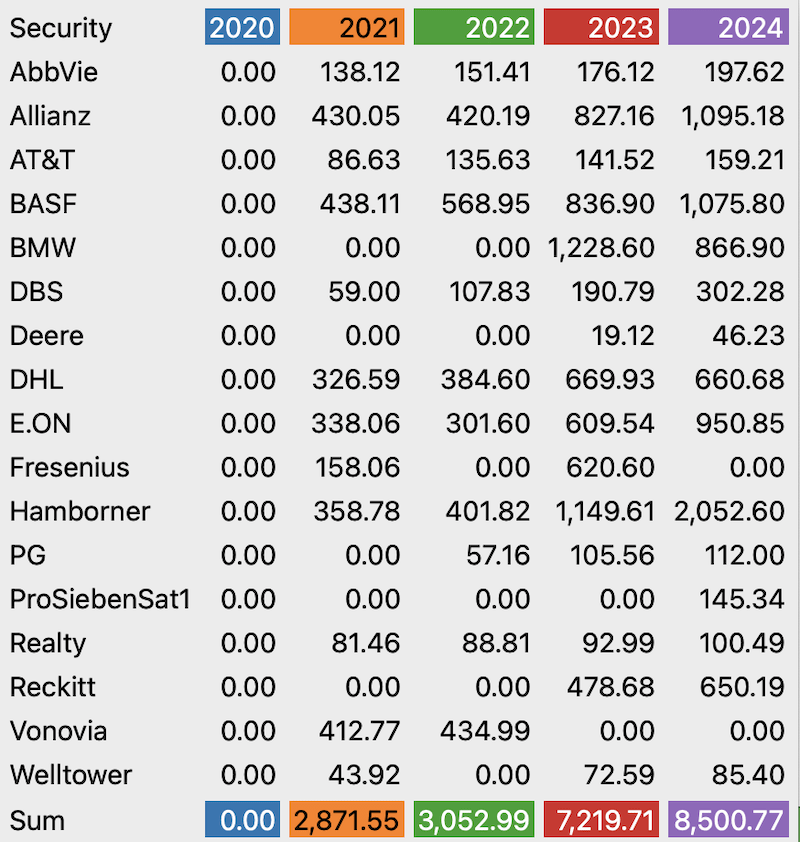

Dividend Breakdown

Dividend-wise, May has always been the best month. In 2023, I received $7,230 and this year $8,544.

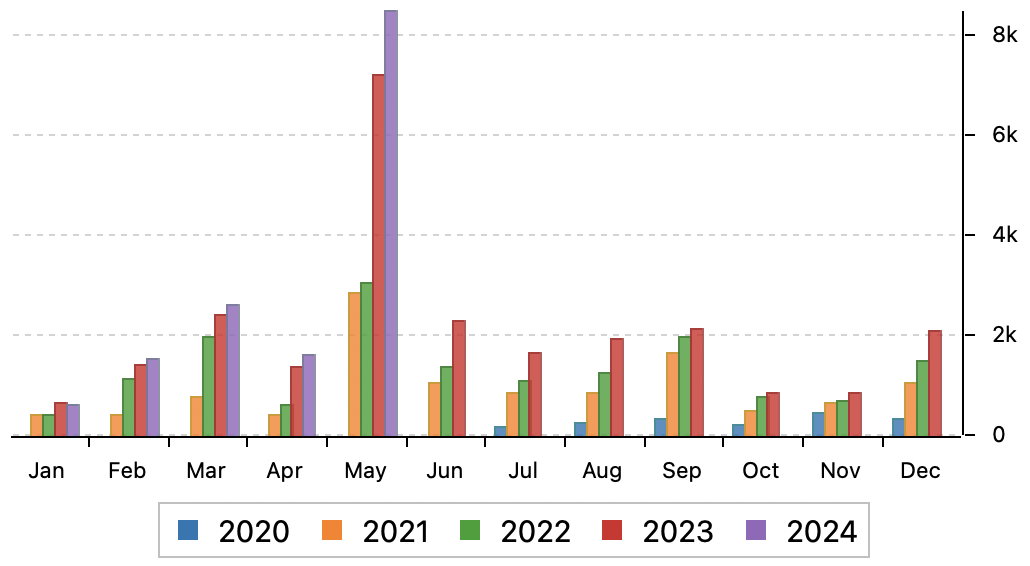

You can see the entire progress of my income from my dividend stocks in the following chart:

Detailed Dividend Breakdown

| Dividends | Shares | Received |

| Hamborner | 4,500 | $2,053 |

| BASF | 400 | $,1101 |

| Allianz | 100 | $1,095 |

| E.ON | 2,250 | $951 |

| BMW | 180 | $867 |

| DHL | 450 | $674 |

| Reckitt | 600 | $650 |

| DBS | 770 | $302 |

| AbbVie | 150 | $198 |

| AT&T | 675 | $159 |

| ProSiebenSat1 | 3,675 | $149 |

| PG | 150 | $112 |

| Realty | 460 | $100 |

| Welltower | 200 | $85 |

| Deere | 37 | $46 |

| Total | $8,544 |

This month, two dividend payments made it into my Top 10:

The largest payer was the German REIT Hamborner, making it the biggest single-stock dividend I ever received.

And German chemical company, BASF, makes it into my Top 10 too.

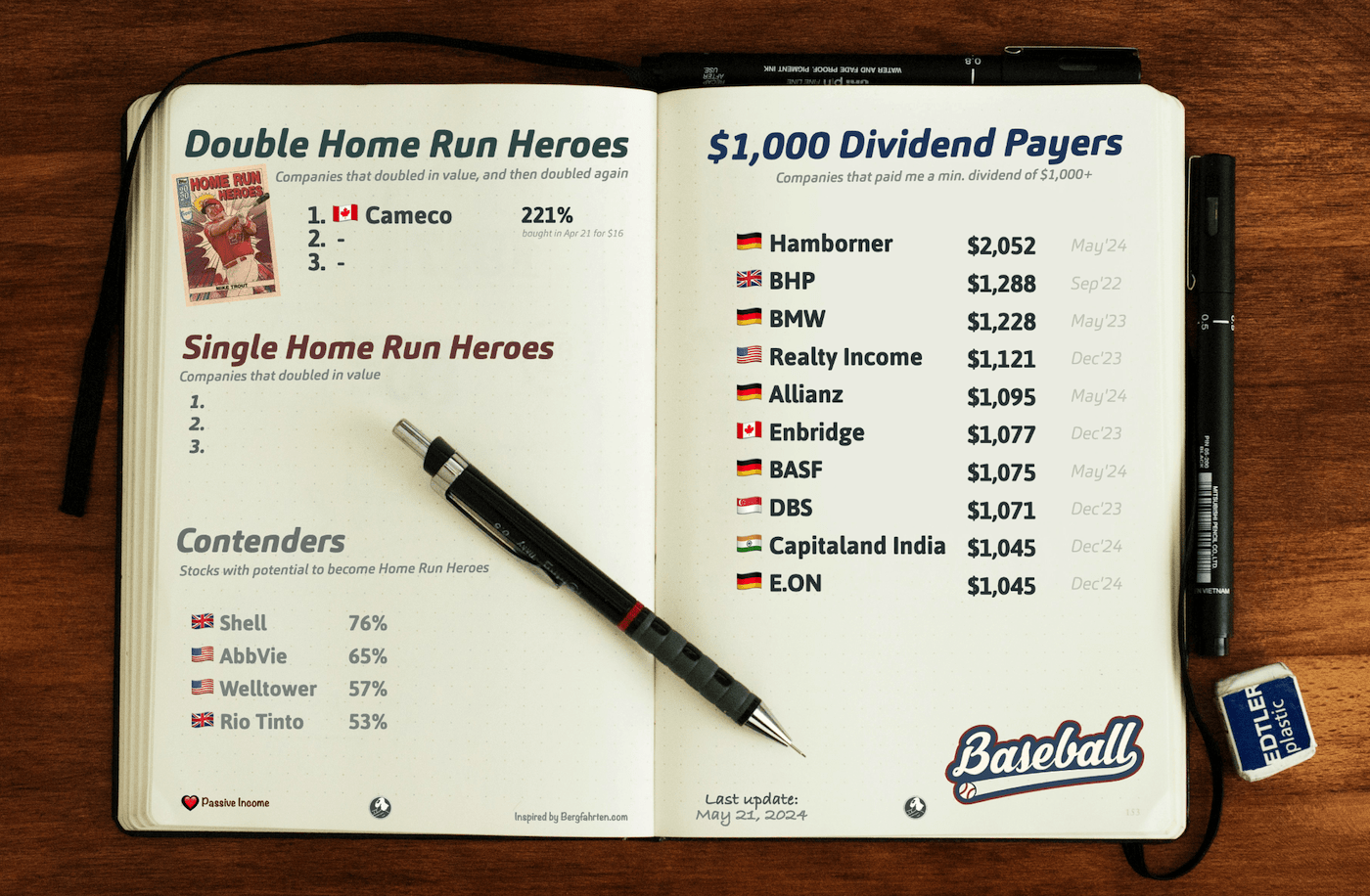

The following chart shows the largest dividends I have received since I started building my All-Weather Dividend Portfolio in mid-2020.

Inspired by my fellow financial blogger Bergfahrten.com, I also wanted to track how many companies pay me a yearly dividend of $1,000!

So far I have 10 companies, with hopefully many more to come!

I also list out my Single Home Run Heroes – shares of companies that doubled in value.

If a company doubles again, it becomes a Double Home Run Hero. The uranium mining company Cameco (CCJ) went up so fast that it is not only my first Single Home Run Hero, but already a Double one as well.

I believe the Uranium investment theme is an extremely interesting one, and I plan to hold Cameco for a very long time, preferably forever.

Dividend Stock Purchases

In terms of investments, I put $11,800 to work.

Here are the shares I bought:

| Purchases | Shares | Invested |

| E.ON | 250 | $3,552 |

| Porsche | 50 | $2,715 |

| BASF | 50 | $2703 |

| Alibaba | 250 | $2,445 |

| AT&T | 25 | $432 |

| Total | $11,846 |

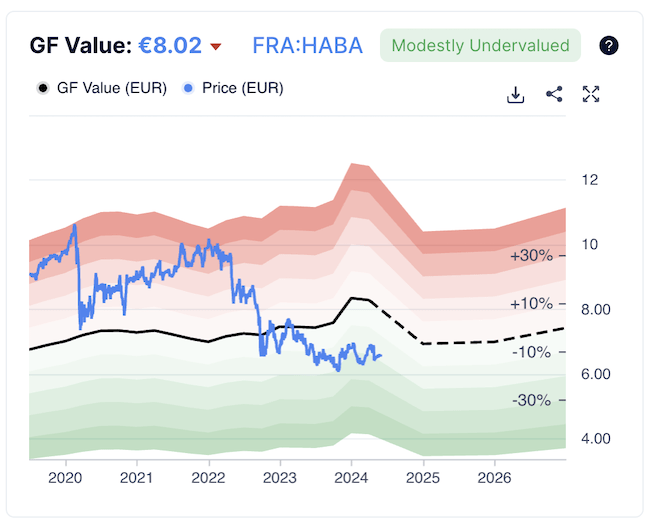

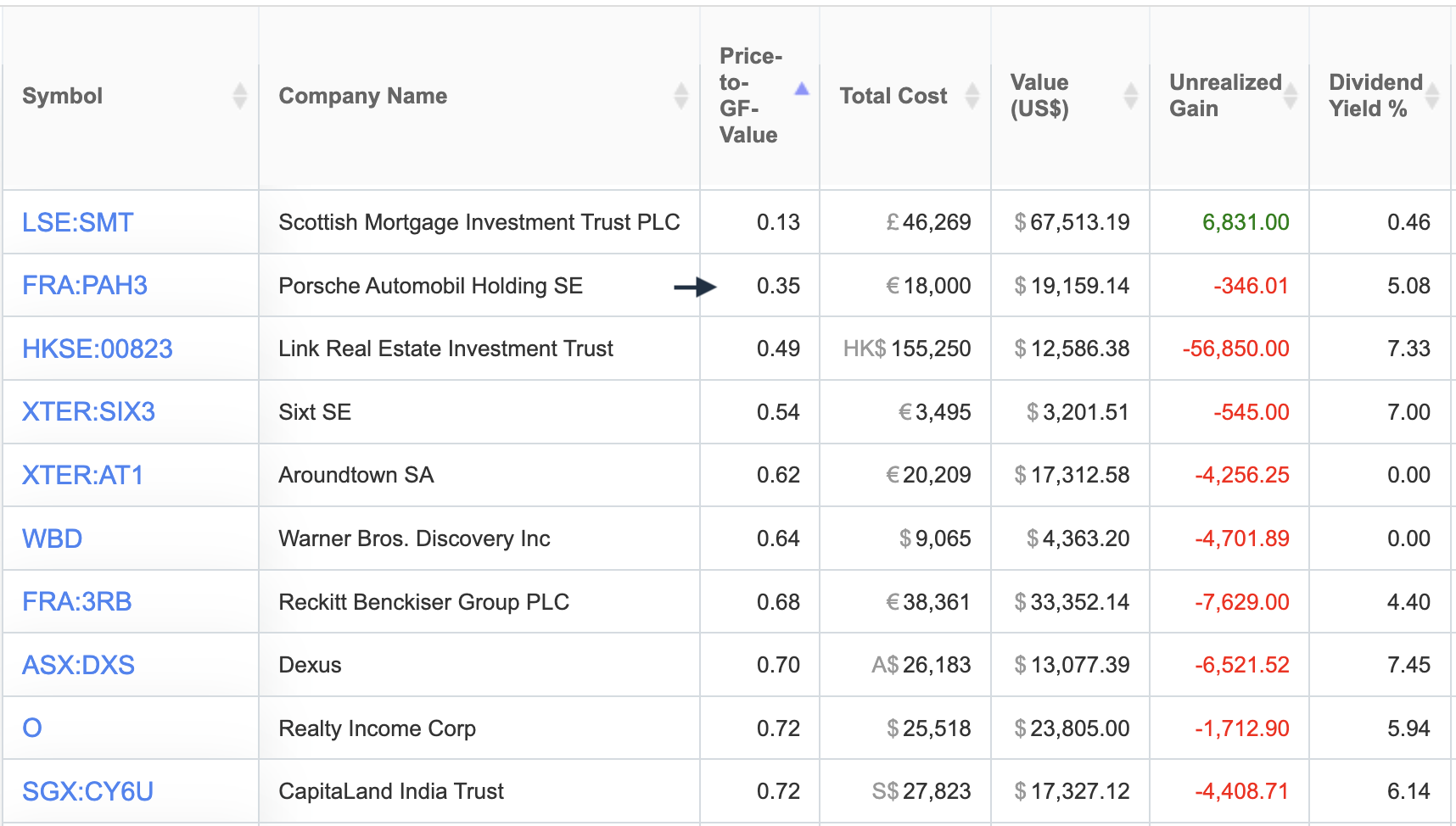

Knowing What To Buy

If I am unsure what position to add to, I often turn to Gurufocus.com.

As a premium user, I get access to its in-house GF Value, the Gurufocus value, providing the following 6 evaluations:

- Possible Value Trap, Think Twice

- Significantly Overvalued

- Modestly Overvalued

- Fairly Valued

- Modestly Undervalued

- Significantly Undervalued

Dividend Breakdown – May 2020-2024

This chart shows all dividends in the month of May for the past years.

Many of those increases are due to additional money I invested in the respective stock.

Out of 17 stocks, two cut their dividends in those years, namely ProSiebenSat1, and Fresenius.

I can live with that and don’t want to trade in and out of these stocks.

So I am fine just holding through some weakness.

Conclusion

I am super happy with the progress of my passive income.

Writing detailed dividend breakdowns like this one helps me crystallize and structure my thoughts.

Thank you for reading till the end. I always love hearing from my readers so please don’t be shy to send me a message anytime.

📘 Read Also

- The AI Investment Pyramid – Building A Balanced Portfolio

- How To Spot A Financial Scam – 4 Important Tips

- Sitting on $1.5M Crypto Gains – Still Frugal Lifestyle Or fatFIRE?

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love