Building A Wealth Fortress Or ‘Die With Zero’?

I recently finished listening to an intriguing audiobook called Die With Zero (find it on Amazon).

The author, a successful and wealthy commodities trader, presents a bold argument: we should aim to fully spend our money within our lifetime.

His philosophy suggests that instead of focusing on accumulating assets, we should live ‘our best lives’, seek out meaningful experiences, and ultimately pass away with no financial legacy. The reward? A wealth of “memory dividends”—lasting, enriching memories for ourselves, and our loved ones.

It’s a thought-provoking concept, one that challenges my perspective.

I believe each generation is responsible for ensuring the next has a solid foundation and a protective financial safety net that can support them through life’s unpredictable challenges.

Particularly now, as we transition from what I see as the “earth epoch” into the “air epoch“—combined with the disruptive forces of a Fourth Turning (find it on Amazon)—economic and social turbulence seems inevitable.

Responsible planning today can offer essential security for future generations through these uncertain times, which may last five, ten, or even fifteen years.

So, which approach should we choose?

Are we supposed to master delayed gratification and build a lasting “wealth fortress” to protect our families? Or do we spend more freely, prioritize the experiences of today, and embrace the idea of “dying with zero”?

What Is a Wealth Fortress?

As a fan of role-playing games, I’ve always been drawn to castles and fortresses. The concept of a fortress represents strength, endurance, and resilience—a solid structure that stands the test of time, providing safety and protection.

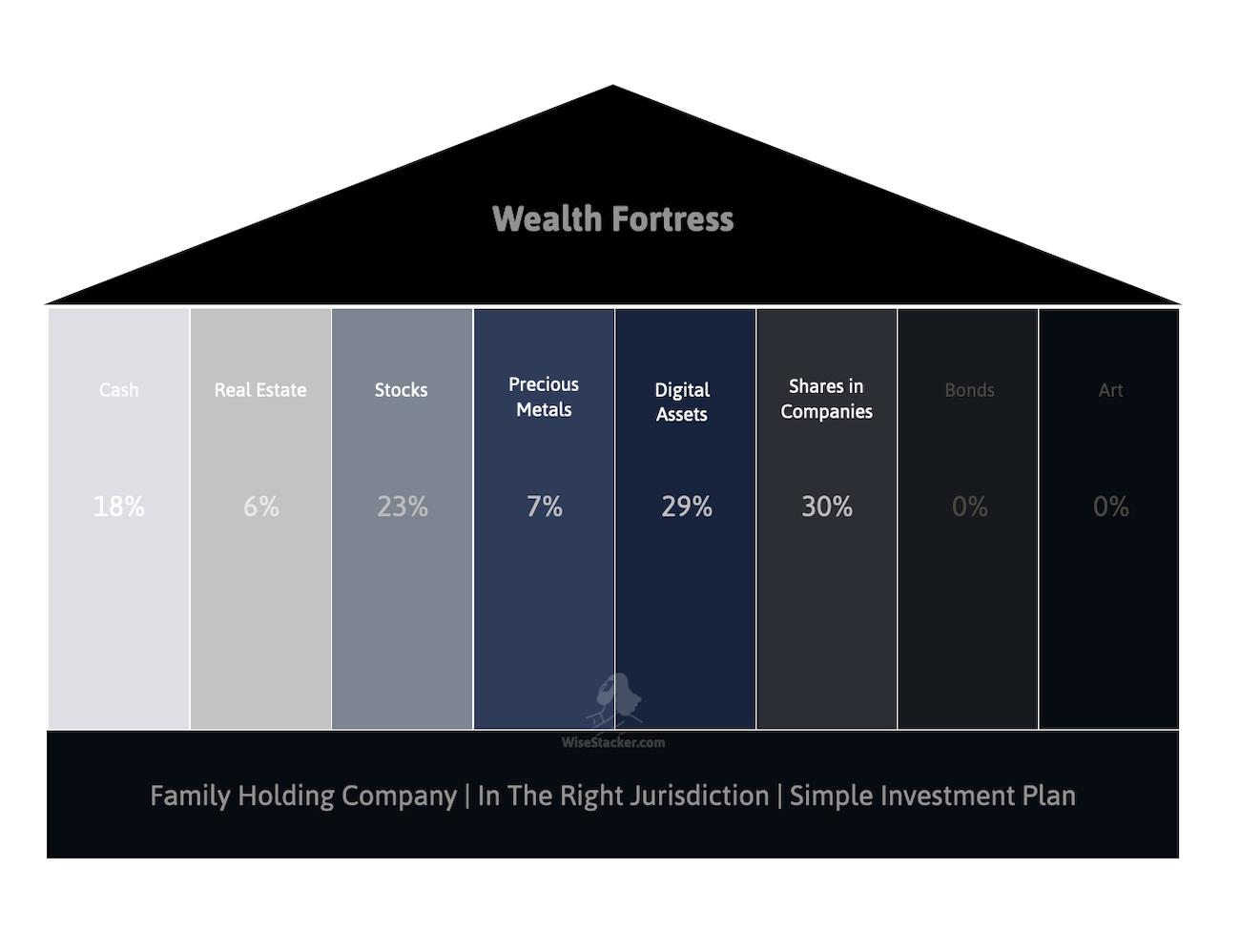

In financial terms, a “wealth fortress” is a robust financial structure with a strong, enduring portfolio.

It’s built on a foundation designed to withstand life’s storms and outlast us, creating a legacy of security and stability for generations to come.

I think of myself as the third generation in a family business story. My grandfather started a company, my father and uncle expanded it, and I… studied art.

Just kidding! But as the saying goes, “from rags to riches and back in three generations.” I aim to be the generation that solidifies our family’s fortune, building something that will outlive me.

I hope that my children will become responsible stewards, preserving and growing our family’s resources for the future.

Right now, here’s what our family wealth fortress is built upon:

Now, the concept of a “wealth fortress” contrasts sharply with the ideas of the following book.

The ‘Die With Zero’ Book

The book Die with Zero by Bill Perkins, challenges the conventional wisdom of accumulating wealth to pass down.

Instead, Perkins advocates for a radically different approach: spending down one’s wealth during one’s lifetime to maximize life satisfaction.

The Key Ideas from Die with Zero

- Redefine Money’s Purpose: View money as a tool for creating rich experiences and memories, rather than as a measure of status or security.

- Focus on Experiences Over Wealth: Perkins promotes investing in meaningful moments and relationships instead of accumulating assets.

- Addressing Financial Concerns: The book tackles fears of running out of money and provides strategies to manage finances to balance living well and maintaining security.

- Real-Life Examples: Through stories and examples from Perkins’ life and those of his clients, readers gain insight into how to apply the “die with zero” philosophy.

Quick Review

- It’s a small book that I enjoyed to read.

- I like its essential message: Don’t forget to enjoy life, and allow yourself to ‘live a little’.

- But this only applies to people who made enough money to never have to worry about life ever again.

- For example, the author invited 25 or so of his closest family members to a boutique hotel on a remote island, with all expenses paid for. If you have that much money, it’s of course awesome to share it with others, but many folks will not be able to relate to that.

My Take And Key Takeaways

In the end, I agree with Bill Perkins’ perspective that we should create as many memorable experiences with our loved ones as we can.

Life is, after all, about the moments we share and the memories we leave behind. However, I believe it would be short-sighted—and even irresponsible—to focus solely on living for today without ensuring that our loved ones have a stable foundation to fall back on.

As so often, I think the balanced Golden Middle is best which is what I opt for: Enjoy life’s richness while building a “wealth fortress” that can support our family through whatever challenges the future may bring.

By blending meaningful experiences with financial security, we can create a legacy that not only lives on in memories but also provides tangible protection and opportunities for generations to come.

📘 Read Also

- The Family Bank: Secure Your Family’s Financial Future

- Is The Kohl Stock The Next Big Short Squeeze Opportunity?

- Buying The Best GenZ Stock | Trade Alert

FAQ

What is a wealth fortress?

A wealth fortress is a financial structure designed to provide lasting security and stability, built to protect and sustain wealth across generations, even during turbulent times.

How can building a wealth fortress benefit future generations?

By creating a wealth fortress, you offer your family a foundation of financial resilience, enabling future generations to weather economic challenges and pursue opportunities without the same financial pressures.

What are the key components of a strong wealth fortress?

A strong wealth fortress typically includes diversified investments, a well-constructed portfolio, risk management strategies, and assets that hold or increase in value over time, such as real estate and equities.

How is a wealth fortress different from traditional wealth-building strategies?

Unlike traditional wealth-building, which often focuses on individual wealth goals, a wealth fortress is built with the intent to outlast its creator, providing a legacy of financial security for the family.

How do I start building a wealth fortress for my family?

Begin by setting long-term financial goals, diversifying your investments, and creating a solid plan that includes risk management and wealth preservation tactics to sustain value over generations.

What are the risks of focusing solely on a wealth fortress approach?

Prioritizing wealth preservation can sometimes limit personal enjoyment of wealth, as well as restrict spending on experiences in the present, which may reduce life satisfaction for those who focus exclusively on legacy-building.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love