Dividend Snapshot Of Oct 2023

In October I saw a relatively modest passive income of $841 US.

Check out the dividend snapshot table below:

| Date | Dividends from | Shares | Amount |

| 2023-10-27 | 🇬🇧 Ecora Resources | 11,280 | $238 |

| 2023-10-02 | 🇨🇦 Brookfield | 550 | $182 |

| 2023-10-17 | 🇺🇸 Avalon Bay | 70 | $98 |

| 2023-10-15 | 🇺🇸 Realty | 435 | $95 |

| 2023-10-02 | 🇺🇸 Pepsico | 72 | $81 |

| 2023-10-26 | 🇺🇸 Cisco | 350 | $81 |

| 2023-10-16 | 🇺🇸 Mondelez | 225 | $67 |

| Total | $841 |

Compared to 2022, I saw an increase of $53, not much, but am still happy about it.

My goal for next year is to increase the dividends I will receive in October and November, which historically speaking are very slow months for me.

I like Parqet’s dividend calendar, which you can check out here.

Dividend Snapshot Charts

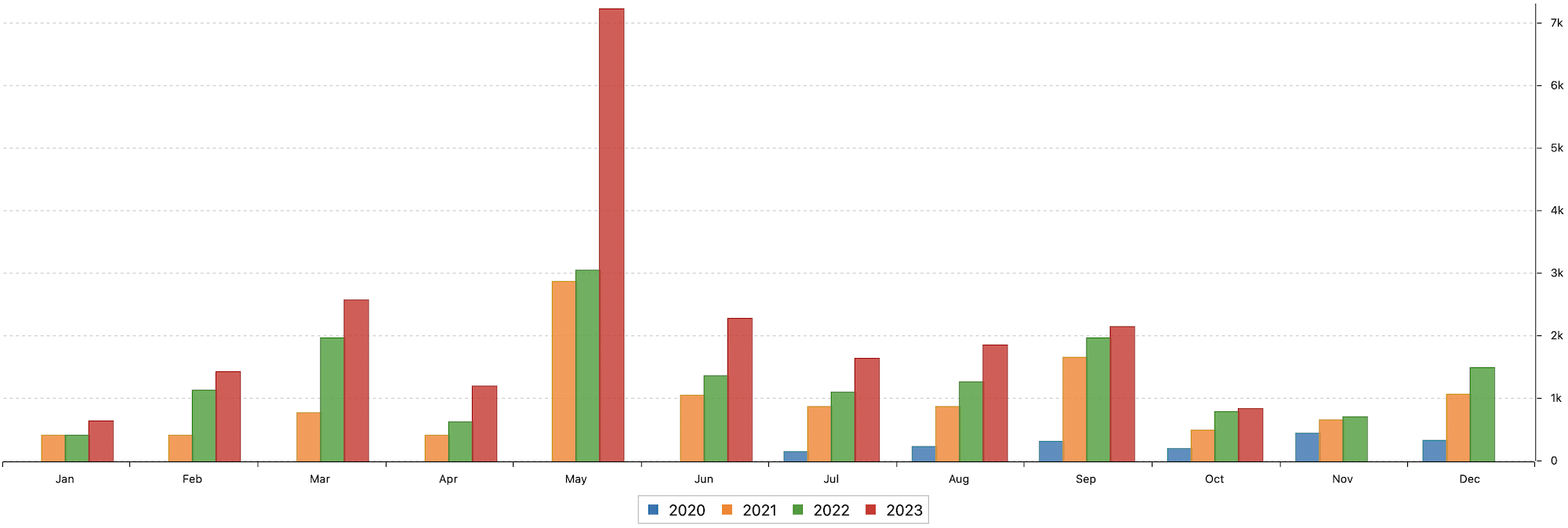

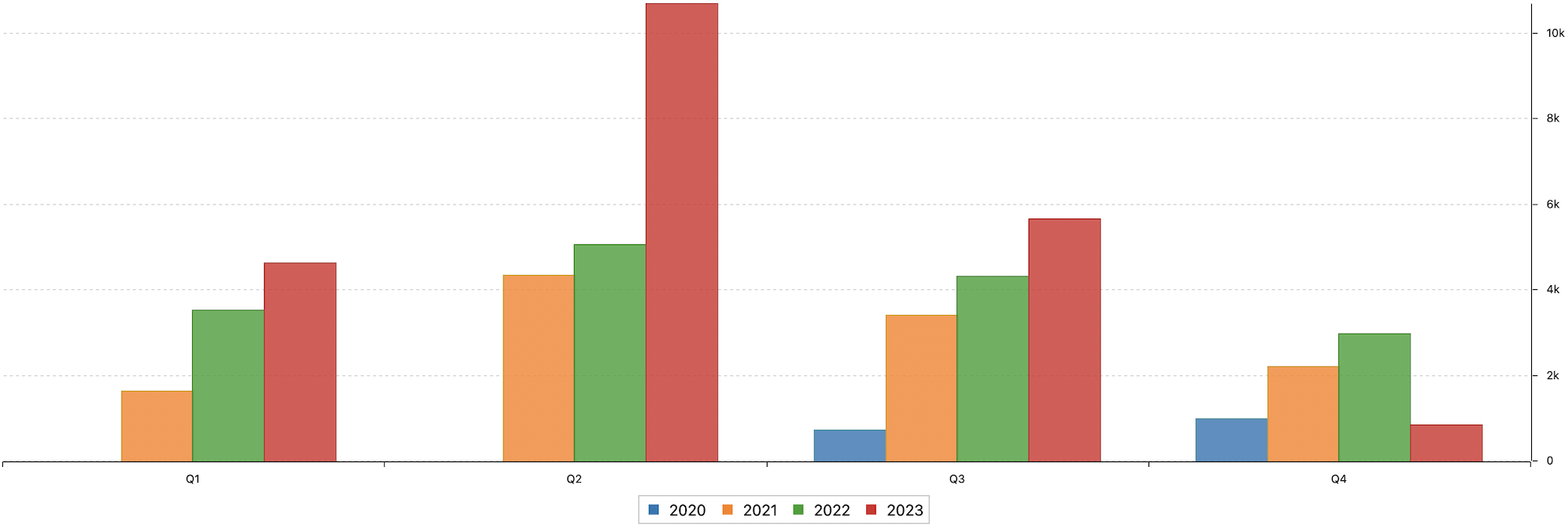

You can see that on some of the following dividend snapshot charts below:

Below is my dividend snapshot by quarter (I started my All-Weather Portfolio in May 2020).

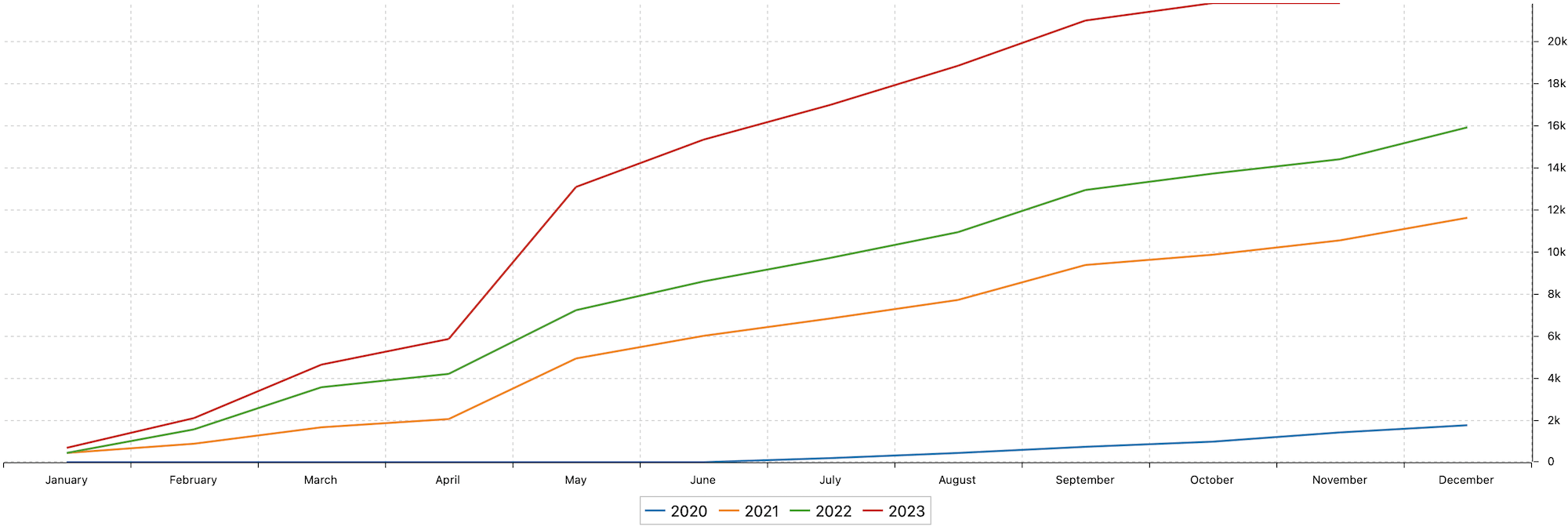

Below is the dividend snapshot progress by year.

Overall, I am happy with the progress. I knew it would take time.

When it comes to long-term passive income building through dividend stocks, I like Bob Proctor’s quote:

“There is a season to sow.

There is a season to reap.

But you can’t do both in the same season.”

Dividend Stock Purchases

In October, I invested a total of about $11,935 US in some of my favorite dividend stocks.

| Date | Purchases | Shares | Amount |

| 2023-10-31 | 🇩🇪 E.ON | 500 | $5,956 |

| 2023-10-04 | 🇩🇪 BASF | 60 | $2,650 |

| 2023-10-26 | 🇮🇳 CapitaLand India | 3,200 | $2,301 |

| 2023-10-18 | 🇺🇸 Realty | 10 | $501 |

| 2023-10-18 | 🇨🇦 Enbridge | 10 | $326 |

| 2023-10-03 | 🇨🇦 Brookfield | 10 | $201 |

| Total | $11,935 |

I had also orders for $PG and $PEP, but they did not get filled and might be executed only in November.

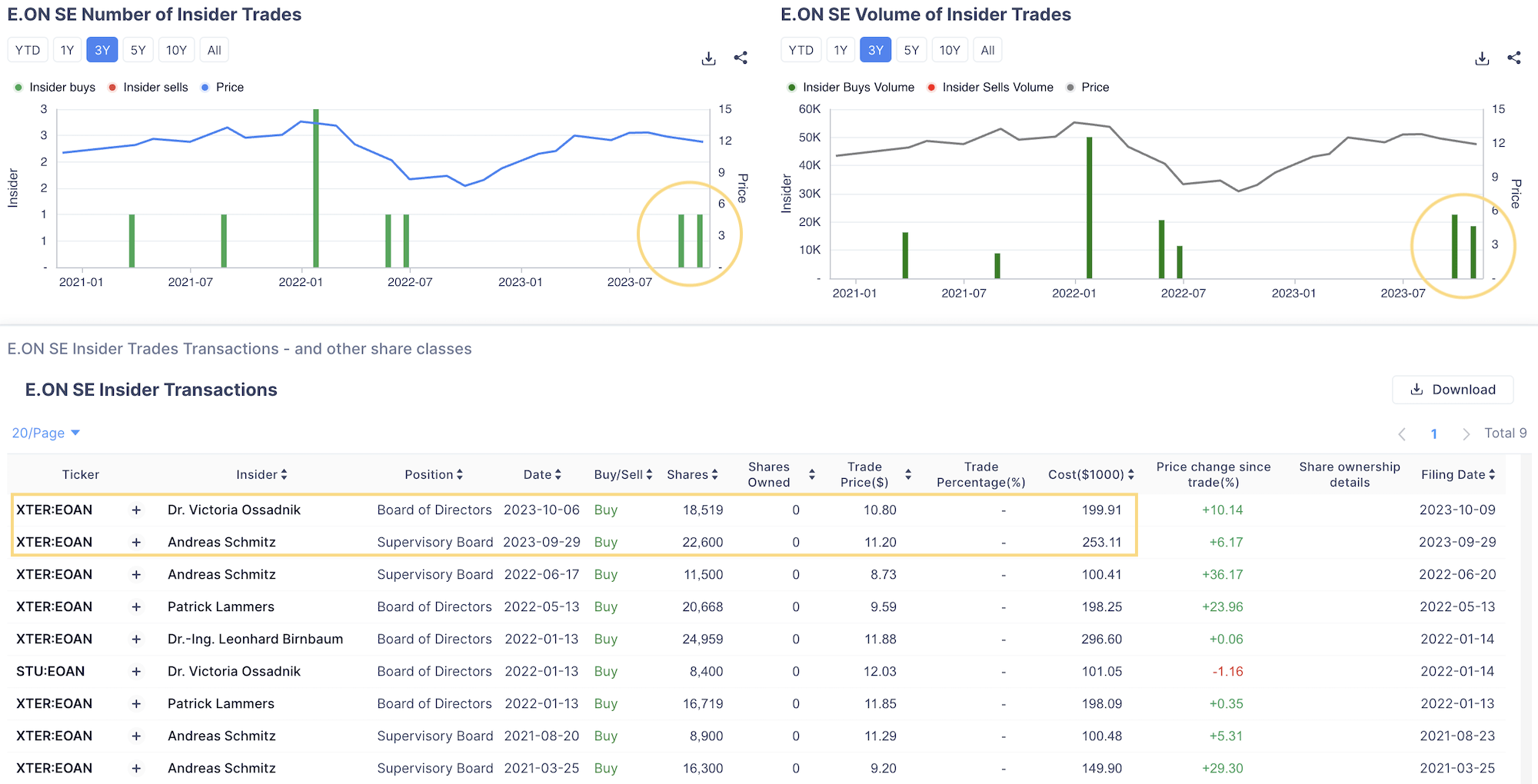

I bought 500 additional E.ON, listed in the U.S. under the ticker symbol $EONGY, because two major insiders made some recent large purchases ($450k worth). When looking at E.ON’s dividend snapshot page, we can see that it raised its dividend continuously in the past nine years, even during the difficult pandemic years. Exactly what we expect from a utility company.

We can see this on Gurufocus’ excellent insider’s page, see the image below.

Conclusion

A relatively short dividend snapshot and quiet month. November looks to be rather a quiet month as well.

Planning to buy more Pepsico $PEP and Ecora Resources $ECRAF.

📘 Read Also

- The 10 Best European Football Stocks

- How To Explain Bitcoin In 10 Easy Steps

- How To Build A Simple Crypto Portfolio – A Step By Step Guide

FAQ

Which dividend stock to buy

If you are looking for a dividend stock to buy, try to take a long-term time horizon, and consider building a portfolio of dividend stocks of various industries, such as

– consumer staples (ideas: $PG, $PEP, $UL),

– industrials (ideas: $MMM, $SIEGY),

– consumer cyclical (ideas: $DIS, $WB)

– etc.

Pay attention to the PE ratios, debt, dividend yield, and payout ratio. Here is my list of best stock picks.

How to analyze dividend stocks

To analyze dividend stocks, follow these steps:

– Research the company’s financial health, industry trends, and competitive position.

– Calculate the dividend yield by dividing the annual dividend per share by the stock price.

– Check the dividend growth rate to see if it’s increasing over time.

– Evaluate the payout ratio to ensure the company can sustain and potentially increase dividends.

– Review the company’s financial statements for consistent earnings growth, manageable debt levels, and strong cash flows.

– Compare dividend yield, growth rate, and payout ratio to other companies in the same industry for benchmarking.

Check out 10 great tips on how to find high yield dividend stocks.

Where dividends are reported?

Dividends are typically reported in several places:

– Income Statement: Dividends are listed as a separate line item under the revenue or income section

– Cash Flow Statement: Dividends are reported in the financing activities section of the cash flow statement.

– Dividend Announcement: Companies often make official announcements regarding dividends through press releases or filings with regulatory authorities.

– Investor Relations Website: Companies may also disclose dividend-related information on their investor relations websites.

This can include dividend history, upcoming dividend payments, and dividend policies.

Remember that dividend reporting practices may vary slightly between companies, so it’s always a good idea to check multiple sources for accurate and up-to-date dividend information.

Will dividend stocks go down?

The performance of dividend stocks can vary. Factors like overall market conditions, company performance, interest rates, and dividend policy changes can impact their prices. It’s important to conduct research and analysis on individual stocks to assess their potential for ups and downs. Diversifying your portfolio and considering a long-term investment strategy can help manage risks.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love