Dividend Growth Compounding in Action – 2024/10 Report

October brought in $925 in post-tax passive income from my All-Weather Portfolio dividends.

Although October is one of my three slowest months (the other two being January and November), I am still happy for just sitting back and watching!

Breakdown of Dividends Received

Essentially all positions have been climbing nicely, but there was one letdown—Ecora Resources (check our their website) my commodities royalty company of choice.

They basically decided to switch from a quarterly payout to just twice a year. So, we’ll be seeing less of them in the monthly breakdown, but hey, the overall growth is still solid.

| Shares | Amount | |

| Brookfield | 740 | $263 |

| Cisco | 600 | $178 |

| Avalon Bay | 100 | $145 |

| Pepsico | 120 | $144 |

| Realty | 470 | $105 |

| Mondelez | 275 | $90 |

| Total | $925 |

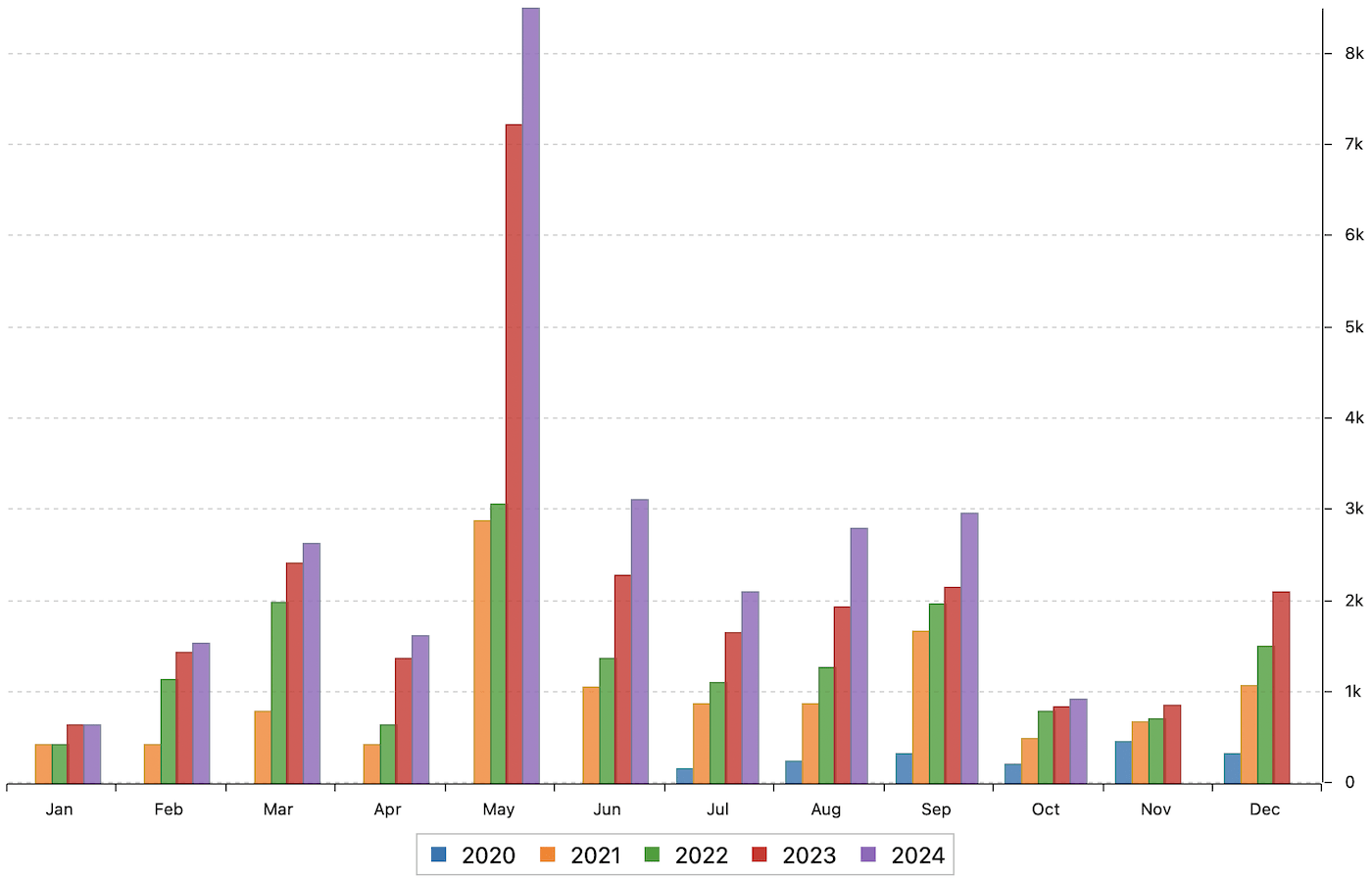

Here’s the month-by-month scoop on my dividend income, and I have to say, I’m pretty happy with the steady upward trend, even if October is, besides January and November, one of my “low-yield” months.

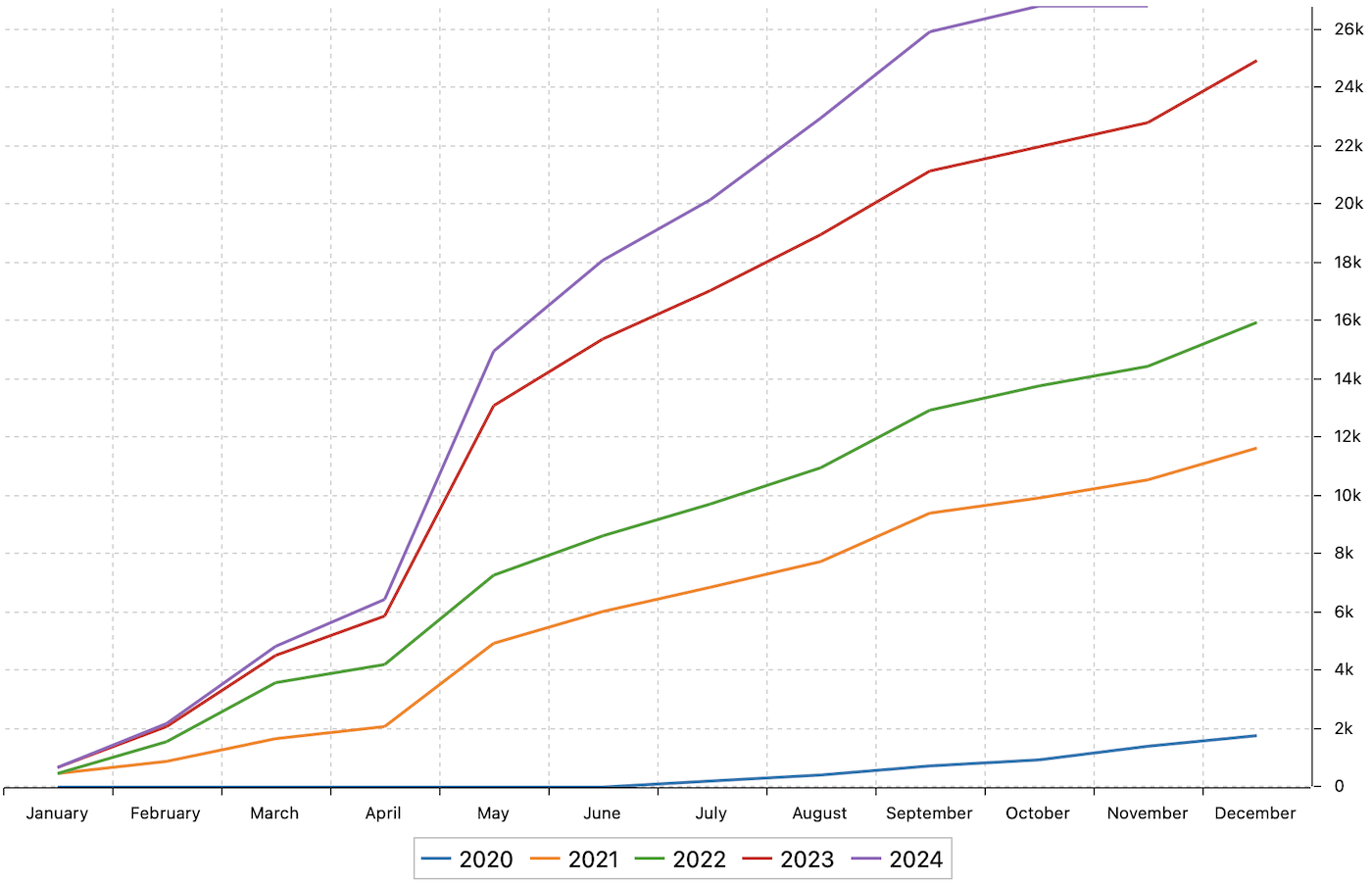

The below chart shows the progress chart for the accumulated amount in each year.

New Purchases in October

I also made some buys this month — some exciting opportunities came up that I couldn’t pass on:

| Shares | Price | Total | |

| L’Oreal | 18 | $440 | $7,920 |

| L’Oreal | 12 | $392 | $4,702 |

| LVMH | 4 | $689 | $2,756 |

| AT&T | 45 | $22 | $986 |

| Realty | 4 | $64 | $256 |

| Total | $16,620 |

L’Oreal and LVMH: These two French dividend stocks dipped even further, giving me a chance to grab some at more attractive prices. After waiting over a year, I finally built a first position in both: $12,000 in L’Oreal and around $10,000 in LVMH.

The recent drop is likely due to both companies’ significant exposure to the currently sluggish Chinese market, but I’m optimistic these two will shine in the long run.

Realty Income (O): Picked up more shares of this favorite REIT, inching closer to my long-term goal of owning 500 shares. I just love those monthly dividends!

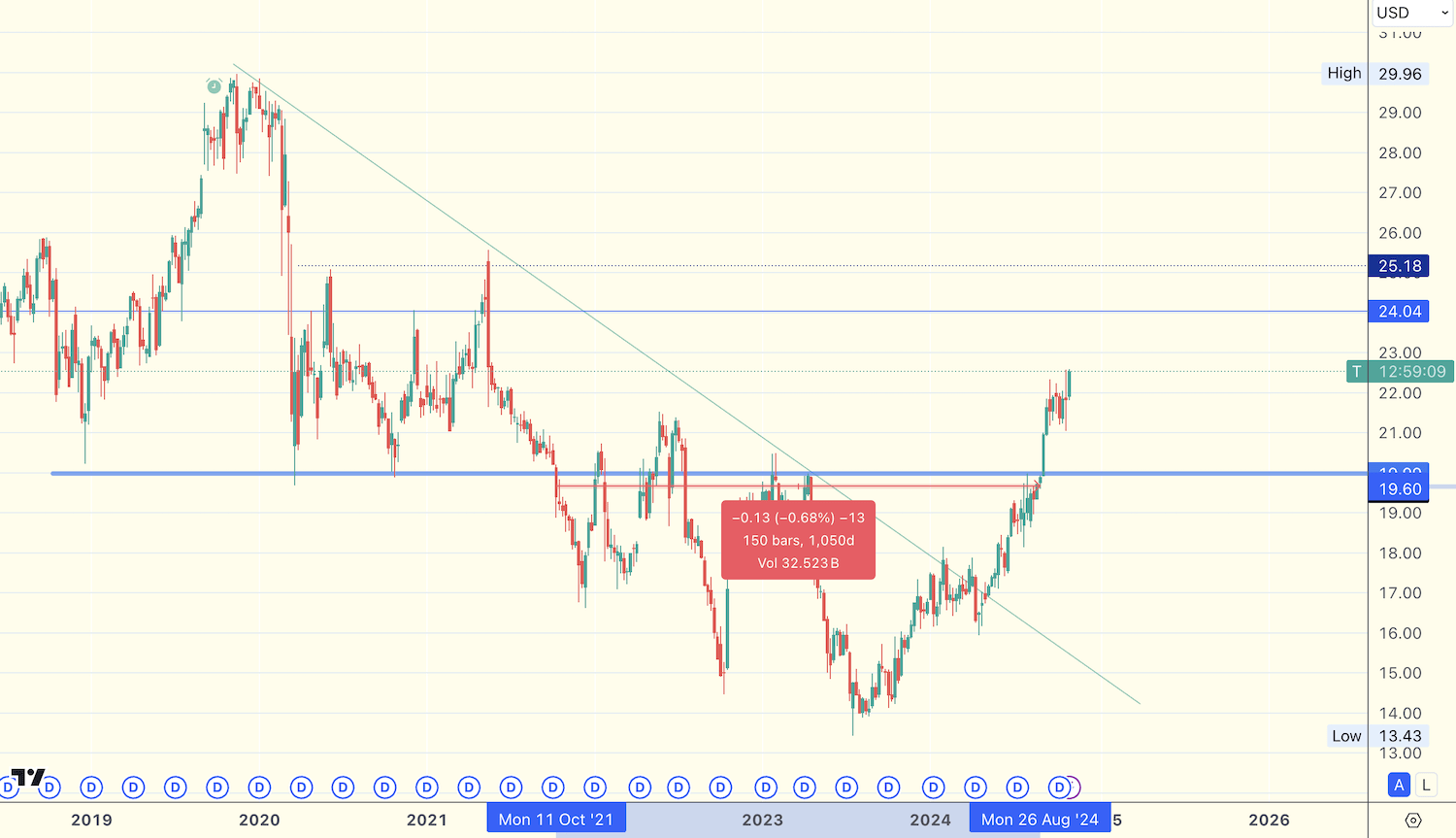

AT&T (T): I also increased my position here, especially after they posted some solid numbers. Their decision to streamline and stick to their telco roots (after spinning off Warner Bros) seems to be paying off. After the stock fell below $20 in 2021, it took 1,050 days to climb back up.

I still believe $T is one of the best telecom dividend stocks you can buy, and I am a happy long-term owner here. I think $20 will now act as a strong support and we can keep claiming from here. Going forward, I believe AT&T will once more become a reliable dividend growth compounding stock that pays off a large quarterly dividend.

I simply love Tradingview! Check out the chart of $T for yourself.

Passive Income From Crypto

Besides generating income from dividend growth compounding stocks, I also am very active in the crypto space. In October, I earned +$6,000 in airdrops.

I received the following:

- $27 Scroll tokens

- $70 Grass tokens (awesome project)

- $5,680 JUP token (read my Jupiter investment thesis here)

- $240 Cloud token (liquid restaking on Solana, great project)

Besides I actively borrow and lend, liquidity farm, and go long with leverage on RabbitX.

Conclusion

That’s the October roundup!

Even with a few “quiet” months, it’s great to see the portfolio growing, and I’m already looking forward to what November brings.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love