Silver Exit, Trimming Uranium, Tesla Bullon (2026-01)

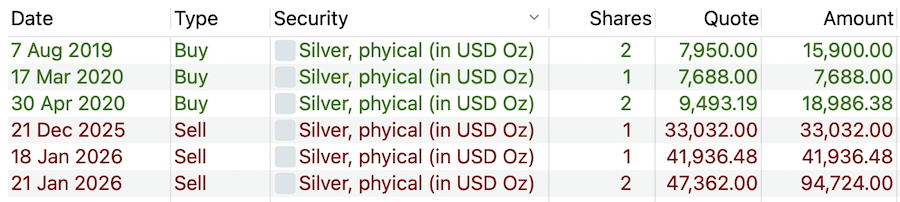

I didn’t do a full silver exit, but sold 80% of my position.

It has been a long time coming. I bought this position in 2019/2020, and after holding it for years, I finally pulled the trigger in January and sold $122k worth. I still have about $42k left, which I wanted to exit at $125 (almost reached!).

Combined with trimming my uranium positions and going heavier into Tesla, this was a busy month.

Here’s a quick summary.

Quick Summary

1/ Dividends Received

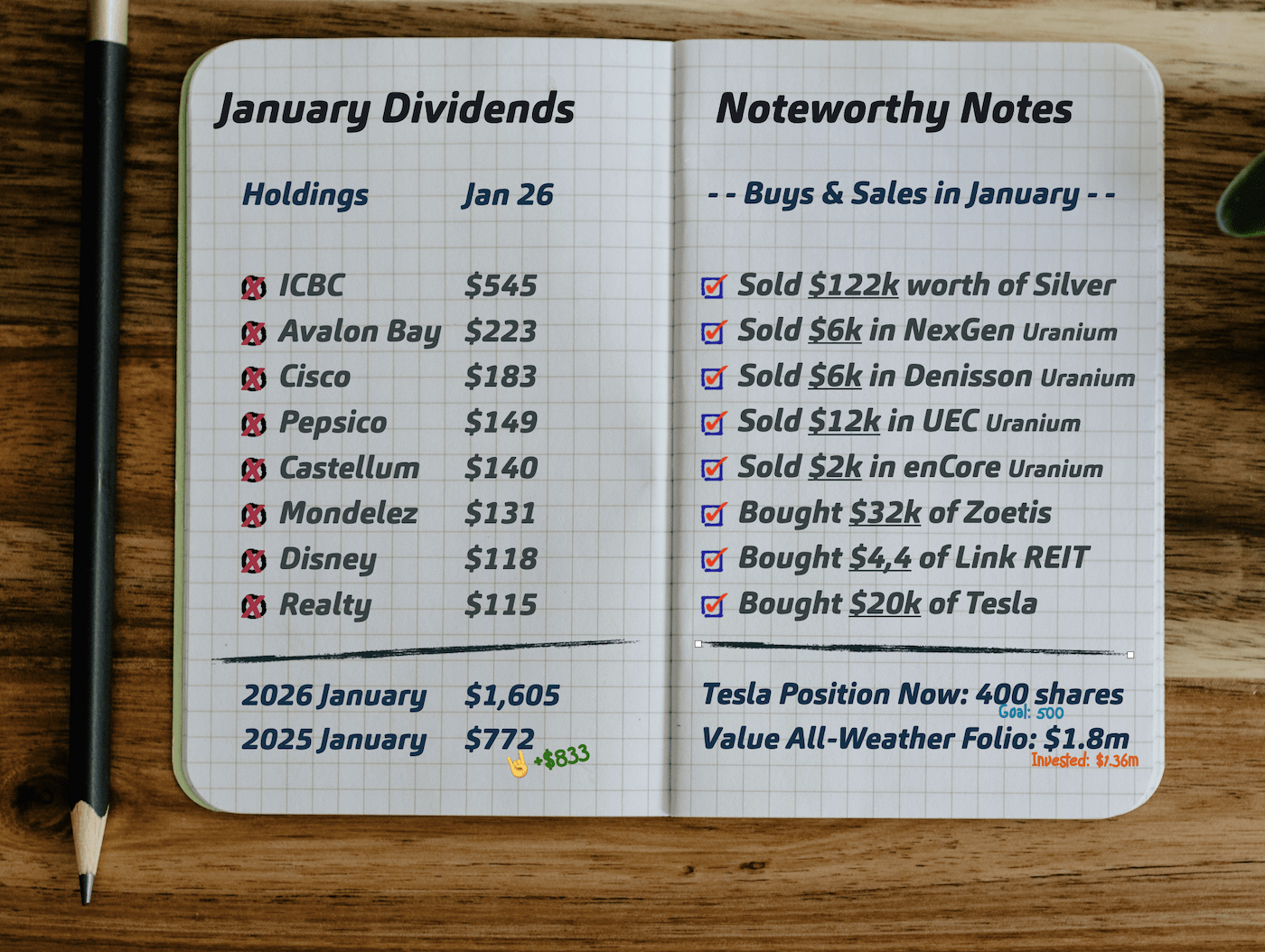

In January, my All-Weather Dividend Portfolio brought in $1,605 in dividends — more than double what I collected in January 2025 ($772). That’s an increase of $833 year-over-year.

| Company | Amount |

|---|---|

| ICBC | $545 |

| AvalonBay | $223 |

| Cisco | $183 |

| PepsiCo | $149 |

| Castellum | $140 |

| Mondelez | $131 |

| Disney | $118 |

| Realty Income | $115 |

| Total | $1,605 |

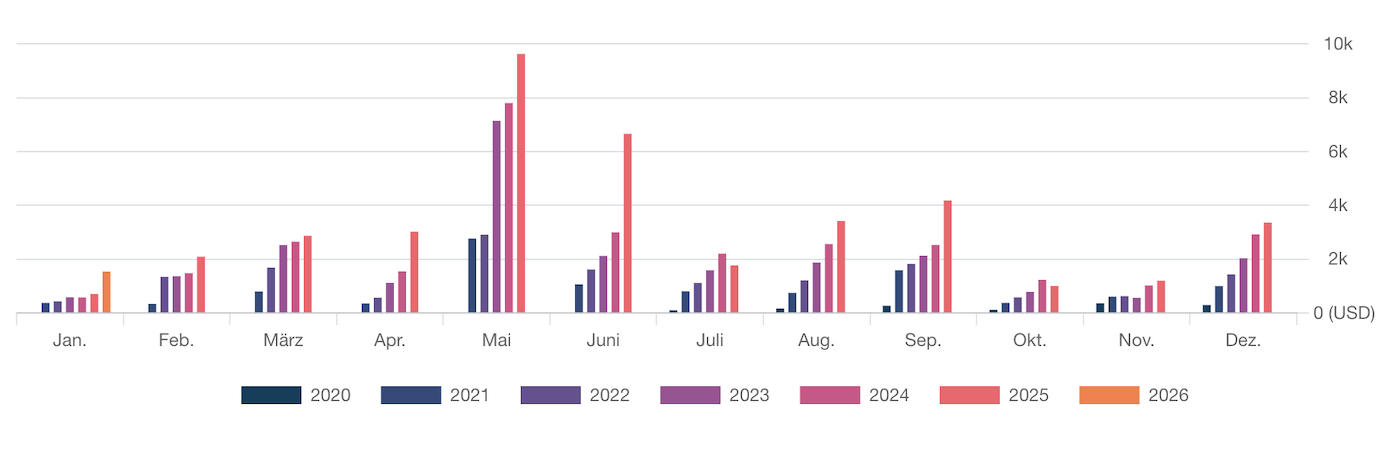

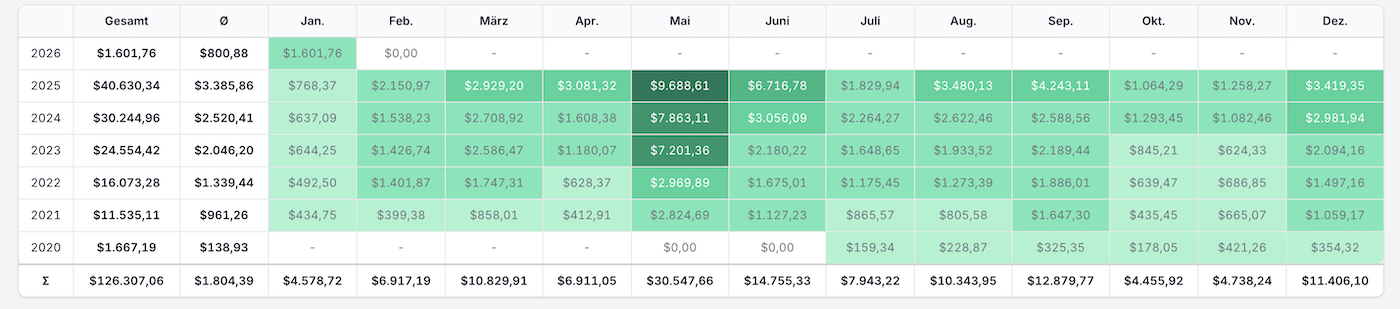

Like other dividend investors sharing their journeys—such as GenXDividend Investor (on Youtube) or Bergfahrten (in German), my dividend history reflects steady, consistent growth in distributions. This is what dividend investing is all about!

I’ve now collected $126,307 in total dividends since 2020. The compounding is starting to feel really real.

The main reason why January this year is a lot better than last year’s is due to my new position in ICBC, based on assets-under-management.

By the way, all these nice charts are created with the free & awesome version of Parqet.

2/ Buys in the Month

I already put some of that silver exit cash to work:

- Zoetis — Added $32k to, IMO, the best animal health stock

- Tesla — Bought 50 share (now at 400, goal is 500) –> trading account

- Link REIT — Small $4.4k addition to IMO the best REIT in Asia

3/ Why The Silver Exit

The silver exit came down to an erratic price swing. When I entered the trade in 2019/2020, my avg. purchase price is around $15/oz, I thought a long-term goal would be maybe $50 or $60 at its best. When the price suddenly shot up to $70, I started selling (see below for all my buys and sells).

I decided to sell 80% of my position (sold 4 out of 5 packages), and keep 20% for now.

4/ Uranium Trimming

Same logic for uranium. I sold:

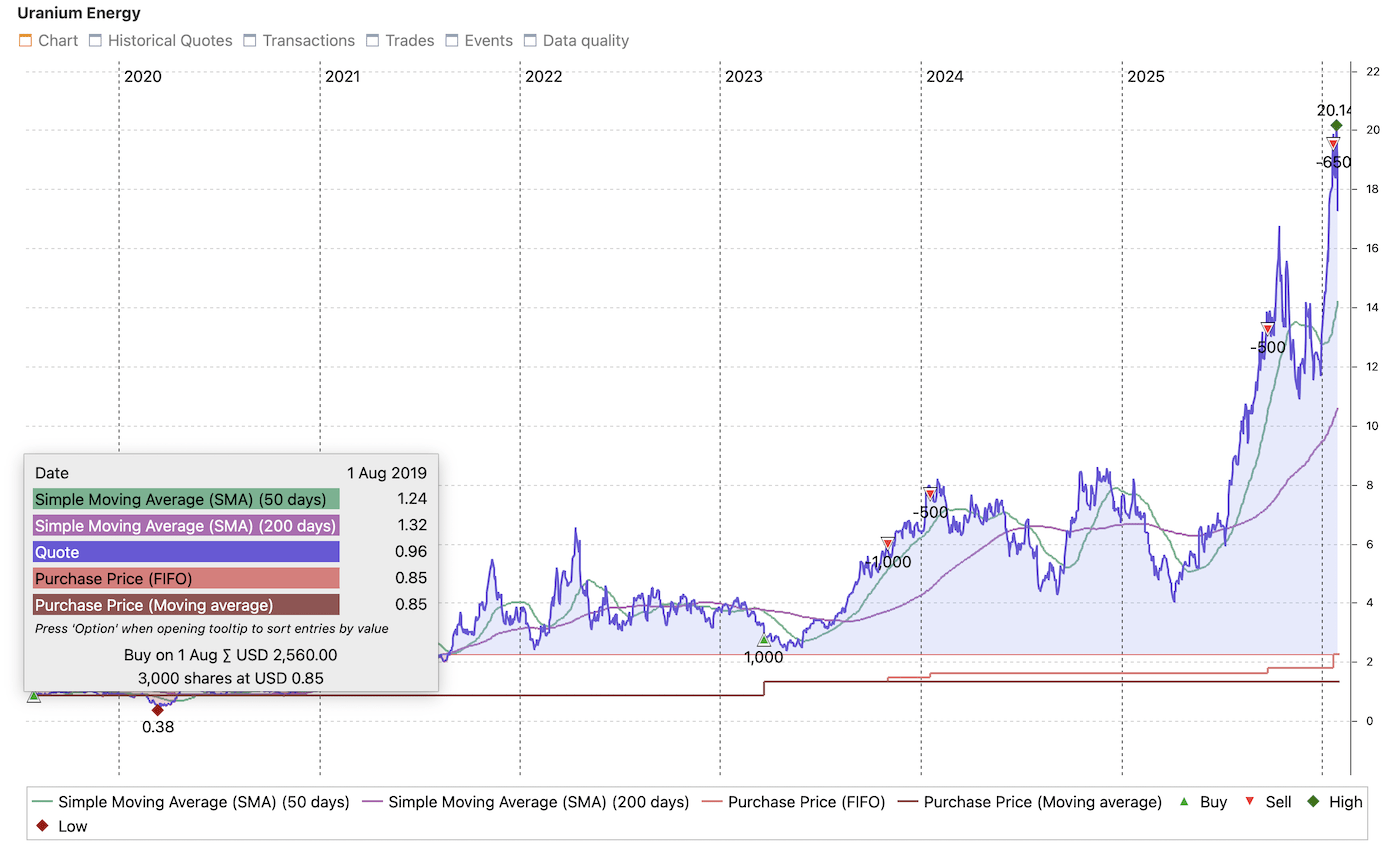

Good trades overall, but not forever holdings. Take a look at $UEC for example, a stock I bought in August 2020 for $0.85. It’s now at $17, hence I try to sell into strength (see red arrows on the chart below).

5/ Portfolio Status

My All-Weather Portfolio sits at $1.8 million (cost basis: $1.36m). Net worth is at $7.9 million.

The strategy stays the same: own quality dividend payers, reinvest, repeat.

I am extremely bullish on Tesla – why? See my 10 reasons below!

Why I Am Extremely Bullish On Tesla

- Core EV Business — Industry-leading EVs with $4.8b free cash-flow!

- Autonomous Driving & Robotaxis — FSD works! Cybercab potential!

- Humanoid Robots — Optimus manufacturing revolution.

- Energy Ecosystem — Solar, storage, charging integrated.

- Battery & Manufacturing — 4680 cells, custom silicon chips.

- Advanced Manufacturing — Gigafactories, machine-making-machine efficiency.

- Insurance — Real driving data advantage.

- Software & Services — OTA updates, subscriptions, recurring revenue.

- Vertical AI Integration — Custom chips, Dojo (!!), in-vehicle inference.

- Ecosystem Lock-in — Products reinforce switching costs, lifetime value.

Thanks for reading. See you next month.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love