Passive Dividend Income Report 2022/08

Last year, in August 2021, I received a total of 757 USD from dividends from my All-Weather Portfolio. This year, I received 1,264 USD (net/after taxes & fees). An increase of about 60% year on year or 506 USD year-on-year. This is, however, mostly due to additional shares I purchased since then.

Here’s my full passive dividend income report for August 2022:

| Date | Company | Shares | Net Received |

| 2022-08-01 | Link REIT 🇭🇰 | 500 | $186 |

| 2022-08-01 | AT&T 🇺🇸 | 575 | $136 |

| 2022-08-08 | Deere 🇺🇸 | 13 | $12 |

| 2022-08-15 | AbbVie 🇺🇸 | 126 | $151 |

| 2022-08-15 | Realty 🇺🇸 | 425 | $89 |

| 2022-08-16 | PG 🇺🇸 | 70 | $58 |

| 2022-08-28 | DBS 🇸🇬 | 450 | $116 |

| 2022-08-31 | Ascendas India 🇮🇳 | 14,000 | $415 |

| 2022-08-31 | Dexus 🇦🇺 | 850 | $99 |

| Total Received (net) | $1,264 |

The largest dividend payment is from Ascendas India, a real estate investment trust acquiring, developing, and operating prime-commercial properties in the main financial and tech hubs of India. I believe India has excellent demographics (“demography is destiny”), is an “incredible country”, and I am bullish on it for the coming two decades.

The second largest dividend is from Link REIT, Asia’s largest REIT. With 24,500 units in total, this used to be my largest position between 2015-2019, but when the uncertainty started to grow around Hong Kong’s future. With a tear in my eye, I sold all shares between 88-94 HKD. Now, three years later, we are hovering above 60 HKD, and I only started to build a small position again.

Recent Dividend Stock Purchases

I was active in August and allocated a total of ~34,000 USD to my dividend stocks, making the following purchases (no new positions, just adding to existing ones):

| Date | Company | Shares | Net Invested |

| 2022-08-03 | Siemens 🇩🇪 | 35 | $3,765 |

| 2022-08-05 | Warner Bros 🇺🇸 | 250 | $3,646 |

| 2022-08-09 | DHL 🇩🇪 | 100 | $4,006 |

| 2022-08-17 | 3M 🇺🇸 | 20 | $2,970 |

| 2022-08-18 | AbbVie 🇺🇸 | 4 | $561 |

| 2022-08-19 | Allianz 🇩🇪 | 25 | $4,472 |

| 2022-08-22 | Dexus 🇦🇺 | 500 | $3,144 |

| 2022-08-22 | Ascendas India 🇮🇳 | 3,500 | $2,988 |

| 2022-08-22 | BASF 🇩🇪 | 35 | $1,496 |

| 2022-08-28 | E.ON 🇩🇪 | 400 | $3,420 |

| 2022-08-31 | PG 🇺🇸 | 25 | $3,481 |

| Total Invested | $33,949 |

Other Passive Income

In August, besides my above-listed dividends, I also earned 2,177 USD passive income from my crypto portfolio. I use various strategies such as staking, liquidity mining, and farming. The most significant contributors were Hedera, Cake DeFi, and my GameFi/Metaverse investment Perion. See here how I earn interest on crypto.

I made 3,962 USD via bank cash deposits.

You can check out all the passive income (currently approx. 12,000 USD/mo) by clicking here.

Investment plan for September

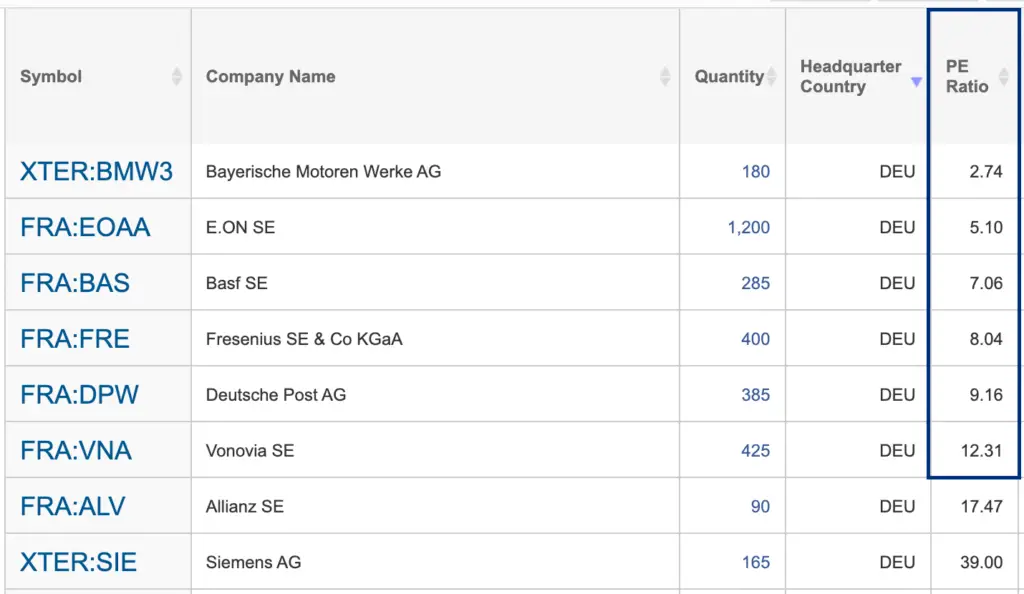

I believe stock prices, especially in Europe, have priced in a lot of uncertainty already. Look at the PE ratios of some of my German dividend stocks.

BMW with a PE of below 3 (!), still had a net profit of +10 Bio Euro (after tax!). E.ON, Germany’s largest utility company, with a PE of 5, BASF, the largest chemical company in the world, with a PE of 7, and so on. No one knows if we have seen the bottom, but I am convinced these companies will still be around a few years from now. Most likely we’ll look back at this passive dividend income report and low valuations, and say to ourselves “damn, those were actually good buying opportunities”. Never let a crisis go to waste!

I keep my investment strategy simple: I only invest 25% of my available cash. I don’t need any of the cash I invest for years to come. If the prices bottom out here and go up, I win. If prices decrease further, I also win, as I still have 75% cash to allocate.

It took me exactly 59 minutes from start to finish to gather all info and write this Passive Dividend Income Report. Something I also keep track of.

Read Also

- Read my stock dividend report for July 2022

- Find out what my favorite natural resource stock is

- Does gold actually outperform the stock market?

- What are the 3 best German dividend stocks in 2022?

- The 3 Best 🇦🇹 Austrian Dividend Stocks To Buy

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love