Key Takeaways

✅ Establishing a family bank can safeguard wealth across generations

✅ Family banks are not only for the ultra-rich – all you need is a Limited

✅ Clear goals, diversified investments, and family involvement are crucial

✅ Regular review and adapt strategies to ensure resilience and longevity

Introduction

In today’s complex financial landscape, preserving and growing wealth across generations is a challenging task.

Despite the clear benefits, only a tiny fraction of families, I’d guess less than 0.1%, take the crucial step of setting up family holding companies, which I will refer to as “family banks.”

Such entities are pretty easy to set up and offer a structured approach to managing family assets, ensuring financial stability, and fostering unity among family members.

What Is A Family Bank?

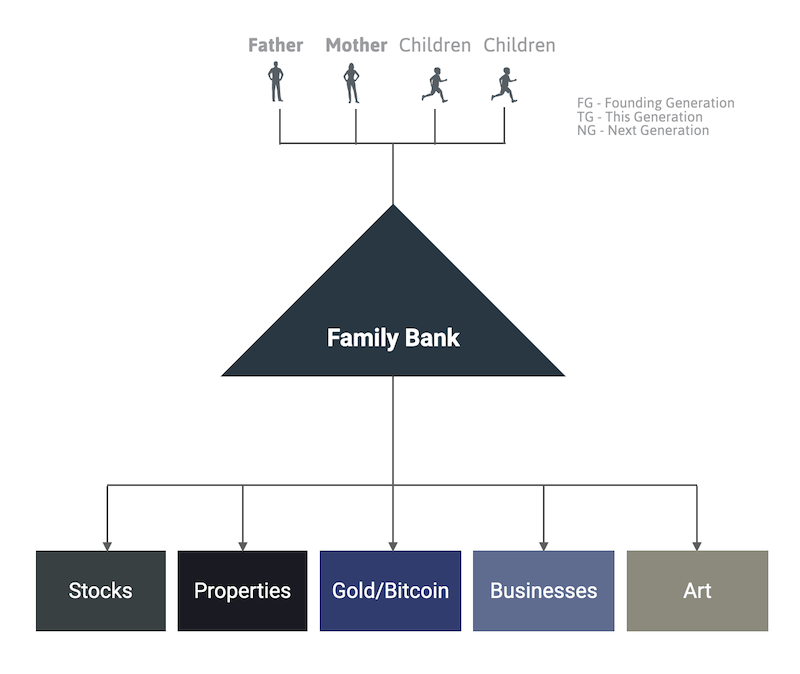

A family bank, also known as a family holding company or family trust, is a structured entity designed to manage and preserve a family’s wealth across multiple generations.

Unlike a traditional bank, a family bank is privately owned and operated by the family itself, often encompassing a range of financial assets, including investments, real estate, and businesses.

By establishing a family bank, families can gain a series of benefits.

Benefits of a Family Bank

Introducing a family bank can revolutionize how wealth is managed and preserved across generations.

Beyond conventional financial planning, these entities offer distinct advantages that empower families to safeguard their assets and foster enduring prosperity.

Family Unity: Promotes collaboration through shared financial goals, open communication, and decision-making

Asset Protection: Centralizing assets within a family bank shields wealth from potential creditors and legal liabilities

Tax Efficiency: Strategic financial planning within a family bank minimizes tax burdens on inherited assets and income

Succession Planning: Shares can be transferred in a tax-optimized manner, ensuring smooth transitions across generations

Financial Education: Provides a platform for educating younger generations about family values and responsibility

Flexibility: Options are endless, e.g. the current can give a loan to the next generation to buy shares in the family bank

By leveraging these benefits, families can establish a robust foundation for long-term financial security and intergenerational prosperity, maintaining their legacy for years.

Are Family Banks Only For The Ultra-Rich?

The concept of a family bank often conjures images of extreme wealth and dynastic families.

However, they offer a structured approach to managing wealth that can benefit families of varying financial backgrounds and sizes.

Let’s dispel the most common myths:

Accessible Structure: Family banks can have simple structures and legal forms, such as a Limited or Inc,., with two shareholders

Financial Planning: They provide the family with more financial tools for effective financial planning, regardless of the wealth

Asset Consolidation: Even modest assets can benefit from consolidation within a family bank, offering protection and strategic management.

How To Set Up A Family Bank?

Setting up a family holding company is surprisingly straightforward:

1/ Create a Family Constitution

- core family values

- mission statement

- governance structure

- Decision-making process (who can decide what, etc.)

2/ Identify Family Assets

- Catalog financial assets

- Assess intellectual assets

- Assess human capital

3/ Define Longterm Goals

- Asset allocation goals

- Risk/reward ratios that are acceptable

- Long-term ROI targets

4/ Set Up The Actual Legal Entities

- Once you have defined the above, talk to your trusted tax advisor

- Choose the right entity (holding company, trust, ..)

- Bring in, buy or contribute the first family assets

- Set up the needed bank accounts for your new family bank

Practical Use Cases For A Family Bank

Education Investment Plan

- Objective: The current generation allocates funds from the family bank to finance specific educational goals for the next generation.

- Implementation: Funds are used for tuition, private schooling, specialized courses, or educational travel experiences that align with family values and goals.

- Benefit: Ensures that the next generation receives quality education without financial constraints, setting them up for a good future

Share Purchase Loan Program

- Objective: Facilitate ownership and engagement in the family bank among younger generations.

- Implementation: Upon reaching a specified age (e.g., 25 years), eligible family members can take out a loan from the family bank to purchase shares in the family bank itself.

- Mechanics: The loan’s interest payments can be tax-deductible, leveraging financial benefits. Dividends received from the shares can then be used to repay the loan over time.

- Benefit: Encourages financial responsibility and investment in the family’s long-term financial health, while also fostering ownership and active participation in family governance and decision-making.

Emergency Fund Provision

- Objective: Ensure financial stability and resilience during unexpected circumstances.

- Implementation: Maintain a designated portion of the family bank’s assets as an emergency fund, accessible to family members in times of financial hardship or crisis.

- Mechanics: Funds can be accessed quickly and without external borrowing costs, providing peace of mind and stability during turbulent economic periods or personal emergencies.

- Benefit: Protects family wealth and avoids the need for liquidation of long-term investments during emergencies, maintaining the family’s financial trajectory and goals.

Venture Capital Fund

- Objective: Support entrepreneurial endeavors and innovation within the family.

- Implementation: The family bank allocates funds as venture capital for promising business ideas and startups initiated by family members.

- Mechanics: Investments can range from seed funding for new ventures to growth capital for expanding businesses, with clear terms and expectations outlined to manage risk and maximize returns.

- Benefit: Encourages entrepreneurial spirit and business acumen among family members, while potentially generating additional income and diversifying the family’s investment portfolio. This also strengthens the family’s economic ecosystem by nurturing new enterprises and creating opportunities for wealth generation.

Most Common Family Bank Challenges

After reading multiple books on this subject, you hear about a certain set of challenges:

- Managing Complex Relationships – only families able to manage emotions and discuss difficult topics well have a chance of making it work

- Mapping family dynamics and relationships – families grow faster than businesses, hence, it is not easy to keep everyone happy and engaged

- Control Without Ownership – some families opt to let the members control the assets without owning them anymore, which might lead to conflicts

- Balancing control and legal ownership – the larger the family bank gets, the more complex the managing becomes – this can lead to power struggles

- Internal or external management – some family banks become so big that the family hires external management – adding further complexity

The Largest Family Holding Firms

Let’s now take a look at some interesting families in some select countries:

| 🇺🇸 U.S. | 🇬🇧 U.K. | 🇩🇪 Germany | 🇫🇷 France | 🇮🇹 Italy |

| Walton – Walmart | Rothschild | Quandt – BMW | Arnault – LVMH | Medici |

| Busch – Anheuser | Cavendish | Haniel* – Cewe / Takkt | Dassault | Colonna* |

| Du Pont | Grosvenor | Albrecht – Aldi | Hermes | Borghese |

| Bechtel | Barclay | Reimann – Reckitt | Bettencourt L’Oreal | Agnelli |

| Ford | Guinness | Porsche – VW | Schlumberger | Orsini |

The Colonna family of Italy is interesting. According to Jim Rickard’s excellent book, The Road To Ruin, for over 900 years, the Colonna family has maintained their wealth through strategic holdings, including

- one-third in land,

- one-third in gold, and,

- one-third in art

centered around their historic residence, The Palazzo Colonna in Rome.

The Haniel family in Germany stands out for its long-standing presence and influence in industrial sectors, particularly through the Haniel Group, which has diversified investments ranging from chemicals to consumer goods.

Known for their prudent management across generations, they have adapted to economic shifts while maintaining a focus on sustainability and innovation, solidifying their legacy as a stalwart of German business and industry.

What makes them unique

- family holding firm has 680 shareholders

- family members may not work in any of the family-owned businesses

- the holding is entirely managed by top-class external managers

- the family bank owns shares in 800+ businesses (portfolio)

Richest Families In Other Countries

| 🇪🇸 Spain | 🇦🇹 Austria | 🇸🇪 Sweden | 🇵🇹 Portugal | 🇳🇱Netherlands |

| Ortega | Mateschitz – Red Bull | Wallenberg | Espírito Santo | Brenninkmeijer |

| Botín | Leitner – Andritz | Kammerlander | Amaral | Heineken |

| Isidoro Alvarez | Graf – Novomatic | Persson | Mello | Van der Vorm |

| March | Swarovski | Klingenberg | Soares dos Santos | Van Oranje-Nassau |

| Puig | Mayr-Melnhof | Ek | Queiroz Pereira | Van Loon |

5 Best Tips for Managing A Family Bank

1/ Keep It Simple: Don’t overcomplicate things. Have a simple family holding Limited or Inc, with the current generation as shareholders.

2/ Define Clear Goals and Governance: Establish a simple family constitution outlining shared values, goals, and governance structures to guide decision-making and ensure continuity across generations.

3/ Diversify Asset Holdings: Spread investments across various asset classes such as stocks, real estate, private equity, maybe bonds, Gold and Bitcoin, to mitigate risks and optimize returns over the long term.

4/ Educate and Involve Family Members: Foster financial literacy and engage family members in financial discussions and decisions to ensure informed participation and unity.

5/ Seek Professional Guidance: Consult with financial advisors, estate planners, and legal experts to navigate complex tax laws, succession planning, and asset protection strategies effectively, safeguarding the family’s wealth for future generations.

Conclusion

By following these 5 best tips and regularly updating your strategy, you are laying a strong foundation for future generations through your family bank.

With proactive management and a commitment to preserving your legacy, your family bank can thrive and endure for many generations to come.

📘 Read Also

- Top 10 Trading Psychology Tips for Your Investing Success

- The Story Of How I Reached Financial Independence With $5M In Net Worth

- My 3 Highest Conviction Investments For The Next 10 Years

FAQ

What is a family bank and how does it work?

A family bank, also known as a family holding company or private trust company, is a structured entity designed to manage and preserve a family’s wealth across generations. It centralizes the management of assets like investments, real estate, and businesses, providing strategic oversight and financial education. Family members can borrow from the bank under favorable terms, fostering financial responsibility and entrepreneurship within the family.

Are family banks only for wealthy families?

No, family banks are not exclusively for the ultra-rich. While they are commonly associated with affluent families, any family with a structured approach to wealth management can benefit from a family bank. By consolidating assets, optimizing tax strategies, and fostering financial literacy, even families with modest wealth can ensure their financial stability and growth across generations. It always depends on each country, but family-holding companies can be started with as little as $25,000 US.

How can a family bank help with succession planning?

A family bank helps with succession planning by clearly defining roles, responsibilities, and governance structures for the transfer of wealth and control. It facilitates a smooth transition of assets and leadership from one generation to the next, minimizing disputes and ensuring continuity. Family banks also provide educational resources and mentorship to prepare younger members for their future roles.

What are the tax benefits of establishing a family bank?

Family banks can offer significant tax benefits, such as reducing inheritance taxes through strategic asset transfers and optimizing income taxes by managing investments and distributions efficiently. By consolidating assets within the family bank, families can leverage tax planning opportunities and legal structures to minimize tax liabilities and maximize wealth preservation.

How do you set up a family bank?

Setting up a family bank involves several steps:

1- Define the family’s goals and create a family constitution.

2- Identify and consolidate family assets.

3- Establish a legal structure, such as a limited liability company (LLC) or trust.

4- Develop governance policies and roles for family members.

5- Regularly review and update the family bank’s strategies and performance.

Consulting with financial advisors, estate planners, and legal experts is crucial to ensure compliance and effectiveness.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love