The Current Landscape Of Crypto Stocks

As we speak, there are only a few stocks of publicly traded companies giving you exposure to cryptocurrencies.

List of Best Crypto Stocks

As of now, here are our options for crypto stocks with varying degrees of involvement in the crypto sector:

- Listed Exchanges Offering Cryptocurrency Trading

- $COIN Coinbase

- $HOOD Robin Hood

- $IBKR Interactive Brokers

- $OSTK Overstock

- $CME CME Group

- Largest Publicly-Listed Mining Companies:

- $RIOT Riot Platforms ($2b market cap)

- $MARA Marathon Digital ($1.8b market cap)

- $HUT Hut 8 Mining ($0.7b market cap)

- $CIFR Cipher Mining ($0.9b market cap)

- $CLSK CleanSpark ($0.6b market cap)

- Wallet And Crypto Infrastructure Providers

- $SQ Block (formerly Square)

- $PYPL PayPal

I am not a fan of cryptocurrency mining stocks. The speed with which the mining rigs get outdated is nuts. Every 3-4 years you have to completely write off your current mining rigs, and invest substantial capital into new ones. Further, the wide price swings of cryptocurrencies make it difficult to project out earnings.

Of the cryptocurrency exchanges, only $COIN is a pure crypto play, meaning it 100% focuses on the crypto space. For Robin Hood, IB, or CME, cryptocurrencies represent just a small part of their overall revenues.

Why Coinbase Is The Best Crypto Stock

Here are the top reasons why I just bought $COIN in my trading portfolio.

1/ Coinbase Is Larger Than People Think

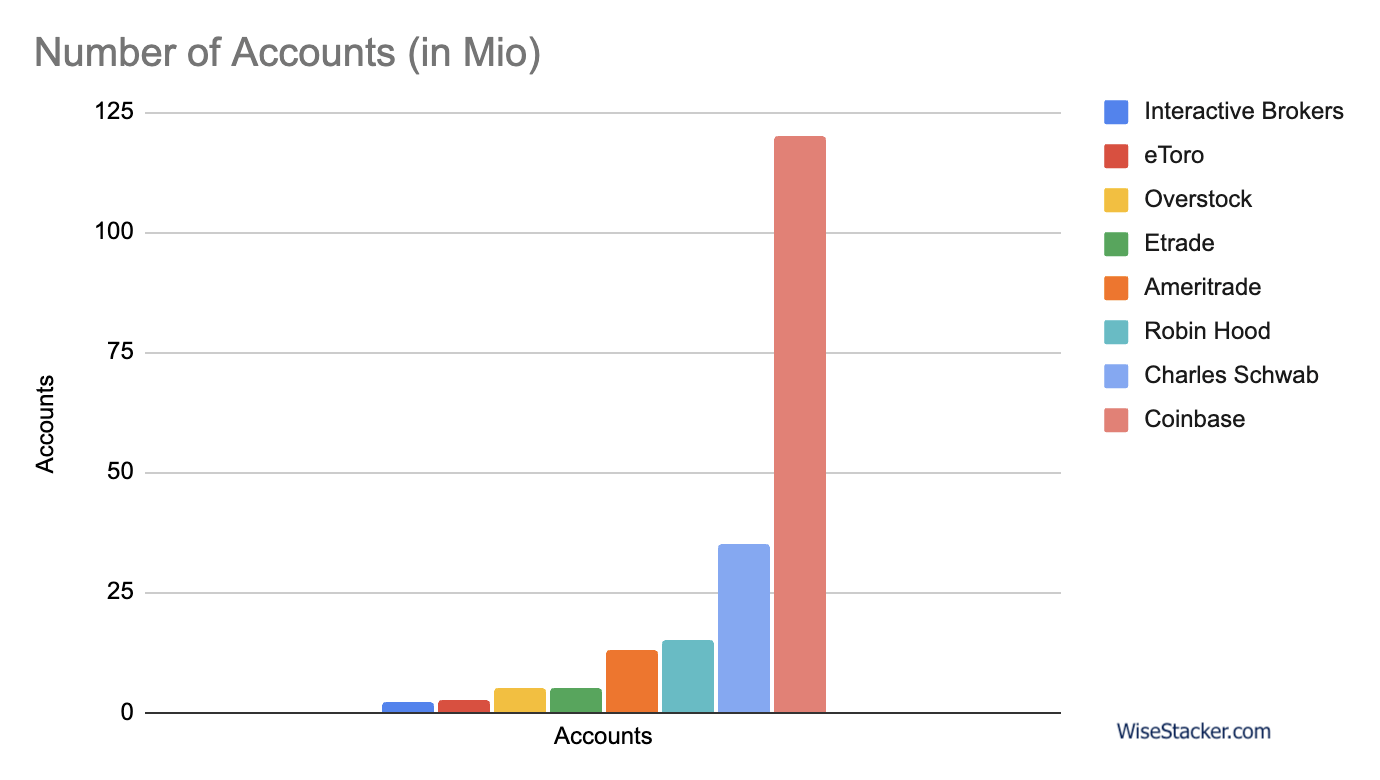

I was surprised when I discovered that Coinbase has a LOT more accounts than Charles Schwab, eTrade, Ameritrade, and IB combined.

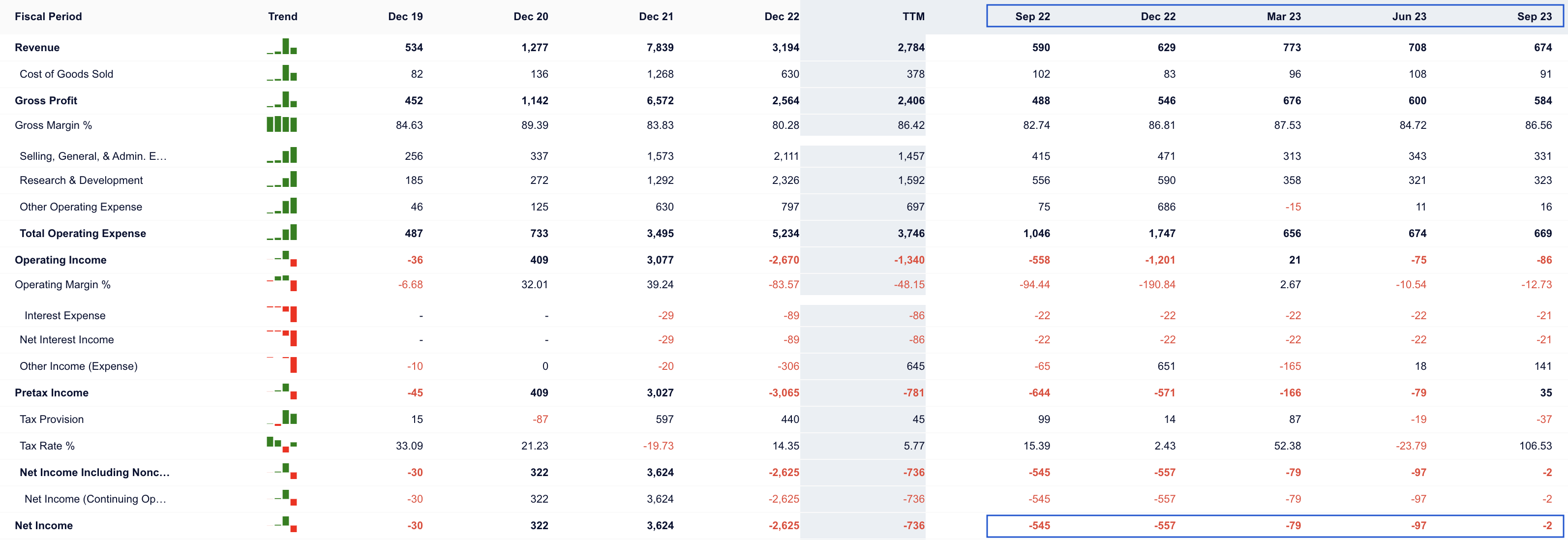

2/ Turning Profitable In Q4 2023

The thesis is that $COIN’s Q4 will be its first profitable quarter and 2024 will be a record year for the company. As we investors need to live in the future, six to twelve months from now, I believe all these catalysts will be priced in a lot earlier.

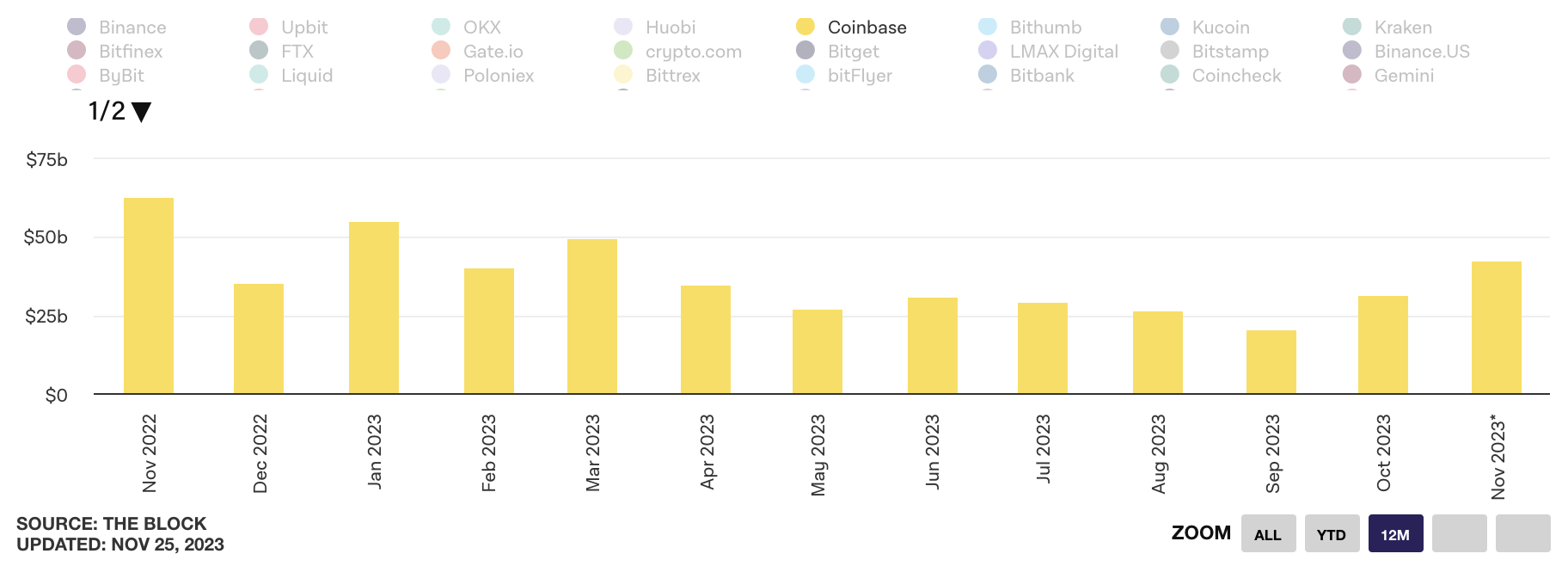

3/ Easy To Track Volumes

TheBlock website has a great chart showing the up-to-date trading volumes of the largest crypto exchanges.

By clicking on Coinbase on their site, you get to see this.

Look at how much better October and November already are compared to the Q3 months!

4/ Other Revenue Streams

Besides its dominant market share of crypto exchanges in the U.S., it also is one of the leading custodians. BlackRock will use $COIN as its custodian, as well as countless other large players. This will further strengthen $COIN’s cementing its lead position for the role of best crypto stock!

5/ Beneficiary of Regulatory Clampdown

Many formerly hyped exchanges and players in the crypto arena went bust in the past 18 months. The list is getting longer, but include FTX, Celsius, Voyager, Three Arrow Capital, BlockFi, Genisis, Hodlnaut, and many others.

Coinbase simply put benefits from every single player being shut down!

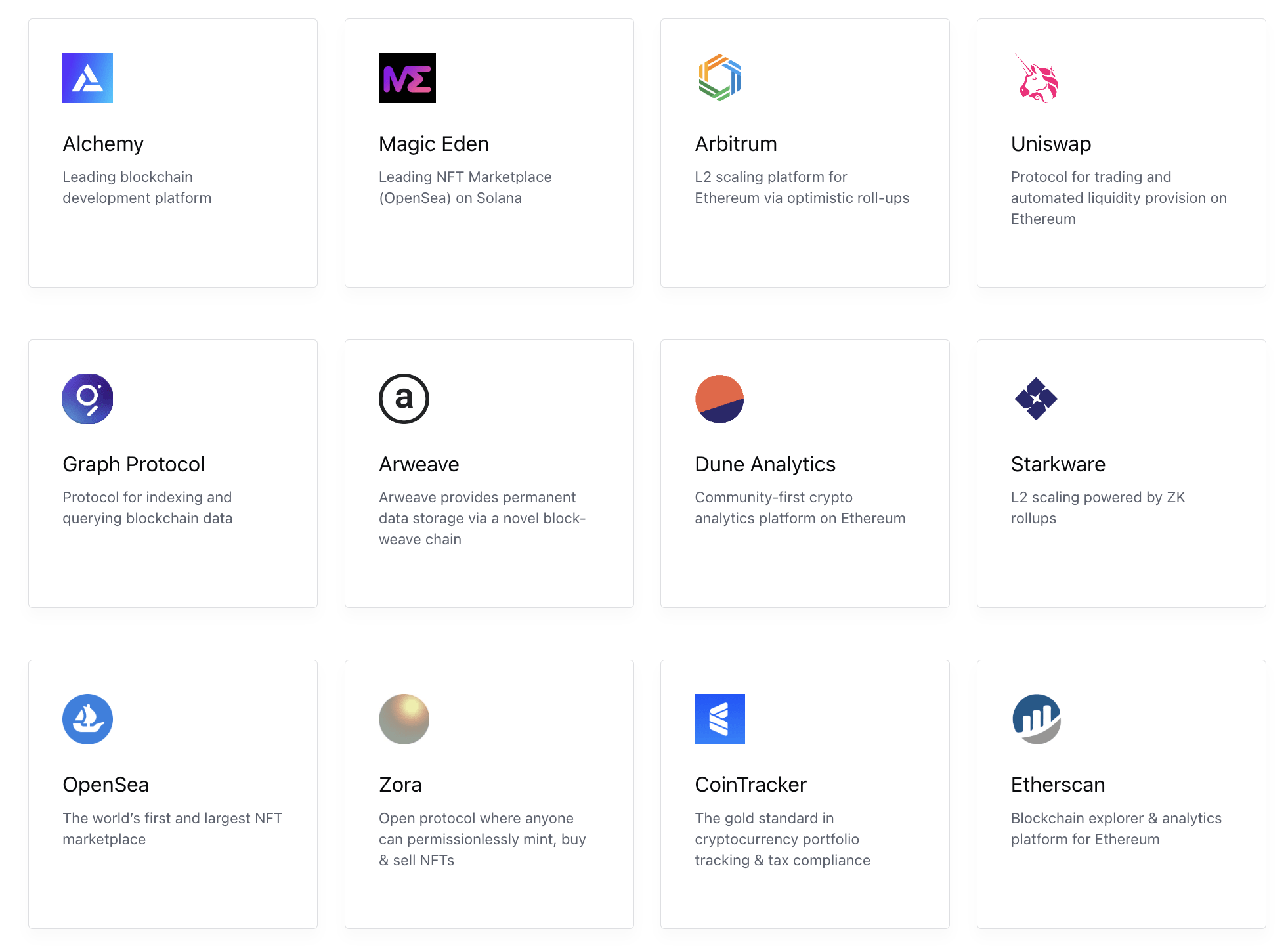

6/ Coinbase Ventures

Many investors don’t know that $COIN has a stake in a massive amount of very interesting ventures, with massive potential.

It for example owns part of more than 50 pure DeFi projects (which try and disrupt $COIN’s legacy CeFi business).

It also owns a stake in Circle (issues of the stablecoin USDC), which I believe will announce its IPO in 2024.

Check out some of those here:

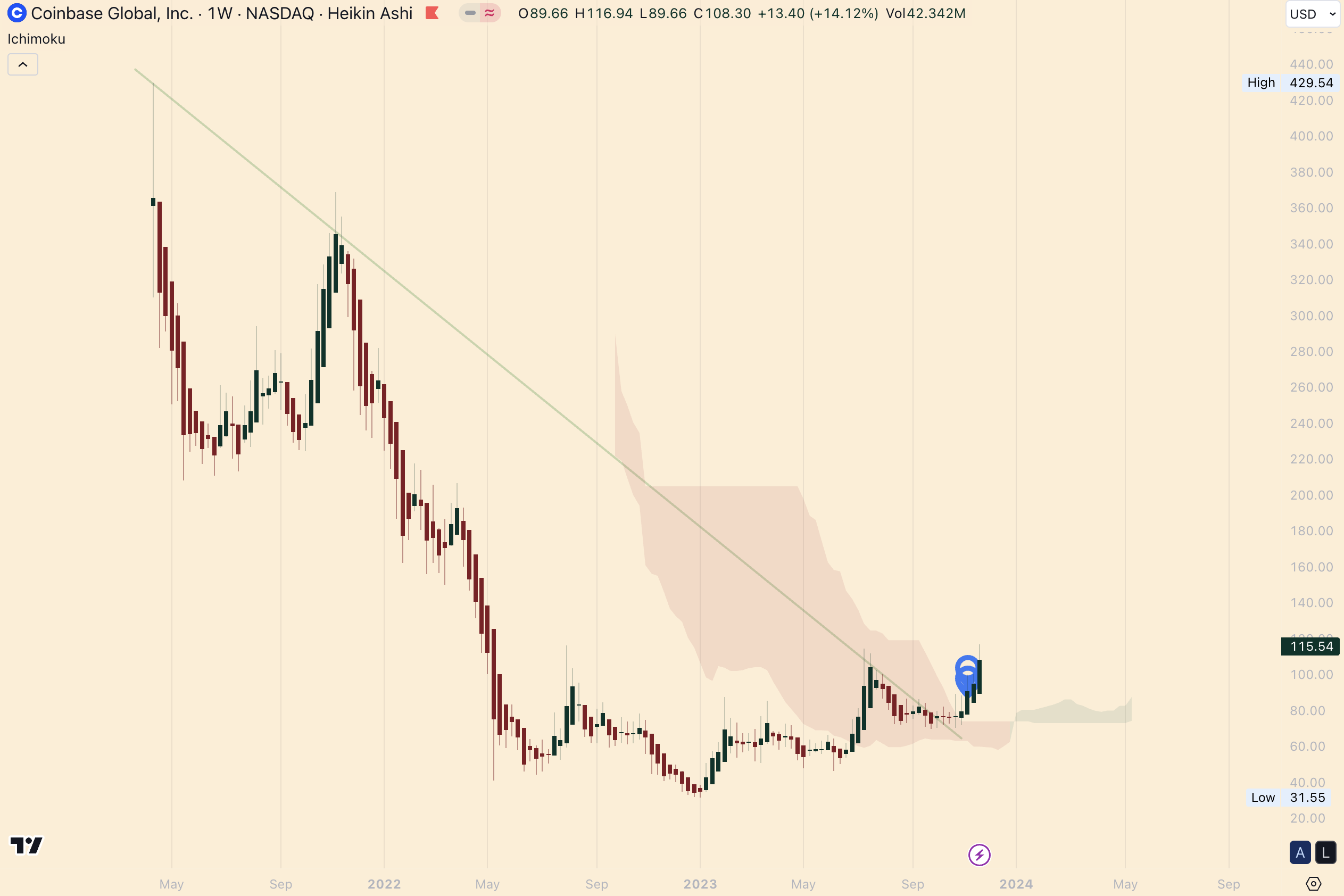

7/ Coinbase Share Price Break-Out

Next, $COIN managed to rise above its weekly Ickimoku Cloud, marking an important change in overall sentiment.

The blue dots indicate two purchases, see further below for the order details.

The above chart shows the setup when I entered the date.

My Coinbase Trading Strategy

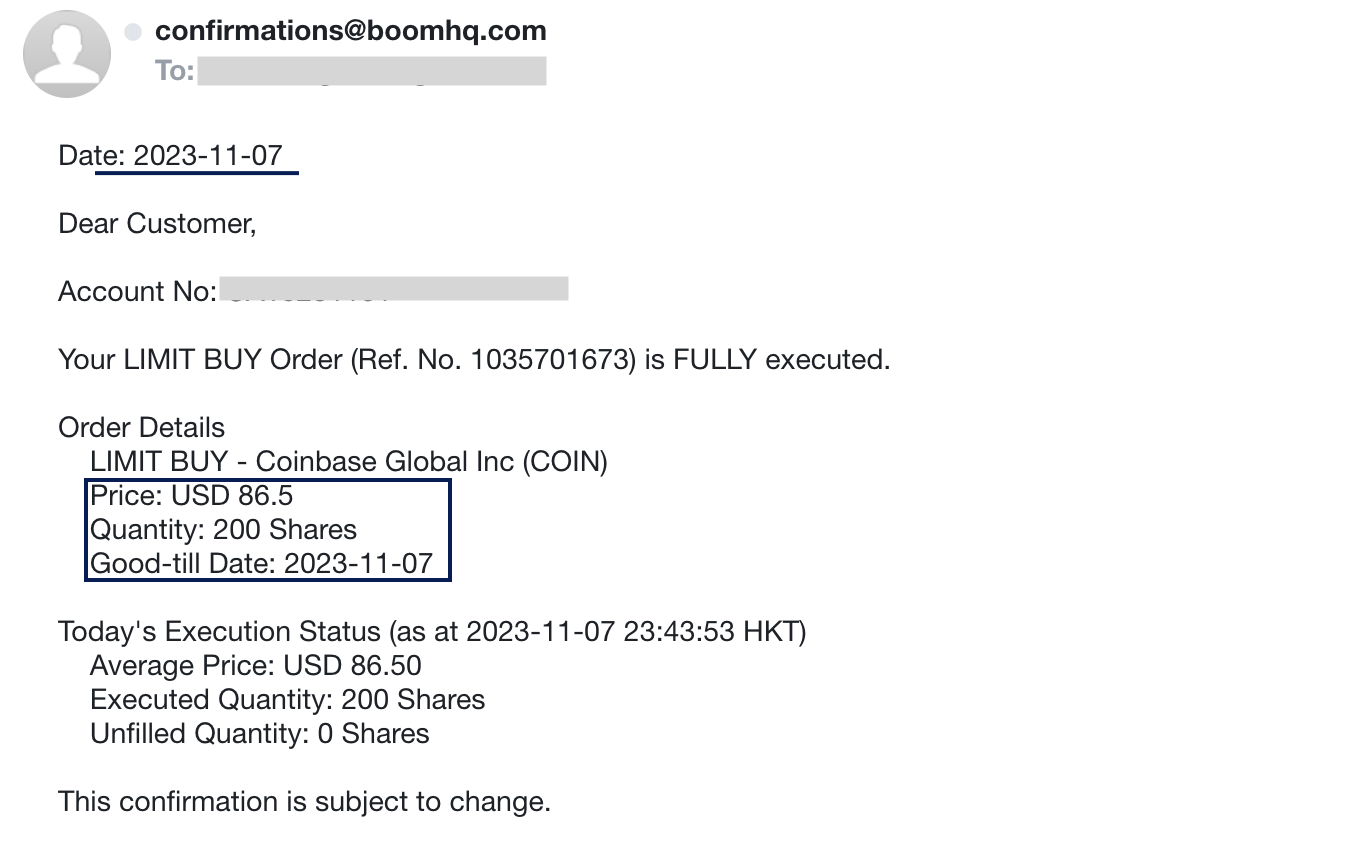

This was my first purchase on Nov 7:

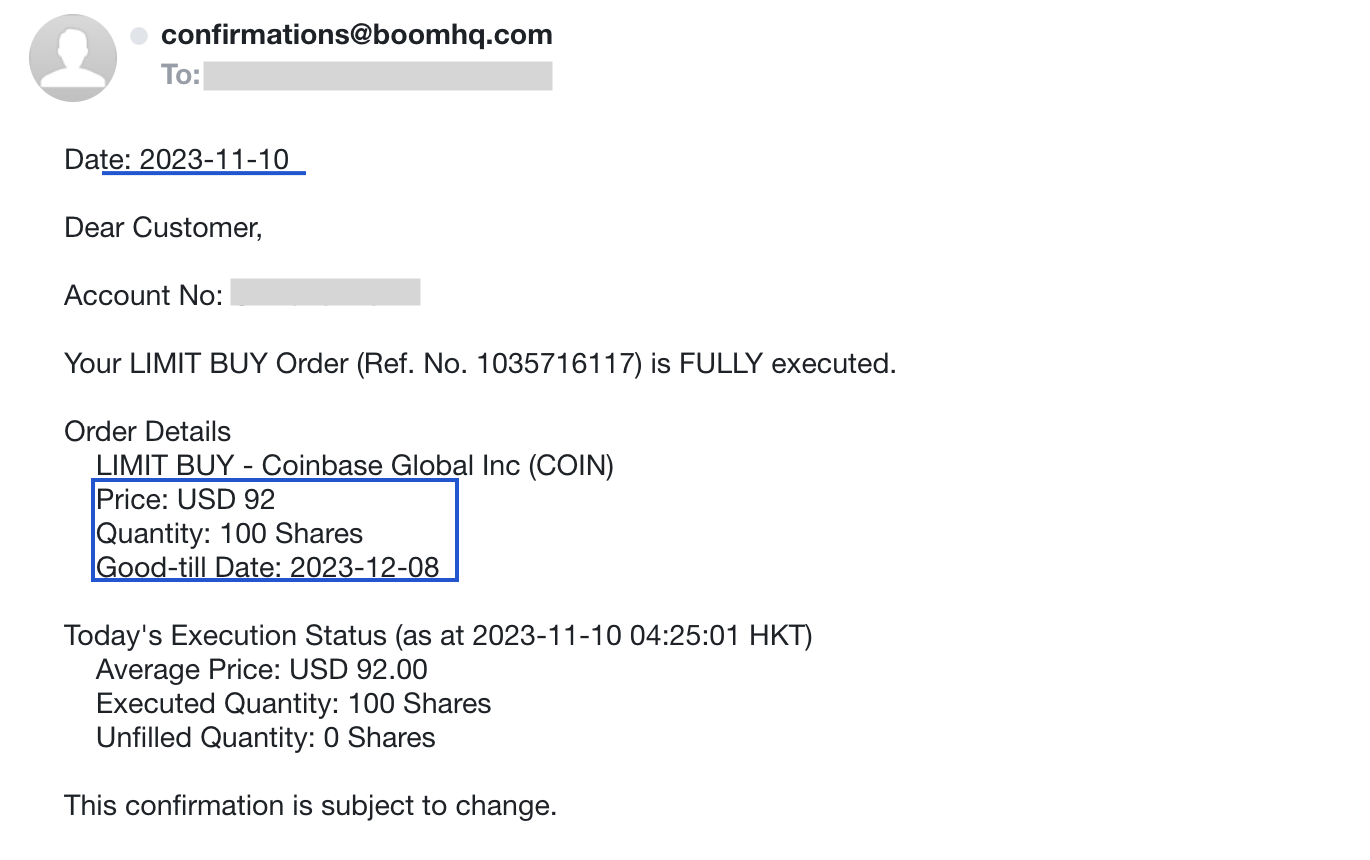

And this was my 2nd purchase (I wanted to wait to see if it could break out of $90 USD).

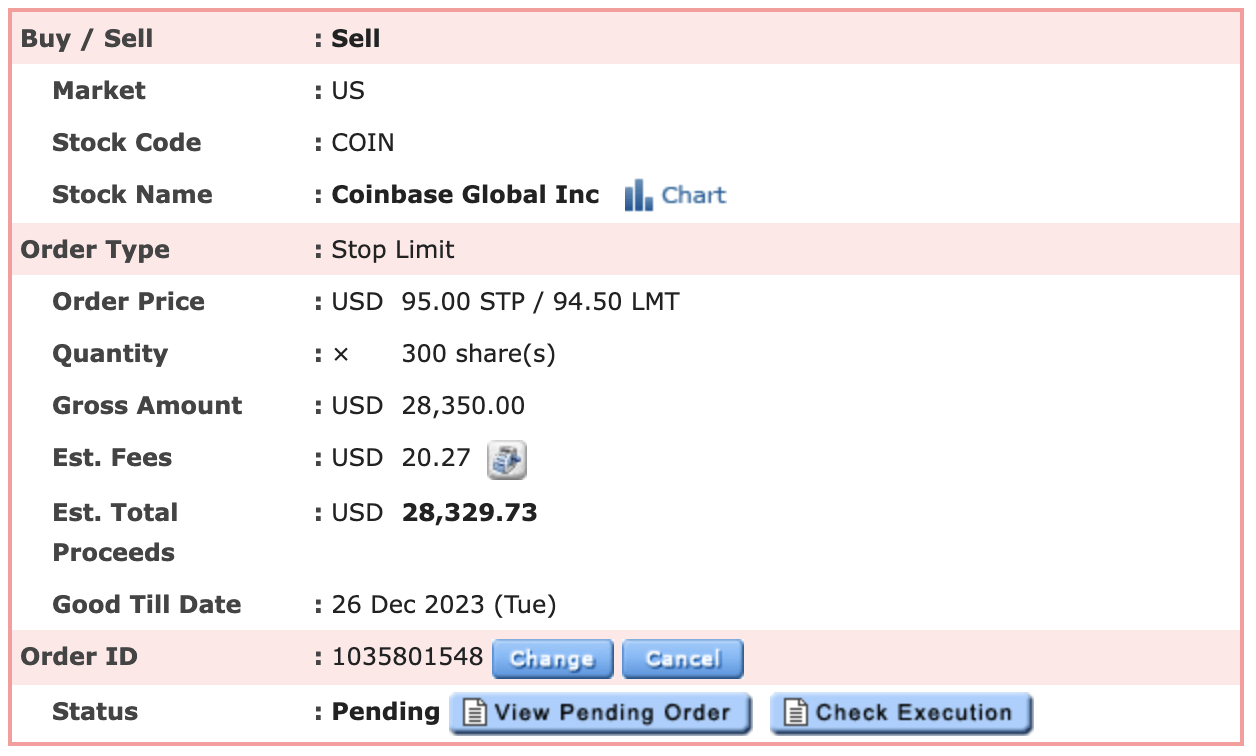

So far the trade is off to a good start. I put a stop-loss order at $94, securing my profit for whatever is to come.

I will sell 50% once it reaches $200 USD, and the other 50% once it hits $350 USD.

The ‘Coinbase’ Trade Idea:

- Buy $COIN below $110, best below $100

- Put a stop loss at $92

- Expect to hold this stock for 12 to 18 months

- Sell the first 50% when $COIN reaches $250

- Sell the second 50% when it reaches $350

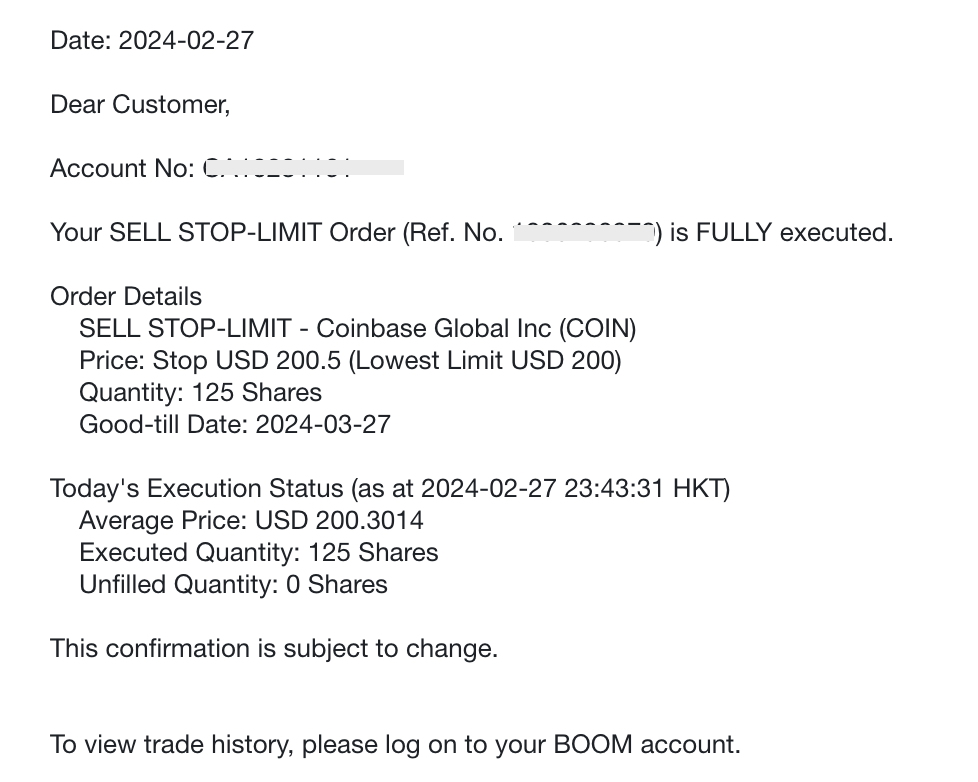

Update Feb 28, 2024: Sold 125 $COIN last night at $200 😝, below is my trade confirmation from Boom, the stock broker I am using in Hong Kong. If the price comes down to $150-160 level, I might add some because I believe the stock has a lot more room to run in the coming 6-12 months.

Disclaimer: Not financial advice. Only you can decide to enter or exit a trade. I just share what I do for informational purposes.

Conclusion

I believe $COIN offers some very attractive risk/reward ratio at these levels and is a strong buy in my opinion.

TINA! Simply put, There Is No Alternative to $COIN for the best crypto stock.

I believe $COIN is the cleanest shirt in the closet, which acts like the adult in the room.

It has the support of TradFi and the trust of many. This will be worth a LOT once we leave crypto spring and enter crypto summer.

Add the Bitcoin halving + the Bitcoin Spot ETF, and I believe COIN can easily reach its all-time high.

In summary, $COIN is the best crypto stock to buy and hold for 2024 and 2025.

📘 Read Also

- Best Crypto Credit Card To Use

- My Story Of How I Reached Financial Independence With $5M

- 5 Best Defense Stocks With Safe Dividends

FAQ

Are crypto stocks a good investment?

What are the best crypto stocks to buy right now?

What are the biggest crypto stocks?

Listed Exchanges Offering Cryptocurrency Trading $COIN Coinbase

$HOOD Robin Hood

$IBKR Interactive Brokers

$OSTK Overstock

$CME CME Group

Largest Publicly-Listed Mining Companies:

$RIOT Riot Platforms ($2b market cap)

$MARA Marathon Digital ($1.8b market cap)

$HUT Hut 8 Mining ($0.7b market cap)

$CIFR Cipher Mining ($0.9b market cap)

$CLSK CleanSpark ($0.6b market cap)

Wallet & Crypto Infrastructure Providers

$SQ Block (formerly Square)

$PYPL PayPal

Can I buy crypto via the stock market?

What are good crypto stocks for the longterm?

I believe $COIN Coinbase offers investors an excellent long-term risk/reward ratio. It is by far, with 120 Mio accounts, the largest crypto exchange, has massive benefits of scale, owns a stake in dozens of interesting smaller projects, has the trust of the largest players like BlackRock, owns a part of Circle (issues of the USDC stablecoin) and is active on a global level.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love