Featured image created with the awesome Limewire AI Studio

All-ETF Investment Guide.. Asking For A Friend

A long-time friend in Germany just recently sold his software business for $2.3 Mio. After tax, he now sits on $1.5 Mio in cash.

Quick overview of his general financial situation:

- 56 years old, not married, no kids, living with a long-time partner

- one residential residence (he lives in), est. value: $1 Mio 🏡

- debt-free, $300,000 in various (high-cost) mutual funds 💸

- no other properties

- no precious metals

- no art/collectibles

After netting the $1.5 Mio, his total net worth looks like this:

- $1.8 Mio in cash (64%)

- $1.0 Mio in real estate (36%)

His house bank, a European-established TradFi bank, offers him to manage his wealth for 1.5% p.a.

This would mean $2,250 per month (!), or $27,000 per year. He called me the other day, asking me how I’d structure his portfolio.

I told him I would keep things simple, and that he should get many ideas himself by googling for simple ETF investment guides.

But he insisted on me telling him what I’d do – so I thought about it and came up with the following portfolio structure.

How I Would Structure An All-ETF Portfolio

First, I would keep things simple and go for an All-ETF portfolio.

Many ETF investment guides suggest a selection of a max. of 10 ETFs, but I believe you can get by with less.

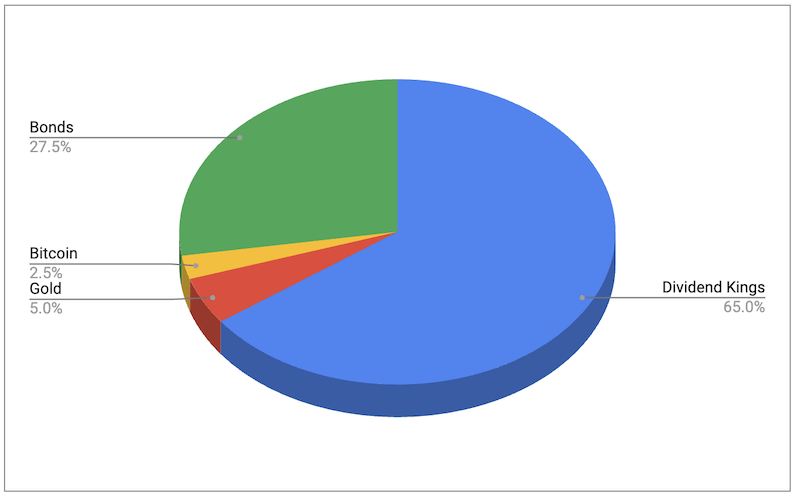

| Position | Allo | Amount | Div/yr | Div/month |

| Dividend Stocks ETF | 65.0% | $1,170,000 | $35,100 | $2,925 |

| Gold | 5.0% | $90,000 | 0 | 0 |

| Bitcoin | 2.5% | $45,000 | 0 | 0 |

| Government Bond ETF | 27.5% | $495,000 | $20,790 | $1,735 |

| Total | 100% | $1,800,000 | $55,890 | $4,650 |

As part of the deal, he will work as a non-executive consultant to the business for three years, generating enough income not having to worry about his monthly living expenses.

His house is fully paid for, he does not have any kids or expensive hobbies, and spends approx. $6,000/mo.

Proposed ETFs

Here are the specific ETFs I would choose to express my global investment view.

| Ticker |

Dividend Months

|

|

| Vanguard FTSE All-World High Dividend | VHYL | 3/6/9/12 |

| iShares Gold Trust | IAU | – |

| BlackRock’s BTC ETF | IBIT | – |

| Vanguard Total International Bond ETF | BNDX | monthly |

Tip – A good website I use often to compare and search for ETFs is JustETF.com.

Nice and simple.

As he does not enjoy managing his money and prefers to avoid dealing with many positions, his portfolio needs to be straightforward and easy to maintain.

The proposed portfolio couldn’t be easier:

- Four positions, paying 16 dividends in total

- The bond fund pays a monthly dividend

- Super easy to file taxes (capital gains taxes are automatically deducted)

- All investments can be held in a single neo-broker account, such as Trade Republic or Betterment

- With a connected credit card, he can easily spend his $55k of passive income

Conclusion

There you have it—a very simple portfolio, not only suitable for people with millions but also for the everyday investor.

Managing a large multi-million dollar portfolio can be done with a simple All-ETF Portfolio, consisting of just four positions. With modern FinTech companies like Trade Republic or Betterment, you can manage your portfolio straight from your phone.

📘 Read Also

- The Family Bank: Secure Your Family’s Financial Future

- The AI Investment Pyramid – Building A Balanced Portfolio

- How To Spot A Financial Scam – 4 Important Tips

FAQ

What is a good ETF investment guide?

A good ETF investment guide provides clear, easy-to-understand information about ETFs. It should explain what ETFs are, how they differ from other investments, and the advantages they offer. It should also cover how to select ETFs based on factors like fees, performance, and diversification. Look for guides that offer practical advice on building and managing an ETF portfolio.

What is the best ETF investment guide?

The best ETF investment guide is one that covers the basics of ETFs, how they work, and how to choose the right ones for your portfolio. Look for guides from reputable sources like financial institutions, investment firms, or well-known financial advisors. They should include information on ETF types, benefits, risks, and strategies for building a diversified portfolio.

What are the benefits of investing in ETFs?

ETFs offer several benefits for investors. They provide diversification, as each ETF holds a variety of assets, reducing the risk associated with individual securities. They are cost-effective, with generally lower fees compared to mutual funds. ETFs are also highly liquid, meaning you can buy and sell them easily during market hours. Additionally, they offer transparency, as their holdings are publicly disclosed. Finally, ETFs can be a tax-efficient investment option, with lower capital gains distributions compared to mutual funds.

How To Invest In ETFs?

Investing in ETFs is simple. First, open a brokerage account with a firm that offers ETF trading, such as TradeRepublic or Betterment. Next, deposit funds into your account. Research and select ETFs that fit your investment goals and risk tolerance. Finally, purchase shares of the chosen ETFs through your brokerage account. It’s a good idea to regularly review and rebalance your portfolio to keep it aligned with your goals.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love