My December 2023 Income Update

In December my income update looks like this:

| Shares | Dividend | |

| 🇭🇰 Link REIT | 2,500 | $413 |

| 🇨🇦 Enbridge | 510 | $285 |

| 🇺🇸 Brookfield | 720 | $243 |

| 🇬🇧 Shell | 250 | $166 |

| 🇬🇧 Unilever | 350 | $122 |

| 🇺🇸 Pfizer | 400 | $115 |

| 🇺🇸 Public Storage | 45 | $115 |

| 🇺🇸 Kraft-Heinz | 400 | $112 |

| 🇺🇸 Realty | 445 | $97 |

| 🇺🇸 BlackRock | 25 | $93 |

| 🏴 Scottish Mortgage Trust | 6,000 | $90 |

| 🇺🇸 J&J | 80 | $86 |

| 🇺🇸 Union Pacific | 75 | $83 |

| 🇨🇦 Cameco | 500 | $45 |

| 🇨🇦 Franco Nevada | 123 | $36 |

| Total | $2,098 |

Purchases in December 2023

I invested a total of $11,466 US in December, adding to my existing positions in the following three dividend stocks:

| Shares | Purchased | |

| 🇺🇸 Pfizer | 200 | $5,718 |

| 🇩🇪 ProSiebenSat1 | 500 | $3,163 |

| 🇩🇪 Allianz | 10 | $2,585 |

| Total | $11,466 |

I now own 100 shares of Allianz. In the long run, I like to get this 250, which would pay me enough in dividends every year that I could cover the yearly insurance costs of my wife and me.

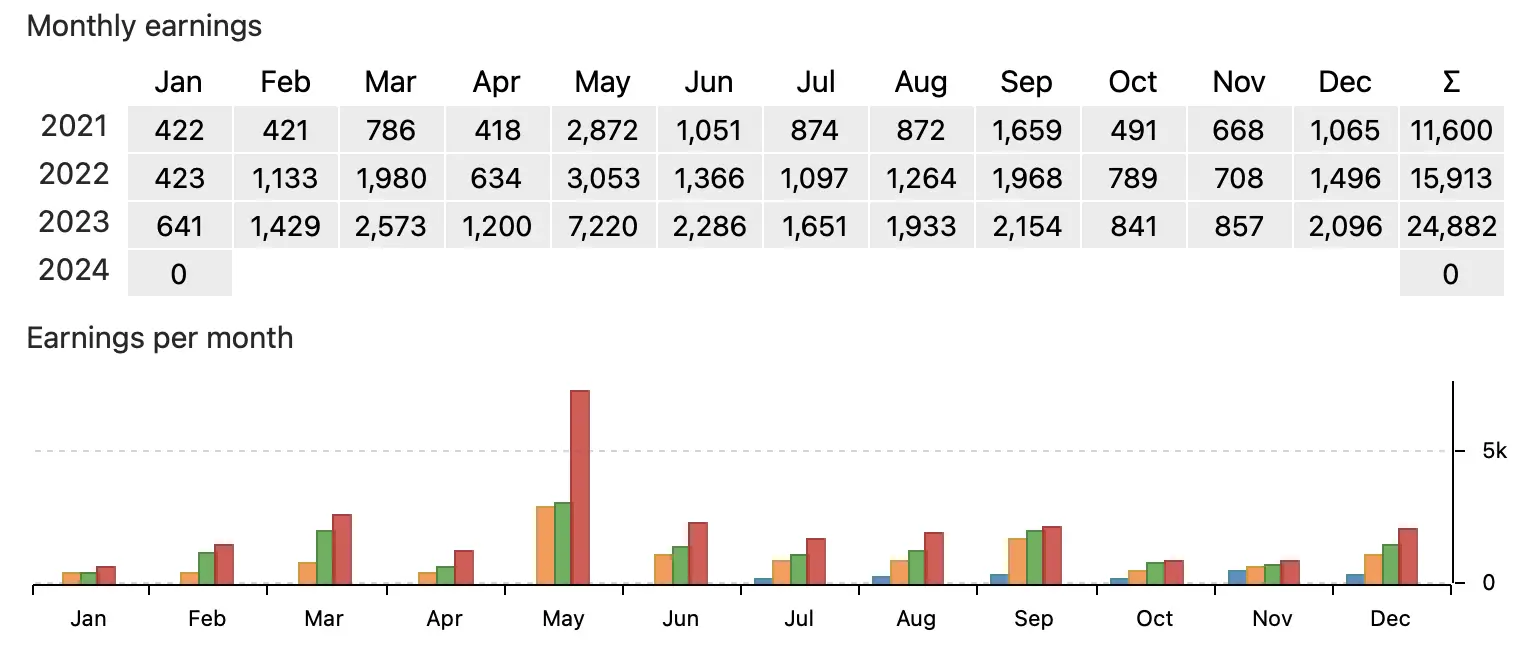

Dividend Income Update For The Year

I am also wrapping up 2023, and reviewing how it went. In total,

- I received $24,880

- logged a total of 130 transactions (incl. dividends, buys, and sales)

- my best month was May with $7,200 in dividends ($9,400 gross)

- my biggest single dividend was $1,220 from BMW

- every single month was better than the one in the previous year

- my 3x best dividend payers were

1/ BMW with $1,220

2/ Hamborner REIT with $1,150

3/ Realty Income with $1,120

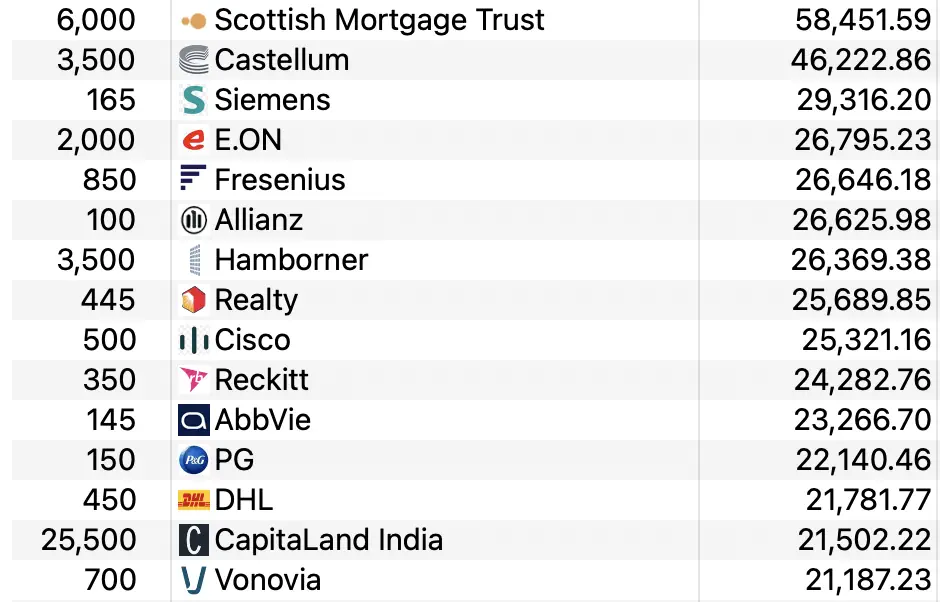

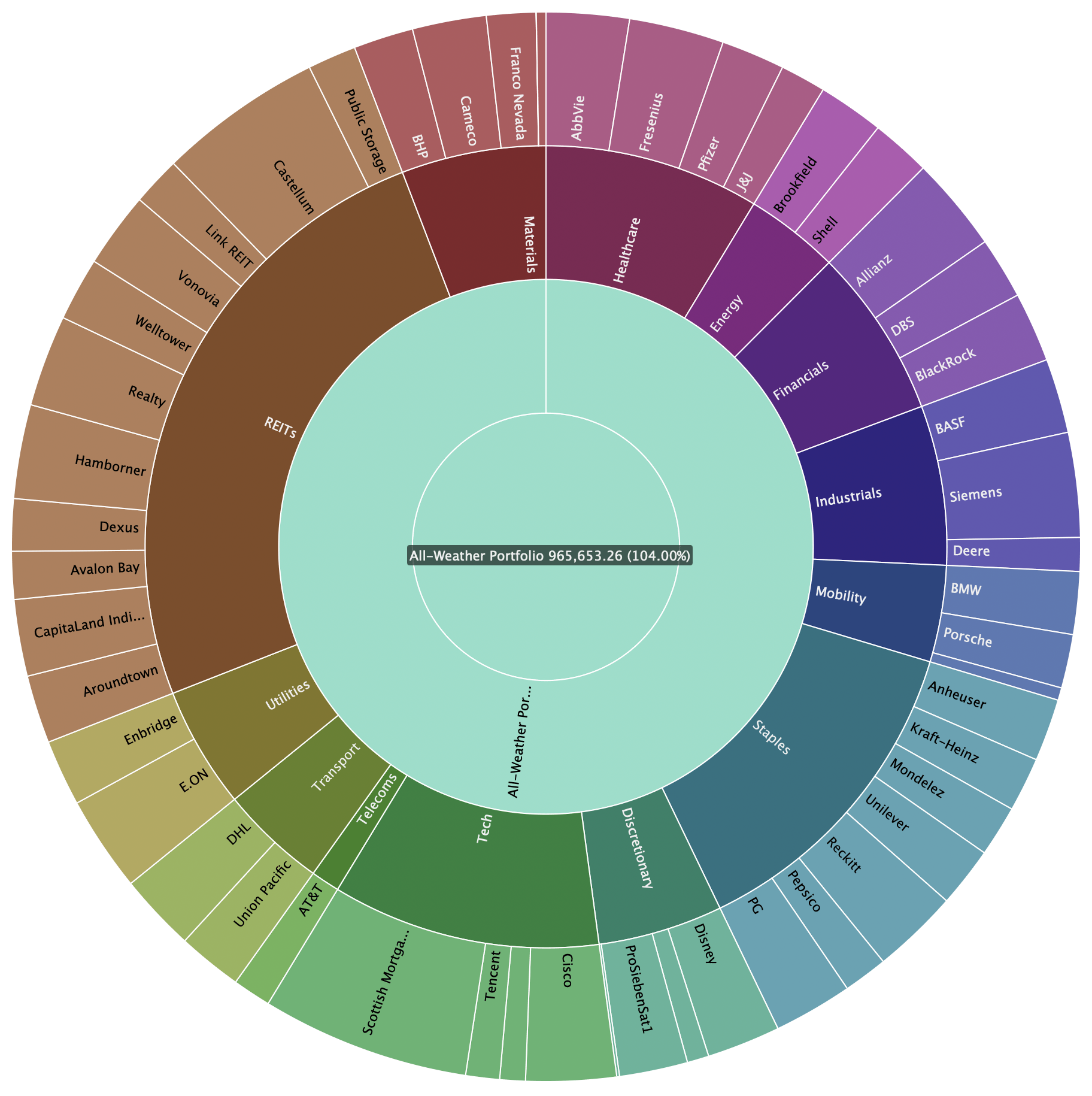

Current Portfolio Holdings

My largest year-end holding is Scottish Mortgage Trust, a fund investing in the most disruptive and exponential tech firms like Tesla, Nvidia, or Bytedance.

My second largest holding is a Swedish REIT called Castellum, which owns hundreds of properties in Scandinavia.

I participated in a special rights capital raise, granting me to buy shares with a 30% discount on the share price then.

I now own 3,500 shares of Castellum x $13 = $46,000 (purchase value of $36,000).

Unfortunately, its dividend was suspended in mid-2023, but I am okay with sitting this one out.

I love my portfolio and am okay with being REIT-heavy, because I also own some

- good tech stocks, i.e. Scottish Mortgage, $CSCO

- Healthcare & Pharma, i.e. $ABBV, Fresenius

- Consumer Staples, i.e. Reckitt, $PG

- some Utilities, i.e. E.ON

- some Industrials, i.e. Siemens

- some Financials, i.e. Allianz

Deep Dive Into My Current Portfolio

This is my current All-Weather Portfolio, containing all the best buy-and-hold forever stocks I call Dividend Kings.

Monthly Income Update Comparison

The below chart shows the payments for each other respective months.

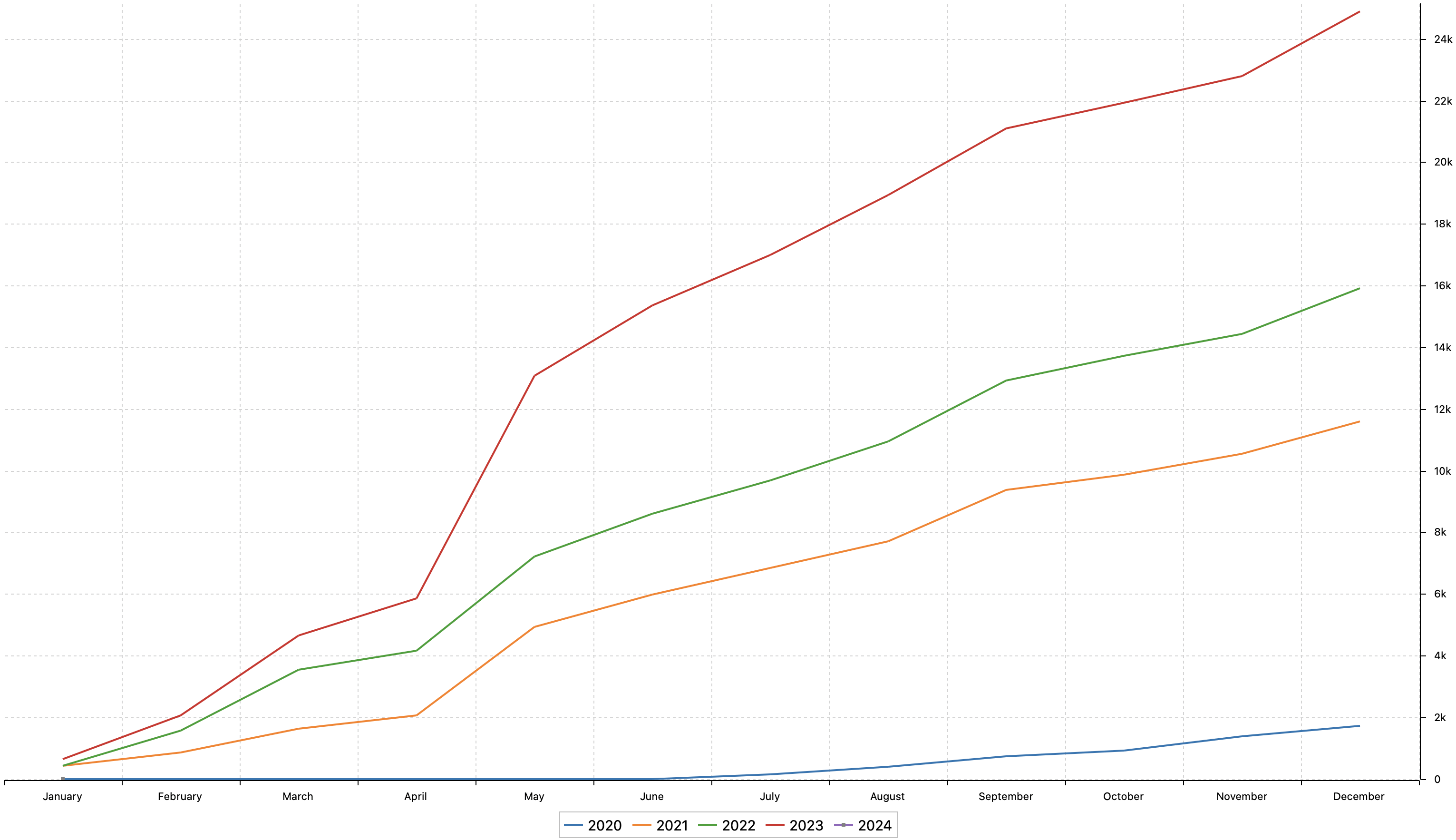

Accumulated Dividend Income 2020-2023

May is an outlier month due to many European companies only paying a single annual dividend.

I am happy about the progress since I started the portfolio in 2020 and look forward to seeing what the 2024 year-end income update will look like.

My All-Weather Portfolio currently represents about 20% of my total net worth.

My Year-End Total Net Worth

My Plan For 2024

I plan to further increase my dividend portfolio by $80,000 US.

I don’t plan to add further funds to my thematic portfolio and recycle profits to my All-Weather Portfolio.

I plan to let my crypto folio run its course and start taking profits once Bitcoin reaches $125,000, Ethereum $6,000, Solana $250, and Hedera $1.

I don’t plan to add to my precious metals holdings.

Predictions For 2024

I believe 2024 will be an eventful and difficult year. I summarised my top predictions in this post.

If I am right we will see a lot of market volatility, with many short-to-mid-term trading opportunities.

I will keep publishing such income updates because they greatly help me to wrap up one month and collect my thoughts for the next.

New Trading Position

As I believe we will witness another banking crisis, I just initiated a new trading position in $FAZ, a 3x inverse banking ETF.

I bought 1,000 $FAZ at $13.83 on Jan 4th.

This is an initial 30% position I plan to build out to 3,000 shares and hold for about six months, in which I expect problems in the banking sector to materialize.

Besides this new position, I also own the following stocks in my trading folio:

Thoughts on Germany & Europe

As some of you know, I am from Germany but have lived in Asia for 20+ years.

My two kids are born there, I genuinely love to live there and believe if the world’s economy is an ass, Asia would be the asshole, as this is where shit happens.

However, having just been to Europe, I was reminded how awesome it is as well.

Some key memories and experiences I take away:

- seeing the kids join the local ski school

- doing a two-hour-long walk with a friend with a Weissbier afterward

- eating awesome Tyrollean food next to an open fireplace

- walking through snowy forests with my wife

- enjoying a coffee & cake near a lake

- spending Christmas Eve with my old folks and sister’s family

You might call these small and minor points. And Europe and in particular Germany and Austria are not perfect.

But Europe offers a certain life quality that is hard to find anywhere else.

For those examples I listed above I simply love Europe and can’t wait to be back for Summer!

Conclusion

I conclude that 2023 was a good year and I mentally get prepared for 2024 to be a difficult one.

If it turns out to be better than expected, great, if not, I try to be prepared.

I greatly hope the world does not spiral out of control. The next black swan could happen in any of the known geopolitical hotbeds, like Gaza, Ukraine, Iran, Azerbaijan, Venezuela, Niger, and Taiwan, but could also originate anywhere else.

I expect a major cataclysmic event will happen before Aug 30th.

Let’s just hope it won’t be too bad.

📘 Read Also

- Financial Astrology – Investment Guide For the Age of Air

- My Story Of How I Reached Financial Independence With $5M In Net Worth

- 5 Best Defense Stocks With Safe Dividends

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love