Monthly Passive Income Report

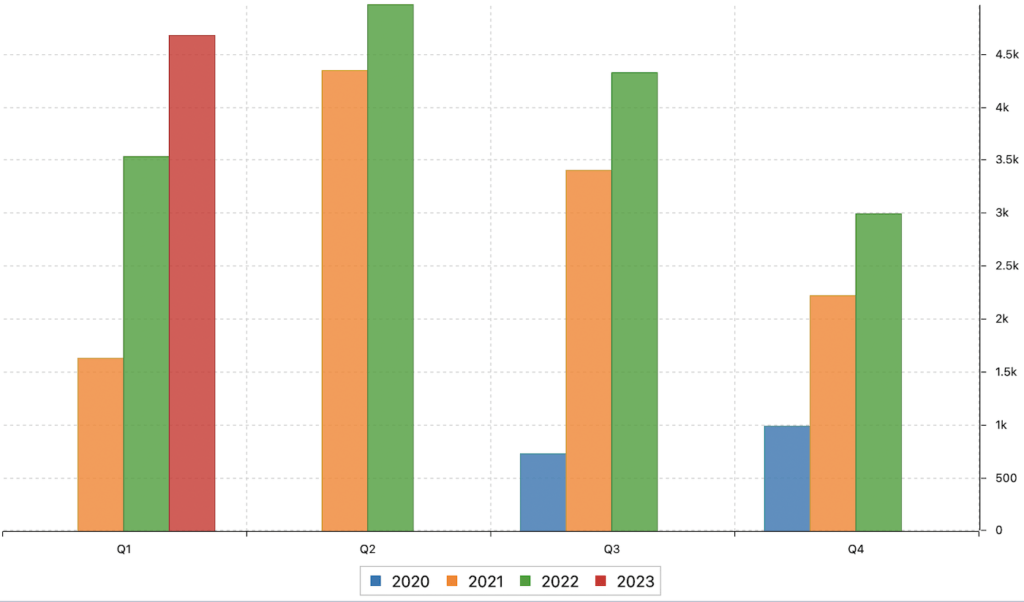

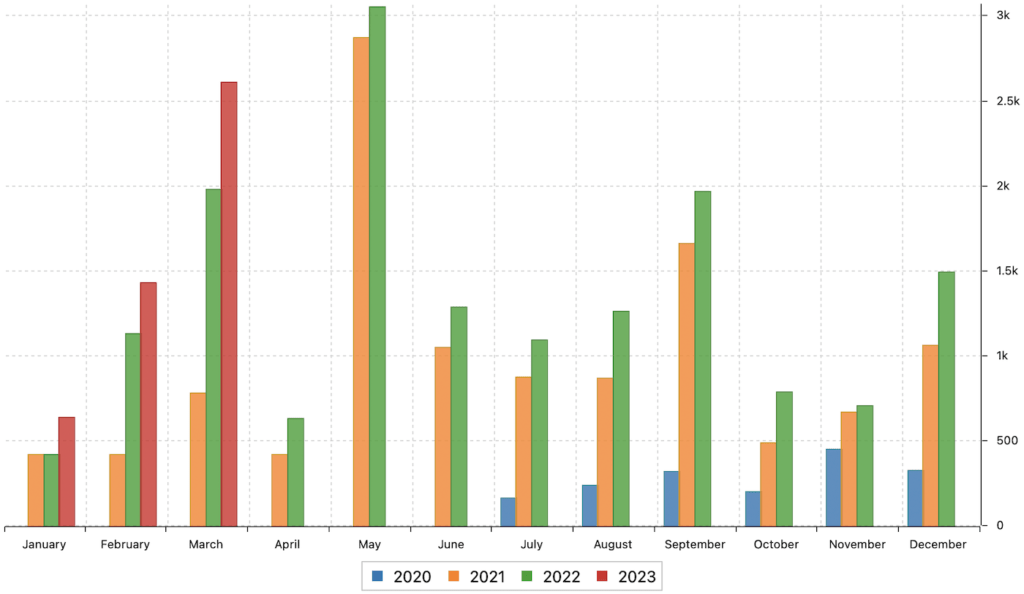

Dividend-income-wise, March is typically a good month for me. My best one is May, and March and September are equally good.

See below a quick chart of the various months.

After starting my dividend portfolio in May 2020, slowly but surely, my income from stock dividends is growing so that I can cover at least some of my monthly costs (currently at roughly 9,000 USD per month). My goal is to have my dividends from stock income cover 100% of my family’s cost.

Stock Dividends Received

Below are the dividends I received during the month:

| Dividends | Amount | |

| 2023-03-08 | 🇮🇳 CapitaLand India | $498 |

| 2023-03-31 | 🇦🇺 BHP | $375 |

| 2023-03-01 | 🇦🇺 Dexus | $271 |

| 2023-03-01 | 🇨🇦 Enbridge | $255 |

| 2023-03-30 | 🇨🇦 Brookfield | $159 |

| 2023-03-23 | 🇬🇧 Unilever | $149 |

| 2023-03-27 | 🇬🇧 Shell | $144 |

| 2023-03-09 | 🇺🇸 3M | $128 |

| 2023-03-15 | 🇺🇸 Realty | $93 |

| 2023-03-07 | 🇺🇸 Pfizer | $90 |

| 2023-03-24 | 🇺🇸 BlackRock | $90 |

| 2023-03-31 | 🇺🇸 Kraft-Heinz | $84 |

| 2023-03-30 | 🇺🇸 Union Pacific | $83 |

| 2023-03-09 | 🇺🇸 Johnson & Johnson | $81 |

| 2023-03-09 | 🇺🇸 Welltower | $73 |

| 2023-03-30 | 🇨🇦 Franco Nevada | $36 |

| Total | $2,608 |

In March last year, my dividend stocks generated $1,953 US, representing an increase of $655, or 34%.

Dividend Stock Purchases

I don’t re-invest distributions in the same stocks, but choose those stocks that I believe offer good risk/reward ratios. I believe this is a key ingredient when aiming to increase your monthly passive income.

Here’s what I bought in March:

| Purchases | Amount | |

| 2023-03-27 | 🏴 Scottish Mortgage Trust NEW | $12,150 |

| 2023-03-02 | 🇦🇺 Dexus | $4,160 |

| 2023-03-16 | 🇭🇰 Link REIT | $3,060 |

| 2023-03-27 | 🇩🇪 DHL | $2,930 |

| 2023-03-09 | 🇸🇪 Castellum | $2,900 |

| 2023-03-23 | 🇺🇸 Warner Bros | $420 |

| 2023-03-09 | 🇨🇦 Enbridge | $380 |

| Total | $26,000 |

I added to various existing holdings, such as $WBD, $ENB, and DHL, to name a few. But I also bought one new one.

New Position in Scottish Mortgage Trust

| Name: |

Scottish Mortgage Trust

|

| ISIN: |

GB00BLDYK618

|

| Ticker: | SMT |

| Symbol: | SSEZF |

| Benchmark: |

FTSE All-World Index

|

| Launch Date: | 1909 |

I started a new position in 🏴 Scottish Mortgage Trust (SSEZF).

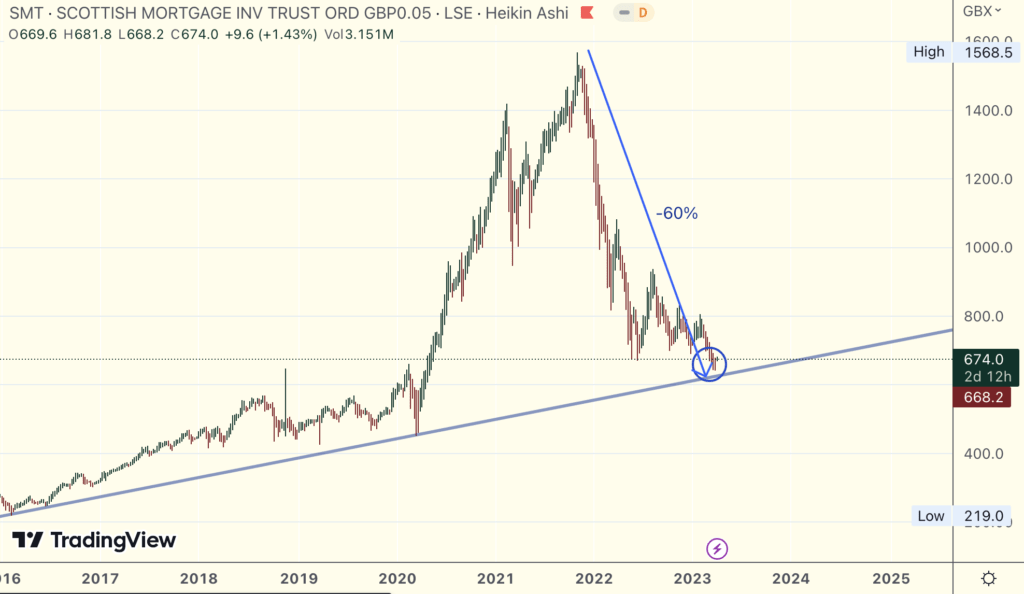

After following it for a year, I finally purchased 1,500 shares x 6.50€. The first time I came across $SSEZF was via Real Vision after watching this interview.

A “Scottish Mortgage Trust” – WTF?

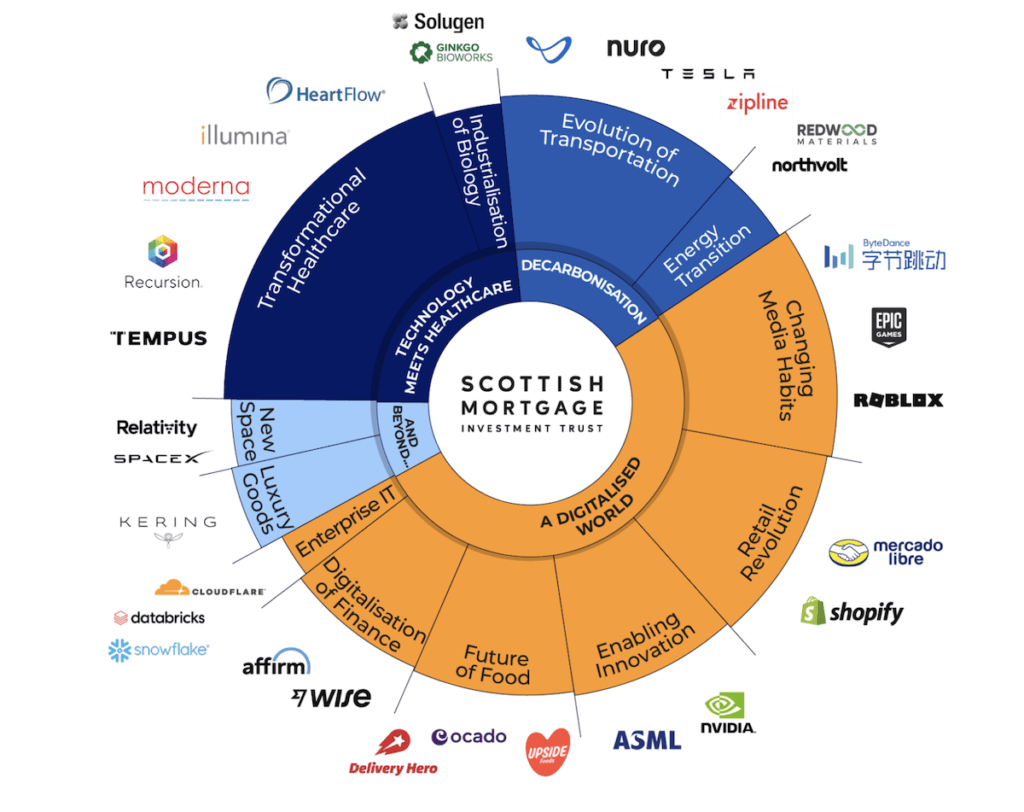

The Scottish Mortgage Trust has nothing to do (anymore) with Scottland, nor Mortgages. It invests in “tech companies that set to change the world”.

It was founded in 1909 and is managed by the fund management firm Baillie Gifford.

For quite a while now, I tried to find a smart way to invest in Tech. I knew I can not neglect the space entirely, but I also did not want to be exposed to single-stock risk (Kodak, Nokia, etc.). The Tech sector is changing so rapidly, and companies get disrupted so quickly, that it’s very tough to step on top of everything.

I eyed the ARK funds a lot but felt their profile became so polarizing, that I never ended up buying it.

Scottish Mortage Trust’s Holdings

"For Scottish Mortgage, we want to invest wherever change is. What we don’t want to be doing is saying, ‘There’s really great progress over there, but we can’t get our shareholders involved in it.’ That’s why being able to invest in both public and private companies really matters." Lawrence Burns, Deputy Manager

What do I like about the Scottish Mortgage Trust?

There are many things I like about $SSEZF:

1️⃣ Awesome mission statement – Identify companies that are set to change the world. Sign me up!

2️⃣ Concentrated positions, as a very small number of stocks, generate the lion’s share of returns

3️⃣ Long-term investment horizon – I appreciate the trust’s patience to let its thesis play out

4️⃣ Stock-picking by an experienced team – lets me sleep well at night

5️⃣ Ultra-low fees (0.30% on the first £4 Bio, 0.25% thereafter, payable to Baillie Gifford)

6️⃣ Invests globally – including China and South America – something I was looking for

7️⃣ Tech on autopilot – I trust the fund’s managers to do the job better than I could do it

8️⃣ Dividend-paying (!) in July and November (two slow dividend months for me)

9️⃣ Price now 60% lower – now is a good time to start building a position, see the chart below

🔟 Super-duper promising illiquid positions – e.g. in SpaceX, Northvolt, Zipline, etc.

I plan to build this position into a 50,000 Euro core holding over the course of the next five months (by dollar-cost-averaging).

Back to my monthly passive income report.

Dividend Income, By Quarter

The chart below shows my dividend income by quarter:

I started building my All-Weather Portfolio in May 2020, hence I got my first dividends in Q3 of the same year.

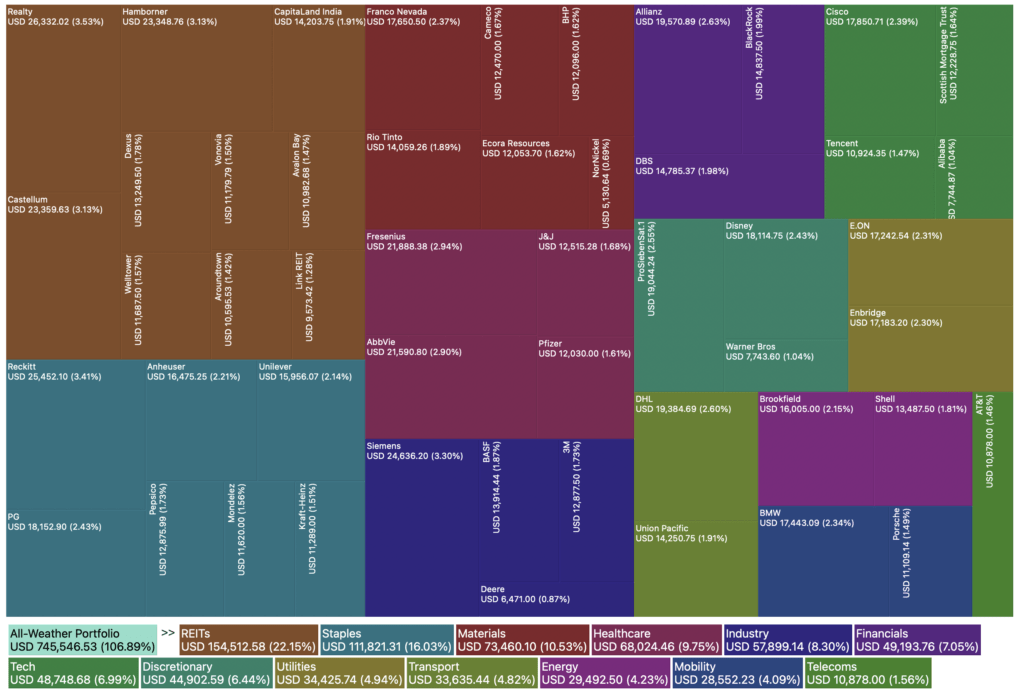

Below shows all my current portfolio holdings:

Tech only represents 7% of my total, while REITs represent 22%, and Consumer Staples 16% (my favorite European Consumer Goods Stock). The biggest contributor to my monthly passive income is Consumer Staples, REITs, Healthcare, and Materials ($BHP & $RIO).

Overall I am happy with the progress, and will simply keep Dripping & DCA’ing.

📘 Read Also

- How To Invest In Artificial Intelligence

- Why I Bought 1 Mio Hedera HBAR

- How To Find High-Dividend Stocks

FAQ

What is the most profitable monthly passive income?

• Invest in dividend stocks and ETFs

• Buy a rental property (real estate)

• Earn interest on crypto

• Invest in high-yield savings accounts

• Invest in peer-to-peer lending platforms like Mintos

• Start a blog and monetize it with affiliate links, ads, and sponsored posts

• Become a silent partner in a business

• Create a passive income product such as an ebook, online course, or app

What is the easiest monthly passive income?

Income from dividend stocks from world-class businesses like Johnson & Johnson, PepsiCo, or Kraft-Heinz, all paying quarterly dividends, or distributions from REITs like Realty Income that pay dividends on the 15th of every month.

How to make monthly passive income?

1/ via dividends from stocks like Realty Income

2/ via peer-to-peer lending platforms like Mintos

3/ earn passive income on your crypto on CakeDefi

4/ earn income from solar panels via Sun Exchange

5/ earn some money on the side with platforms like Yamgo

Where to start with passive income?

Pure monthly passive income typically requires that you already committed time, energy, or money before. Once you have some money you can set aside, you should read and learn as much as possible to figure out ways how to make your money work hard for you. As Warren Buffett once said, “People who don’t learn to make money work, will always work for money.”

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love