Monthly Stock Dividends 2022/09

Last year, in September 2022, my All-Weather Portfolio generated dividends of 1.659 USD. This year, I received 1.909 USD, an increase of about 250 USD, or roughly 15%. Most of the increase though is due to shares I additionally purchased since then.

Check out my full monthly stock dividends for September 2022 on this table:

With 731 USD from $BHP (which I believe is the best natural resource stock you can buy), I received my so far largest dividend payment. $BHP pays two dividends per year, and still, this half-year payment was larger than the annual dividends of my other European dividend stocks.

$BHP‘s stock price sits currently at 50 USD, and in 2022 it paid one dividend of 3 USD in March and one dividend of 3.50 USD in September. So 6.50 USD per year, with a stock price of 50 USD results in a dividend yield of 13%.

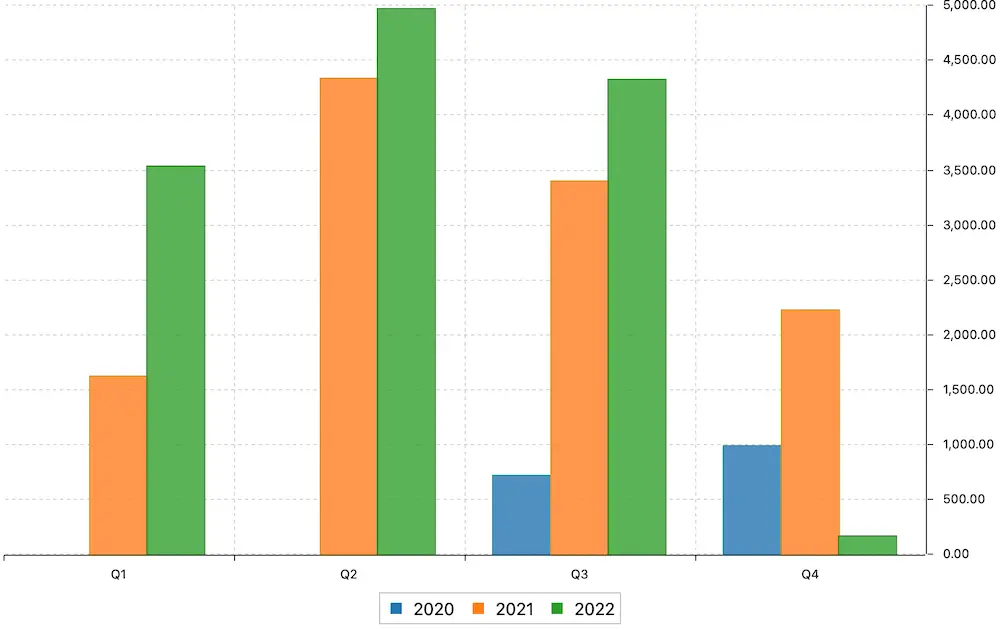

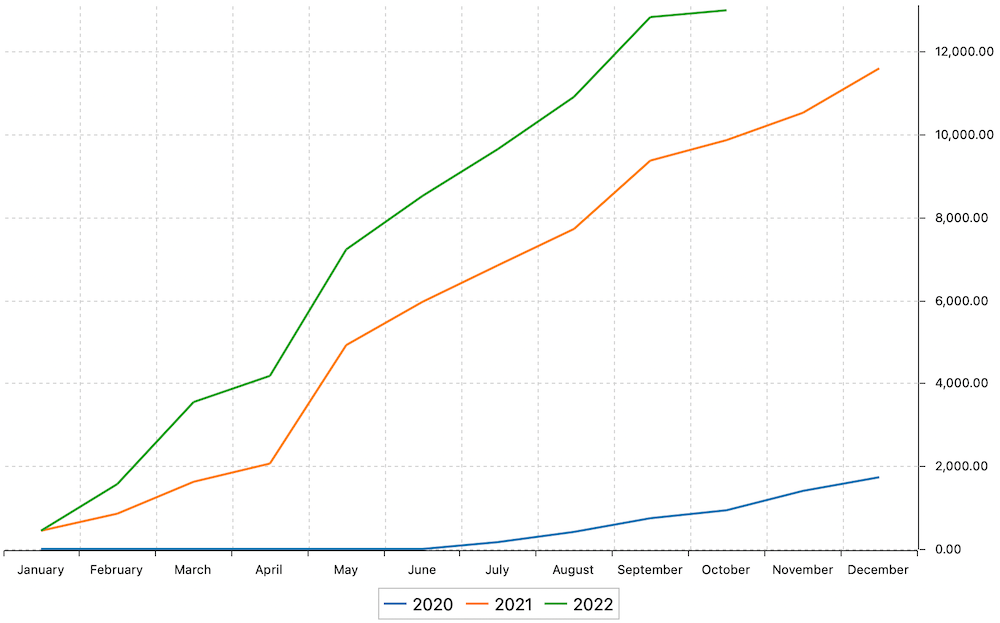

Below are some charts visualizing the monthly stock dividends to previous quarters (Q4 just started):

Buying 71,000 USD Worth Of Stocks

Some readers will remember that in July, I received the payout of a digital asset fund I had invested in 2018. It paid out a total of 700,000 USD (of which I rolled over 200,000 USD into their next crypto fund).

I decided to allocate the 400,000 USD to my All-Weather Portfolio, and 100,000 USD to my Thematic Portfolios. My aim is to significantly increase my monthly stock dividends, and investing during extremely uncertain times like now is okay, in my point of view, if I don’t need the money anytime soon.

As prices of many of the stocks I closely follow came down drastically in the last 2-3 months, in particular, in Europe, I decided to buy the first chunk of stocks and hence, made purchases worth 71,000 USD in the month of September.

See below what I bought in September, and at what price:

Was this nutty? Or was this ballsy? We will see.

As I only choose buy-and-hold forever stocks like PepsiCo, P&G, or Brookfield Renewable, I can ride out any market weakness, and focus instead on the passive income these world-class businesses will generate.

Welcome, BlackRock, Rio Tinto & ProSiebenSat.1

Rio Tinto – Producing Whatever ‘The Brrrr’ Can Not Print

I finally bought some first tranches of $RIO, Rio Tinto, which I have been eyeing for a long time. My simple investment thesis for the coming 10 years is to long the entire periodic system.

I believe anything that can not be printed by central banks will either maintain its purchase power or go up significantly in US Dollar terms. And companies like BHP and $RIO are ideal for that.

$RIO adds two monthly stock dividends to my dividend calendar, namely in March and August, usually not very strong months dividend-wise.

ProSiebenSat.1 – An Undervalued Media Company

After listening to a super interesting 1.5 hour interview with the new of CEO of ProSiebenSat.1 (FRA:PSM), the largest digital media group in the German-speaking market (100.8 Mio people living in GER, Austria and Switzerland), I was impressed what they have been working on:

-

- DACH’s largest TV channel

- now 100% owner of Joyn (Europe’s Netflix)

- invested in dozens of innovative startups like AboutYou, Zalando, Asana Rebel,

- owner of Parship, Europe’s largest dating platform

- PE of 6, dividend yield of 11%, 3-Year ROIIC % of 38% (!)

BlackRock – A Financial Powerhouse

I also purchased some first stocks of BlackRock (BLK), the largest financial asset manager in the world. After it came down by 43% since its high in Nov 2021, I finally tipped my toes in and bought some stocks.

My thesis here is again simple: The world is increasingly getting interested in buying financial assets, and BlackRock, with its thousands of managed mutual funds and gazillions of ETFs (iShares family), is perfectly positioned to benefit from this trend.

They also recently started offering digital asset investing to their customers and launched crypto mining and metaverse ETFs, showing that whatever the latest trends there are, BlackRock will always create an investable product.

I believe $BLK is a great buy-and-hold-forever stock, that will add four payments of monthly stock dividends.

Investment plan for October

I will further add slowly and not aggressively to my large buy-and-hold forever positions in my All-Weather Portfolio. A LOT of sh*t has been priced in already at this stage.

Other Passive Income

Besides the above-listed dividends of 1,909 USD, I also earned 11,911 USD in other forms of passive income. Put differently, my dividends from stocks currently only represent 15% of my total passive income.

Click here if you like to unlock it & instantly see the breakdown.

Read Also

- Read my passive dividend income report for August 2022

- Find out which consumer staples stock I love

- Read about my favorite residential REIT in the U.S.

- What the Store Capital Buyout means

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love