Passive Stock Dividends Report – Dec 2022

Comparing my passive stock dividends received in Dec 2021 versus Dec 2022, I can see an increase of 416 USD, from 1,080 USD to 1,496 USD, about +29%. The only new position I received dividends from and that I did not own last year, is BlackRock (BLK).

In total, I received dividends from 15 different companies in December 2022 (the below amounts represent net dividends, meaning after the withholding taxes have been deducted already. In other words, the money I actually received in my account):

|

Date |

Company |

Dec 2021 |

Dec 2022 |

|

Dec 1 |

🇨🇦 Enbridge | $250 | $250 |

|

Dec 30 |

🇭🇰 Link REIT | $98 | $196 |

|

Dec 9 |

🇬🇧 Unilever | $99 | $138 |

|

Dec 31 |

🇨🇦 Brookfield Renew. | $75 | $134 |

|

Dec 12 |

🇺🇸 3M | $94 | $127 |

|

Dec 20 |

🇬🇧 Shell | $102 | $125 |

|

Dec 15 |

🇺🇸 Realty Income | $88 | $90 |

|

Dec 31 |

🇺🇸 Kraft-Heinz | $84 | $84 |

|

Dec 7 |

🇺🇸 Johnson & Johnson | $81 | $81 |

|

Dec 7 |

🇺🇸 Pfizer | $59 | $74 |

|

Dec 30 |

🇺🇸 BlackRock |

– |

$72 |

|

Dec 30 |

🇺🇸 Union Pacific | $50 | $55 |

|

Dec 15 |

🇨🇦 Cameco | $26 | $37 |

|

Dec 22 |

🇨🇦Franco Nevada | $26 | $33 |

| Total | $1,080 | $1,496 |

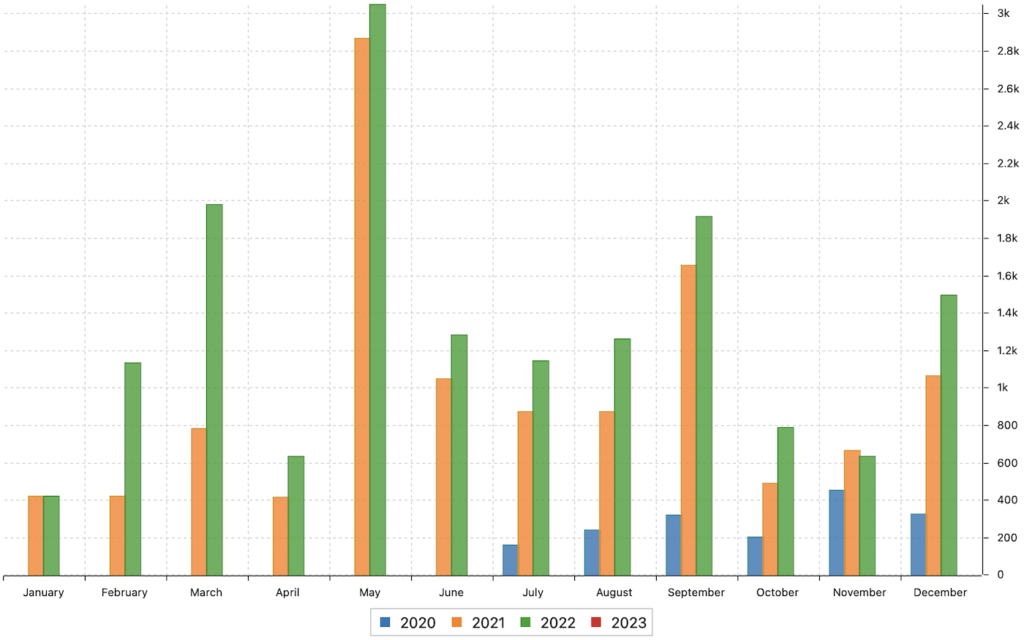

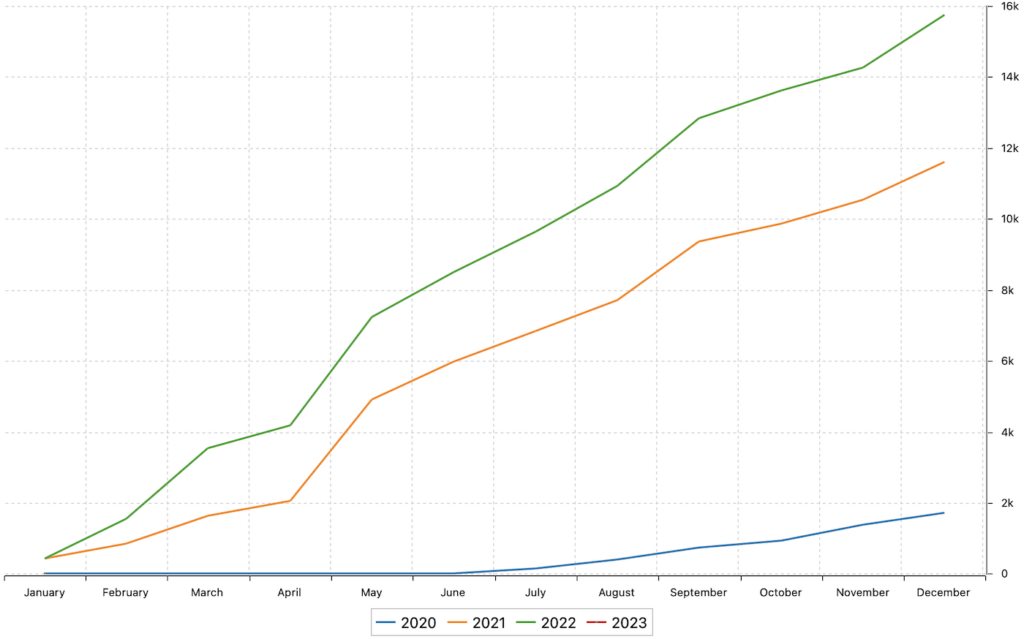

Passive Stock Dividends – Chart

I started building my All-Weather Portfolio in May 2020. Looking at the dividend history since then, my dividends developed like this:

The month-by-month accumulated charts look like this:

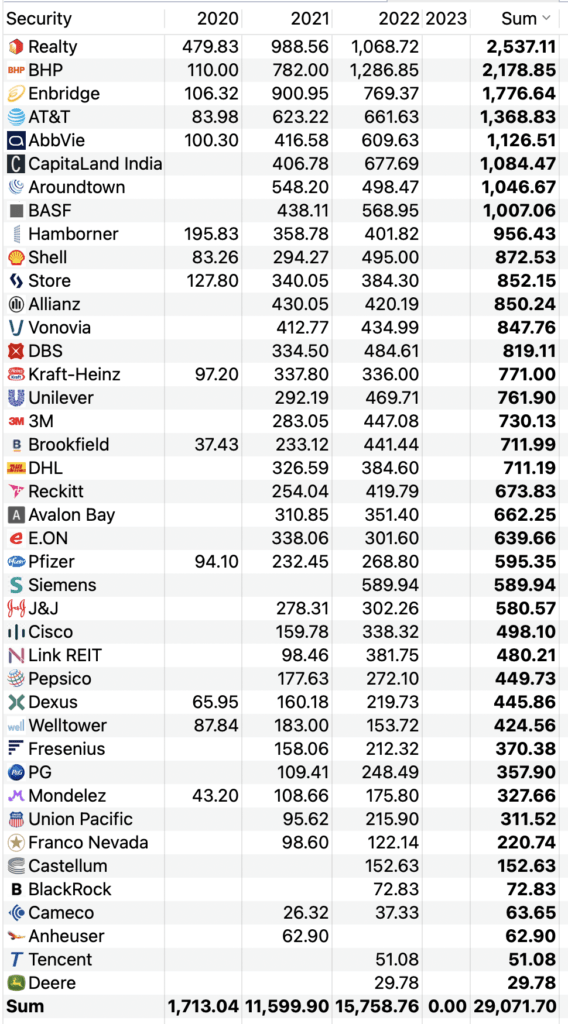

In general, please disregard some number inconsistencies. Those are often from gross and net tax bookings. Sometimes Portfolio Performance uses the gross

dividend amount, sometimes the after-tax ‘net income’.

All three years, 2020, 2021, and 2023, with all dividend payments in one table:

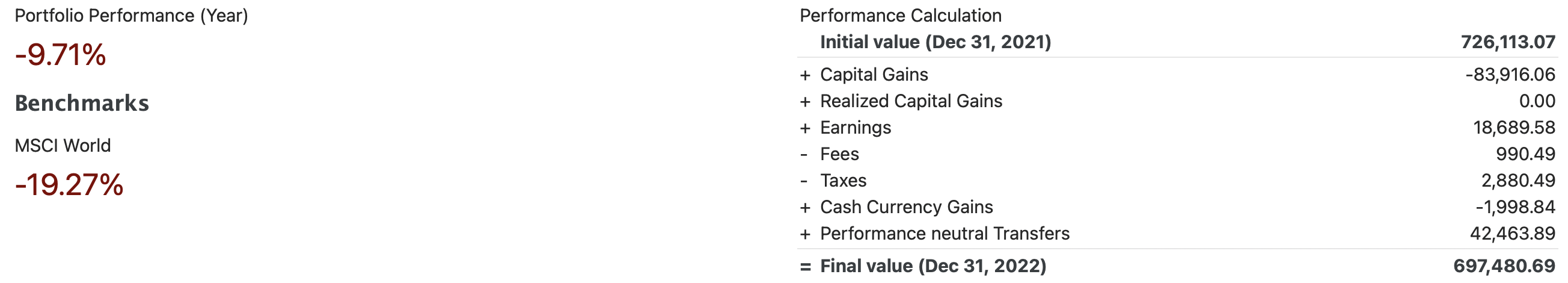

Passive Stock Dividends – Calculation

According to my Portfolio Performance, the portfolio management software I have been using for years, my 2022 looks like this.

Review Of My Stock Dividends

The year 2022 was pretty bad, capital gains-wise (with -83,916 USD).

But compared to the MSCI World (-19,27%), I actually did quite okay (-9,71%).

Stock Purchases

I was quite active in December and made multiple stock purchases. In total, I invested more than $30,000 USD in December:

| Date | Security | Shares | Invested |

|

Dec 5 |

🇩🇪 Hamborner REIT | 1,000 | $8,164 |

|

Dec 7 |

🇩🇪 Vonovia REIT | 125 | $3,057 |

|

Dec 8 |

🇸🇪 Castellum REIT | 500 | $6,662 |

|

Dec 15 |

🇺🇸 Warner Bros | 40 | $401 |

|

Dec 16 |

🇺🇸 Avalon Bay | 3 | $498 |

|

Dec 30 |

🇩🇪 Porsche | 200 | $11,107 |

|

Dec 30 |

🇺🇸 Realty Income | 4 | $255 |

|

Total |

$30,145 |

After I purchased shares of BMW last month in November, I now purchased my second car stock, Porsche.

I bought shares of the holding company Porsche Automobil Holding SE (POAHF), which owns 53% of the ordinary shares of the entire Volkswagen AG, as well as 25 percent plus one share of the ordinary shares in the recently IPO’ed Porsche AG.

Further, I bought more shares in

- 🇸🇪 Castellum, Sweden’s largest REIT

- 🇩🇪 Hamborner REIT, one of Germany’s largest commercial/office REITs, and,

- 🇩🇪 Vonovia, Europe’s largest residential property owner.

I believe Europe will get through this tough time, and I see these beaten-down European REIT prices as good buying opportunities.

I also keep buying shares of Warner Bros, a stock I believe in.

My strategy for 2023 is to keep on re-investing paid-out dividends to my core holdings, and maybe add one or two more shares from companies in sectors I feel I am still underinvested in.

The above dividend income from my All-Weather Portfolio is about 20% of the total passive income I generated in December.

If you like to see the full breakdown, please click here.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love