Key Takeaways

✅ We are living in highly complex and dynamic times

✅ Our assets need to grow in value by+14% to beat inflation

✅ To invest successfully in this exponential age is challenging

✅ Scottish Mortgage is an excellent disruptive tech fund

The Only Disruptive Tech Fund You Ever Need

In this blog post, I share why I believe the Scottish Mortgage Trust is the only disruptive tech fund you need!

Investing in tech stocks is inherently challenging. The rapid pace of technological advancements and the risk of companies becoming obsolete, as evidenced by the declines of once-prominent giants like

- Kodak

- BlackBerry

- Toys “R” Us

- Polaroid

- Blockbuster

- Sony-Ericsson

An actively managed fund like the Scottish Mortgage offers the advantage of professional oversight and strategic decision-making, allowing you to navigate volatile tech markets more skilled by leveraging insights, diversification, and proactive adjustments to derisk and capitalize on the best opportunities.

Scottish Mortage Trust Snapshot

| Name | Scottish Mortgage Trust |

| Tickers | $SMT:LSE / SSEZF / A115BA / ISIN GB00BLDYK618 |

| Website: | scottishmortgage.com |

| AUM | $17b US |

| Dividend Yield | 0.53% |

| Total Expense Ratio | 0.34% |

| Launch Date | 1909 |

Brief History

Founded in 1909 in Edinburgh, Scottland, by two lawyers with £50,000 of capital, the 🏴 Scottish Mortgage Trust defies expectations as an unconventional yet compelling choice for investing in disruptive tech.

While not exclusively a disruptive tech fund, it strategically invests in companies

- poised to revolutionize industries,

- prioritizes long-term horizons, and,

- resonates with the philosophies of its invested companies.

With holdings deeply entrenched in disruptive tech, advancements, and innovations, including intriguing illiquid investments (see further below), the trust embodies a unique approach to navigating the evolving landscape of disruptive tech companies.

10 Reasons Why It Is The Best Disruptive Fund

Navigating Disruptive Tech

Amidst the dynamic landscape of disruptive technologies, we as individual investors face the daunting task of staying abreast of the myriad key disruptive technologies.

Recognizing the pitfalls of investing solely in single tech stocks—a lesson underscored by the declines of industry giants like Kodak, Blockbuster, and Sony Ericsson—I advocate for a different approach.

Rather than navigating this complex terrain alone, I entrust my entire investments in disruptive tech to the seasoned managers of $SMT.

Their expertise, diversified portfolio, and strategic insights offer a shield against the uncertainties inherent in the ever-evolving tech landscape, providing a prudent path toward sustainable growth and resilience.

At the moment, I own 6,000 shares of $SMT, making it my largest position in my All-Weather Portfolio.

Experienced Managers

The two managers at the helm, Tom Slater and Lawrence Burns, have a fantastic track record of picking the right stocks early.

The returns we aim to produce for shareholders will appeal to many,

but the road traveled in achieving them may not.

Tom Slater

Patient Permanent Capital

I appreciate the fund’s commitment to providing long-term capital to outstanding public & private growth companies, aiming for returns over a five to ten-year time horizon while minimizing fees to benefit shareholders. It does not sell a stock because it has one or two bad quarters.

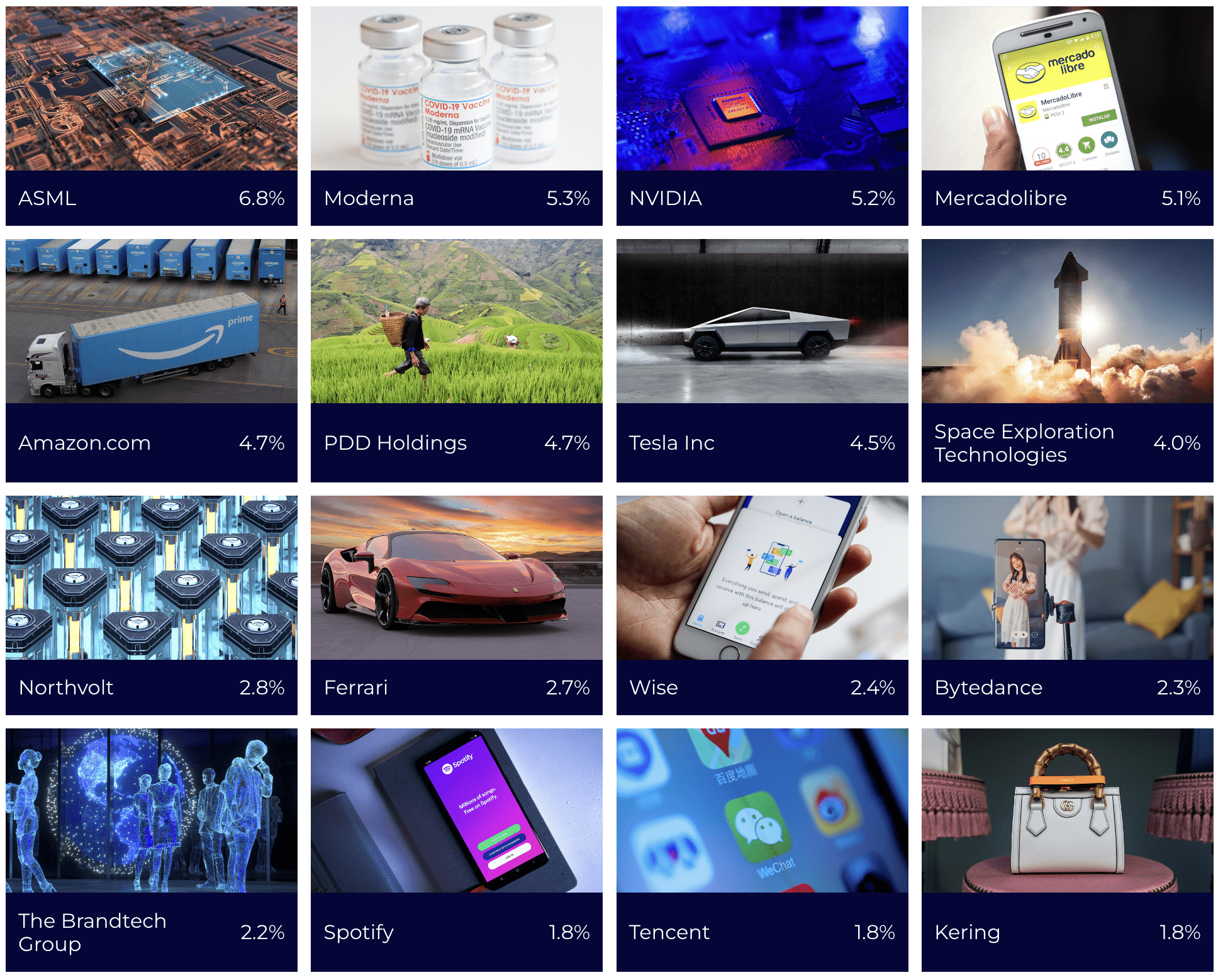

The image below shows the top 16 holdings of the trust.

The fund’s philosophy prioritizes investing in companies driving structural change and long-term growth, advocating for patience amidst share price fluctuations as progress prevails.

Geographic Diversification

I salute how geographically diversified the trust is. We can see a lot of U.S. and Europe-based companies, but also many leading LatAm and Asia-based companies are in their top holdings, such as

- ByteDance – Asia

- MercadoLibre – LatAm

- PinDuoDuo – Asia

- Tencent- Asia

- Meituan – Asia

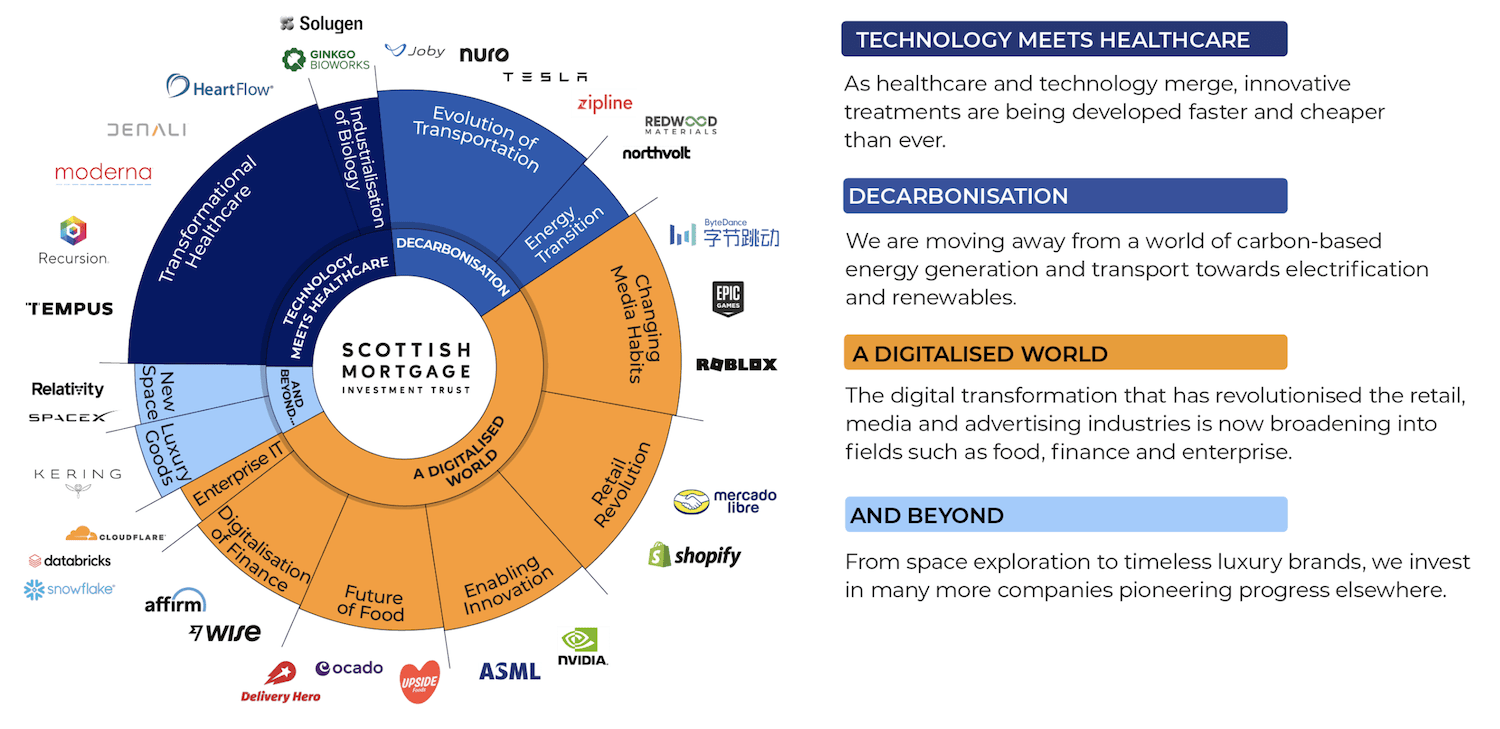

Covers All Major Disruptive Investment Buckets

The Scottish Mortgage Trust covers in my point of view all essential disruptive technologies:

- Energy Transition

- Retail Revolution

- Innovation Enablers

- Digitalization

- Space Exploration

- Transformational Healthcare

- Decarbonization

- Metaverse

Excellent Time To Build A Position

After reaching an ATH at approx. $18 and coming down 60%, I believe now is an excellent time to start building a position in $SMT.

Admittedly, it did not outcompete the Magnificent Seven in recent years; however, I am very confident it will do so once the unlisted companies have their IPOs (see next point).

Massive Unlocked Potential

To me, Scottish Mortgage is most probably the world’s best disruptive tech fund due to its investments in 35 promising private and unlisted companies.

Interested in pre-IPO investment opportunities in the following Decacorns?

- SpaceX (actually a Centacorn with an approx. value of $150 Bio US)

- Ant Financial (another Centacorn, the ParentCo of Alipay)

- ByteDance (a third Centacorn, ParentCo of TikTok)

- Epic Games (ParentCo of Fortnite/Unreal Engine 5)

- Stripe

- Northvolt

- Zipline (amazing company, watch this)

- plus many others

In 2023 alone, Scottish Mortgage allocated $263 Mio toward investments in disruptive private companies.

The above chart is from an excellent article in the SHARES magazine, which I read weekly.

By purchasing shares of Scottish Mortgage Trust, you essentially gain exposure to all the mentioned companies before their IPO.

I believe once one or two of these companies will go public, $SMT will see a quick increase in price.

Which other tech stock ETF or technology mutual fund can offer such a proposition?

Raoul Pal Is A Fan Too

The Scottish Mortgage Trust has many popular supporters all around the world.

It’s not a secret that the co-founder and CEO of Real Vision, Raoul Pal, agrees and believes $SMT is an excellent disruptive tech fund allowing investors to do well in the exponential age we live in!

Ultra Low Fees

You won’t need to agree to any 2%/20% fee structures, commonly employed by hedge/PE funds, which include a yearly 2% fixed management fee and a 20% performance fee once they reach a certain hurdle, like 7% YOY.

Scottish Mortgage Trust does not charge any performance fee, only a flat ongoing charge of 0.34%.

Cool, right?

Dividends, Anyone?

🍒 The cherry on top: The best disruptive tech fund offers the fantastic benefits mentioned above and pays dividends.

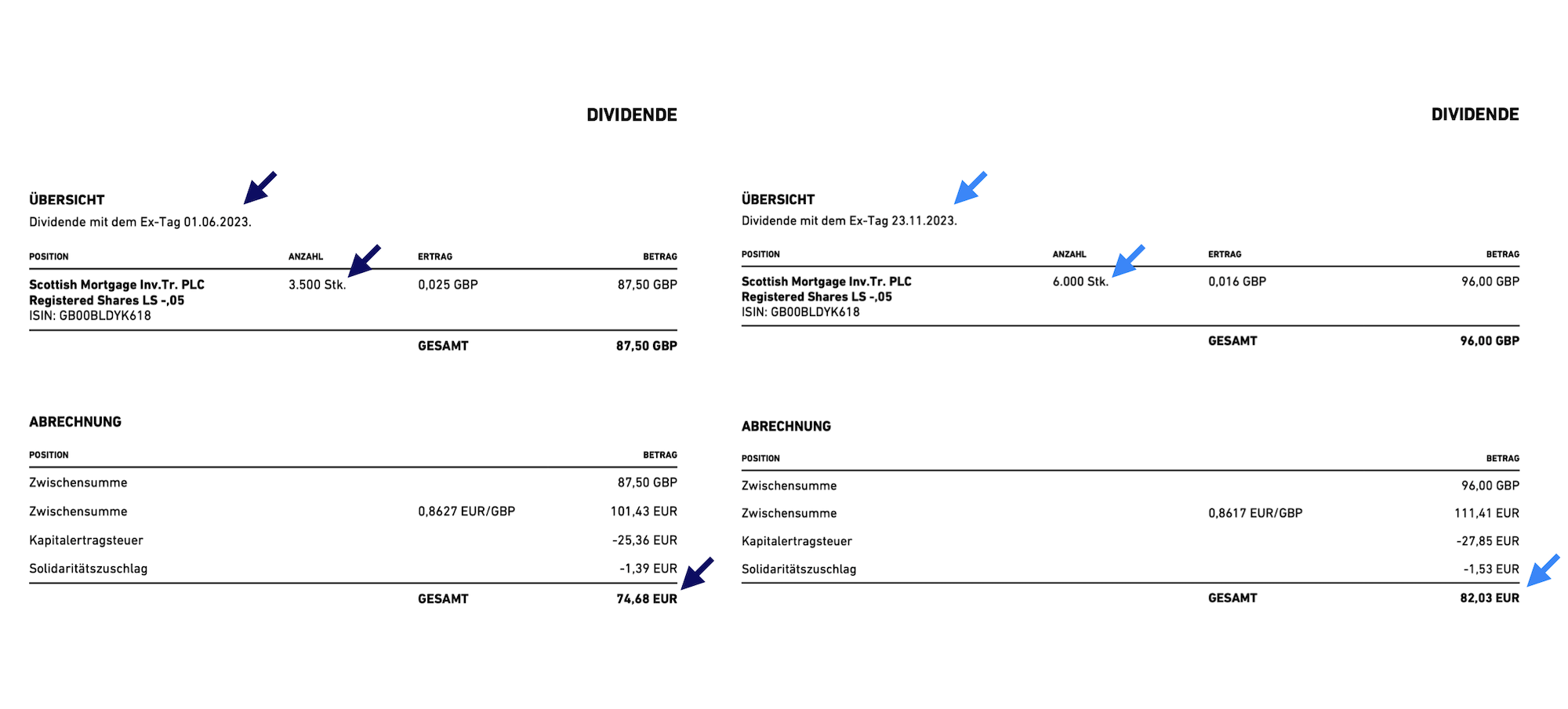

And not just once, but twice a year. Below are the first statements of the dividend payments I received.

The above dividend statements are from my TradeRepublic account, love their flat $1 US/trade commissions.

Conclusion

In conclusion, The Scottish Mortgage Trust stands out as a premier option for investors seeking exposure to disruptive technology companies, offering a unique blend of pre-IPO opportunities, transparent fees, and the potential for strong performance in the evolving market landscape.

📘 Read Also

- The 10 Best Emerging Market Stocks To Buy

- Financial Predictions For 2024 – Top 10 Invest Ideas

- My Story Of How I Reached Financial Independence

FAQ

Is disruptive technology good or bad?

By itself, disruptive technology isn’t inherently good or bad. It always depends on how it is used. Disruptive tech can bring positive changes like innovation, efficiency, and new opportunities. But it can also lead to challenges like job displacement or privacy concerns. Companies like Netflix disrupted the movie rental business, think Blockbuster, digital photography disrupted analog photography, think Kodak and Polaroid, etc.

What’s disruptive technology?

Disruptive technology is an innovation that significantly alters the way things are done, often displacing established methods or products. It introduces groundbreaking changes that can revolutionize industries and create new markets. Such innovations often improve the status quo by not 10%, but 10X.

Disruptive technology can be found in mostly the following sectors:

– Energy Transition

– Retail Revolution

– Innovation Enablers

– Digitalization

– Space Exploration

– Transformational Healthcare

– Decarbonization

– Metaverse

What are the best disruptive tech ETFs?

Disruptive tech ETFs investors can consider:

$ARKK – ARK Innovation ETF

$XT – iShares Exponential Technologies ETF

$CHAT – Roundhill Generative AI & Technology ETF

$NBDS – Neuberger Berman Disrupters ETF

$ILDR – First Trust Innovation Leaders ETF

$FDTX – Fidelity Disruptive Technology ETF

What are good disruptive technology mutual funds?

The following funds are considered leaders in the disruptive technology mutual funds space, sorted by expense ratios:

Fidelity Select Technology (FSPTX) 0.70%

T. Rowe Price Science & Technology (PRSCX) 0.84%

Janus Henderson Global Technology and Innovation (JNGTX) 0.81%

Columbia Seligman Global Technology Advisor (CCHRX) 1.04%

BlackRock Technology Opportunities Fund (BSTSX) 1.17%

Rydex Electronics Investor (RYSIX) 1.39%

How to invest in disruptive technology companies?

Investing in disruptive tech companies can be done through various avenues like buying the individual shares of companies, mutual funds, or exchange-traded funds (ETFs) focused on technology and innovation.

Researching companies with innovative products or services and assessing their growth potential is crucial.

Which companies do well in the exponential age?

In the exponential age, companies that excel often embrace innovation, AI, adaptability, and transformative technologies. Here are some of my favorite exponential age stocks:

– SpaceX *, revolutionizing space exploration *

– Airbnb, transforming the hospitality industry with its innovative sharing economy model

– Zoom, revolutionizing remote communication and collaboration

– Palantir, pioneering data analytics and intelligence solutions

– Stripe *, revolutionizing online payments and financial infrastructure for businesses

– NVIDIA, driving advancements in artificial intelligence, gaming, and autonomous vehicles

– Moderna, leading the way in mRNA vaccine technology

– Square, reshaping financial services with its mobile payment solutions

– Beyond Meat, disrupting the food industry with its plant-based meat alternatives

– Slack, redefining workplace collaboration with its user-friendly messaging platform

– Robinhood, revolutionizing stock trading with its user-friendly app and free trades

– DoorDash, reshaping the food delivery landscape by connecting restaurants and customers

– Spotify, redefining the music industry with its streaming service and personalized playlists

– Alibaba, driving e-commerce innovation and digital payments in Asia

*unlisted, but by buying the Scottish Mortgage Trust you can get in before SpaceX’s IPO

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love