How I Earned $15,000 in a Day as a Business Broker

Network equals Net Worth – this quote resonated with me ever since I first heard it in 2015. It captured something I had always felt but could never articulate: the real value of connections.

Since then, I’ve made a conscious effort to build, maintain, and nurture my network, focusing on people I respect, like, and genuinely enjoy spending time with.

This is the foundation of my journey as a business broker. While I don’t actively seek deals, I’ve brokered several in the past three years, often connecting small and medium-sized enterprises with investors interested in full or partial ownership.

Let me take you through one particular deal where I earned $15,000 in just one day.

The $15,000 Business Broker Deal

A friend of mine introduced me to Mario, the Founder and Co-Owner of a health-focused F&B company in Germany. They were already selling their products in supermarkets, online, and via subscription models, generating approx. $8 Mio US in sales and rapidly growing.

Mario was seeking a buyer to acquire the shares of a co-owner looking to retire and exit the business.

When Mario asked me, I instantly had to think of Niklas, who I knew predominantly invests in fast-moving consumer goods companies.

I agreed on a 1.5% business broker fee, and connected the two, who instantly hit it off and closed the deal within a couple of weeks.

The deal was swift and straightforward. I only had set up the initial introductory call and was not involved in the deal or negotiation thereafter.

At the end, Niklas bought the shares for 1 Mio US, and I received $15,000 in introduction fees, paid by Mario.

How to Get Started as a Business Broker

You don’t need to be a professional M&A advisor to get into business brokering. I started by just helping friends to sell a stake in their firm. Most of the times, they just want to sell partial shares, rather than full buyouts.

Here’s how you can start building your network as a business broker:

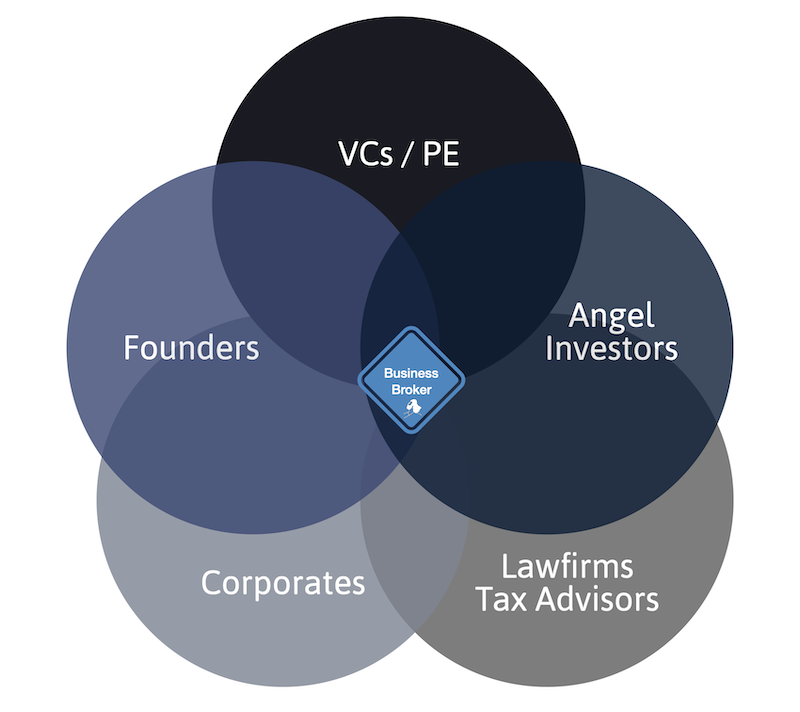

- Founders: Connect with founders, sooner or later they will be seeking investors.

- Angel Investors: You need to know angels that can become early-stage investors.

- Venture Capital & Private Equity Firms: Professional investors looking for growth potential.

- Corporates: Companies interested in strategic acquisitions.

- Law Firms & Tax Advisors: Critical partners who can provide referrals and help you navigate deal complexities.

- Business Broker Clubs & Associations: There are multiple associations you can join, such as

In essence, building your network is crucial, as each connection can lead to future deals.

The broader and deeper your network, the more valuable you become as a business broker.

Key Skills for Business Brokers

But being a successful business broker requires more than just connections. Here are the essential skills you need:

- People Skills: Understand and empathize with both sides of the deal.

- Communication: Be clear, concise, and persuasive in your messaging.

- Trustworthiness: Your word and reputation is your currency. Take good care of it.

- Resourcefulness: Know where to find the right people or information.

You don’t need to be an extrovert. I’m an introvert who prefers one-on-one interactions over small talk. Authenticity is what matters most. Stay true to your style, and you’ll attract the right deals.

Business Valuation: A Must-Know for Brokers

Understanding business valuation is crucial, even if you’re not a certified advisor. As a business broker, you should grasp how businesses are priced, so you can evaluate offers and negotiate effectively. Key elements of valuation include:

- Revenue and Profitability: What are the company’s earnings and potential for growth?

- Industry Multiples: What multiples are assigned to the specific industry, i.e. 12x of EBITDA, 7x of NOI, etc.

- Industry Trends: Is the business in a growing or declining market? Is the industry facing headwinds or tailwinds?

- Assets and Liabilities: What does the company own, and what does it owe?

Having a basic understanding of these factors helps you act as a more informed intermediary, adding value to both parties involved.

Finding Investors: Where to Start

When a founder is looking for an investor, start by checking your “angel investor” bucket. Even if none of them are directly interested, they may know someone who is. In my experience, the shareholders of companies I’m invested in often make great referral sources.

Your network is your greatest asset as a business broker.

Keep it active, and always be on the lookout for opportunities. Touch base with and regularly check in with founders. Don’t be “transactional”, but rather show sincere interest in their progress and know the current challenges they are facing.

By this, you build a real relationship, and you can mention things like ‘Hey, I have a couple of friends who are seeking to invest money in a business like yours, so when there ever is interest on your end to get investment, let me know‘.

Leveraging Your Network as a Business Broker

Once you’ve built a strong network, the next step is leveraging it effectively. Here are some dos and don’ts

Dos:

- Stay in touch: Regularly check in with your contacts, even when you don’t need anything.

- Add value: Share relevant opportunities or insights with your network, not just requests.

- Be transparent: Always be upfront about your role and what you stand to gain.

Don’ts:

- Don’t be transactional: People can tell when you’re only interested in them for a deal.

- Don’t spam: Tailor your outreach, so your message feels personal, not generic.

- Grow by attraction: Help when needed, don’t be pushy, better grow organically.

Maintaining relationships takes years, but it’s well worth the effort. It’s like planting many small seeds.

Many of my deals have come from people I met years ago, simply because I stayed in touch and added value along the way.

How Much Should You Charge as a Business Broker?

One of the most common questions new brokers ask is: How much should I charge?

There’s no one-size-fits-all answer, but here are some common fee structures for business brokers:

- Flat fee: A set fee for your services, regardless of the deal’s value. Not recommended.

- Percentage of the deal: A percentage of the total transaction value, typically ranging from 1.5-10%.

- Success fee: Payment only if the deal closes successfully.

- Retainer: A monthly fee to try and find a buyer. Not recommended for sellers, good for brokers.

The fee you charge should reflect the size, complexity, and time required for the deal. For larger or more complex deals, a percentage-based or success fee often makes more sense.

How Long Does It Take to Close a Deal?

Closing times vary greatly in business brokering. It can take anywhere from a single phone call to months or even years. The time frame depends on factors such as:

- Business health: Fast-growing companies sell quicker than those in decline.

- Valuation: Fairly priced businesses are easier to match with buyers.

- Market conditions: Industry trends can either expedite or delay deals.

Most deals I’ve brokered took 3-4 months from signing to closing.

Conclusion

Becoming a successful business broker is about building strong relationships, leveraging your network, and developing key skills. With persistence and the right connections, you can create valuable opportunities and earn significant commissions, just like I did with my one-day deal.

📘 Read Also

- How to Invest in Asia – The 5 Best Asian Stocks To Buy

- Roasting The Wealth Allocation Pillars Of Two Fellow Readers

- The Family Bank: Secure Your Family’s Financial Future

FAQ

How much are business broker fees?

Business broker fees typically range from 2% to 10% of the deal value, depending on the size and complexity of the transaction.

Who pays the business broker fee?

The fee is usually paid by the seller, but in some cases, both the buyer and seller may share the cost.

How do I become a business broker?

To become a business broker, you’ll need to build a network of business owners and investors, develop negotiation skills, and understand business valuation.

How do I find a business broker?

You can find a business broker through online directories, referrals from accountants or lawyers, or by searching local brokerage firms specializing in business sales.

What types of businesses are sold by business brokers?

Business brokers typically work with:

– SMEs: Small to mid-sized companies looking for investors or buyers.

– Startups: High-growth potential companies seeking angel investors or venture capital.

– Family-owned businesses: Companies transitioning ownership to the next generation or outside investors.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love