Passive Income Progress – January 2024

From a passive income progress point of view, January sucked. My dividend income this month was less than last year. That was mainly due to 🇸🇪 Castellum, a Scandinavian REIT of which I hold 3,500 shares. Last year, it paid $218 in dividends, this year, nada! Nilch!

Passive Income Progress Overview

| Date | Dividends | Shares | Amount |

| 2024-01-25 | 🇺🇸 Cisco | 500 | $144 |

| 2024-01-17 | 🇺🇸 Avalon Bay | 73 | $102 |

| 2024-01-15 | 🇺🇸 Realty | 445 | $97 |

| 2024-01-18 | 🇺🇸 Mondelez | 275 | $82 |

| 2024-01-10 | 🇺🇸 Pepsico | 72 | $82 |

| 2024-01-12 | 🇨🇳 Alibaba | 750 | $69 |

| 2024-01-11 | 🇺🇸 Disney | 225 | $61 |

| Total | $637 |

Last year in January, I received $641, this year I got $637. One of my first months ever to receive less compared to last year. That of course sucks, but it won’t discourage me. Dividend investing is a long-term play, and nothing can go up in a straight line.

On the bright side, $DIS and $BABA re-initiated their dividend payments. I got $94 from $BABA and $68 from $DIS. I take those $162 any day of the week and am grateful for these two battled firms to even distribute anything!

In terms of pure passive income progress, it’s not a good start in the year, but I am confident that the coming months will be better.

Passive Income Progress + Purchases

In terms of stock purchases, I was quite active and bought the following stocks.

| Date | Purchases | Shares | Amount |

| 2024-01-15 | 🇩🇪 Hamborner | 1,000 | $7,640 |

| 2024-01-17 | 🇬🇧 Shell | 100 | $6,297 |

| 2024-01-16 | 🇨🇳 Tencent | 150 | $5,387 |

| 2024-01-05 | 🇨🇳 Alibaba | 500 | $4,631 |

| 2024-01-24 | 🇬🇧 Unilever | 50 | $2,365 |

| 2024-01-25 | 🇺🇸 AT&T | 50 | $847 |

| 2024-01-06 | 🇨🇦 Brookfield | 10 | $258 |

| Total | $27,423 |

I enjoy getting the following type of automatic emails sent for all of my holdings. It’s a free service from Simplywall.st, you need to create a free account, build one watchlist/portfolio, add your stocks, and you are set. Check it out here.

$MDLZ Mondelez reported excellent ’23 numbers:

- EPS: US$3.64 (up from US$1.97 in FY 2022).

- Revenue: US$36.0b (up 14% from FY 2022).

- Net income: US$4.96b (up 83% from FY 2022).

- Profit margin: 14% (up from 8.6% in FY 2022).

Sentiment towards Chinese stocks could not be worse. Alibaba and Tencent are still printing money, a growing quickly, and each owns 500+ innovative startups. I added to both of my positions.

Purchases of the Month

$T AT&T also reported excellent numbers. We are seeing the first signs of its re-valuation after the $WBD Warner Bros spin-off. The company generates very high free cashflows and pays back its debt quickly.

Also added to the German REIT Hamborner (XTER:HABA). They mainly own the properties of supermarkets (Edeka is one of their largest customers). It’s now my 3rd largest holding in my All-Weather Portfolio.

I also bought some $UL Unilever because I like what they are recently doing. Getting rid of smaller/non-core brands. Focusing on their $1 Bio+ brands. Streamlining the operation. This stock does not move for years, but then suddenly makes a quick steep jump, and I believe something like this will happen in the coming 12-18 months.

Same as gold. I believe something is bubbling below the surface. Gold will break $2,080 this year, and then reach $2,500 rather quickly. For all of you who don’t own some physical gold yet, best to get some. One good shop in the UK is Direct Bullion. You can check them out here.

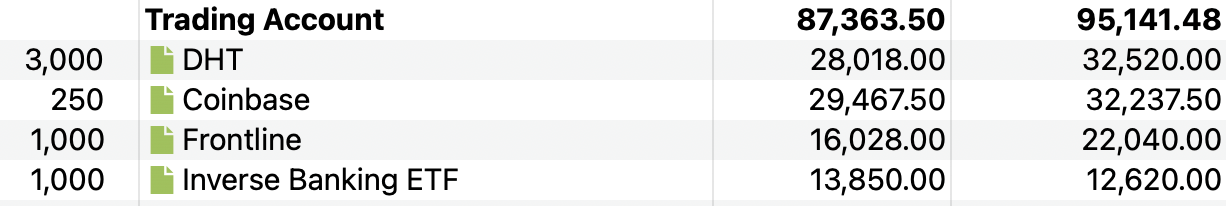

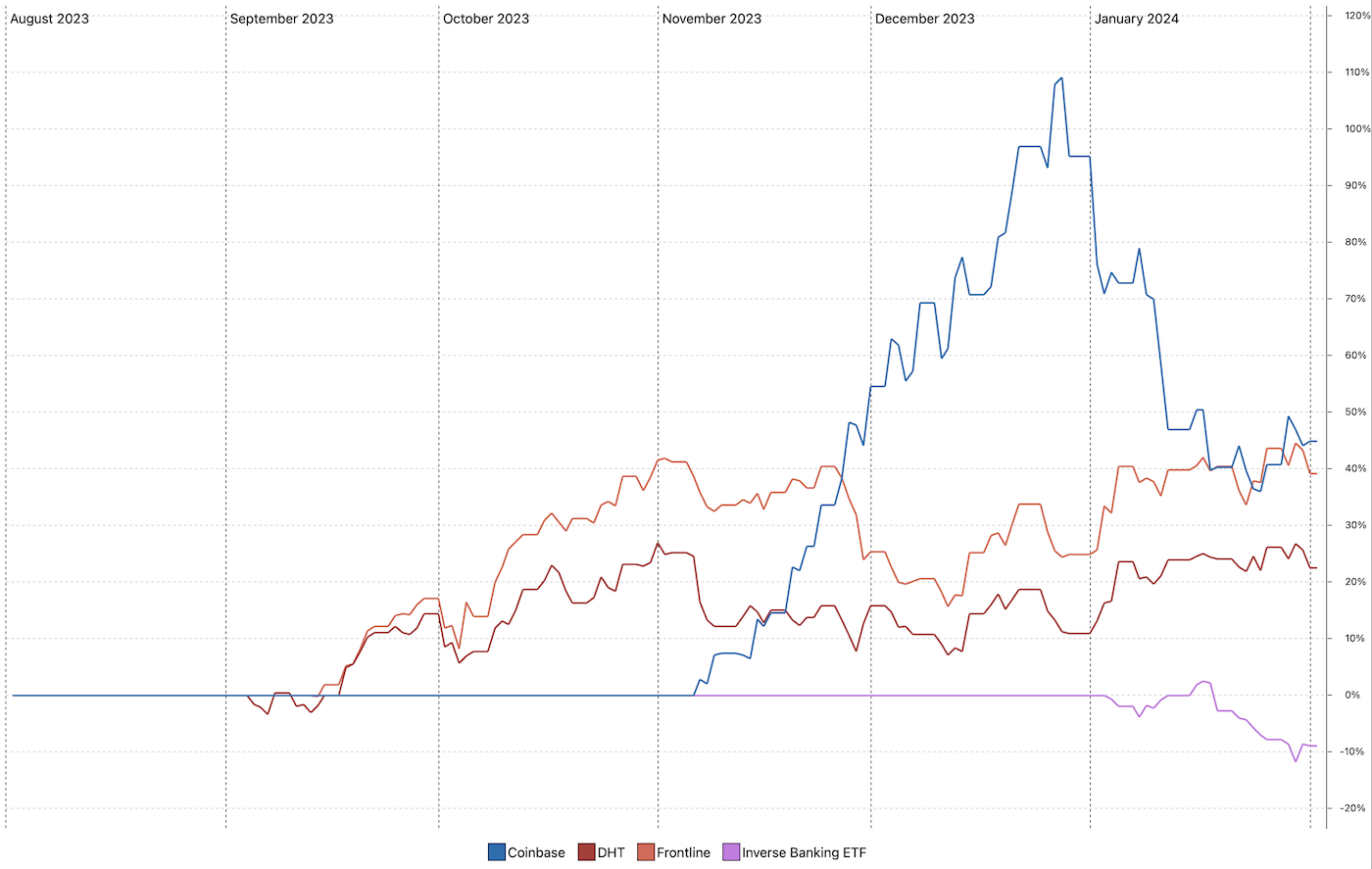

Passive Income Progress – Trading Account

I currently have 4x short-term trades on and plan to hold on to all of those for the time being.

Of the four, three are in good profit. Check out the overview below (the left column shows the purchase value, the right column shows the current value), and the performance chart.

Conclusion

Not a great month, but looking forward to February and March!

📘Read Also

- The 3 French Dividend Stocks To Buy

- How To Build A Simple Crypto Portfolio

- My Story How I Reached Financial Independence

FAQ

What does passive income mean?

Passive income is money you earn with minimal effort or active involvement. Put simply, its income generated from investments, stocks, rental properties, royalties, or businesses that don’t require attention. In other words, it feels awesome.

How to track passive income progress?

To track passive income, you should keep records of all the dividends, rental income, interest from investments, and other sources you receive. Use simple spreadsheets like Google Sheets or financial apps like the 100% free Portfolio Performance to monitor growth over time.

Why is passive income important?

Warren Buffett is famous for saying ‘If you don’t find a way to make money while you sleep you will work until you die’. Therefore, passive income provides financial stability, reduces reliance on a traditional job, and creates opportunities for wealth-building and early retirement. It offers flexibility and can help achieve financial goals.

What is progressive passive income?

Progressive passive income refers to income streams that grow over time without requiring additional work. In other words, it is when you see positive passive income progress. This could include investments in dividend-paying stocks, real estate properties, or royalties from creative works.

What types of passive income are there?

Passive income can come from various sources, including dividends from equities, interest from bonds, interest from P2P lending platforms like EstateGuru, or savings accounts, rental income from real estate properties, royalties from intellectual property, affiliate marketing, and online businesses. Each type offers its advantages and considerations for investment.

Is passive income taxable?

Passive income like most other income is generally taxable, yes. Dividends, interest, rental income, and other passive income sources are subject to taxation based on applicable tax laws and regulations. However, tax rates and rules may vary depending on the type of passive income and the jurisdiction in which you reside. It’s essential to understand the tax implications of your passive income streams and consult with a tax professional if needed. Keep good track of your passive income progress and document (and celebrate!) each passive income transaction.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love