How To Explain Bitcoin In 10 Easy Steps

Over the years I sat down with people of all ages and walks of life, trying to explain Bitcoin in the most easy-to-understand manner.

I tried countless approaches, and I came to realize that the following guide to explain Bitcoin works best!

Explain Bitcoin In 5 Minutes

- Reserve currencies typically last 80 years, while the US dollar is already in its 120th year

- Rising national debt & increasing inflation erode the value of traditional currencies

- People’s faith in governments and institutions is at an all-time low.

- Politicians have proven to be bad capital allocators as they lack real-world experience

- Just as we separated religion from politics, it’s time to separate money creation from politics

- Gold is not the answer, because it is physical, making it unsuitable for our digital age

- Bitcoin is politically neutral, digitally scarce, secure, and enables instant peer-to-peer transactions globally

- It empowers individuals of all backgrounds to be in control of their wealth (freedom + property)

- Its fixed, inelastic, and immutable supply, makes it resistant to inflation

- Consider allocating 1% of liquid net worth to Bitcoin, as a potential hedge

Explainer – Explained!

The above sequence of items is building logically on itself. Each point sets the stage for the next.

It starts with undeniable hard facts that everyone agrees to (reserve currencies, rising debts, deficits, diminishing trust in institutions, ..).

It then briefly covers why Gold is a great wealth preserver over time, but, unfortunately, with Gold, ‘it is not possible to ‘send wealth across space‘ (unless we use IOUs, which due to the lack of trust is not a solution).

Then Bitcoin is introduced, first, not with a technology angle, but by being politically neutral, digitally scarce, secure, and enabling individuals to transact with each other effortlessly and globally.

Then, it covers the ‘Bitcoin is for everyone‘, regardless of race, gender, age, political or religious views, unbanked or not, and the ability to securely hold their wealth.

Then it addresses that Bitcoin’s supply is mathematically fixed, inelastic, and immutable, making it resistant to inflation!

– –

Would you explain Bitcoin differently?

Best Bitcoin Explainer Videos

There are two Bitcoin explainer videos I encourage everyone to watch.

One is from Andreas Antonopolous, and the other one is with Josh Rosenthal, a history professor who was interviewed on the Bankless podcast.

It was the above video that made me invest my first $100 US in BTC in mid-2017. I also set up my first own wallet and transferred the Bitcoin to it.

Andreas’s educational videos on Bitcoin are excellent, and a great place to start learning about Bitcoin!

The second one, the one below, blew my mind. I love how Prof Rosenthal connects multiple dots and gives a lot of context to why blockchain is so revolutionary. I never heard someone explain Bitcoin in a better way!

How To Explain Bitcoin In Under 90 Seconds

I believe the following script is the best one when you try to explain Bitcoin in 90 seconds or less:

- Countries have too much debt

- Politicians love printing presses, and won’t let go of them

- Inflation is here to stay, eroding the value of fiat currencies

- Gold is not the answer, it is physical, and unsuitable for our digital age

- Bitcoin is the solution, it’s digitally scarce & enables instant peer-to-peer transactions, globally

- It empowers individuals of all backgrounds to be in control of their wealth (freedom + property)

- Consider allocating 1% of liquid net worth to Bitcoin, as a potential hedge

- Welcome to the fam 🫶

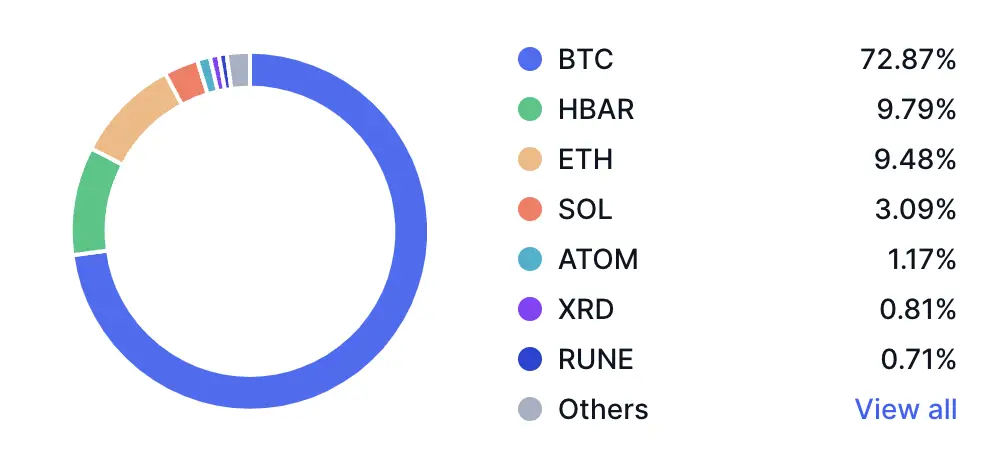

My Crypto Portfolio

As you can see on the following chart, about 72% of my digital asset portfolio is currently allocated to Bitcoin. It’s by far my largest position.

I currently have a total of approx. $800,000 US in this portfolio, meaning I currently hold about $587,000 US in BTC. The above portfolio is however not what I recommend to others.

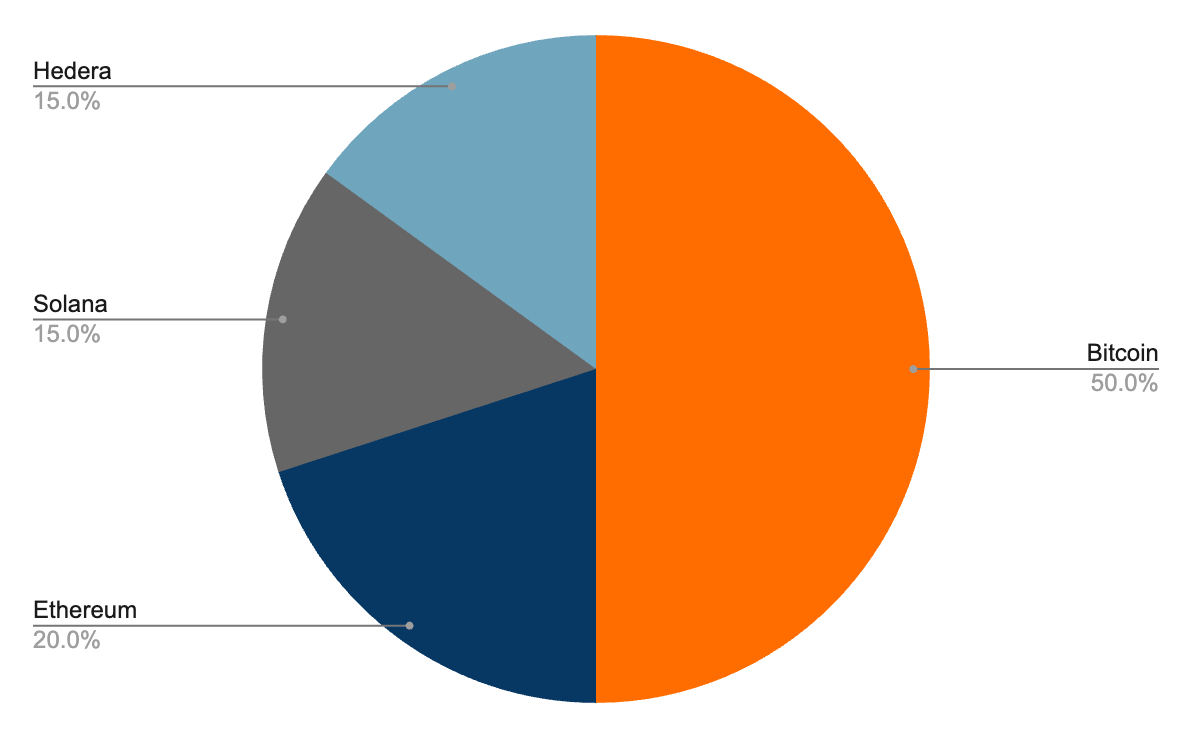

Instead, I would recommend this simple crypto portfolio.

Why I am bullish on Hedera you can read here.

Conclusion

It easily takes 100 – 1,000 hours to truly understand Bitcoin with all its nuances such as Bitcoin mining, the halving, wallet, fees, exchanges, swaps, etc.

I hope the above scripts help to explain Bitcoin in an easy-to-understand and straightforward way.

📘 Read Also

- How To Earn Interest On Your Crypto

- How To Build A Simple Crypto Portfolio – A Step By Step Guide

- Uncovering The Best Crypto To Invest In – Hedera Hashgraph

- How A Millionaire Invests $20 Mio After A Property Sale

FAQ

Can you explain Bitcoin to me?

Bitcoin is a digital currency that operates on a decentralized network called blockchain. It’s like virtual money that can be used for online transactions. Unlike traditional currencies, it’s not controlled by any government or bank. Bitcoin offers secure and transparent transactions, and its limited supply helps maintain its value. It allows individuals to have control over their money and facilitates peer-to-peer transactions globally.

How can I explain Bitcoin?

As a decentralized digital currency, Bitcoin is independent from governments and banks. Transactions are recorded on a secure and transparent blockchain, that is powered by the Bitcoin miners. Bitcoin has a limited supply. It facilitates peer-to-peer transactions globally, granting you more control over your finances.

How to explain how Bitcoin works?

Bitcoin operates on a decentralized digital ledger called blockchain. Transactions are recorded transparently and securely. Miners use complex algorithms to verify transactions and are rewarded with new Bitcoins. It uses cryptography and peer-to-peer networking for secure and efficient digital transactions.

Explain how Bitcoin mining works?

Bitcoin mining involves the process of validating and adding transactions to the blockchain. Miners use powerful computers to solve complex mathematical puzzles that secure the network. Their objective is to find a solution that meets specific criteria, earning them the right to add a new block to the blockchain. Once a block is added, miners receive a reward in the form of newly created Bitcoins. This process ensures the security and integrity of Bitcoin transactions and the overall network. For mining blocks, they get compensated with 6x bitcoin every 10 minutes. After that halving in 2024, this will go down to 3x Bitcoin etc.

Explain what Bitcoin is?

Bitcoin is a decentralized digital currency that operates on a technology called blockchain. It is not controlled by any government or bank, making it independent and secure. Bitcoin can be used for online transactions, just like traditional money. Unlike physical cash, it exists digitally and is stored in digital wallets. It offers transparency, privacy, and the ability to send money globally without intermediaries. With a limited supply and growing adoption, Bitcoin holds the potential to change the future of finance.

What is the Bitcoin halving?

The Bitcoin halving is an event that occurs approximately every four years in the Bitcoin network. It is a programmed reduction in the reward that miners receive for validating transactions and adding them to the blockchain. Specifically, the number of new Bitcoins created and given to miners is halved. This mechanism is in place to ensure a controlled and predictable supply of Bitcoins over time. The halving plays a crucial role in maintaining scarcity and is often associated with potential effects on Bitcoin’s price and mining dynamics.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love