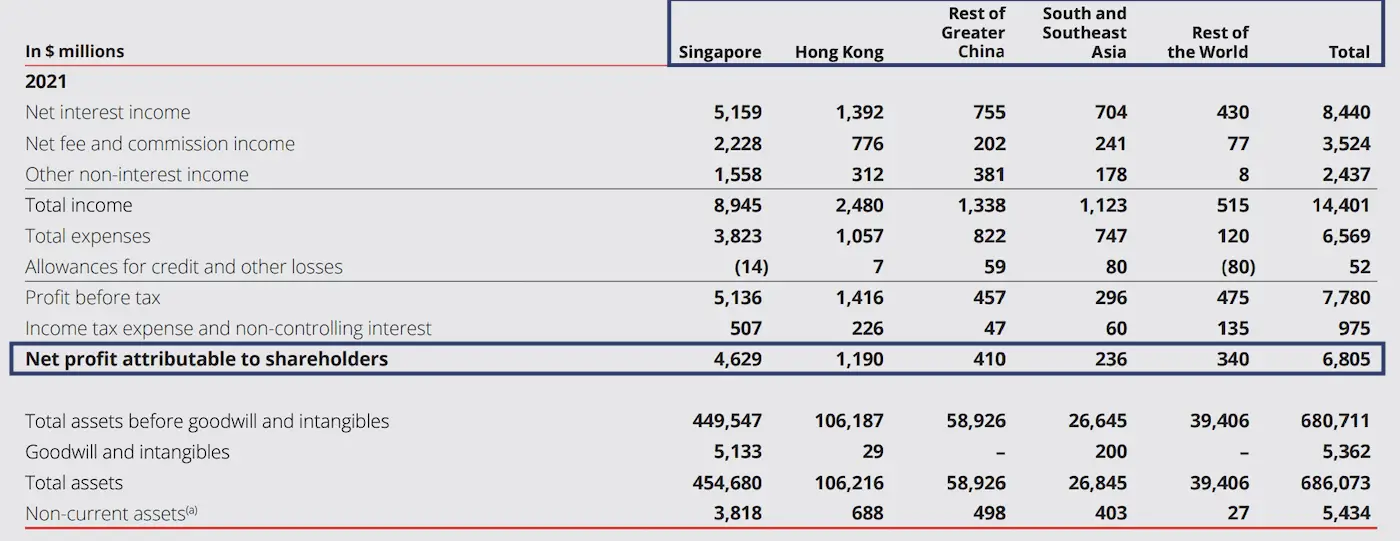

Very Good Diverse Geographic Footprint

A third great feature of DBS is its geographic coverage. It operates in 18 countries, and what I find particularly convincing is the fact that DBS shows the ability to make money in each country. See the following table:

Source: DBS Annual Report, 2021;

As you can see, each country shows a net profit, and DBS makes 6,805 Mio SGD in net profit with 14,401 Mio SGD in total income. A healthy ratio!

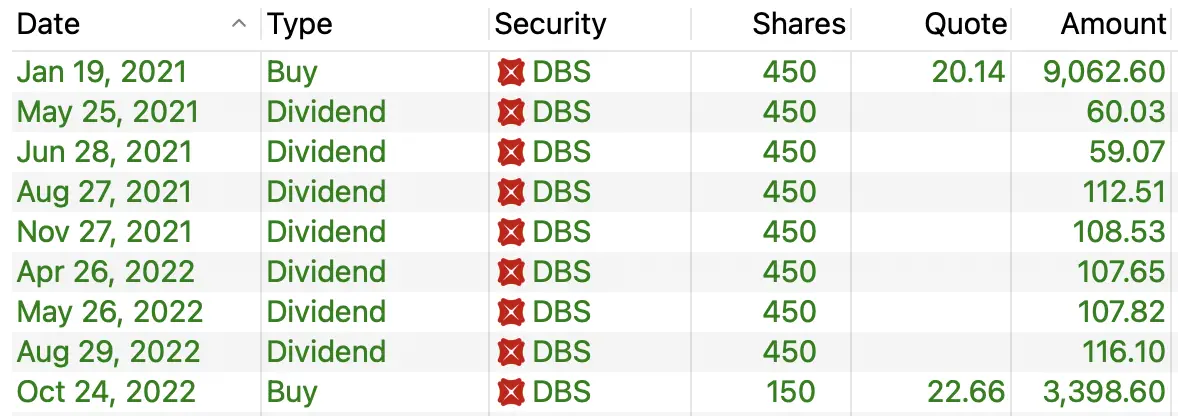

My Take on DBS: In my opinion, DBS is clearly the number one Asian bank stock to buy and hold for the long term. I put my money where my mouth is, see below the money I invested so far in DBS.

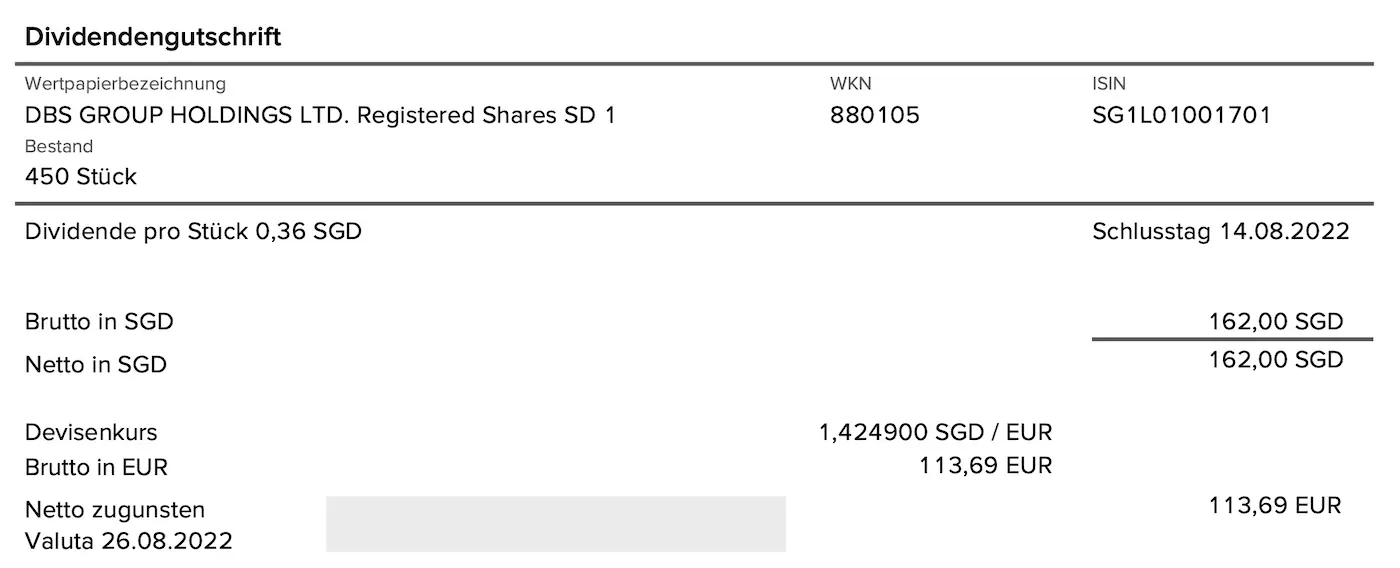

I originally purchased 450 shares in Jan 2021 and added another 150 shares in Oct 2022. Since then, my performance looks like this:

| Company | Purchase Value | Market Value | Dividend Total | Absol. Performance |

| DBS | 12,510 USD | 14,840 USD | 671 USD | 24.00% |

A Great Option For German Investors

It’s also interesting to note that, as a company based in Singapore, no withholding tax is deducted when dividends are paid to German brokerage accounts. See below’s dividend transaction, paid to my Consors account in Germany.

Conclusion

There you have it, fellow stackers. I present the top 3x Asian bank stocks, of which one I own (DBS).

My investment thesis for being very selective in only choosing DBS is that I believe it ticks all the important boxes and really is at the forefront of digital transformation. I believe 95% of all banks will go under, and only the fittest will survive.

My bet is DBS is one of them!

📘 Read Also

-

- Read about what I believe is the best residential REIT in the U.S.

- Check out the 5x best REITs in Asia to buy in 2023

- The 5 Best European Insurance Stocks To Buy

- Why I Add The BlackRock Stock To My Dividend Portfolio

FAQ

What is the largest bank in Asia?

The largest bank in Asia is the Industrial & Commercial Bank of China (ICBC). Other largest banks in Asia, measured by market cap:

1 | ICBC | 193b | China

2 | China Construction Bank | 143b | China

3 | Agricultural Bank of China | 132b | China

4 | Bank Of China | 117b | China

5 | HSBC | 111b | Hong Kong

6 | HDFC | 105b | India

7 | China Merchants Bank | 101b | China

8 | Al Rajhi Bank | 89b | Saudi Arabia

9 | ICICI Bank Ltd | 79b | India

10 | PT Bank Central Asia Tbk | 70b | Indonesia

Do Asian bank stocks pay good dividends?

Yes, some of the Asian bank stocks presented above pay attractive yields:

– Malayan Banking Bhd 6.7%

– HSBC Holdings PLC 4.8%

– DBS $DBSDF Ltd 3.9%

– Shinhan Financial Group Co Ltd 2.9%

– Vietcombank Vietnam 1.6%

– BDO Unibank Inc 1.6%

– HDFC Bank Ltd 0.9%

Are Asian bank stocks a good investment?

What are the biggest banks in Asia?

– ICBC | China

– China Construction Bank | China

– Agricultural Bank of China | China

– Bank Of China | China

– HSBC | Hong Kong

– HDFC | India

– China Merchants Bank | China

– Al Rajhi Bank | Saudi Arabia

– ICICI Bank Ltd | India

– PT Bank Central Asia Tbk | Indonesia

Which country has the most banks in Asia’s Top 100 Largest Banks?

China – 32

Japan – 15

Taiwan – 9

India – 8

South Korea – 7

Hong Kong – 6

Australia – 5

Thailand – 5

Malaysia – 3

Singapore – 3

Indonesia – 1

Macau – 1

New Zealand – 1

Source: money-gate.com

-

What are the most profitable banks in the world?

1) Industrial and Commercial Bank Of China Ltd. (IDCBY) Net Income (TTM): $45.3B

2) JPMorgan Chase & Co. (JPM) Net Income (TTM): $36.4B

3) Japan Post Holdings Co. Ltd. (JPHLF) Net Income (TTM): $4.7B

4) China Construction Bank Corp. (CICHY) Net Income (TTM): $38.7B

5) Bank of America Corp. (BAC) Net Income (TTM): $27.4B -

What are good Asian bank stocks?

Bank stocks from Japan, South Korea, and Singapore have the most trusted Asian bank stocks. Banks from countries like China often are seen as riskier as most of the large ones are at least partly owned by the government. The leading bank stocks is Asia:

– Japan Post Holdings (Japan)

– DBS $DBSDF (Singapore)

– HDFC (India)

– HSBC (Hong Kong)

– Malayan Banking (Malaysia) -

Which Asian stocks to buy?

Asia has thousands of interesting stocks. One good place to start is considering Asian bank stocks. These usually pay interesting dividends, are geographically diversified, have a high ROE (return on equity) as well as high ROA (return on assets), and most of them embrace digital transformation (mobile banking, trading of digital currencies, etc.). Asian stocks such as DBS (DBSDF) are a good start, as they are located in Singapore, a leading financial center, and overall an excellent jurisdiction.

The Best Asian Bank Stock - DBS

DBS ticks all critical boxes and is at the forefront of digital transformation. If I could only buy one Asian bank stock, it would be DBS.

PROS

- Highest Return on Assets

- Highest Return on Equity

- Rapid Digital Transformation

- Diverse Geographic Footprint

- No Withholding Tax

CONS

- Not As Massive As Some Peers

- Not strong presence in U.S. & E.U.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love