Ordinary Dividend Income 2022/10

This month, I received ordinary dividends from 8 companies for a total of 1,011 USD. That’s about 500 USD more compared to last year’s October when I received 485 USD in ordinary dividends. I am of course happy with that increase, which is mainly due to the additional money I invested since then.

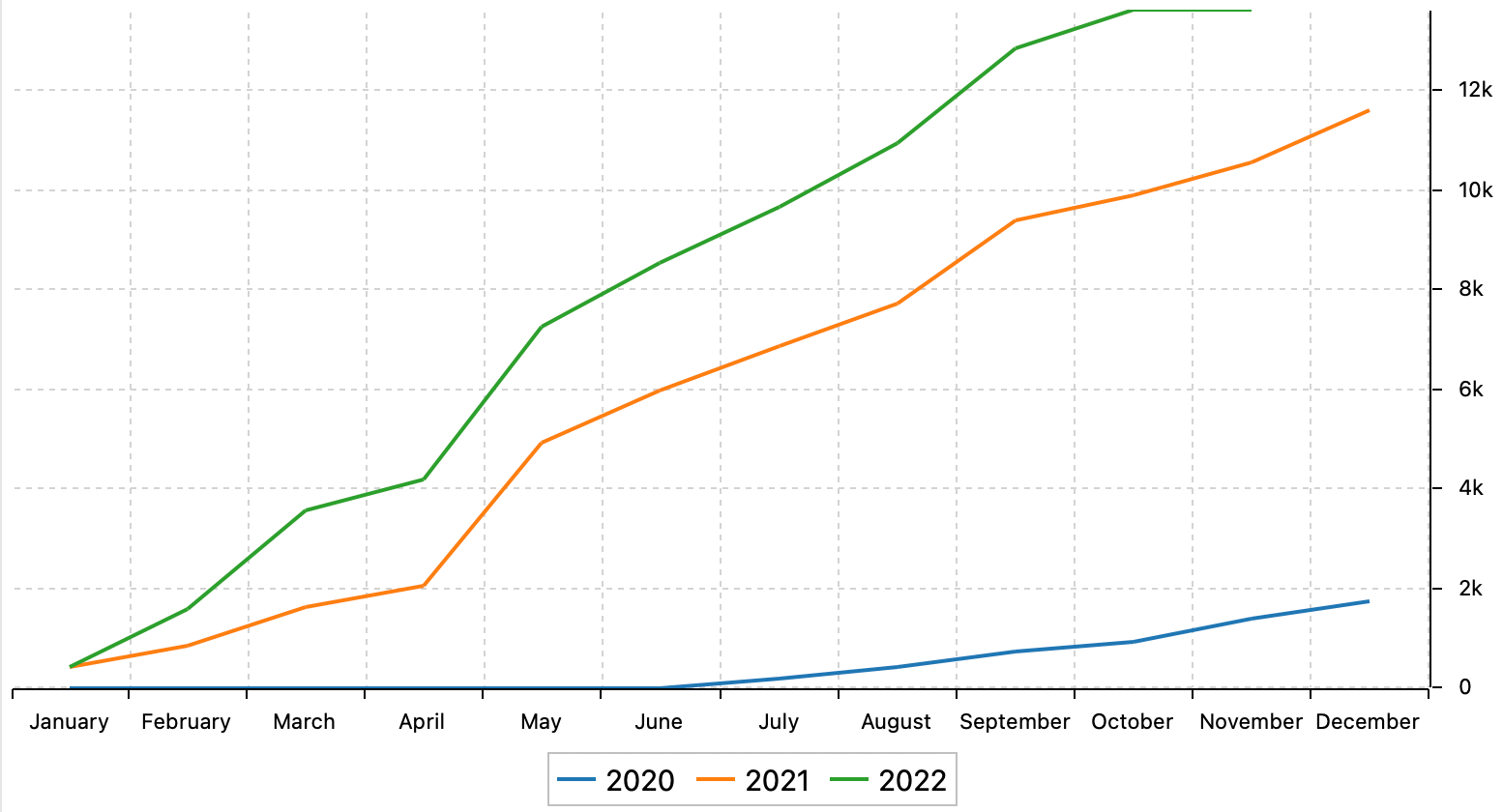

See the chart below showing how my ordinary dividend income develops since I started my All-Weather Portfolio in May 2020.

Ordinary Dividends In 2022

The value of my All-Weather Portfolio currently sits at 599,000 USD. For the whole of 2022, I received a total of 13,600 USD in ordinary dividends. See the following chart showing how the ordinary dividends I received add up for the year:

I started this portfolio in May 2020, hence the slow ramp-up phase in the second half of 2020.

Here are the ordinary dividends I received in detail:

| Date | Company | Dividend in USD |

| Oct 3 | 🇨🇦 Brookfield | $137 |

| Oct 3 | 🇺🇸 Pepsico | $83 |

| Oct 7 | 🇸🇪 Castellum | $218 |

| Oct 15 | 🇺🇸 Realty | $105 |

| Oct 15 | 🇺🇸 Mondelez | $67 |

| Oct 17 | 🇺🇸 Avalon Bay | $103 |

| Oct 18 | 🇺🇸 Store | $164 |

| Oct 27 | 🇺🇸 Cisco | $133 |

| Total | $1,011 |

Please note that these are the gross amounts received.

Ordinary Dividends In October 2022

It was the first time I received an ordinary dividend from the 🇸🇪Swedish REIT Castellum. This is a stock I have been following a lot and already reviewed before. 30% withholding tax was deducted, in line with Sweden’s withholding tax. I sent a withholding tax reduction claim fax to my broker but seems this did not go through.

In regards to Store Capital (STOR), I expect this is one or maybe the last dividend I will receive, as it is bought out by a Singaporean group.

Stock Purchases

I was again quite active and used the depressed stock prices to add to my core holdings. In total, I bought stocks worth

| Date | Company | Amount Invested |

| Oct 3 | 🇺🇸 Anheuser | $225 |

| Oct 4 | 🇺🇸 Welltower | $3,250 |

| Oct 6 | 🇨🇦 Brookfield | $3,998 |

| Oct 12 | 🇩🇪 E.ON | $2,159 |

| Oct 13 | 🇩🇪 Fresenius | $2,912 |

| Oct 24 | 🇸🇬 DBS | $3,399 |

| Oct 25 | 🇺🇸 PG | $3,846 |

| Oct 26 | 🇬🇧 Reckitt | $3,409 |

| Oct 28 | 🇬🇧 Rio Tinto | $2,650 |

| Total | $25,846 |

How To Grow Ordinary Dividend Income?

My strategy remains on buying stocks that yield good dividends.

With the $75,000 US I bought stocks with in September, it will take a few months before I’ll see an increase in my dividend income.

In general, I feel the markets priced it a lot of negativity already. Can the stock market still go down from here? Of course, it can, and most likely it will.

Investment Plan For November

I keep on focusing on buying buy-and-hold forever stocks such the AT&T dividend stock, P&G, or forms like Franco Nevada, in my opinion, the best gold stock in the world. I have no doubt these companies will outlive me. My investment time horizon is in decades, not years or even months.

By focusing on the ordinary dividends I will receive in the years to come from these excellent businesses, I am super relaxed and chilled about whatever the stock market has in store for us in the coming weeks and months.

Other Passive Income

Besides the above-listed dividends of 1,011 USD, I also earned 11,616 USD in other forms of passive income. In other words, the income I generated from ordinary dividends in October represents approx. 9% of my total passive income.

Click here to unlock and instantly see the breakdown of those 11,616 USD.

Read Also

- Read my passive dividend income report for August 2022

- Find out which consumer staples stock I love

- Read about my favorite residential REIT in the U.S.

- What the Store Capital Buyout means

FAQ Section

What are ordinary dividends?

Ordinary dividends are the most common form of dividends when companies pay out earnings. In general, dividends can be classified as ordinary dividends or qualified dividends. Ordinary dividends are taxable as ‘ordinary income’, whereby qualified dividends usually meet certain requirements and are taxed at lower capital gain rates.

Are ordinary dividends taxable?

Yes, usually ordinary dividends are subject to withholding taxes that vary from country to country. In the U.S. for example, withholding tax for ordinary dividends ranges between 20%-30%. Withholding taxes on ordinary dividends can usually be balanced off, but this requires the help of a tax advisor.

Are qualified dividends included in ordinary dividends?

For tax purposes, ordinary dividends typically include qualified and non-qualified dividends received. In other words, dividends of stocks bought in the United States, and held for at least 60 days may be “qualified” for the lower rate.

What are examples of ordinary dividends?

Ordinary dividends are the most common form of dividends. The dividend stock AT&T for example paid out an ordinary dividend of $0.2775 USD in August of 2022, of which $0.04 US, or 18%, in the form of withholding tax was instantly deducted. Ordinary dividends are taxed differently depending on the specific details of each company.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love