Best Dividend Stocks in France

French is a fantastic country, with a rich history, beautiful culture, amazing landscapes, and awesome food and wine. It also has some fantastic companies creating products that are respected and used all over the world. But how many of those are dividend-paying stocks? Can we find any gems? Let’s take a close look at the best French dividend stocks!

Largest French Dividend Stocks

| Ticker | Company | Sales in Bio | Market Cap | PS |

| (XPAR:MC) | LVMH ⭐️ | $93 | $375 | 4.0 |

| (XPAR:OR) | L’Oreal ⭐️ | $44 | $258 | 5.8 |

| (XPAR:TTE) | TotalEnergies | $234 | $154 | 0.7 |

| (XPAR:SAN) | Sanofi | $51 | $131 | 2.6 |

| (XPAR:CDI) | Christian Dior | $93 | $129 | 1.4 |

| (XPAR:SU) | Schneider Electric ⭐️ | $39 | $107 | 2.8 |

| (XPAR:AI) | Air Liquide | $33 | $98 | 3.0 |

| (XPAR:EL) | Essilorluxottica | $28 | $91 | 3.2 |

| (XPAR:BNP) | BNP Paribas ⭐️ | $66 | $79 | 1.3 |

| (XPAR:CS) | AXA | $116 | $73 | 0.6 |

| (XPAR:DG) | Vinci | $73 | $72 | 1.0 |

| (XPAR:KER) | Kering ⭐️ | $23 | $51 | 2.2 |

(stocks with a ⭐️ are those I like from a first look, and also like as I have worked with them either directly or indirectly)

Haute Couture Rules

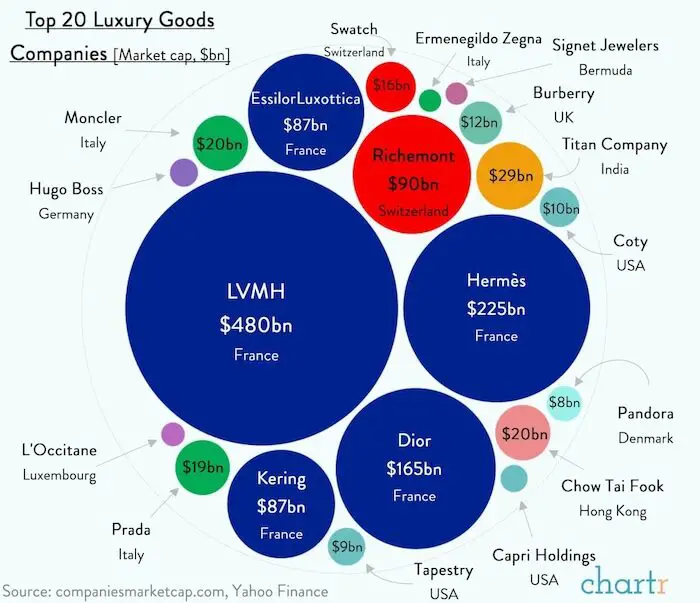

LVMH, Hermès, Dior, EssilorLuxottica, and Kering, prominent French entities, collectively boast a market capitalization exceeding €1 trillion.

This constitutes roughly 80% of the cumulative value of the world’s top 20 luxury companies, solidifying Paris’s stock exchange as the largest in Europe!

LVMH (Louis Vuitton Moet Hennessy) stands out, as it is not only the stock with the highest market cap in France but in all of Europe. With hundreds of brands, ranging from handbags, perfumes, fashion, and spirits to shoes, LVMH is like a “Luxury ETF” in itself.

Key Dividend Metrics Of Best French Dividends

Let’s take a look at the key dividend metrics of the best French dividend stocks:

| Company Name | Div Frequency | Yield in % | Payout Ratio | Div Growth (5 Yr) |

| BNP Paribas ⛔️ | 1 | 😊 6.3 | 0.53 | 🚫 0.0 |

| AXA ⛔️ | 1 | 😊 5.8 | 0.59 | 🚫 3.5 |

| TotalEnergies ⭐️ | 4 | 😊 4.9 | 0.39 | 🚫 2.1 |

| Sanofi ⛔️ | 1 | 3.8 | 0.49 | 🚫 2.3 |

| Kering ⭐️ | 2 | 3.7 | 0.5 | 😘 16.6 |

| Vinci ⛔️ | 2 | 3.5 | 0.51 | 🚫 4.3 |

| Christian Dior | 2 | 1.9 | 😘 0.33 | 😘 23.6 |

| LVMH ⭐️ | 2 | 1.8 | 😘 0.38 | 😘 17.8 |

| Schneider Electric ⭐️ | 1 | 1.8 | 0.45 | 6.9 |

| Essilorluxottica ⛔️ | 1 | 1.8 | 0.62 | 🚫 2.8 |

| Air Liquide ⛔️ | 1 | 1.7 | 0.49 | 🚫 5.9 |

| L’Oreal ⛔️ | 1 | 1.4 | 0.55 | 🚫 6.6 |

All stocks marked with a ⛔️ have less than a 7% dividend growth rate and are therefore not interesting enough for me to be allowed to enter the holy halls of my All-Weather Portfolio, in which I intend to only hold the best buy-and-hold forever dividend growers in the world.

Valuation of Best French Dividend Stocks

Let’s now look at the price-to-earning or PE rations, and price-to-book or PB rations, as well as the price-to-free-cash-flow.

As a happily paying member of Gurufocus, I also get to see the assessment of their in-house valuation method. According to this most of the presented dividend stocks are ‘modestly undervalued‘.

| Company Name | PE | PB | Price-to-FCF | Gurufocus Valuation |

| TotalEnergies | 8.1 | 1.3 | 11.7 |

Modestly Undervalued

|

| Kering | 13.1 | 3.1 | 23.9 |

Significantly Undervalued

|

| Christian Dior ⛔️ | 17.5 | 5.8 | 11.2 |

Modestly Undervalued

|

| LVMH | 21.0 | 5.8 | 32.2 |

Modestly Undervalued

|

| Schneider Electric ⛔️ | 🚫 24.8 | 3.9 | 26.9 | Fairly Valued |

As Christian Dior owns more than 40% of LVMH, it essentially acts like a family holding firm. That’s why I will not consider it further.

Although I like the products and services of Schneider Electric, a PE of 24.8 is too high for me.

This leaves us with..

🥁🥁 drum roll..

The Three Best Dividend Stocks in France

- LVMH (LVMUY)

- Kering (PPRUY)

- TotalEnergies (TTE)

I have written about the 10 best dividend-paying luxury stocks before, and it is no surprise that two of the three top dividend stocks are luxury brands.

My conclusion was that Kering (owner of Gucci, Yves Saint Laurent, and Bottega Veneta) is the creme de la creme.

But let’s take another look and see how it compares to LVMH and TotalEnergies when looking at a few more important valuation metrics.

ROIs of The 3 Best Dividend Stocks in France

We can see a tight race when looking at the return on assets and return on invested capital, but arguably the most important metric of them all is the return on equity. And here is where LVMH takes the crown.

| Company Name | ROE% | ROA% | ROIC% |

| LVMH 👑 | 29.4 | 11.9 | 14.0 |

| Kering ⭐️ | 24.3 | 10.0 | 14.6 |

| TotalEnergies 🚫 | 16.8 | 6.3 | 10.1 |

Return on Equity (ROE%) is often considered more crucial than Return on Assets (ROA%) or Return on Invested Capital (ROIC%) because it directly measures how well a company is generating profits from the shareholders’ equity.

Put simply, ROE tells you how efficiently a company is using its shareholders’ money to make a profit. A higher ROE suggests that the company is better at turning invested money into profits, which is ultimately what shareholders want.

Why LVMH Is My Favorite French Dividend Stock 🏆

I believe any of these three companies are good buys and long-term holds, but my favorite French dividend stock is LVMH.

Below are a couple of reasons why I like the stock, and why I decided to build a position in it:

Consumer Spending Trend

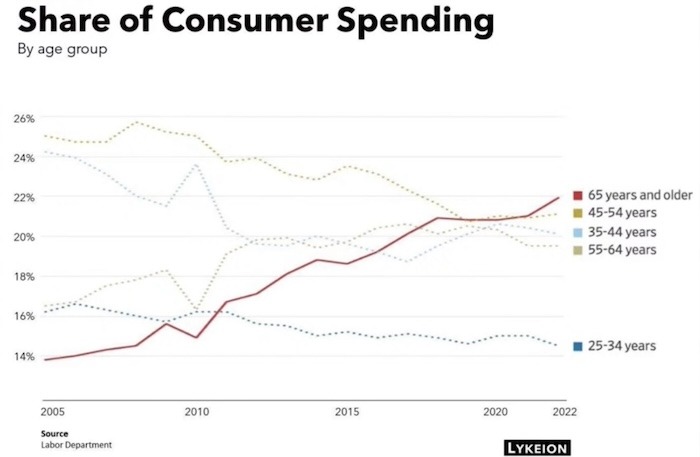

When you look at the following chart, you can see that essentially only the wealthy cohort shows a growing spending trend.

LVMH is in the business of selling ultra-scarce products, such as a Louis Vuitton handbag. With the increasing competition, only companies that sell ultra-high-end stuff will prosper (hence Mercedes ditching the A class and focusing on the premium segment).

Dominant Market Share

LVHM is the 800-pound gorilla in this space. Whatever competitor grows too quickly can be acquired.

The company is like a magnet for the greatest talents in the space.

LVMH is more valuable than the next three largest competitors, Hermes, Dior, and Kering, combined, whereby Dior is only that valuable because it owns a 40% stake in LVMH.

Master Acquirers With High ROIs

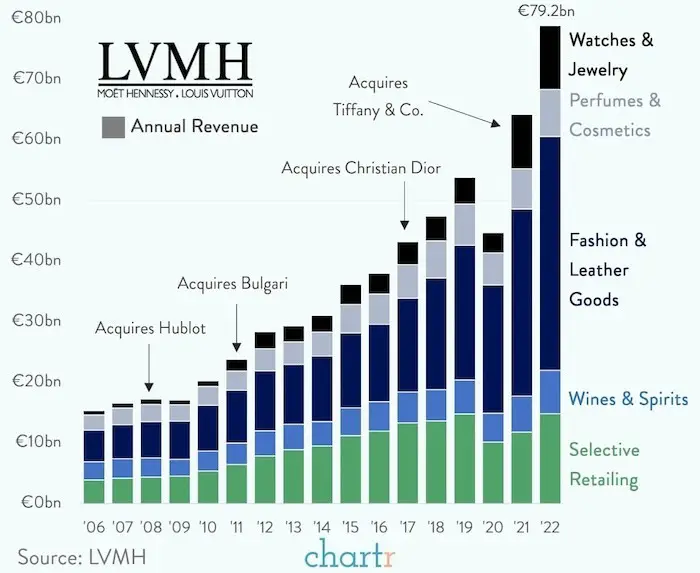

The management team around Mr. Arnaut has proven to be a good capital allocator, look at the series of good acquisitions they made:

LVMH’s ROI is 14%, meaning the average deployed capital yields a return of 14%, much higher than the average cost of debt!

The acquisition of Tiffany & Co. in 2021 has proven to be a significant asset, contributing to the company’s success through strategic investments, marketing campaigns, and renovations, leading to a substantial increase in LVMH’s share price and reinstating Bernard Arnault as the world’s richest individual.

Fantastic Numbers

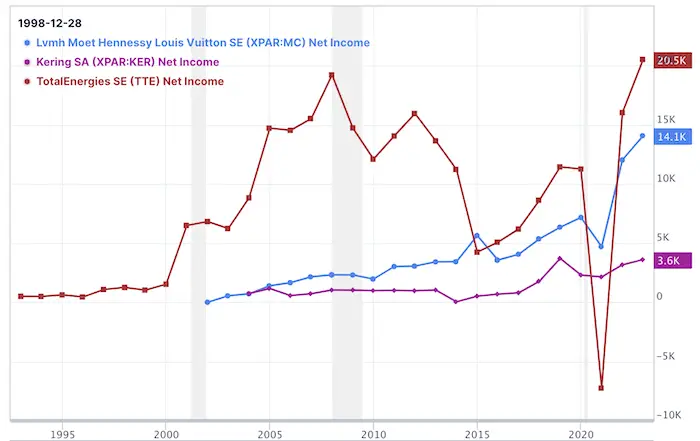

Check out LVMH’s net profit over time. Only an oil major like TotalEnergies can keep up.

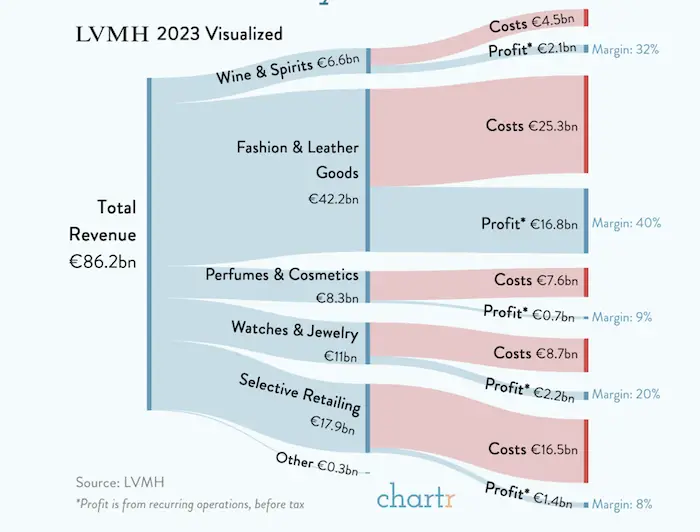

Interesting Mix of Margins

LVMH can generate healthy margins across all its visions. The Fashion & Leather Goods division, with its iconic Louis Vuitton bags, kicks it out of the park with a 40% margin (ultimate scarcity!).

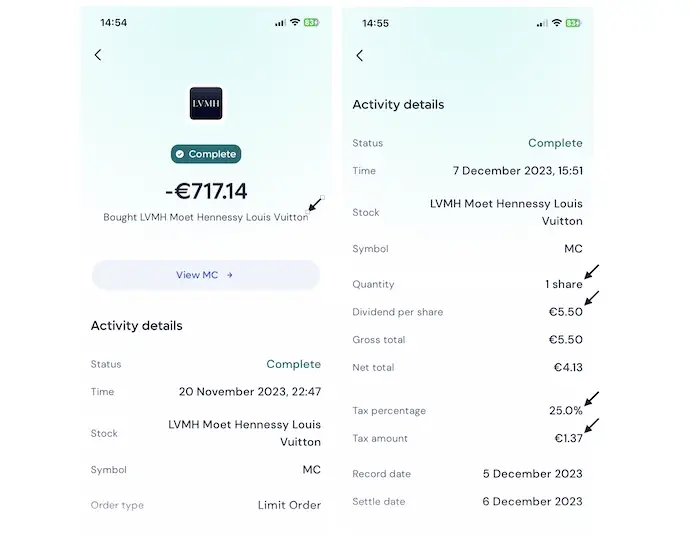

My First LVMH Purchase

After having analyzed the best French dividend stocks for quite a while, I decided to put one first toe in the water and buy 1x of LVMH.

My main goal was to see how the tax would be handled. Here’s the transaction slip of the first purchase, and how the dividend is handled.

Turns out the dividend (paid on Dec 7), is taxed at 25%, in line with my other purchases. I still need to check with my tax advisor if any other tax will need to be deducted, but if not, it would be okay for me to start building a position.

Conclusion

We can find a whole series of excellent stocks in France, but the three best French dividend stocks, in my opinion, are LVMH, Kering, and TotalEnergies.

Because I already have a big position in Shell (and get the dividend with 0% tax deducted!), I prefer the two luxury stocks.

Both companies I believe are excellent, but because the Scottish Mortage Trust (see its holdings) already owns a big position in Kering, I opt with LVMH and start a position!

📘 Read Also

- Financial Predictions For 2024 – My Top 10 Invest Ideas

- How To Structure An Investment Portfolio – 8 Strong Pillars

- The Story Of How I Reached Financial Independence

French Dividend Stocks FAQ

What are good French stocks to buy?

Good French stocks mean different things to different people. Some might prefer fast growth, while others appreciate a high dividend. One of the best-performing French stocks over the last 20 years is LVMH, now Europe’s most valuable company by market cap. Kering and TotalEnergies are often stated as good French dividend stocks as well.

Which French stocks are listed on the NYSE?

The 10 French stocks by market cap that are listed on the NYSE are

– LVMH

– L’Oreal SA

– TotalEnergies SE

– Sanofi SA

– Christian Dior SE

– Schneider Electric SE

– Air Liquide SA

– Essilorluxottica

– BNP Paribas

– AXA SA

You can find a full list of NYSE-listed French ADRs here.

What are the best French dividend stocks?

The three best French dividend stocks are

1/ LVMH (Louis Vuitton, Moet, Tiffany, Bulgari, Hublot, Dior, etc.

2/ Kering (Gucci, Yves Saint Laurent, Bottega Veneta)

3/ TotalEnergies

What is the dividend yield of French dividend stocks?

The French dividend stocks paying the highest dividend yields:

BNP Paribas with 6.25%

AXA with 5.76%

TotalEnergies with 4.87%

Sanofi with 3.75%

Kering with 3.67%

Vinci with 3.52%

Christian Dior with 1.91%

LVMH with 1.83%

Schneider Electric with 1.81%

Essilorluxottica with 1.75%

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love