Buying Dividend Stocks Worth 37k + Got $873 in January’25

January proved to be a busy month for my investments.

I received dividends from two private companies for which I’ve held shares for over 15 years, totaling $64,800. The breakdown was as follows:

- $56,000 from a manufacturing company

- $9,600 from a sourcing/trading company (both in December)

- $64,800 in total

I opted to reinvest $37,000 of this amount into dividend stocks, purchasing the following:

| Stock Purchases | Shares | Value |

| a new Latin America Energy Stock | 1,800 | $15,944 |

| Link REIT | 2,500 | $10,046 |

| L’Oreal | 27 | $9,900 |

| Anheuser | 25 | $1,245 |

| Total | $37,135 |

I added to three existing dividend stock holdings:

- $LKREF – Link REIT (Asia’s best REIT)

- $LRLCY – L’Oreal

- $BUD – Anheuser-Busch (stock review)

Also, after weeks of research, I finally bought my first Latin American stock, in my point of view the region’s best energy stock. More on that next week!

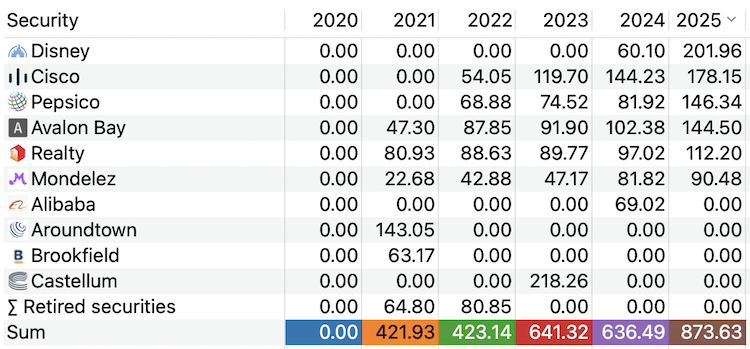

Besides those purchases, I received $873 from my other All-Weather Portfolio’s dividend stocks (in USD):

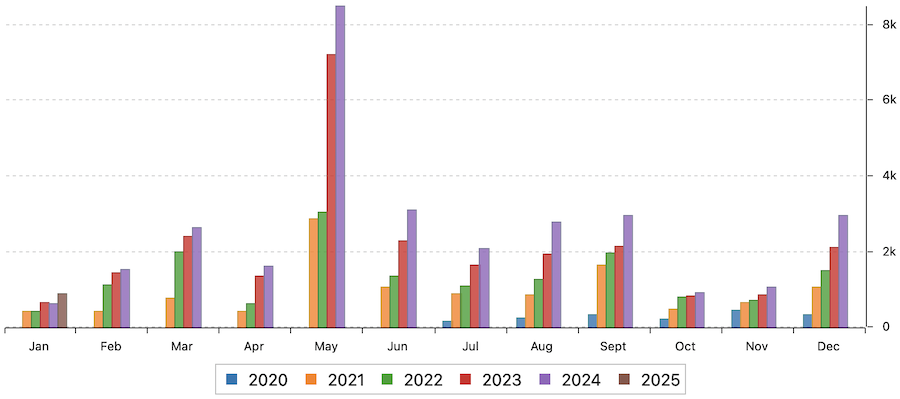

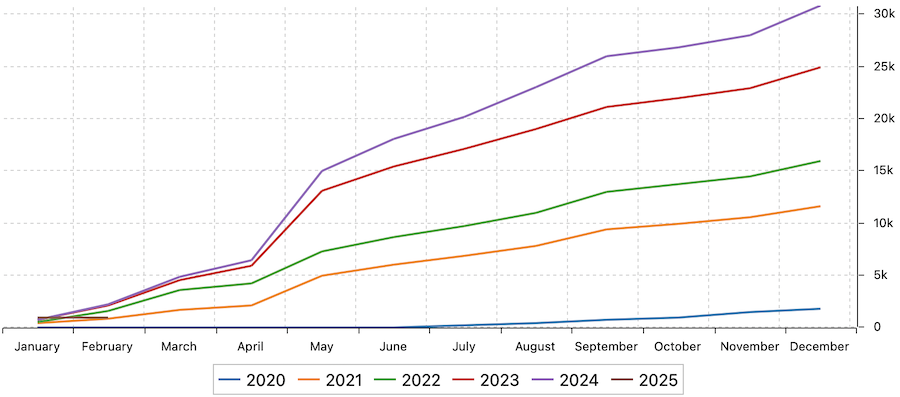

The dividend snowball is slowly growing, and similar to other long-term dividend investors, I see the income my dividend stocks generate for me increase step-by-step on a monthly basis.

I reached my goal for 2024 of generating $30k+ of passive income throughout the year.

May is by far my strongest month, as this is when most of the European stocks I own pay their annual dividends.

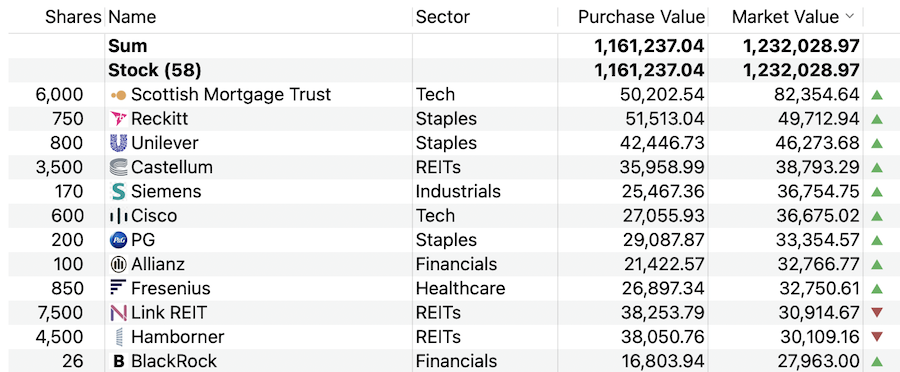

Below are my 12 largest holdings.

Of those, 7 are European dividend stocks, 3 are American, one is from Asia, and Scottish Mortgage Trust (holdings), my largest position and in my opinion, the best fund disruptive tech fund.

Income From Stablecoin Farming

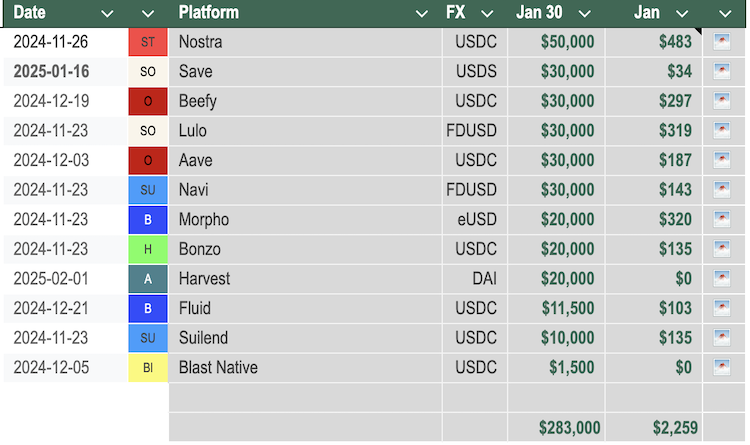

In January, my stablecoin farming strategy delivered $2,259 in pure, passive income. To mitigate risk, I’m currently diversified across 12 different Dapps spanning 6 blockchains.

At the end of each month (on the 30th), I harvest all the accumulated interest. From there, I either transfer the funds to my Nexo account to earn even more interest, or easily spend the money with my Nexo credit card.

- ATM, I have one $50,000 farm on Nostra (also earning 175 Stark tokens/mo. on top of the USD yield)

- five farms with $30,000

- three farms with $20,000

- and some smaller ones for further testing

Besides the stablecoin farm, I also received $7,265 in form of airdrops.

| Chain | Qty | Price | 🪂 Value |

| Jupiter (JUP token) | 6,942 | $0.890 | $6,178 |

| Blast (BLAST token) | 155,210 | $0.007 | $1,086 |

| Total | $7,265 |

Jupiter Exchange is my favorite project on Solana. They just announced a 30% token burn (3b tokens) plus to buy back JUP tokens every month with 50% of the fees they generate from their Perp product. Insane! Extremely bullish.

My Current View On The Market

For the rest of the first half-year of 2025, I am

- very bullish on Bitcoin, Solana, and Sui

- Gold and Gold Stocks (my favorite Gold stock is this one)

- Uranium stocks (get started with this post).

As always, I love to hear from you – simply drop me a message via the message board below!

📘 Read Also

- Selling My Sixt Stocks After An Awful Experience

- Trade Alert – Buying The Best AI Agent Infrastructure Project!

- Are AI Agents The Next Megatrend?

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love