The 5 Best European Stocks With Quarterly Dividends

Investors from the U.S. are spoiled. There are thousands of stocks with quarterly dividends to choose from. But how about other parts of the world? Let’s take a look at how many stocks we can find that pay quarterly dividends.

According to Gurufocus’ excellent All-in-one-screener, there are

- 1,740 quarterly dividend-paying stocks in the U.S., and

- 435 Asian stocks are paying quarterly dividends, and,

- 68 European stocks are paying quarterly dividends.

Of those thousands of companies, I list my favorite dividend payers below.

My Top 5 Quarterly Dividend Paying Stocks, By Region

| 🌎 North America | 🇪🇺 Europe | 🌏 Asia |

| Johnson & Johnson | Unilever | DBS Bank |

| PepsiCo | Castellum | Taiwan Semiconductor |

| John Deere | British American Tobacco | Samsung Electronics |

| BlackRock | Shell | Maple Tree Logistic Trust |

| Cisco | ASML | Posco Holdings |

Europe’s Stock Dividend Culture

The way people and companies see dividends in Europe is different compared to the U.S. Most companies in Europe pay annual dividends (ie. Allianz, BASF, Siemens, etc.). Sometimes they pay semi-annually dividends (ie. LVMH, Heineken, Novo Nordisk, etc.).

Very few pay quarterly dividends. Most are located in the UK, which technically is not part of the European Union. Without the likes of Unilever, BAT, and Shell, it would not be possible to come up with five stocks with quarterly dividends.

The 5 Best European Stock With Quarterly Dividends

#1 Unilever – The British/Dutch Dividend Juggernaut

| 🇬🇧 Unilever (UL) | |

| Dividend Yield | 3.7% |

| Market Cap | $125 Bio US |

| PE Ratio | 16 |

| PB Ratio | 6 |

Unilever is a favorite among income investors all over the world. Its products are household names such as Dove, Knorr, Wall’s, Domestos, and Bertolli are consumed by billions of people every single day. Its portfolio of brands consists of 400 brands generating revenue of +50 Bio USD.

Unilever’s 13 flagship brands each generate sales of 1 Bio USD. With its financial resources, worldwide reach, popular brands, and experience, I believe Unilever is one of the best European stocks with quarterly dividends.

Disclaimer: I own Unilever in my All-Weather Portfolio.

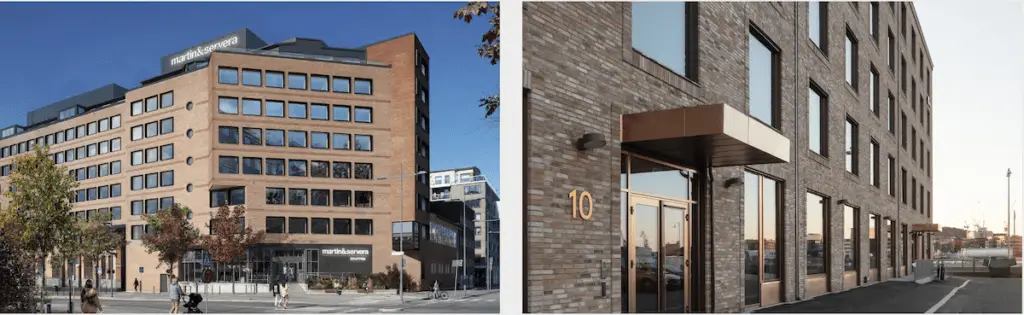

#2 Castellum – A Swedish Property Powerhouse

| 🇸🇪 Castellum (CWQXF) | |

| Dividend Yield | 4.7% (!) |

| Market Cap | $5.0 B Bio US |

| PE Ratio | At Loss |

| PB Ratio | 0.48 (!) |

Castellum is my favorite real estate company in Scandinavia.

It operates acquires, develops, and operates properties primarily in Sweden and Denmark. It develops office, retail, residential, and industrial properties, while also providing third-party property management services.

It tries to focus on cash-generative projects, with excellent risk/reward and growth ratios.

In Q1 of 2023, it owns 750 properties with a total of 5,6 Mio sq. m., meaning an average Castellum property is 7,600 sq.m. (about 75,000 sft).

Personally, I believe Castellum is one of the few and best European stocks with quarterly dividends.

Castellum currently has a PB, or price-to-book, of 0.5! For a well-run property portfolio, this represents a good buying opportunity, and I am happy to hold and add to my position at these levels.

Disclaimer: I own Castellum in my All-Weather Portfolio.

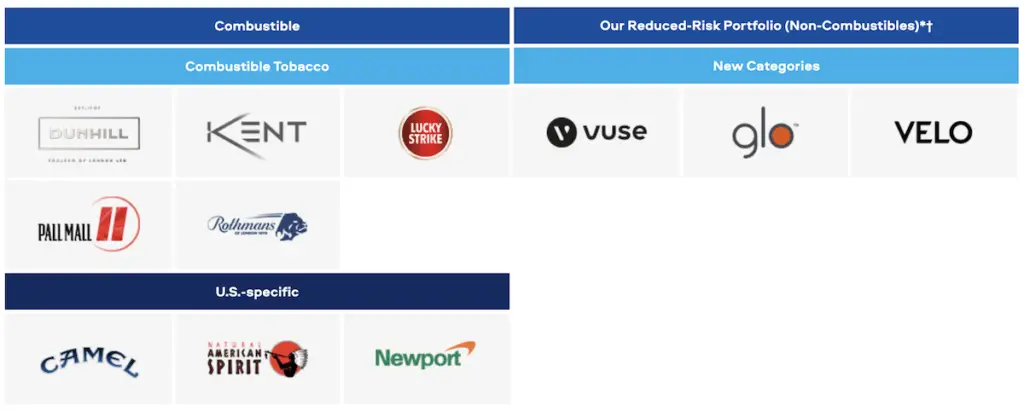

#3 British American Tobacco – A Dividend Powerhouse

| 🇬🇧 British American Tobacco (BTI) | |

| Dividend Yield | 7.3% |

| Market Cap | $81 Bio US |

| PE Ratio | 10 |

| PB Ratio | 0.88 |

I am not a friend of sin stocks and am not a holder of any tobacco, defense, or liquor stock. I hold Anheuser Busch, as I believe beer is on a different level than hard spirits.

For income investors, many consider British American Tobacco (BTI) as one of the best European stocks paying a quarterly dividend.

Owning brands such as Lucky Strike, Dunhill, Kent, Pall Mall, Rothmans, and Camel, this multinational also markets vapor or e-cigarettes, including its popular Vype brand of heated tobacco, Glo, and hand-rolled smokeless tobacco products.

It also owns a 31% stake in ITC Limited, India’s leading tobacco maker.

#4 Shell – The Best European Stock In The Energy Space

| 🇬🇧 Shell (SHEL) | |

| Dividend Yield | 3.8% |

| Market Cap | $184 Bio US |

| PE Ratio | 5 |

| PB Ratio | 0.99 |

In another post, I summarized already why I believe Shell to be the best oil company.

As it is a UK-based company, shareholders get dividends “tax-free”, with no withholding tax deducted.

Shell is one of the largest oil produc aers in the world. It produces about 1.7 Mio barrels of liquid & 8.7 Bio cubic feet of natural gas per day.

Its production assets are located in Europe, Africa, the Americas, and Asia. The largest chemical plants, often integrated with local refineries, are located in Central Europe, China, Singapore, and North America.

Shell is an investor-favorite, and easily one of the five best European stocks with a quarterly dividend. Its strong pivot to renewable energy makes it also a “climate change” stock, as the company is one of the largest investors in renewable energy.

Disclaimer: I own Shell in my All-Weather Portfolio.

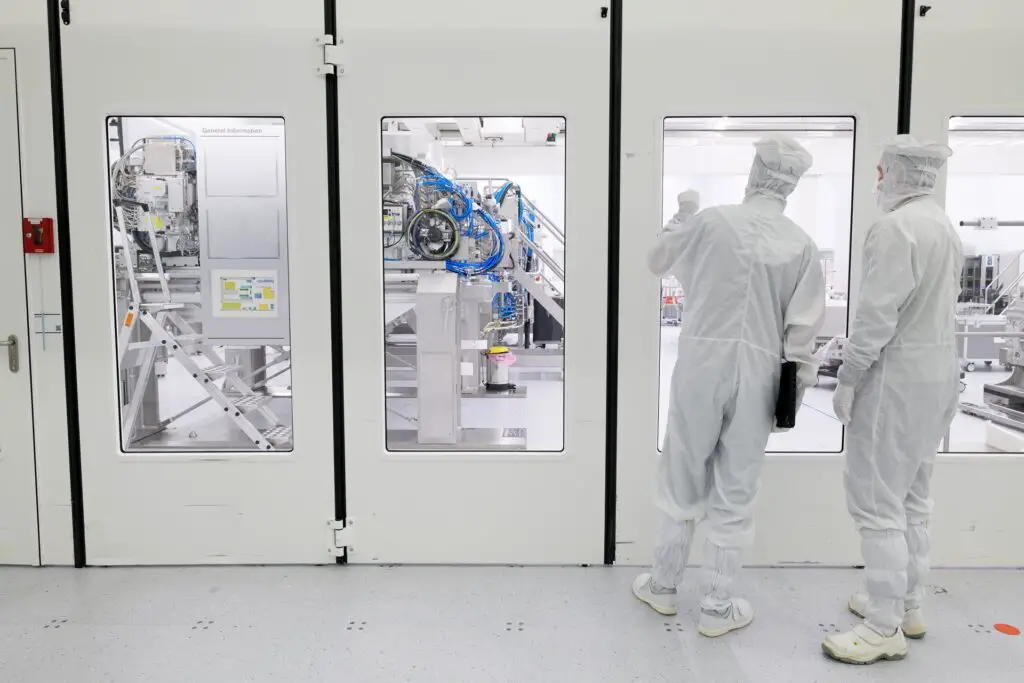

#5 ASML – The Dutch Tech Giant

| 🇬🇧 ASML (ASML) | |

| Dividend Yield | 1.3% |

| Market Cap | $248 Bio US |

| PE Ratio | 42 (ouch) |

| PB Ratio | 26.81 (ouch³) |

Most people don’t know ASML, but it is by far the biggest of the presented 5 stocks.

The company was founded in 1984 and is based in the Netherlands.

Interesting ASML Fact:

The company Philips, ticker symbol $PHG, owns +20% of ASML, making their stake more valuable than their current market cap!

It is a worldwide leader in photolithography systems for semiconductor manufacturing.

What that means, simply put, is that ASML is “very good” in the process of exposing circuit patterns from a photomask onto a semiconductor wafer using a light source. LOL.

As I don’t understand a single word of what I just wrote, I don’t invest in tech stocks such as ASML. Remember Nokia? Sony Ericsson? Kodak? These tech sectors get disrupted every 2-3 years. Simply staying relevant and surviving is already an achievement.

When it comes to my long-term dividend portfolio, I decided to avoid tech stocks completely.

ASML managed to generate $23 Bio USD in sales, with a healthy gross margin of +50%.

For the tech-savvy investors among you, ASML is a very interesting pick, because it is a fast dividend grower, has superior tech (for now), and its products are essentially required for millions of different devices.

Personally, this stock is not for me.

Largest European Stocks, By Market Cap

When looking at the largest European companies by market cap, we can see that only one of the stocks presented above makes it onto this list: ASML.

Only one of the top seven companies with a market cap of +$200 Bio does so (ASML).

| Company | Country | Sector |

Market Cap in Bio

|

| LVMH | France | Consumer Cyclical | $427 Bio |

| Nestle | Switzerland | Consumer Defensive | $316 Bio |

| Novo Nordisk | Denmark | Healthcare | $313 Bio |

| ASML | Netherlands | Technology | $246 Bio |

| Roche | Switzerland | Healthcare | $227 Bio |

| L’Oreal | France | Consumer Defensive | $219 Bio |

| Prosus | Netherlands | Communication Services | $209 Bio |

Conclusion

Of the 68 stocks to choose from, I believe those presented above are the best European stocks paying quarterly dividends.

With those five stocks, investors get exposure to consumer staples, real estate, energy, and the tech space.

Personally, I hold Unilver, Castellum, and Shell, and am happy to hold them for years, or even decades, to come.

📘 Read Also

- How To Start With Investing – An Ultimate 10-Step Guide

- The 5 Best European Insurance Stocks To Buy

- The 5 Best Asian REITs To Buy

- How To Find High Yield Dividend Stocks

FAQ

What are the best European stocks with high dividends?

Five great European stocks with high dividends, in the below case quarterly dividends:

1/ Unilever

2/ Castellum

3/ British American Tobacco

4/ Shell

5/ ASML

Are there European stocks with quarterly dividends?

Yes, in total there are 68 European stocks with quarterly dividends. The largest one, by market cap, is ASML. It pays dividends four times a year with a total dividend yield of 1.3%.

What are the European companies with biggest market cap?

LVMH, from France, with $427 Bio US in market cap

Nestle, from Switzerland, with $316 Bio US in market cap

Novo Nordisk, from Denmark Healthcare $313 Bio US in market cap

ASML, from the Netherlands, with $246 Bio US in market cap

Roche, from Switzerland, with $227 Bio US in market cap

L’Oreal, from France, with $219 Bio US in market cap

Prosus, from the Netherlands, with $209 Bio US in market cap

What are the best European stocks with highest dividend yield?

The following five European stocks pay solid and quarterly dividends:

1/ Unilever, with a 3.7% dividend yield

2/ Castellum, with a 6.6% dividend yield

3/ British American Tobacco, with a 7.3% dividend yield

4/ Shell, with a 3.8% dividend yield

5/ ASML, with a 1.3% dividend yield

What are 5 good European quarterly dividend stocks?

1/ Shell, with a 3.8% dividend yield

2/ Castellum, with a 6.6% dividend yield

3/ ASML, with a 1.3% dividend yield

4/ Unilever, with a 3.7% dividend yield

5/ British American Tobacco, with a 7.3% dividend yield

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love