Passive Income & Dividend Report

In May 2022, my dividend report shows a total of approx. 15,000 USD in passive income. 2,984 USD is from my All-Weather Portfolio, consisting of the best dividend machines:

| Dividend Stock | May 22 |

| BASF | $540 |

| Vonovia REIT | $408 |

| Allianz | $398 |

| Hamborner REIT | $382 |

| DHL | $364 |

| E.ON | $287 |

| AbbVie | $146 |

| AT&T | $129 |

| DBS | $101 |

| Realty REIT | $86 |

| PG | $55 |

| Total | $2.984 |

Last year, in May 2021, I received 2,717 USD, an increase of roughly 10%. Nice.

Besides the dividend income I receive from my All-Weather Portfolio, I received an additional 12,000 USD from my other passive income streams (check them out here if you like).

Recent Buys.

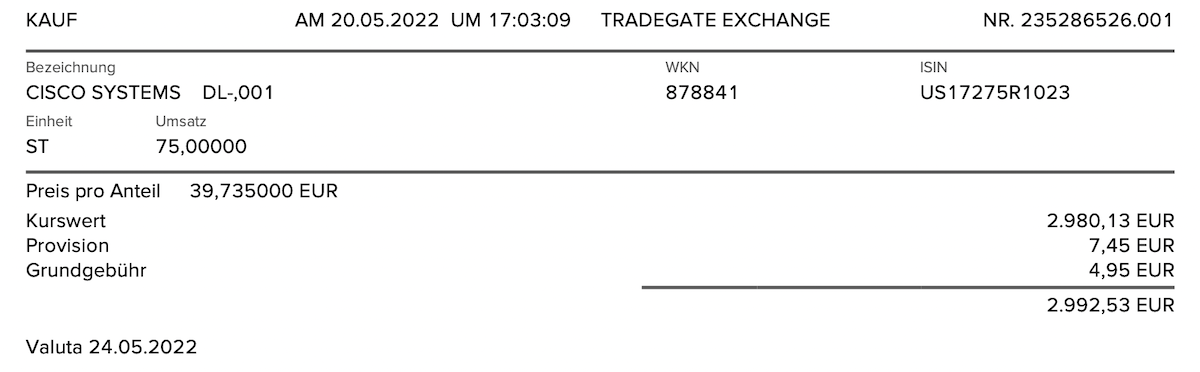

In the month of May, I bought 75 shares of Cisco ($CSCO) at 39,74 Euro (approx. 42 USD/share).

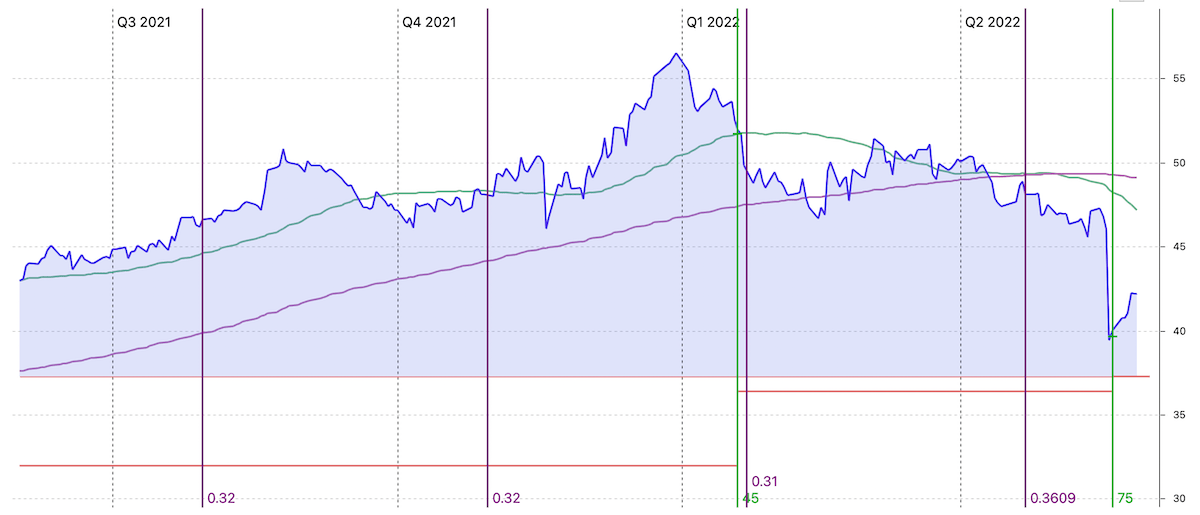

It had dipped quite a bit, and I took advantage of this opportunity.

The purple markers show the paid-out dividends, the green marker the recent buys.

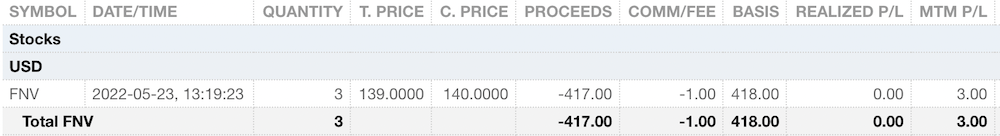

I also reinvested the dividends I received in April to buy 3x shares of Franco Nevada ($FNV). I bought those shares in my Interactive Brokers account, with a low commission of 1 USD per trade. Nice.

Further, I bought 16 shares of Vonovia ($VNA), one of my favorite European REITs, at 35 Euro (I now own 350x Vonovia shares in total).

I am about to commence acquiring the first shares of John Deere ($DE). I am excited about adding the shares of the world’s largest agricultural equipment manufacturer to my long-term dividend portfolio. I explain my 5 top reasons to buy John Deere in an article you can read here.

Besides listed equities, I just bought 70x Solana ($SOL) at 42,50 USD – adding to my growing position in my Digital Asset Portfolio.

Income From Digital Assets.

Celsius (RIP), Nexo, and Hodlnaut (RIP) performed well and were stable as usual. Terra Luna (RIP)went belly up. What a disaster. I had about 60,000 USD on the Anchor protocol and owned 2,000 Luna, which were worth approx. 100,000 USD at the beginning of May. It now doesn’t exist anymore, but Terra2 was launched, and I now own 2,250 of those, valued at 8 USD per Luna. A crazy story I cover in detail in this article.

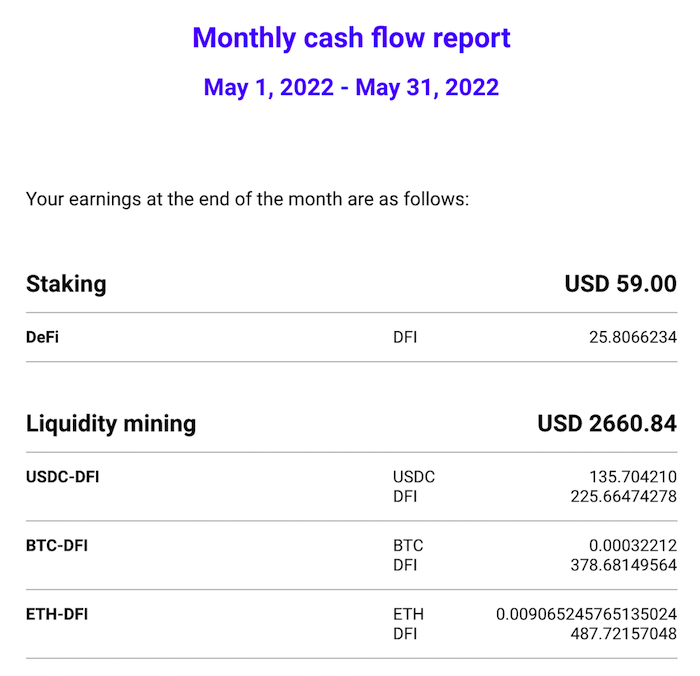

My second full month with Cake DeFi was again very good. See below for the monthly cash flow email I just received today.

I love Cake DeFi’s clean reporting. Everything is extremely transparent, and each transaction can be tracked on-chain.

Overall an okay to average month. For the upcoming month of May, I expect significantly more income from my dividend stocks in my All-Weather Portfolio, as May is typically my strongest month. Last year in 2021, I was able to collect 2,870 USD (withholding taxes already deducted) in passive income – let’s see what this month brings!

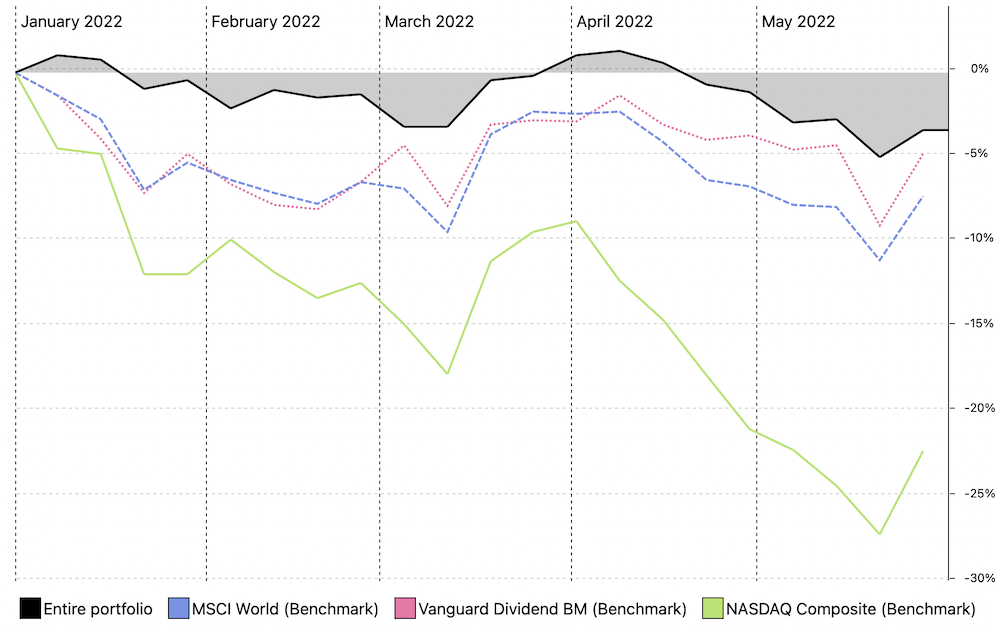

Portfolio Performance

My All-Weather Portfolio decreased in value from 507,000 USD down to 471,000 USD. Not good. But for the year, compared to various indexes, I am pretty happy with my portfolio’s performance. YTD the Nasdaq is down 22%, and the MSCI World approx. 8%, and my portfolio is roughly 4%. I am of course happy and can live with that!

Overall a pretty shitty month due to the Luna collapse. But thank god I started building a more conservative portfolio in 2020! I am following a barbell strategy, that recommends striking a balance between reward and risk by investing in two extremes of high-risk (digital assets) and low-risk assets (blue-chip dividend compounders) while trying to avoid the mushy middle.

I love it when my different portfolios cross-populate each other. For example, in June, it will be the first time that I’ll take some interest earned from crypto, cash it out, and use these proceeds to buy the AgTech giant John Deere.

Related Posts

- Read the Passive Income report 2022/04

- Check out my Gratitude Page

- Why I think this chemical company is a buy-and-hold forever stock

- Read my Dividend Report 2022/06

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love