A New Media Giant Is Born

AT&T spun off its “media” business into a separate company, that then merged with one of the other key industry players, Discovery, at the same time.

As a shareholder of AT&T, I received shares of Warner Bros Discovery in a ratio of 24:1. At the time of the merger, I had 575 shares of AT&T ($T), and subsequently received 139 shares in $WBD.

Since then, I bought another 11 shares at 20,99 USD as I like even numbers ;-). I now hold 150 shares in $WBD.

AT&T now holds 71% of Warner Bros Discovery, while Discovery’s holds the remaining 29%.

The new company is a highly-focused media juggernaut, with one of the world’s best media IP portfolios, an immense worldwide reach, and potential. Below I explain the Top 5 Reasons Why WBD Is A Longterm Hold For Me.

Keep in mind that I am not a professional analyst, just a passionate DIY investor managing his own money.

Let’s dive in.

1/ Treasure Cove of Formidable IP

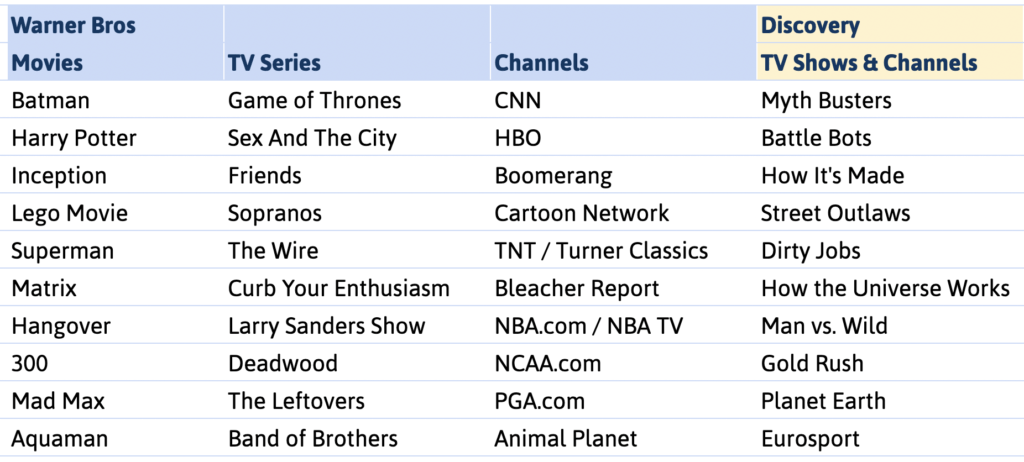

Warner Bros Discovery’s intellectual property portfolio is immensely wide & deep, from news, sports, kids, teenagers, adults, and food to history. It is the dream of any entertainment fan 🍿:

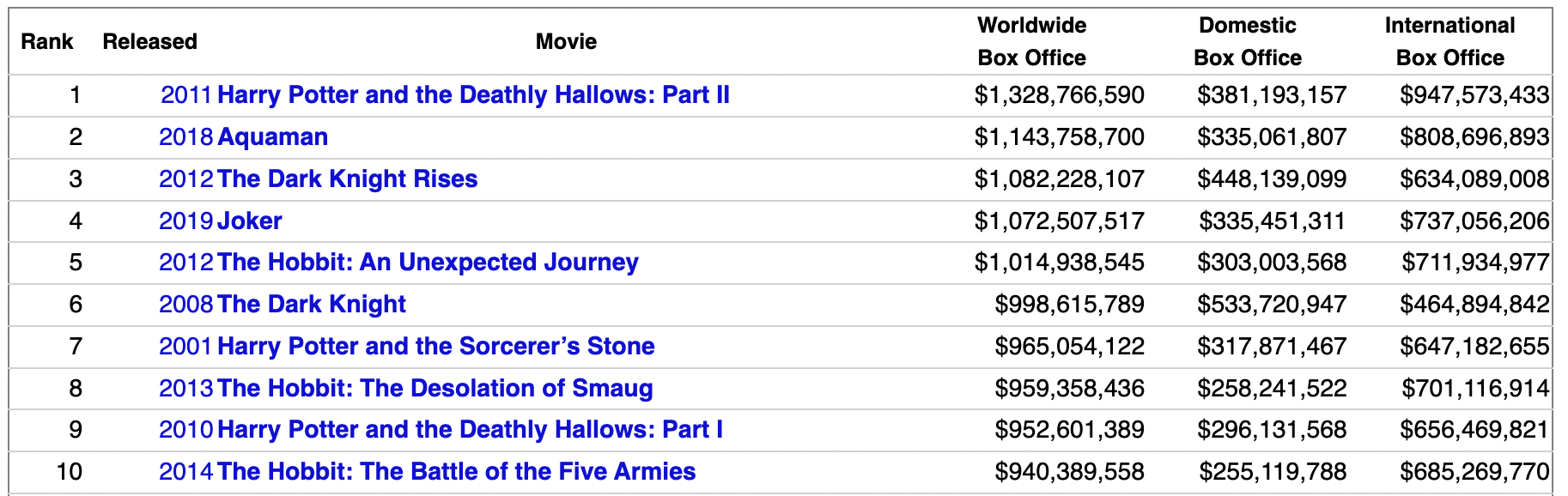

And check out the 10 highest-grossing movies in Warner Bros’ history:

Which young professional doesn’t dream of shaping the future of his or her favorite DC characters like Batman, Superman, Wonderwoman, or Game of Thrones?

2/ Great Reach Via An Unparallel Platform

Via their combined channels, Warner Bros Discovery has an enormous global reach. It’s +70 Mio subscribers, to bring entertainment, education, news, and sports to millions of users. The newly combined company, just one year after the merger, aims to have a free cash flow of 8 Bio USD per year – a rather nice junk of money to be able to deploy back into improving their IPs and producing more world-class movies and TV series.

Presently, in 2022, Warner Bros Discovery is operationally active in more than 220 countries in over 50 different languages.

3/ Potential Unleash Of Lots of Creativity

Running a multi-billion telecom company is very hard. Managing one of the world’s largest media companies within the same organization even more so. We are talking about two completely different worlds: The telecom industry attracts a fundamentally different type of people compared to the media business. That’s why I personally always felt AT&T and Warner Bros is a marriage that was not meant to last. Now that all the media side of the business got spun off and merged with Discovery, there is a good chance that the merger acts as a rejuvenating jab into the massive biceps of this new media juggernaut, and lots of creative energy gets unleashed.

Just Think for a minute about the humongous potential Warner Bros Discovery has when it comes to immersive entertainment, edutainment, and education in VR, AR, and Gaming! Virtual Classrooms could use Discovery’s IP to teach kids in never-before-see ways. Like to put on a VR set and visit Harry’s dorm room at Hogwarts? Have a larger-than-life front-row seat at the NBA finals via ESPN’s immersive AR experience. The possibilities are endless.

4/ Focused Leadership

Under the leadership of David Zaslav, a veteran media CEO with a fantastic track record and decades of relevant experience, I believe the company has the potential to become a streamlined and efficient media powerhouse. He led Discovery since it began trading as a public company in 2008, grew it to a Fortune 500 company in 2014, and acquired Scripps Networks Interactive (2018) to make it the #1 most-watched pay-TV portfolio in the U.S.

Listen to Warner Bros Discovery’s CEO David Zazlav:

(timestamp 3:37 re. 8 Bio USD in cash flow expected for 2023)

5/ Cost Synergies Via Economies of Scale

Trying to achieve synergies by marrying a telecom and media company is extremely hard. Gaining synergetic benefits by merging two media companies is a lot more likely! On a high level, I believe the odds to achieve this are much higher, and WBD has a good shot at making it happen.

6/ Massive Potential With Gaming

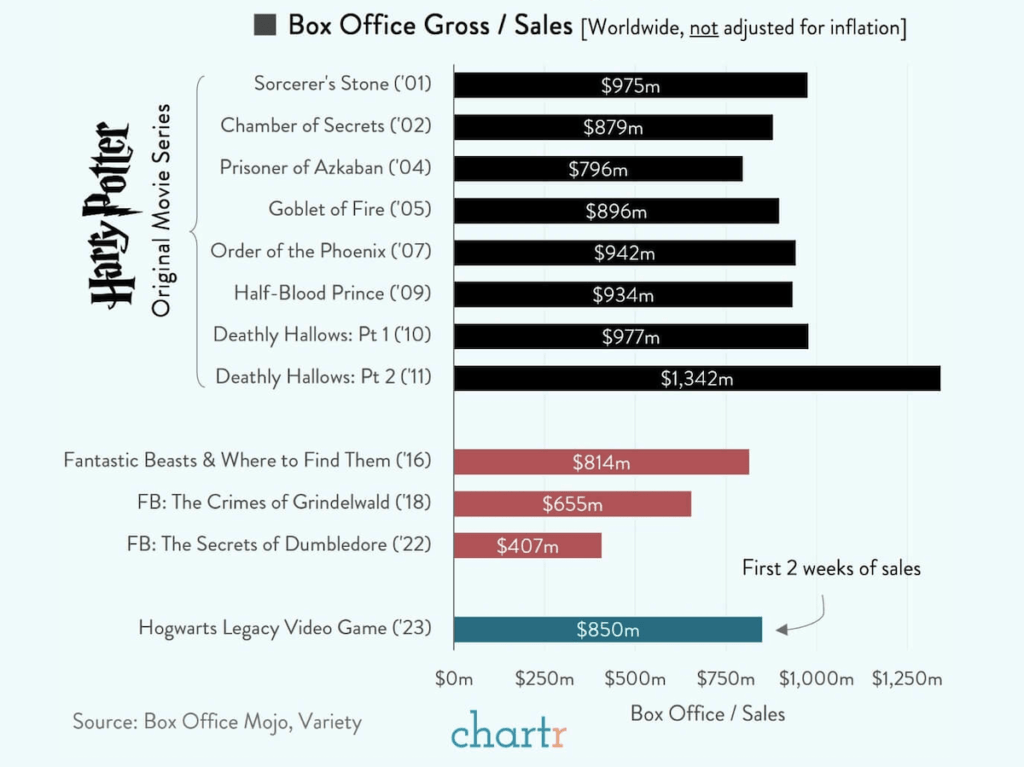

The movie industry in 2022 generated revenues of 26 Bio USD at the global box office. The video game industry in comparison (including sales from mobile, console, and PC games), has more than 175 Bio USD. In other words, the gaming industry is 7X larger.

This is a massive opportunity for $WBD, owning some of the best IPs on the planet.

Check out this awesome chart showing that within two weeks of its launch (!), WB Games already generated almost the same amount of revenue for the company as the box office.

What About The Risks?

Now, spinoffs and mergers never come without risks. You never really know if a newlywed couple will become partners for life, or if they eventually will break up. But at least they have a good shot and aligned interests.

Further, although now more manageable, it still is quite the monster of a company with hundreds of thousands of associates to manage, and the competition in this space is intense (Disney, Netflix, Amazon, Apple, ..).

Then there is the debt of approx. 58 Bio USD (43 Bio USD were “contributed” by AT&T, Discovery 15 Bio USD).

But CEO Zazlav is determined to pay that back as soon as possible, and with 8 Bio USD of free cash flow, it is still very manageable.

But ultimately, I am convinced that $WBD has the IP, focus, leadership, and economies of scale to make it big and embrace and monetize all the new ways media will be immersively consumed.

Conclusion

Warner Bros Discovery is an ultra-long hold for me here, and I’m happily holding it in my All Weather Portfolio.

📘 Read Also

- Best tools for your Investor Toolbox

- See which European REITs I think are good buys

- The Best Dividend-Paying Entertainment Stocks

- Like to see my total monthly income 👉 Dividend Calendar

FAQ

Who owns Warner Bros Discovery?

AT&T now holds 71% of Warner Bros Discovery, while Discovery’s holds the remaining 29%.

How does Warner Bros make money?

Warner Bros Discovery (WBD) primarily makes money with films, music, television programs, video games and comic books. It also generates revenues via amusement parks, web portals, broadcasting/licensing/publishing/streaming services.

Does Warner Bros make money with video games?

Yes, in fact, Warner Bros starts to make significant revenues with the games it publishes. It owns games IP such as Harry Potter (Hogwart’s Legacy), Batman, Injustice, Lego, Middle-earth, and Mortal Kombat. Its most recent game, Harry Potter’s Hogwart’s Legacy, passed 850 Mio USD in sales just 2 weeks after its release.

What does Warner Bros Discovery own?

Warner Bros Discovery is a large diversified media group, owning HBO, Discovery, CNN, TNT, TLC, DC, Eurosport, Cartoon Network, and some of the most popular and loved IPs in the world, such as Batman, Harry Potter, Game of Thrones, Matrix, Superman, Mad Max or Aquaman. Its gaming division publishes all IP-related games.

WiseStaker's Take

The spin-off and merger with Discovery creates a new and highly-focused media giant. Warner Bros Discovery is an ultra-long hold for me here, and I welcome it to my All Weather Portfolio.

PROS

- Treasure Cove of Formidable IP

- Great Reach Via An Unparallel Platform

- Potential Unleash Of Lots of Creativity

- Focused Leadership

- Cost Synergies Via Economies of Scale

- Massive Potential With Gaming

CONS

- post-merger uncertainties

- competitive industry (streaming wars)

- debt burden

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love