Mindful Snacking – A Global Megatrend.

Humans all over the world love to snack. In fact, snacking is becoming preferred to eating meals for 59% of adults worldwide. And for the Millennial generation, that figure jumps to 70%, according to the “State of Snacking” report. This is no surprise to me. In the times we live in, people love to enjoy ‘the little things’ and occasional treats. Mondelez is a company that is perfectly positioned to benefit from this global trend.

In this article, I’ll explain why Mondelez has many things going for it, why I will hold it for a long time, and why it is a good dividend stock in general.

Disclaimer: I am a shareholder of Mondelez since mid-2020. I own 175 shares with an average purchase price of 58 USD. I’m currently receiving about 39 USD per quarter in Mondelez dividends.

About The Company

Mondelez International ($MDLZ), is the world’s biggest chocolate, candy, and biscuit maker. The company is based in Chicago, Illinois, and once was part of Kraft Heinz (another buy-and-hold forever stock I own in my All-Weather Portfolio), before it was spun off into a separate company in 2012.

Its products are loved by consumers all over the world, often without knowing that they are owned by the same company. Ask anyone in Europe who manufactures Milka, Philadelphia, or Oreo, and 99% of all people don’t know.

What is the meaning of the word ‘Mondelez’?

The word Mondelez is derived from the Latin words, mundus (world) and delez (delicious).

Six Great Reasons Why Mondelez Is A Good Dividend Stock

#1 A Worldclass Brand Portfolio

Same as with other companies I keep in my All-Weather Portfolio e.g. Warner Bros or Brookfield Renewable, my family absolutely loves Mondelez products.

Here’s a list of Mondelez products we are a family regularly buy, and love (click on any of the links to go straight to the exact product on Amazon we love and buy):

- Milka chocolate (my favorite one is Hazelnut Milk flavor)

- belVita biscuits (our kids have belVita 2-3 times a week)

- Chips Ahoy (my perfect coffee companion)

- Toblerone (we buy one whenever we’re at an airport)

- Oreo (my wife’s -only- weakness)

- Triscuit crackers (a family favorite with creme cheese)

- Philadelphia (Original flavor is our favorite)

- Peet’s Coffee (love the coffee chain and the capsules)

We as a family already consume enough products each month that Mondelez’s revenue is secured for years to come ;-)!

My investment philosophy has always been that when looking for a good dividend stock, ideally, I also want to like its products, and this couldn’t be more the case with Mondelez. Why not choose stocks of companies creating products we love and use anyways, right?

An interesting note is that the top 9 global brands only’ represent 43% of Mondelez’s revenues, meaning there is no cluster risk or one single blockbuster product.

Fun Fact

Did you know that there is a street called Oreo Way in New York? A part of 9th avenue was renamed to Oreo Way honoring the location where the very first cookie was made and where the very first Nabisco factory was located, the original producer of Oreo, and now a subsidiary of Mondelez.

👉virtually visit Oreo Way

#2 Excellent Global Footprint

It’s no surprise that Mondelez is EVERYWHERE. Although it’s a U.S.-based company, it has operations and sells its products in 150+ countries. People from all over the world love Mondelez’s brands, and I found its products even in the smallest mom-and-pop stores on islands in Thailand, in the outback of Australia, or in remote towns in Northern Norway.

Because of its massive global footprint, we as investors benefit from the rapidly growing middle-class in emerging and developing economies because Mondelez’s products are affordable and easy to get! For poorer families, trying out and enjoying some ‘international snacks’ is one of the first and easiest ways to treat your family. I know Mondelez is well-positioned to benefit from this long-term trend!

| Percentage of 2019 Net Revenues | |

| Europe | 39% |

| North America | 27% |

| Asia Middle East Africa |

22% |

| Latin America | 12% |

Absolutely love the fact that 34% of Mondelez’s revenues are already from those areas of the world with much better demographics and population growth. For any good dividend stock, I like to see at least 25% of the revenues generated outside its home country. Mondelez checks this easily.

Back in Singapore, Peet’s Coffee stores are usually PACKED. Gives me as a coffee lover and Mondelez shareholder a good feel every single time!

Quick background info on Peet’s Coffee: The company was formed in 2015 via a merger of Mondelez’s coffee division and Jacobs Douwe Egberts. Peet’s coffee is now a separate company, listed on the stock exchange in Amsterdam under the ticker symbol $JDEP. It now serves about 4,500 coffees every single second. Its brand portfolio includes L’OR, Peet’s, Jacobs, Senseo, Tassimo, and Douwe Egberts.

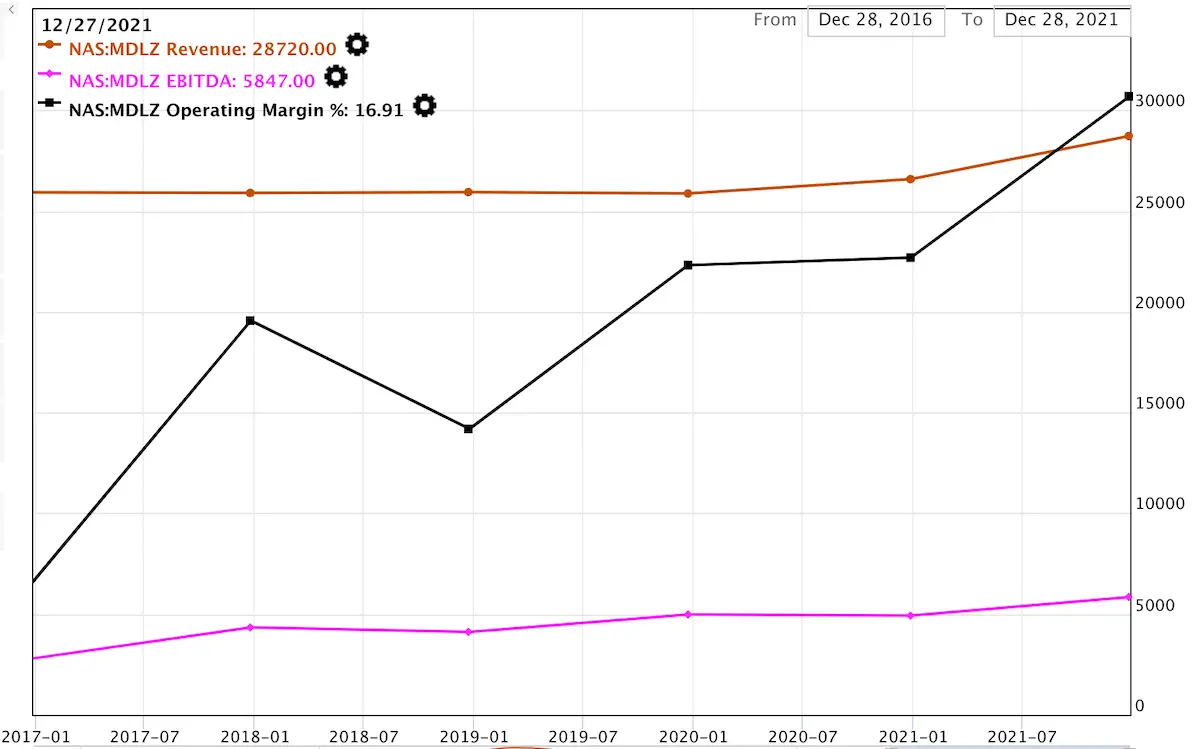

#3 Solid Financials

Looking at the revenues, operating margin, and EBITDA, we see a positive stead trend. The growth of the revenue is slow but steady, and there are clear improvements in terms of operating margin and EBITDA. To me, Mondelez is a good dividend stock with solid financials. No red flags here.

#4 The Leader Of Mindful Snacking

What does Mondelez mean by ‘mindful snacking’? It is about ‘eating with intention and attention, focusing on the present moment, and savoring how the food tastes so you really enjoy it. In short, it’s about making the most of snacking in the moment. One way the company is trying to help its customers is by focusing on ‘portion control pack formats’. Nice.

How To Mindfully Snack?

- Minimize distractions

- Portion out your snack

- Focus on the smell and taste

- Notice the textures

- Chew thoroughly

- Finish one bite before starting the next

Personally, I appreciate Mondelez’s effort to educate consumers about mindful eating and snacking. I noticed if I do so, I tend to consume a little bit less and make each snack a bit of a special moment.

It also focuses a lot of resources on the growing trend of healthy snacking. Mondelez’s flagship “Mindful Snacking website” is a great source of information. It even has one site catering to the special snacking needs of health professionals.

Fun Fact

About 50% of Oreo lovers pull the two cookies apart.. me included unless I dunk them in coffee 😉

#5 Collaborating With Innovative Startups

Another aspect I like about Mondelez is that they engage a lot with innovative, disruptive startups. Large corporates tend to become complacent and slow to react, hence I feel it is important that they are in touch with entrepreneurs, startups, and smaller companies that are thinking out of the box. In this regard, Mondelez is

#6 Strong Dividend Per Share Increases.

Yes, it is. It produced double-digit dividend per share increases for the past five years (13.2% CAGR for the past 5 years!). It has a payout ratio of 46%, and a dividend yield of 2.37%, making Mondelez not the highest-yielding but a good dividend stock. See below for the dividends I collected since I purchased my first MDLZ shares in early June 2020.

| Currency | Dividend | Ex-Date | Record Date | Pay Date | Type | Frequency |

|---|---|---|---|---|---|---|

| USD | 0.350 | 2022-06-29 | 2022-06-30 | 2022-07-14 | Cash Div. | quarterly |

| USD | 0.350 | 2022-03-30 | 2022-03-31 | 2022-04-14 | Cash Div. | quarterly |

| USD | 0.350 | 2021-12-30 | 2021-12-31 | 2022-01-14 | Cash Div. | quarterly |

| USD | 0.350 | 2021-09-29 | 2021-09-30 | 2021-10-14 | Cash Div. | quarterly |

| USD | 0.315 | 2021-06-29 | 2021-06-30 | 2021-07-14 | Cash Div. | quarterly |

| USD | 0.315 | 2021-03-30 | 2021-03-31 | 2021-04-14 | Cash Div. | quarterly |

| USD | 0.315 | 2020-12-30 | 2020-12-31 | 2021-01-14 | Cash Div. | quarterly |

| USD | 0.315 | 2020-09-29 | 2020-09-30 | 2020-10-14 | Cash Div. | quarterly |

| USD | 0.285 | 2020-06-29 | 2020-06-30 | 2020-07-14 | Cash Div. | quarterly |

What Are Mondelez’s Risks?

There are a couple of areas to which Mondelez needs to pay attention. It currently has a 20 Bio USD in long-term debt. This is a lot, but in the last 10 years, we’ve seen historic low-interest rates, hence it’s also smart of a company to use these low rates to re-invest and grow your business faster.

Another concern is Mondelez’s revenue. It has been doing ‘okay’ in the past five years, but the growth is slow. This is one point I really do not like and watch closely. Its operating margin has improved a lot, a good sign, but I don’t want to be invested in companies that stopped growing. A good dividend stock should have growing revenues, but as the past three years were incredibly challenging, I will follow closely what numbers the company will be reporting in the coming years.

The third point of concern is the rising input costs, in particular, its commodity prices. For example, cocoa and dairy prices have increased a lot, and prices of palm oil & wheat as well. And last but not least, sugar prices are back to their 2017 highs.

Conclusion

From my point of view, Mondelez is a good dividend stock I will buy & hold forever. The above six reasons give me the confidence that I am investing money in a company producing products that enrich people’s lives. We as a family love and consume a whole series of different Mondelez products, on an almost daily basis!

And every time my family buys products from Mondelez, I feel great, because I feel I am getting something in return!

📘 Read Also

- Read about the best consumer staples stock in the world

- See which European REITs I think are good buys

- Check out my dream REIT stock in the U.S.

- Like to see my total monthly income 👉 Dividend Calendar

FAQ

Is Mondelez a good stock to own?

Yes, Mondelez (MDLZ) has the hallmarks of a good stock to own over the long-term, such as

– Fantastic Brand Portfolio

– Excellent global footprint

– Solid financials

– Leader Of Mindful Snacking

– Collaborations With Innovative Startups

It pays a solid and stable dividend and is reasonably priced.

How to buy Mondelez stock?

You can buy it at all common brokers such as Charles Schwab, Robin Hood, or Etrade.

Does Mondelez pay a dividend?

Yes, in 2022, the yield is 2.41% p.a., and the four quarterly dividend payments amount to $1.54 US in total.

WiseStacker's Take

I see Mondelez as a very stable and good dividend stock, that should do well in the decades to come. Its brands are loved and consumed all over world. More than 34% of its sales originate from developing/emerging markets.

PROS

- Fantastic Brand Portfolio

- Excellent global footprint

- Solid financials

- Leader Of Mindful Snacking

- Collaborations With Innovative Startups

CONS

- Revenue growth rather slow

- 20 Bio debt burden

- Rising input/commodity costs

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love