The Two Best Latin American Energy Stocks

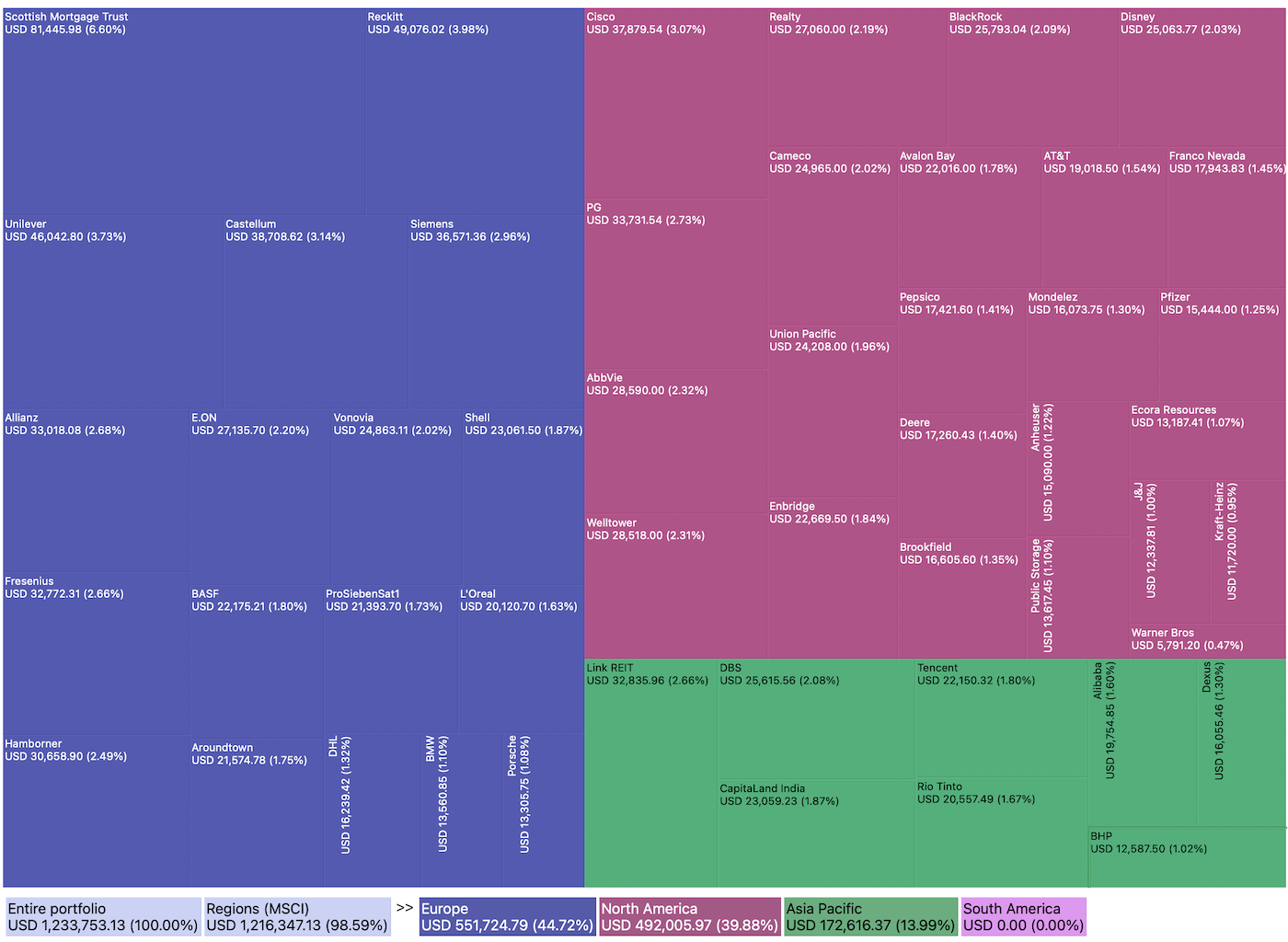

As an international investor, I have a large allocation to Europe, the U.S., and Asia, but none to Latin America.

Check out the following image showing my entire current holdings of my All-Weather Portfolio.

Things Are Changing

I currently see Argentina and the U.S. leading a global shift toward reining in excessive leftist ideological spending and returning to more pragmatic, fiscally responsible policies.

Argentina is already starting to see the early rewards of this shift, and I believe it’s only a matter of time before more countries follow suit.

Leftist governments often prioritize ideology over practicality—pushing hard for human rights, equality and renewables, while sidelining fossil fuels like oil.

But here’s the thing: oil isn’t going anywhere anytime soon. In fact, we haven’t even hit peak oil demand yet! The world still runs on it, and that’s not changing overnight.

With more rational, conservative governments gaining traction, I think now’s a smart time to keep an eye on Latin American energy stocks.

There could be some real value gems hidden in the market, waiting for investors like us to uncover them. It’s all about spotting opportunity where others might not be looking.

Why Oil Is Not Dead

First off, here is why I believe oil will be relevant for decades to come:

Beyond Transport: Oil is everywhere, e.g. in plastics, chemicals, and pharmaceuticals, ensuring ongoing demand.

Transition Pace: The energy shift is slow due to infrastructure and tech limits, keeping oil relevant.

Demand Growth: Middle classes emerge in the 2nd/3rd world, hence the energy needs to grow, sustaining oil demand globally.

Investment Drop: Less exploration due to regulation, can lead to future supply shortages.

Only 40% of the oil consumed goes into actually becoming gasoline, and with hundreds of millions of people joining the middle class, even a constant demand for gasoline is given.

Are These The Two Best Latin American Energy Stocks?

When I started looking for potential energy stocks in Latin America, I used Gurufocus’ excellent All-in-one-screener and searched for

- HQ in Latin America, but listed overseas

- Oil & Gas sector

- min. $5b in market cap

- min. 1% dividend yield

The Gurufocus screener found two options that meet my criteria:

| Ticker | Company | Country | Market Cap | PE | Yield % |

| $PBR | Petrobras | Brazil | 85B US | 5.4 | 20.5% |

| $EC | Ecopetrol | Colombia | 20B US | 5.7 | 14.5% |

Wow, good first impression!

Let’s dig a little bit into these companies.

Latin American Energy Stock #1 – EcoPetrol

We first travel to Colombia.

EcoPetrol Quick Profile

-

Company Name: Ecopetrol S.A.

-

Industry: Oil and Gas

-

Founded: 1921 (as the Tropical Oil Company)

-

Headquarters: Bogota, Colombia

- Revenues: 243b US

-

Core Business: An integrated energy company involved in the exploration, production, transportation, refining, and commercialization of oil and gas.

-

Segments: Exploration and Production, Transport/Logistics, Refining, Petrochemical & Biofuels, Electric Power Transmission

-

Ownership: Majority is owned by the Colombian government, with shares also traded on the Colombian Stock Exchange and the NYSE.

-

Global Presence: Operations in Colombia, the U.S., Brazil, Peru, and the Gulf of America

My Investment Thesis For EcoPetrol

I’m bullish on $EC due to its

- excellent oil projects in multiple jurisdictions,

- attractive valuation,

- strong dividend yield, and

- the potential for significant political and economic tailwinds in the coming years.

Trading at a compelling valuation compared to its peers, $EC offers investors an opportunity to buy into a stable, cash-generative business at a steep discount.

Looking ahead, I see a potential catalyst in Colombia’s expected political shift from a leftist to a more conservative government in 2026. Historically, conservative administrations in Latin America have been more business-friendly, particularly toward the energy sector.

I expect this shift could lead to improved regulatory conditions, increased investment in oil and gas infrastructure, and a more favorable environment for $EC to expand its operations. Additionally, as global oil demand remains resilient and the world continues to rely on hydrocarbons, Ecopetrol’s focus on both traditional energy and renewable initiatives provides a balanced growth strategy.

In summary, $EC combines value, income, and growth potential, making it a standout opportunity in the Latin American energy sector. For investors willing to take a medium-term view, the stock offers a compelling mix of stability and upside, especially as political and economic conditions evolve in its favor.

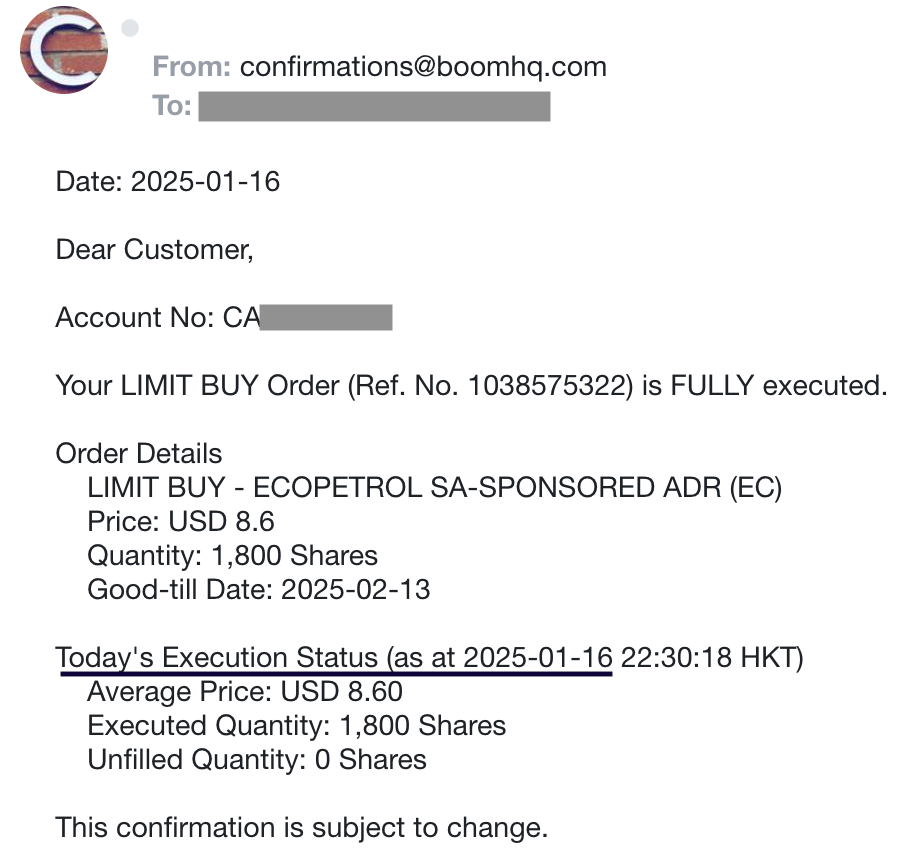

I therefore went ahead and made my first purchase a few weeks ago:

Latin American Energy Stock #2 – Petrobras

Let’s move further to the Southeast and see what we can find in Brazil.

- Company Name: Petróleo Brasileiro S.A.

- Industry: Oil and Gas

- Founded: 1953

- Headquarters: Rio de Janeiro, Brazil

- Revenues: 712b US

- Core Business: A global energy giant engaged in the exploration, production, refining, distribution, and marketing of oil and gas, as well as renewable energy initiatives.

- Segments: Exploration and Production, Refining, Transportation and Marketing, Distribution, Gas and Power, Biofuels, and Renewable Energy.

Ownership: Majority-owned by the Brazilian government, with shares traded on the São Paulo Stock Exchange (B3) and the NYSE. - Global Presence: Operations span across Brazil, the U.S., Argentina, Bolivia, Nigeria, and several other countries, with a strong focus on deepwater and ultra-deepwater oil exploration.

My Investment Thesis For Petrobras

I’m bullish on Petrobras (PBR) due to

- its dominant position in Brazil’s energy sector,

- attractive valuation, and

- robust dividend payouts.

All of which make it a standout opportunity in the global oil and gas market.

$PBR trades at a discount compared to many of its international peers, offering investors an entry point into a high-quality, cash-generative business. The company’s commitment to returning capital to shareholders through substantial dividends is a major draw, especially in a low-yield environment.

Looking ahead, I see significant upside potential as $PBR continues to capitalize on its world-class deepwater and ultra-deepwater oil reserves, particularly near Brazil’s coast.

These assets are not only cost-competitive but also position $PBR as a key player in meeting global oil demand for decades to come.

In summary, $PBR also offers a unique combination of value, income, and growth potential.

For investors with a long-term horizon, the stock represents a compelling opportunity to gain exposure to a resilient energy giant with significant upside as it continues to unlock the value of its world-class assets.

Petrobras & EcoPetrol VS The Best

Let’s compare $PBR and $EC with the best of the best: Shell (which I also own in my portfolio), Exxon Mobil and Warren Buffett’s favorite, Occidental Petroleum.

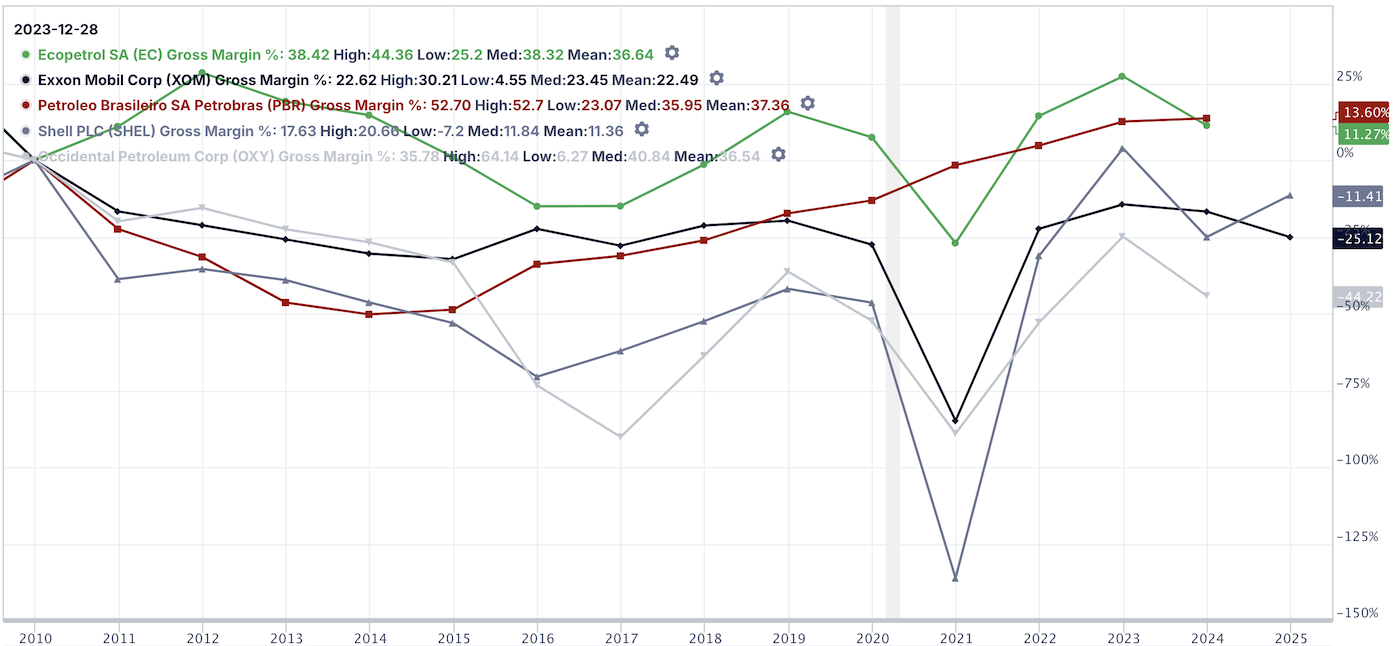

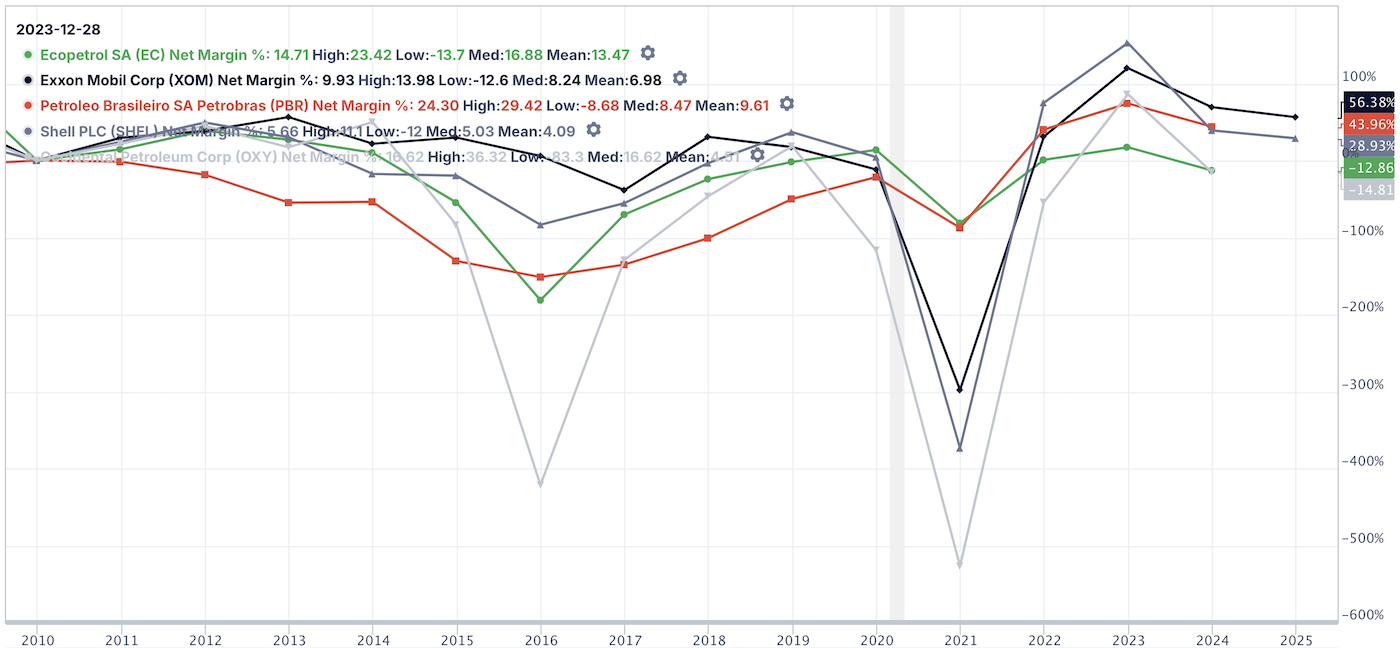

First off, let’s compare their margins:

Over the span of 15 years, both $PBR and $EC have better Gross Margins than the best oil companies in the world – wow.

Let’s look how quickly they grow:

| 3Yr Rev Growth/share | 3Yr EBITDA/share | ||

| $EC | Ecopetrol | 42 | 51 |

| $PBR | Petrobras | 22 | 43 |

| $OXY | Occidental (Buffett) | 15 | 0 |

| $SHEL | Shell (I own Shell) | 12 | 7 |

| $XOM | Exxon Mobil | 7 | 11 |

Again, both do very well.

$EC stands out as the clear winner, due to is fast growth. Growing is easy, but growing its EBITDA per share at the same time is not!

It’s impressive how both companies grew their profitability faster than their revenues!

| Company | Price-to-GF-Value | PE | Yield in % | PS |

| Exxon Mobil | 1.09 | 14 | 3.6% | 1.4 |

| Shell | 1.10 | 13 | 4.1% | 0.8 |

| Petrobras | 1.26 | 5 | 20.5% | 1.0 |

| Occidental | 0.88 | 12 | 1.8% | 1.7 |

| Ecopetrol | 1 | 6 | 13.7% | 0.6 |

(Price to GF Value is the Price to the Gurufocus value – the lower the better. 1 equals fairly price, below 1 is undervalued.

Last but not least, let’s look at the net margin, which is what the companies take home after everything is paid for, incl. taxes.

Look at 2020 to 2022 – impressive how well our two Latin American energy stocks!

Final Head-2-Head

There are many things I like with $EC and many I like in $PBR. Here is a final head-2-head:

The Verdict And Plan

I really like both companies a lot and believe both represent excellent long-term investment opportunities.

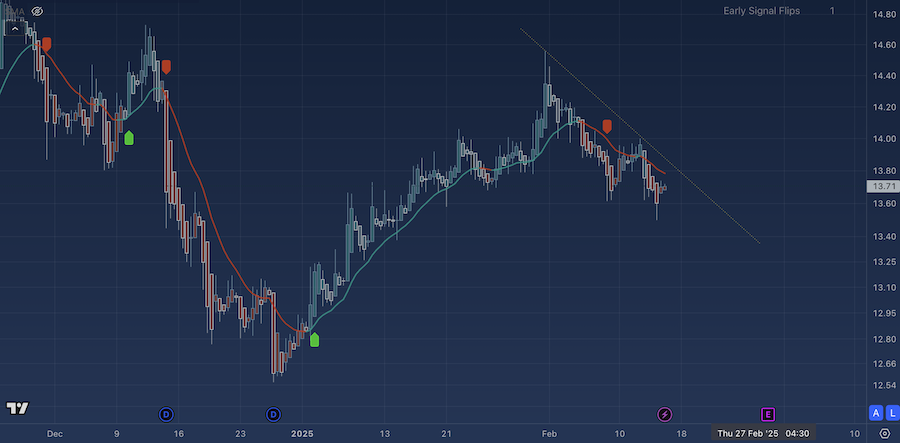

As I shared before, I already bought 1,800 shares of $EC at $8.60 US. I did not buy $PBR yet because I have not received a buy signal from my main indicator yet on Tradingview (see image below – green means buy).

Similar to $EC, I will put in approx. $15-20,000 into $PBR shares once my Tradingview alert gets triggered!

Conclusion

I am happy to have found two excellent Latin American energy stocks that I plan to hold for the ultra-long term.

Both are dividend machines that will add to my passive income ($135,000 in 2024).

📘 Read Also

- The 5 Best Container Shipping Stocks with Dividends

- 5 European Stocks with 20Yr Consecutive Dividend Increases

- 10 Best European Football Stocks To Buy

FAQ

Are energy stocks a good long-term investment?

Yes, energy stocks can be a strong long-term investment due to the world’s ongoing reliance on oil and gas, coupled with the sector’s steady cash flows and dividends.

What are the best Latin American energy stocks to buy now?

How are Latin American energy stocks performing compared to global peers?

Latin American energy stocks are performing competitively, with many companies benefiting from lower valuations and region-specific growth opportunities.

Which energy stocks pay the highest dividends in Latin America?

Why are energy stocks rising in Latin America?

Energy stocks in Latin America are rising due to stable oil prices, political shifts toward pro-business policies, and the region’s vast natural resources.

When is the best time to invest in Latin American energy stocks?

The best time to invest is now, as many Latin American energy stocks are undervalued and poised to benefit from improving economic and political conditions.

Where are energy stocks headed in the next 5 years?

Energy stocks are expected to remain strong over the next 5 years, driven by global energy demand and the transition to a balanced energy mix.

Will Latin American energy stocks benefit from global energy demand growth?

Absolutely, Latin American energy stocks are well-positioned to benefit from rising global energy demand, thanks to their cost-competitive production and strategic reserves.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love