Stock Dividend Report of July 2022

July was a great month for me financially. As you might know, I own some shares in six different companies. Some of them do well, and pay one to two times dividends per year. As three of those respective companies had a very good 2021, they paid out relatively larger dividends than usual.

Here’s what I received in July:

- 64,000 USD from a service business #1 (2015)

- 55,000 USD from manufacturing company #1 (2012)

- 16,000 USD from manufacturing company #2 (2008)

135,000 USD in total

Last year, in July 2021, I received 39,000 + 28,000 USD = 66,000 USD, so this year is significantly better.

Besides the dividends from the above-mentioned private companies, I received the following dividends from my All Weather Portfolio:

| 2021 July | 2022 July | |

| Aroundtown | 383 USD | 498 USD |

| Store Capital | 97 USD | 108 USD |

| Brookfield | 56 USD | 102 USD |

| Cisco | 53 USD | 94 USD |

| Realty | 83 USD | 89 USD |

| Avalon Bay | 88 USD | 88 USD |

| PepsiCo | 70 USD | 75 USD |

| Mondelez | 23 USD | 43 USD |

| Total Dividends Received | 853 USD | 1,097 USD |

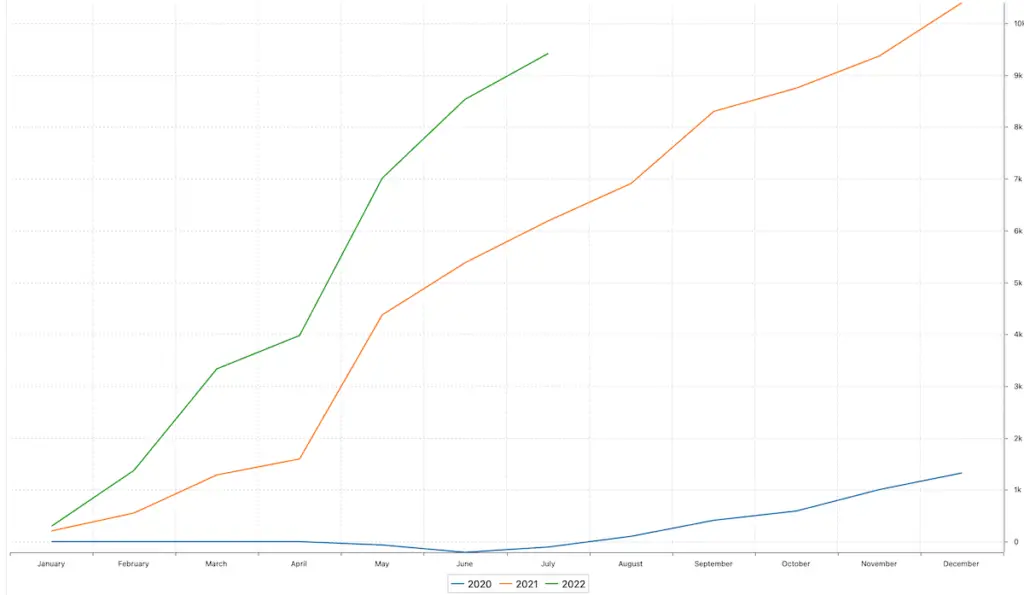

When I compare this year’s with last year’s stock dividend report, I see an increase of approx. 29% year-on-year. Nice. And when comparing the accumulated dividends in the year 2020, 2021, and 2022, it looks like this:

I was quite active and tried to put the money from the dividends I received to good use. Made the following stock purchases this month:

| Date | Security | Shares | Quote | Total (USD) |

| July 5 | 3M (MMM) | 2 | 127 | 254 |

| July 8 | Warner Bros (WBD) | 10 | 14 | 143 |

| July 8 | Allianz (FRA:ALV) | 15 | 182 | 2,726 |

| July 11 | BASF (FRA:BAS) | 50 | 42 | 2,090 |

| July 11 | Vonovia (FRA:VNA) | 75 | 28 | 2,100 |

| July 11 | Aroundtown (XTER:AT1) | 750 | 3 | 2,271 |

| July 11 | Castellum *new (FRA:TEX) | 1,000 | 13 | 12,704 |

| July 11 | BMW *new (FRA:BMW) | 180 | 71 | 12,705 |

| July 12 | Fresenius (FRA:FRE) | 100 | 28 | 2,762 |

| July 18 | Realty ($O) | 2 | 70 | 140 |

| July 18 | Dexus ($ASX:DXS) | 400 | 6 | 2,512 |

| July 18 | Pfizer ($PFE) | 50 | 51 | 2,550 |

| July 20 | Ascendas ($SGX:CY6U) | 3,100 | 1 | 2,493 |

| July 28 | Anheuser ($BUD) | 50 | 52 | 2,600 |

| Total | 48,049 |

Why did I buy these stocks?

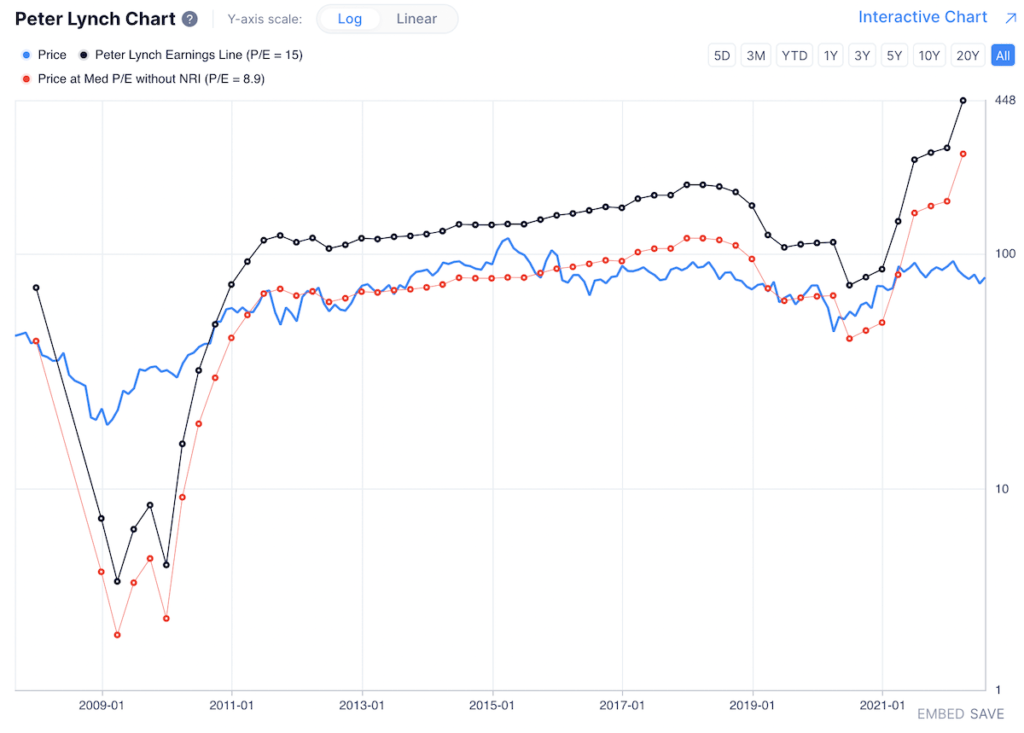

All companies in my All Weather Portfolio are great businesses I intend to be a shareholder forever in, hence the current stock price does not concern me too much. But I enjoy looking at a combination of things before I make a purchase, including

- the stock’s technical chart pattern,

- the Gurufocus valuation model,

- and the Peter Lynch chart.

I like to keep things simple, and maybe spend 5 to the max. 10 minutes on choosing which stock to buy.

For example, look at BMW’s (FRA:BMW) Peter Lynch chart: As you can see, the earnings line increased a lot, while the stock price is flat for quite some time.

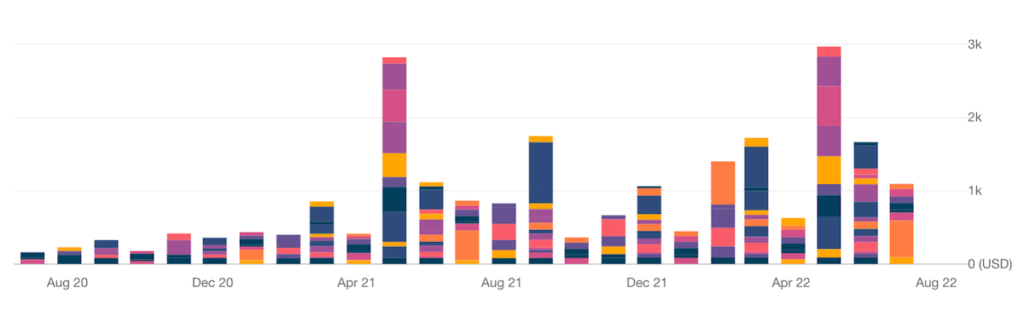

Below is my stock dividend report from Parquet.com (one of the essential tools I like and use) a lot.

Other passive income

In the month of July, I earned 2,688 USD in form of passive income from staking and liquidity mining. The three biggest contributors were Hedera, Cake DeFi, and Perion. Read more about how I earn interest on crypto.

I also made 1,405 via cash deposits on HSBC.

You can check out all the passive income (currently approx. 12,000 USD/mo) by clicking here.

Investment plan for August

In August, I plan to make further investments but also like to keep a lot of dry powder. Typically the months of September and October are very volatile, and with all the pandemic, Ukraine war, supply chain interruptions, the European energy crisis, the high inflation, etc., I believe there will be better buying opportunities ahead!

Wishing all of you a great summer month!

Read Also

- The dividend income I received in June 2022

- Check out which 7 video game stocks are worth a look

- Why I believe this is the best senior living REIT

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love