Key Takeaways

- No single investment portfolio suits everyone

- It’s important to be diversified across multiple pillars

- The key is to re-balance occasionally, but not too frequently

- Investment portfolio management should be simple & fun

How To Structure An Investment Portfolio

Many readers know that I have been managing my money for +30 years (I started when I was 15 years old).

In today’s article, I would like to share how I structure my investment portfolio.

Please consider that I am not a professional financial advisor – I just share how I manage my portfolio with a current net worth of 5 Mio USD (you can read my story about how I made 5 Mio US here).

My 8 Foundational Pillars

When thinking about structuring an investment portfolio in general, let’s first take a step back and look at all the possible pillars:

As investors, we can allocate money to one of, some, or all of the following 8x foundational pillars:

- Cash

- Real Estate

- Stocks

- Metals

- Crypto

- Equity

- Bonds

- Art

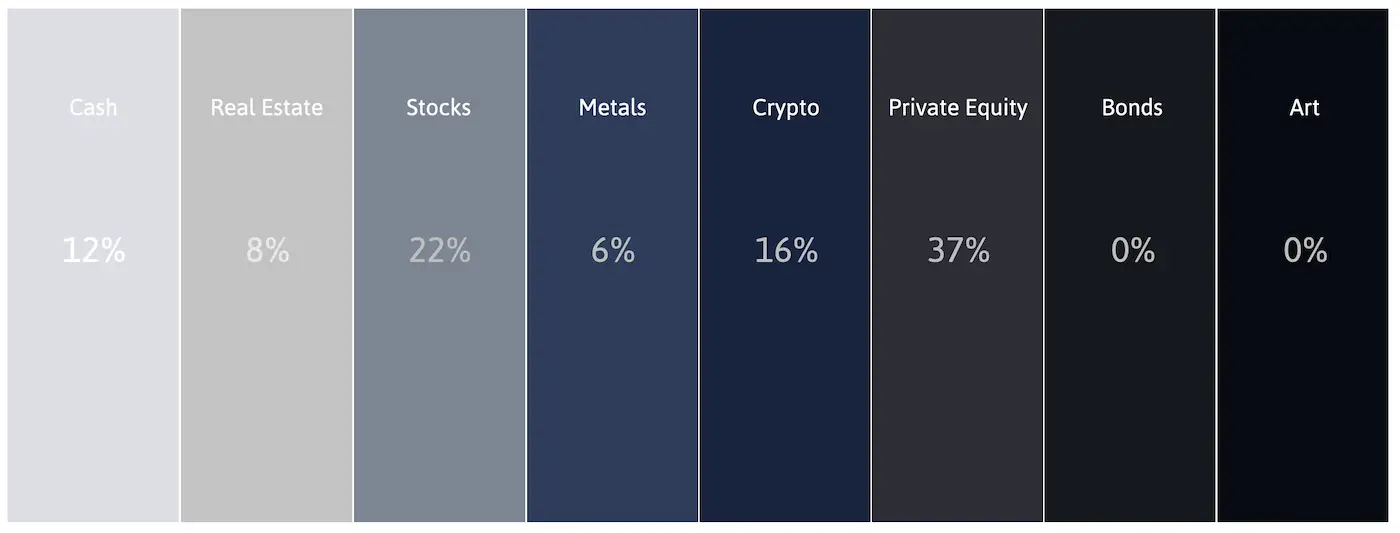

My Current Personal Allocation

I do not have an allocation to all of the pillars. See below for what my personal investment portfolio allocation looks like:

| in ‘000 | ||

| Cash | $485 | 12% |

| Real Estate | $380 | 8% |

| Stocks | $1,330 | 22% |

| Metals | $390 | 6% |

| Crypto | $1,075 | 16% |

| Equity | $1,810 | 37% |

| Bonds | – | 0% |

| Art | – | 0% |

| Total | $5,47 Mio US | 100% |

Pillar I – Cash

I want to always have a good amount of cash available, ready to be deployed whenever opportunities arise.

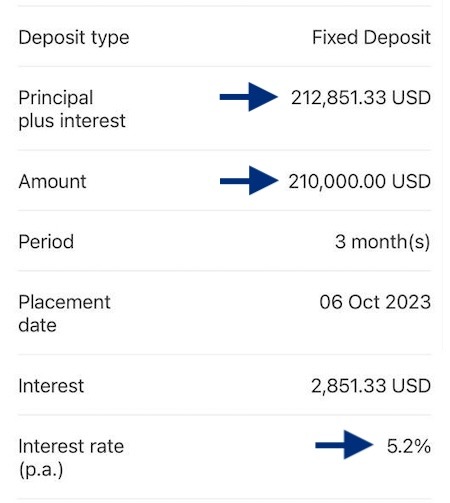

Even when I am in cash, the big majority of my cash (currently 80%), is working hard for me. I typically use fixed deposits to gain approx. 4.5-6% at the moment.

See below what one of such fixed deposits looks like:

Pillar II – Real Estate

The arguably most important pillar for most investors will be real estate, including your own home, plus rental properties.

We own, or to be more precise, my Boss-Wife owns a nice apartment in Singapore, and one in Germany, but I only own one small rental property near Munich.

I bought this 80m2 two-bedroom apartment in 2013 with an 80,000€ down payment and a 200,000€ bank loan at an interest rate of 2,75%.

The total purchase value was 300,000€ incl. notary fees, property taxes, etc.

According to a realtor, it’s now worth 360,000€ (+20%), currently yielding 1,100€/mo, or 13,200€/yr.

That will be a 17% yield on cost once I, or better, hopefully, my tenant, paid back the loan (currently sitting at 130,000€, paying a roughly 800€ annuity).

Tip: Don’t have sufficient cash to make a down payment for a property? Then you can consider investing with EstateGuru, a platform making it easy to invest in thousands of loans to businesses across Europe and grow a diversified real estate portfolio, all backed by the peace of mind provided by a mortgage on an actual, real estate property. I used them before and they are one of the few platforms I can recommend!

Pillar III – Stocks

I structure my third pillar, stocks, and equities, in several different buckets:

- My dream All-Weather Portfolio consists of the world’s best dividend stocks

- A natural resource portfolio with the best commodities stocks

- My short-term trading portfolio with which I try to generate additional cash flow

- A Uranium portfolio, consisting of the best nuclear stocks I could find

- My Metaverse portfolio, with some high-risk/reward Web 3.0 Gaming investments

- My CRISPR portfolio, consisting of my ultra-long-term bets for the CRISPR revolution

Whenever it is time to harvest the fruits of a successful investment theme, I reallocate profits to my long-term All-Weather Portfolio.

Long-term, I plan to grow my All-Weather Portfolio to $3 Mio US, making stocks the strongest pillar of my investment portfolio, which by then should provide me with a passive dividend income of $100,000.

Pillar IV – Metals

I am a long-term stacker of precious metals, mainly Gold, Silver, and Platinum. It started when my grandfather gifted me the first small Krugerrand when he returned from a trip to South Africa. I was instantly hooked.

There are many options to choose from, but I use Goldbroker.com which makes it easy for me to buy and store precious metals in various parts of the world.

Gold and Silver have been a reliable store of value for thousands of years. They did not moon as Bitcoin did, but they also come with significantly fewer risks.

That’s why I allocate quite a bit to Gold, which the Incas believed was the “Sweat of the Sun” and Silver represents the “Tears of the Moon”.

If you like to buy just one single gold stock, it has to be Franco-Nevada, the world’s biggest royalty company, owning 400+ assets in total (of which 112 are producing mines!)

Pillar V – Crypto

This pillar is not for everyone, but one of the most important ones in my investment portfolio.

I believe the asymmetric reward to risk for this asset class is just too appealing not to allocate even just a small part of your liquid net worth.

From my perspective, one % of your liquid net worth is the minimum, and 5% may be the maximum allocation.

As we speak, my current allocation is 16% of my total net worth (incl. real estate and private equity!).

From my liquid net worth, digital assets currently make up 33% (and my dividend stock portfolio makes up 28%).

I am perfectly fine with this and will reallocate accordingly once I see the time is ripe.

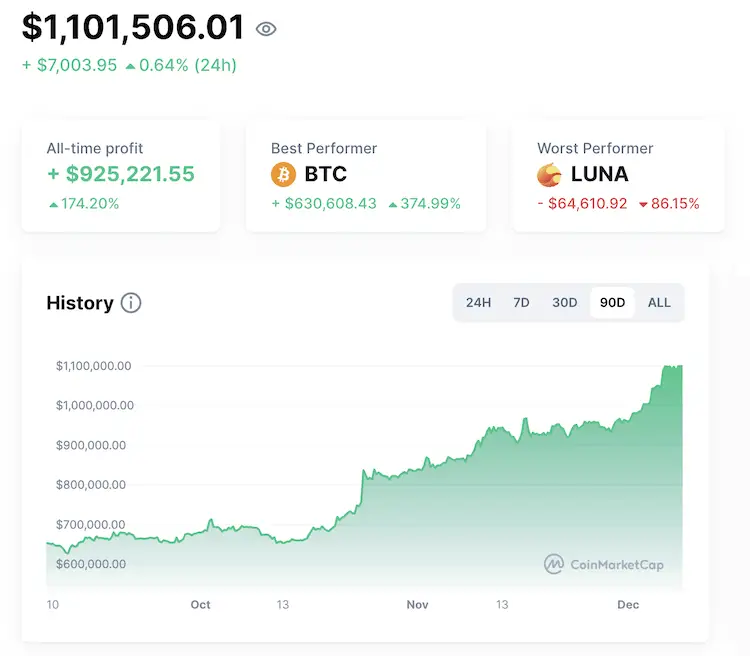

My Current Crypto Portfolio

My portfolio serves as a good illustration of the crazy nature of an asymmetric, high-risk/high-reward investment.

Currently, I have realized a profit of $925,000, coming from an initial investment of $175,000.

It’s not my intention to brag, rather, I see this moment as the emergence of a new groundbreaking asset class, one that will reshape our world. I aim to embrace this change, and not be this unhappy individual shaking my fist at the rapidly evolving landscape.

If you’re unsure where to begin, start by setting up a free account with Kraken or Nexo, and start by just buying $100 worth of Bitcoin. For a simple guide, read my How To Build A Simple Crypto Portfolio post.

Pillar VI – Private Equity

This is the most challenging pillar to build. It involves owning shares in private entities.

Now this can come in multiple shapes and forms, e.g.

- establishing and owning shares in your own company

- acquiring and owning shares in companies of friends, family, or other third parties

- acquiring shares in companies via VC or PE funds (Venture Capital or Private Equity)

- providing seed funding to startup platforms like Kickstarter.com

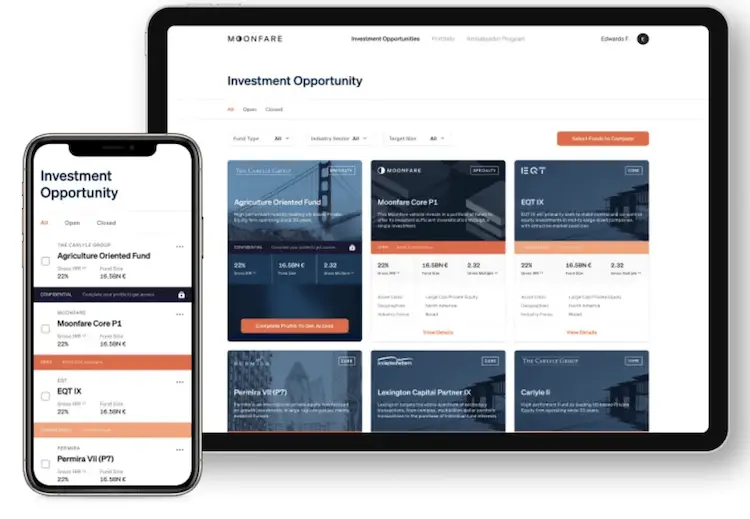

- providing growth capital to PE funds via platforms like Moonfare.com

The ultimate aim for any investor is to end up owning shares in cash-flowing companies, meaning companies that pay a regular dividend.

Dividends From Shares Of Private Companies

I am fortunate enough to own shares in three private, dividend-paying companies. In 2023 so far, I received the following payments:

- $68,572 in May from a service business (from the firm that acquired mine)

- $55,965 in July from a manufacturing business

- $7,677 in July from a sourcing/trading business

I am expecting one more dividend to be paid in mid/late December at approx. $30,000.

It took me my entire +20-year career to get there, but this was always my dream.

Tip: If you don’t know startups or SMEs you can potentially invest in, I’d try to invest between $10,000 to $250,000 in Moonfare.com, a platform giving you access to closed private equity funds managed by established PE firms like KKR.

Pillar VII – Bonds

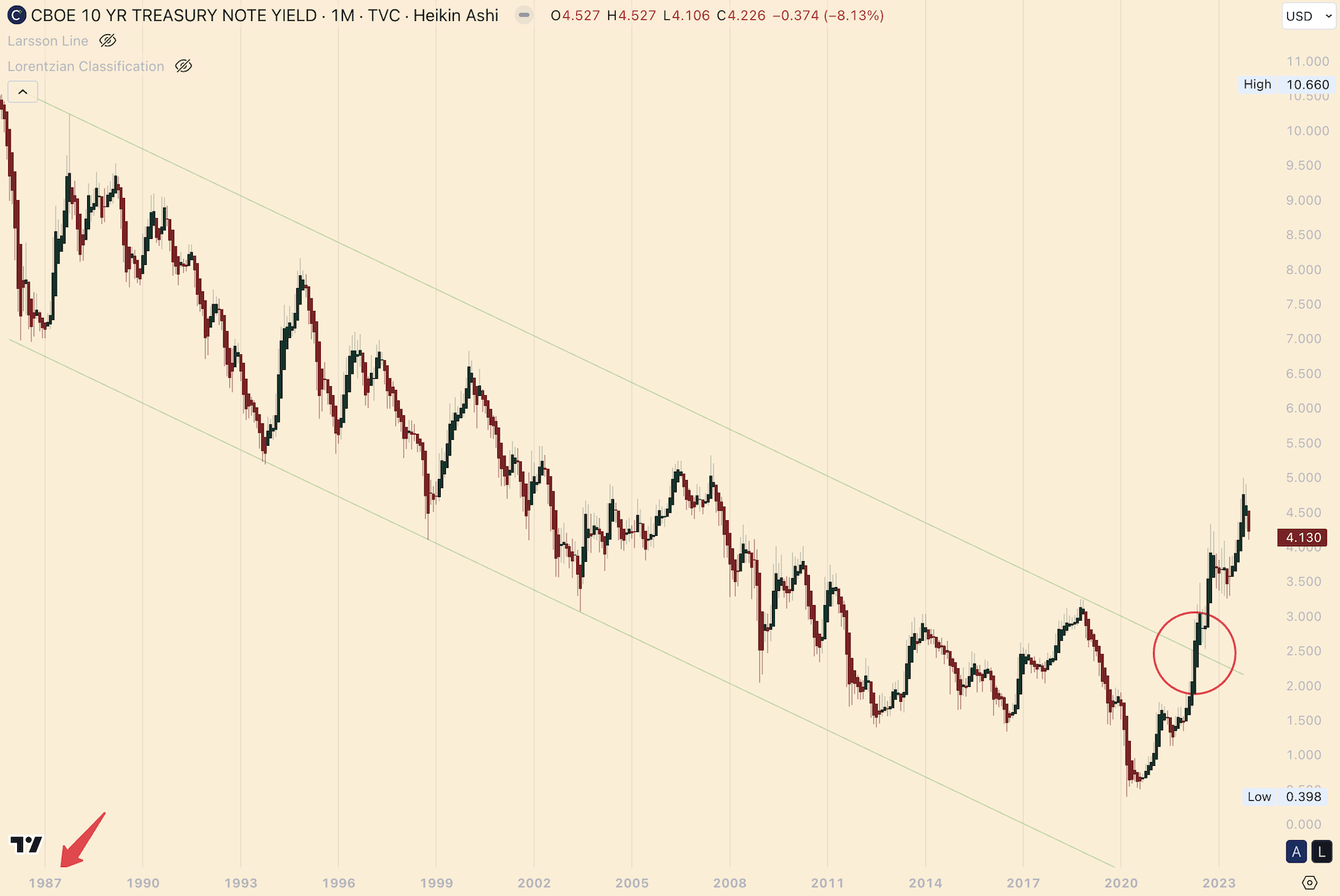

Search for the symbol TVC:TNX on Tradingview.com to view this chart.

I am not a bond guy. I am in my mid-40s, and in my entire adult life, all I have seen are falling interest rates.

Just in 2023, they were able to break out of a 25-year downward trend channel.

For the more senior readers, I understand that bonds might be THE most important pillar in their investment portfolio, and that is fine, it’s just not for me.

With the obscene money printing happening everywhere in the world, I prefer to keep my money in hard assets, and anything that can not be printed.

Pillar VIII – Art

I read in one of Jim Rickard’s books that an Italian family is known to be the one able to preserve wealth the longest.

For more than 900 years this family managed to remain rich.

How? With a simple investment portfolio of three pillars:

- a third in real estate

- a third in gold

- a third in fine art

Yep, art.

But why? Because whenever a war, hyperinflation, or major depression happens, pieces of fine art are so rare that they tend to maintain their value well.

Provided you have enough liquidity to make it through such a crisis, if you come out on the other side still owning some land or properties, some gold, and fine art, you most likely have a good position to re-build, especially when considering a historical perspective spanning centuries rather than just decades.

I love art but don’t know enough about it to make money with it.

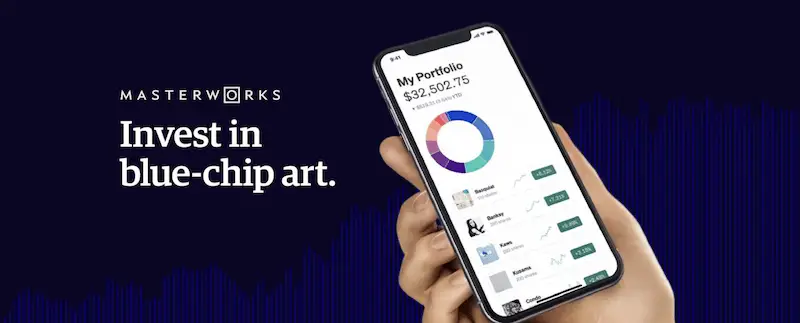

So How To Invest In Fine Art?

Investing in fine art directly I feel is very tough – I think this should only be considered with an art consultant or an expert you know and trust.

I have not tried Masterworks.com yet, but this is something want to try in the next 2-3 years. Surely sounds interesting, they are trying to democratize ownership in blue-chip paintings! A straightforward way of adding fine art as another pillar in your investment portfolio.

Check it out.

How To Get Started?

If you don’t know where to start structuring your investment portfolio, download my 100% free Google Sheet here, make a copy of the sheet (click File then Make A Copy), and fill out the pillar tab with your current allocation.

This will give you a good overview. See which pillars are still missing, or spot pillars where you are over-invested!

Conclusion

I believe it is important and wise to think about the proper structure of your investment portfolio.

In the complex and uncertain times, we live in, a multi-pillar approach is recommended in addition to a good diversification in terms of geography

No one knows what government will completely go crazy and confiscate or tax the shit out of anyone with money. Germany is heading down this way.

That’s why I believe it’s important to have multiple baskets spread across at least a few countries is the way to go.

📘 Read Also

- My Story Of How I Reached Financial Independence With $5 Mio

- The Best Crypto Stock To Buy

- The 5 Best European Insurance Stocks To Buy

FAQ

What is the perfect investment portfolio?

No single investment portfolio suits everyone, but there are a couple of important general rules. For example, it’s important to be diversified across multiple pillars, as well as at least two countries, better even regions (e.g. the U.S. and Europe or Asia). A healthy mix of different asset classes, that you can rebalance occasionally is a good start.

What are investment portfolio examples?

Depending on each investor’s preference, most investment portfolios allocate more or less to each of the following asset classes:

– Cash

– Real Estate

– Stocks

– Metals

– Crypto

– Equity

– Bonds

– Art

Depending on whether you own a home or not, you can start by applying the “a third rule”, meaning one-third should be in real estate, one-third in stocks, and one-third e.g. in bonds, cryptocurrencies or private equity.

What is a portfolio structure?

The way you structure your portfolio across several different asset classes such as Cash, Real Estate, Stocks, Metals, Crypto,

Equity, Bonds, and Art. There are more, but these are the most important and used ones. Try to have at least three different asset classes, best in 2-3 different countries.

What is a good investment portfolio for 30 year-old?

This depends on many different factors, but in general, by the age of 30, you should either already own a home or prepare enough funds for a down payment to buy a home. Then another part should be invested in good, long-term, and low-cost index funds. Maybe consider a small allocation to metals and cryptocurrencies.

Do you have an investment portfolio example excel?

Yes, feel free to make a copy of my free investment portfolio Google Sheets (save it as an Excel file). Click on the Pillars tab and start filling in your information.

What are investment portfolio categories?

The most important investment portfolio categories are typically the following:

– Cash

– Real Estate

– Stocks

– Metals

– Crypto

– Equity

– Bonds

– Art

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love